Is $MSTR in danger?

As the price of $BTC once dropped to MSTR's cost price, many are worried that MSTR could be the biggest bombshell this year. With over 760,000 Bitcoins in its holdings, will MSTR's liquidation or sale of BTC lead to a significant drop in BTC's price?

From the actual situation, I personally believe it won't be the case, because MSTR's first major debt repayment is due on September 15, 2028. Of course, this is the maturity date, and according to the contract, the noteholders can choose to require MSTR to repurchase on September 15, 2027.

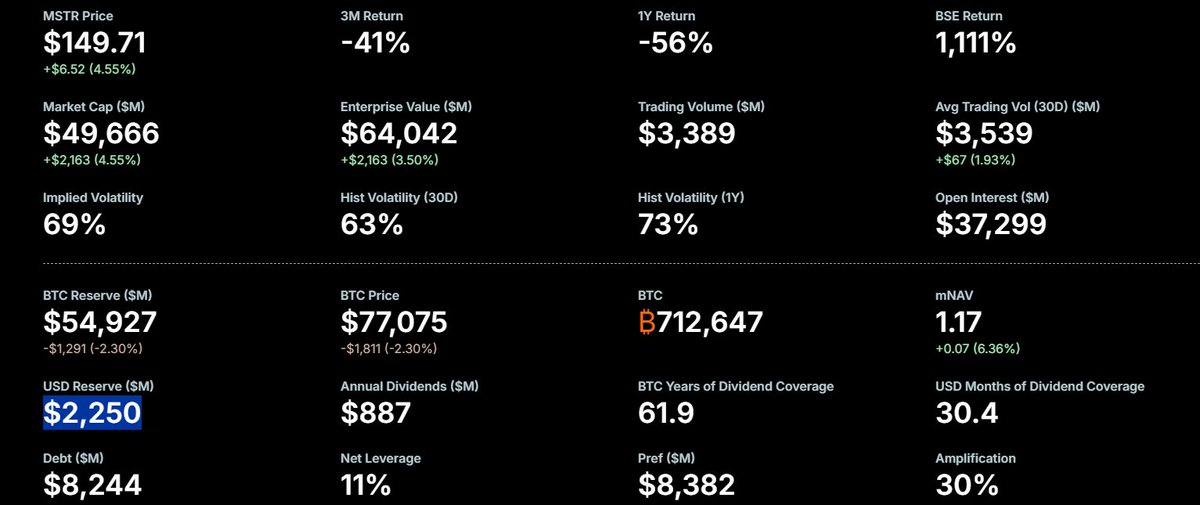

This means that if all noteholders demand an early repurchase, the expenditure will occur in September 2027, requiring a payment of $1.01 billion. Currently, MSTR has cash reserves of $2.25 billion, which are specifically allocated for paying interest and debts, and this amount will continue to increase. Even the existing cash reserves are already sufficient to cover the $1.01 billion debt.

At least based on MSTR's current asset situation, it is safe until June 2028 (with a maturity in 2029 and a scale of $3 billion), and 2028 is likely to be a true bull market in the last four years. After all, by 2028, it is highly probable that the Federal Reserve's interest rates will be significantly lowered, or even quantitative easing may occur, especially since 2028 is an election year, which would further reduce MSTR's pressure.

So overall, we can't see MSTR's downfall just yet, and MSTR does not need to sell BTC to repay its debts.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。