Fear brings what it fears. Just yesterday, I was worried about whether the weekend would continue to decline, and the impact of a weekend drop would be greater due to lower liquidity. It indeed happened. Although the market is closed today, the significant drop in $BTC started from the U.S. time zone, coinciding with the usual opening time of the U.S. stock market, indicating that this wave of selling is mainly driven by American investors.

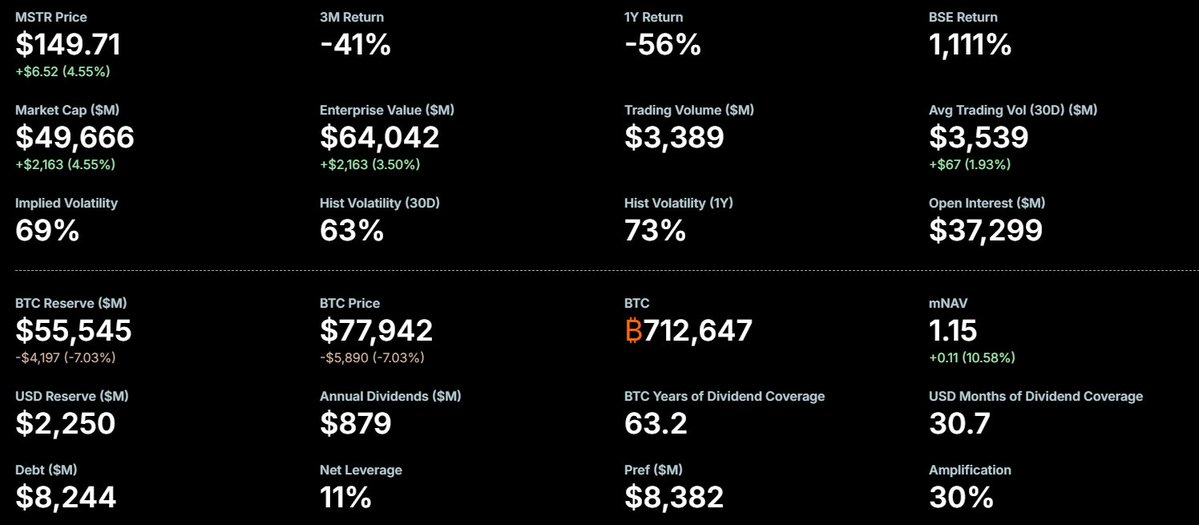

It seems that they first liquidated U.S. stocks and precious metals, then worried about a continued decline on Monday, leading to the sale of liquid assets over the weekend. If this is the case, it means that the market has already priced in next week's movements over the weekend. At the lowest point today, it has already dropped below the $76,000 cost of $MSTR, but it has not yet fallen below mNAV; if it does, then it can be considered.

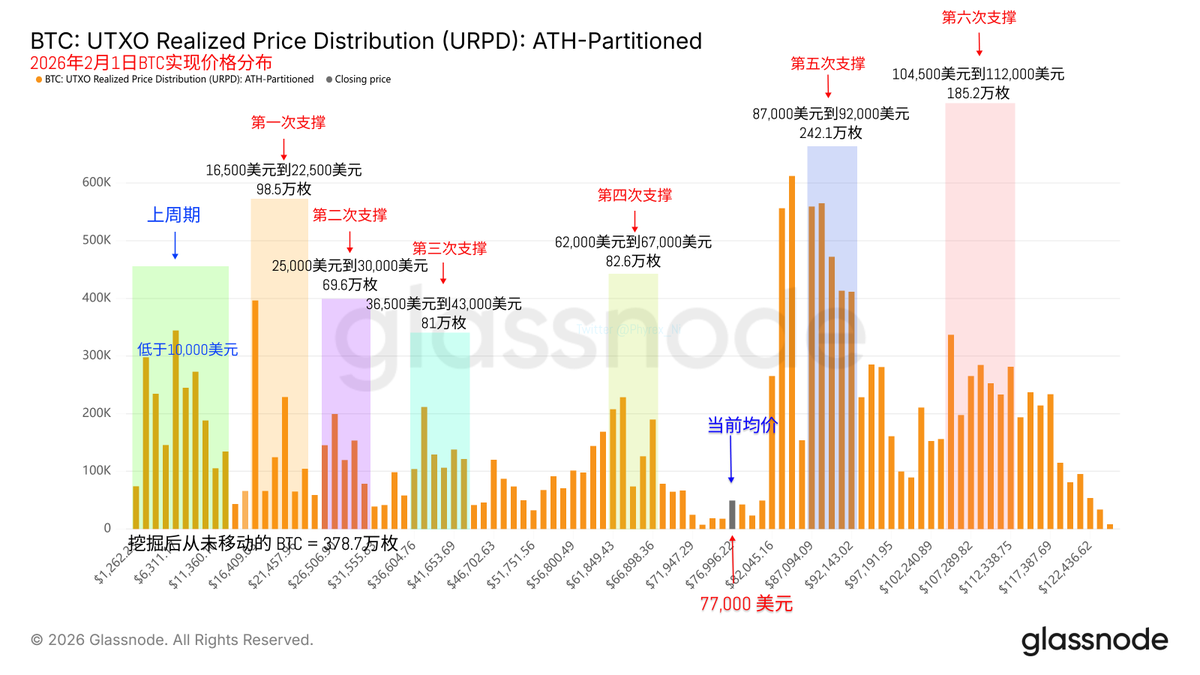

Generally speaking, if there is no change in the fundamentals, it is very likely that liquidity will rebound on Monday. I am not sure if this will happen, but I personally bought the dip; this price is still attractive to me. If it falls below $70,000, I will continue to buy. I was just discussing with friends that the average cost of Bitcoin for U.S. ETFs is around $70,000, and if it drops below $70,000, many miners will also shut down.

Looking back at Bitcoin's data, the price has dropped significantly, and the turnover rate is quite high, especially since such a large turnover likely started from the U.S. trading time zone. It is still unknown what the attitude of Asian investors is this morning. If Asian investors panic as well, it could lead to another large liquidation, so the focus is still on Monday.

The lowest point after the rise in the past year was $74,400 on April 7. Let's see if this price will be broken. However, from the chip structure, it still appears relatively stable, and there has not been widespread panic among most investors; the actual selling is mainly from short-term investors.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。