TL;DR

- This month, the Federal Reserve maintained interest rates, emphasizing policy independence. Inflation has eased but remains above target, and employment shows resilience, though job growth has slowed. The overall policy tone is cautious and steady. U.S. stocks have fluctuated upward, driven by AI and earnings expectations, but political uncertainty, fiscal expansion, and external risks continue to disrupt the market. Looking ahead to February, if inflation continues to decline, U.S. stocks are expected to rise, but caution is needed regarding policy divergence and geopolitical risks.

- In January, the cryptocurrency market exhibited a range-bound trading pattern, with trading volume lacking sustainability, reflecting a recovery in market activity but persistent bullish-bearish divergence, making it difficult to form a clear trend in the short term. Newly launched popular tokens are primarily VC-backed projects, with Brevis, Sentient, and Fogo showing relatively active performance, while meme projects lack sustained interest.

- In January, BTC and ETH spot ETFs saw net inflows of $2.23 billion and $500 million, respectively, indicating a recovery in institutional risk appetite and a resurgence in demand for mainstream asset allocation. Meanwhile, the total circulation of stablecoins slightly decreased, but USDT remained stable, with some emerging stablecoins like USD1 and USDE experiencing counter-cyclical growth, reflecting a structural migration of funds in a stagnant environment.

- Both BTC and ETH broke through key technical levels, with short-term momentum weakening. Any rebound is more likely to be a technical correction, with support levels to watch at $84,000 and $2,623, respectively. Although SOL found support and rebounded around $117, it remains under pressure from moving averages, maintaining a generally weak and volatile pattern, necessitating caution against accelerated downside risks if support is lost.

- This month, stablecoins and regulatory issues became the market's core focus, with World Liberty Financial advancing its application for a national trust bank license, while the CLARITY Act made procedural progress in the Senate, though party divisions are evident. Meanwhile, the ban on X regarding the InfoFi project triggered a sector pullback, indicating structural changes in platform incentives and traffic governance logic. On the technical side, ERC-8004 officially launched on the Ethereum mainnet and collaborated with the x402 micropayment protocol, laying the groundwork for the decentralized AI agent economy.

1. Macroeconomic Perspective

Policy Direction

In the January meeting, the Federal Reserve decided to keep interest rates unchanged (maintaining the 3.50%–3.75% range), demonstrating confidence in the current economy while emphasizing that it will continue to adjust policies based on data. Although there is significant speculation about potential rate cuts in the future (some expect cuts between M6 and M9), the policy remains cautious and steady in the short term, with no clear inclination towards substantial rate cuts. Federal Reserve officials have repeatedly stated their commitment to monetary policy independence, suggesting that future chairs should uphold this principle to prevent political interference in inflation and employment decisions.

U.S. Stock Market Trends

In January, the U.S. stock market generally exhibited a high-level upward fluctuation. The S&P 500 index historically broke through the 7,000-point mark, primarily driven by the AI sector, strong corporate earnings expectations, and expectations of loose policies. Tech stocks led the rally, with heavyweights like Nvidia and Microsoft serving as driving forces. However, the market still faces short-term fluctuations and emotional divergence, especially when geopolitical and bond market volatility news arises, posing a risk of pullbacks, but the overall trend remains bullish.

Inflation Data

Recent data shows that U.S. inflation has moderated but remains above target: CPI year-on-year is approximately in the 2.6%–2.8% range, and core CPI also remains at a moderate level. Short-term base effects and rental factors may lead to a month-on-month rebound, but the overall downward trend in inflation has not significantly changed. Structurally, tariffs and supply chain disruptions still impact consumer prices, while inflation expectations may maintain a "new normal" in the 2.5%–3% range in the medium term.

Employment Data

Recent employment data presents a "strong contradiction": non-farm job growth is significantly below expectations, while the unemployment rate remains relatively stable or even slightly decreases; wage growth still exceeds inflation, indicating that companies are improving efficiency amid marginal contractions in labor demand. The overall job market remains resilient, but the growth of new jobs has slowed, and whether the labor market continues to remain strong is a core variable in the Federal Reserve's policy considerations.

Political Factors

Political uncertainty continues to disrupt the market. On one hand, the competition for the Federal Reserve chair position and discussions surrounding monetary policy independence have drawn market attention; on the other hand, the Trump administration's aggressive strategies on tariffs and trade policies have temporarily intensified market volatility, but in the long run, it may shift towards negotiation and compromise to ease market sentiment. The risk of a government shutdown is also seen as a potential short-term suppressive factor for the market.

Fiscal and External Risks

U.S. fiscal expansion and loose measures (such as the MBS purchase program) have positively impacted reducing actual financing costs and supporting the real estate market, but they may also exert marginal upward pressure on the inflation center. In terms of external risks, U.S.-EU trade frictions, geopolitical events (such as the Greenland land purchase topic), and global bond market fluctuations are potential short-term risk points; abnormal fluctuations in the Japanese bond market and yen also increase uncertainty in the global asset price transmission mechanism.

Outlook for Next Month

As February approaches, the market will closely monitor the progress of trade negotiations, the results of government shutdown negotiations, the selection of the Federal Reserve chair, and the upcoming PCE and labor data releases. Against a backdrop of relatively stable fundamentals, U.S. stocks are expected to continue fluctuating upward, but policy divergence and external risks may exacerbate volatility. If inflation continues to hover in the 2.5%–3% range, it will open a window for rate cuts by mid-year, but in the short term, the policy remains "data-driven and cautious." Overall, the strategy suggests focusing on the profitability of the tech sector and AI growth logic, the safe-haven attributes of precious metals, and asset rotation opportunities driven by macro events.

2. Overview of the Cryptocurrency Market

Cryptocurrency Data Analysis

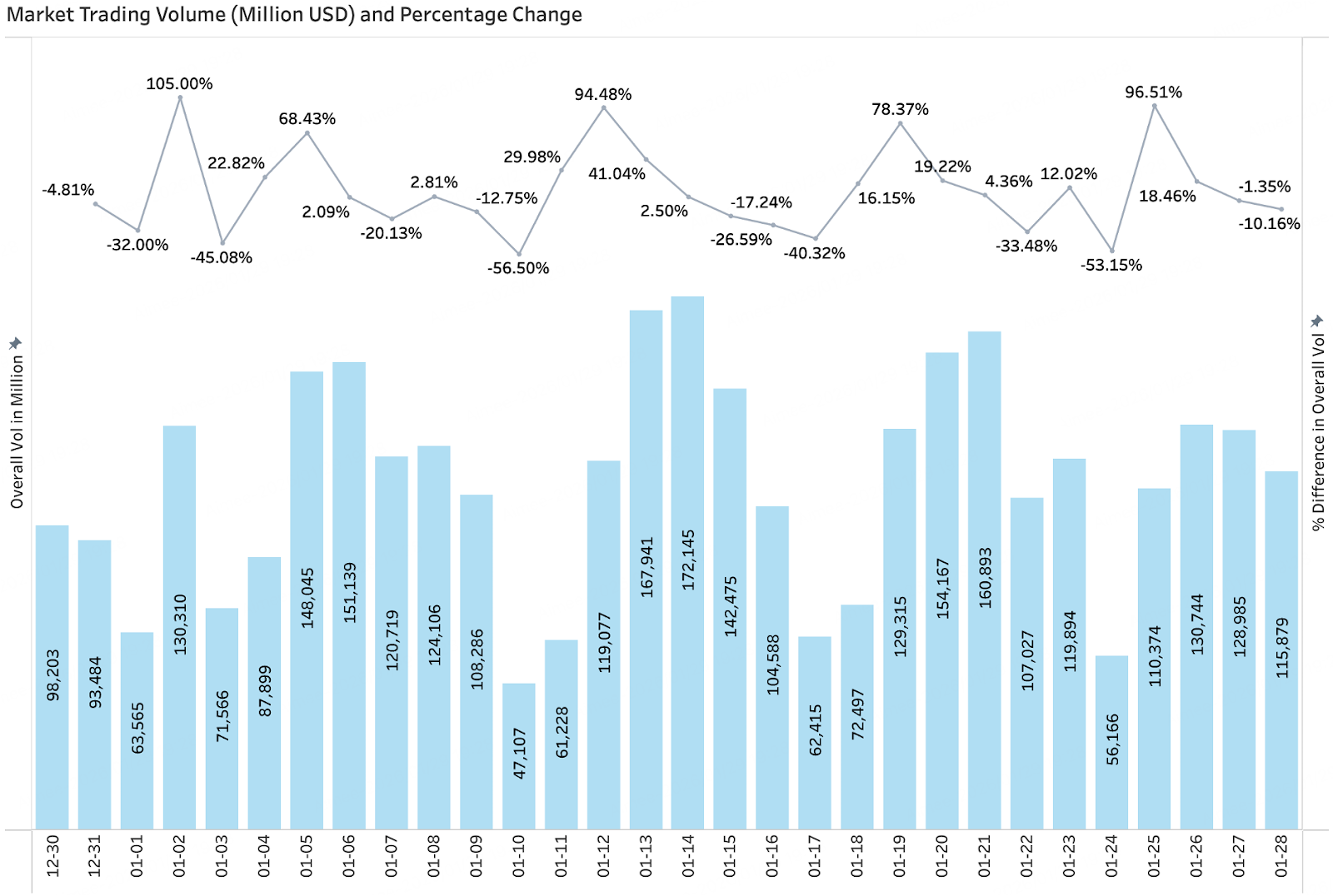

Trading Volume & Daily Growth Rate

According to CoinGecko data, as of January 28, the overall trading volume in the cryptocurrency market fluctuated significantly, with the average daily trading volume roughly concentrated in the $110 billion to $160 billion range. During this period, there were multiple short-term spikes in volume, but sustainability was lacking, often quickly retreating in a short time, reflecting that the market has not formed a clear trend. From a trading structure perspective, active trading is more driven by short-term funds and event-driven factors rather than sustained entry from medium- to long-term funds. Overall, January's trading volume reflects a recovery in activity but persistent bullish-bearish divergence, making it more likely for the market to maintain a range-bound pattern.

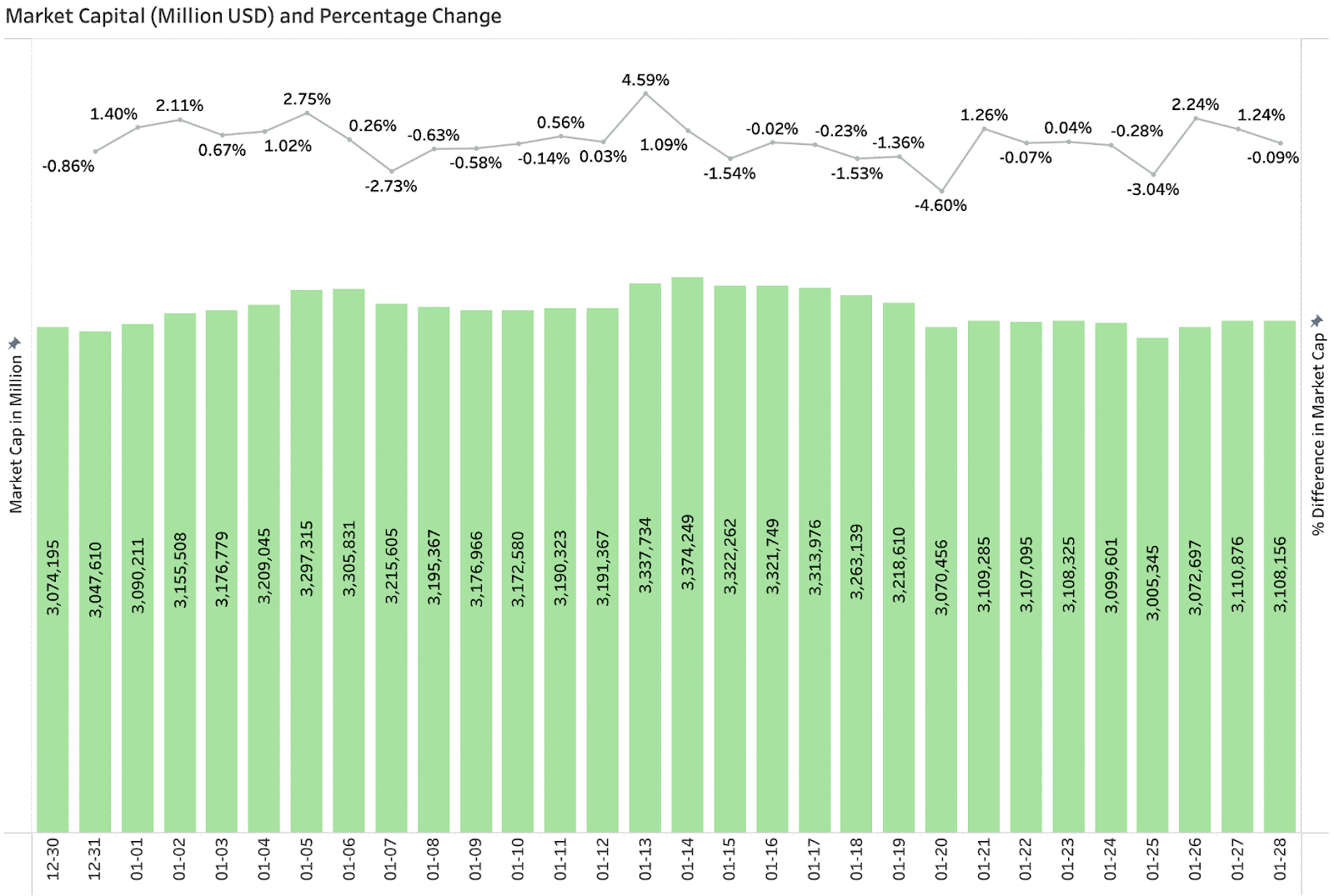

Total Market Capitalization & Daily Growth Amount

According to CoinGecko data, as of January 28, the overall market capitalization of the cryptocurrency market exhibited a fluctuating pattern. The total market capitalization mainly operated in the $3.00 trillion to $3.37 trillion range, with overall volatility relatively controllable, and most trading days saw price fluctuations maintained around "±1%," with only a few instances of temporary pullbacks or rebounds. After reaching a phase high in the middle of the month, it failed to form an effective breakthrough, subsequently retreating and entering a consolidation phase. Overall, January's total market capitalization performance reflects that the market has entered a relatively mature fluctuation stage, with balanced bullish-bearish forces, making it more likely to maintain a range-bound volatility pattern in the short term.

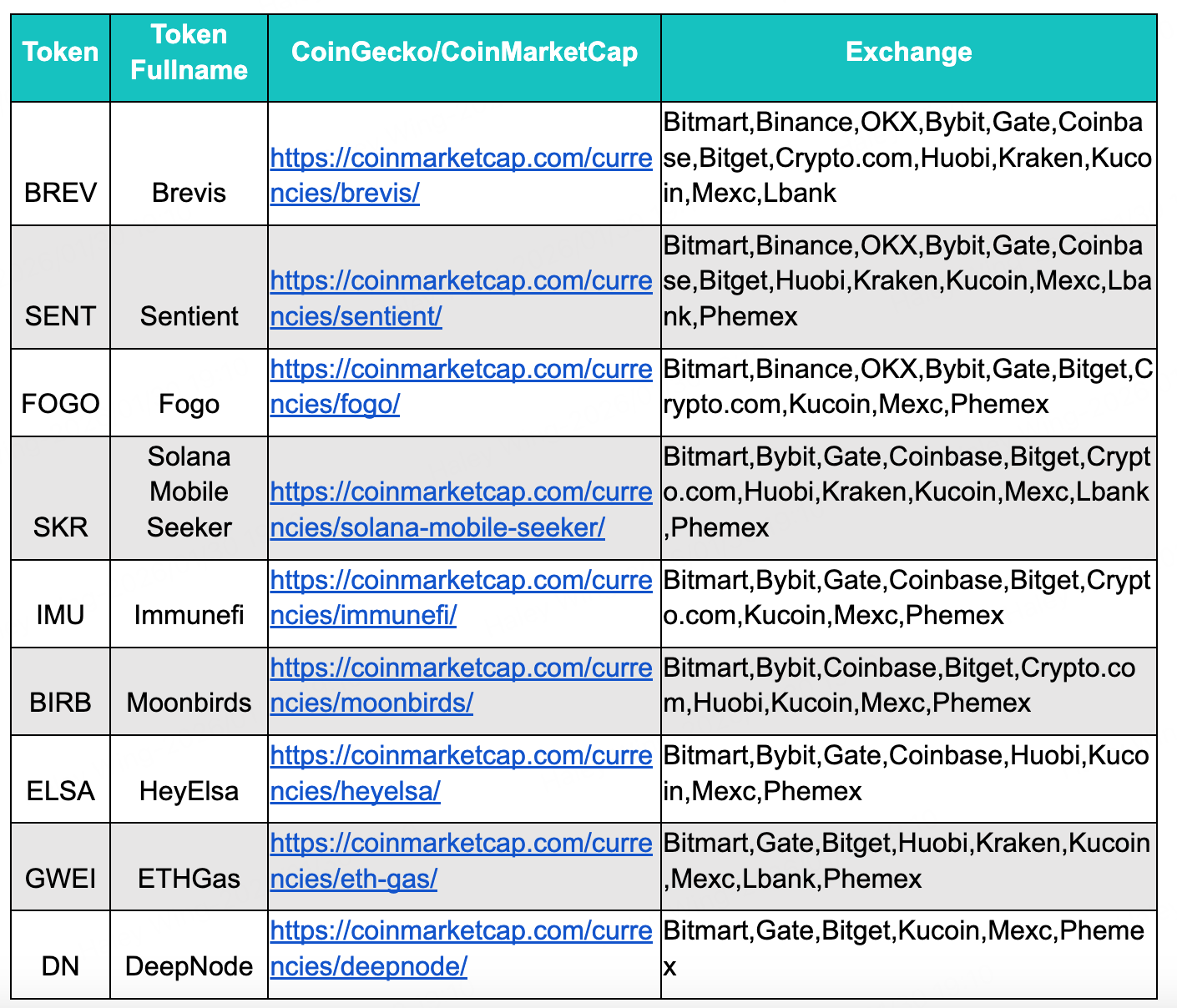

Newly Launched Popular Tokens in January

The newly launched popular tokens in January are still primarily VC-backed projects, with meme projects lacking sustained activity. Among them, Brevis, Sentient, and Fogo performed outstandingly, with relatively active trading volumes post-launch.

3. On-Chain Data Analysis

Analysis of BTC and ETH ETF Inflows and Outflows

January BTC Spot ETF Net Inflow of $2.23 Billion

This month, the BTC spot ETF saw a significant inflow of funds, with a net inflow of $2.23 billion, indicating a marginal improvement in institutional fund sentiment. The BTC price slightly increased, with the opening price rising from $87,835 to $89,104, an increase of about 1.4%, driving the total assets of the ETF to rise correspondingly, with total net assets increasing from $113.07 billion to $115.3 billion, a month-on-month growth of 1.9%. After experiencing previous market fluctuations, the overall risk appetite in January has somewhat recovered, with funds flowing back into Bitcoin-related allocation tools, reflecting a warming recognition of BTC's medium- to long-term value among institutions.

January ETH Spot ETF Net Inflow of $500 Million

This month, the ETH spot ETF recorded a moderate net inflow, with a monthly inflow of about $500 million, indicating a steady recovery in market demand for Ethereum asset allocation. The ETH price rose from $2,947 to $3,022, with a monthly increase of about 2.5%, driving the ETF's total assets from $17.72 billion to $18.22 billion, a month-on-month growth of 2.8%. Compared to the previous phase of fund outflows, the January ETH ETF shows a stabilizing and recovering trend, indicating that institutional investors' confidence in the Ethereum ecosystem and its medium- to long-term application prospects is gradually restoring.

Analysis of Stablecoin Inflows and Outflows

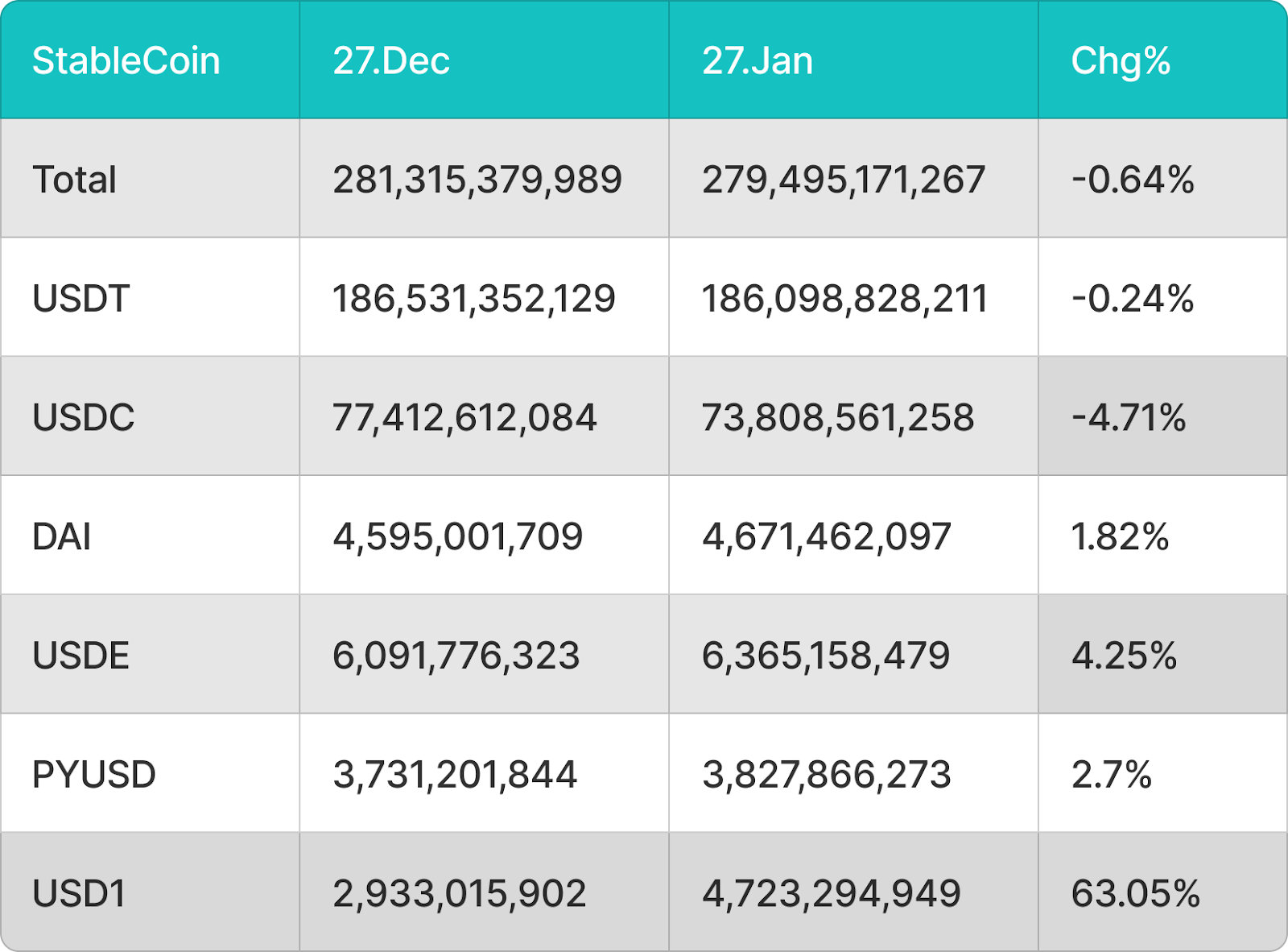

January Total Circulation of Stablecoins Decreased by $1.82 Billion

Due to the structural adjustments in the overall cryptocurrency market, the inflow of incremental funds from the over-the-counter market continues to slow, leading to a slight decline in the overall circulation of stablecoins, with the total scale decreasing from approximately $281.3 billion to $279.5 billion, a month-on-month decrease of 0.64%. Among them, USDT remained relatively stable, with only a slight outflow of 0.24%, indicating that its market position as a core settlement and storage tool remains solid. USDC, on the other hand, recorded a more significant outflow, decreasing by about 4.71% in a single month, reflecting that some funds are migrating from compliant stablecoins to other assets or on-chain scenarios.

At the same time, some non-mainstream or emerging stablecoins have seen counter-cyclical growth. USDE and DAI achieved slight expansions of 4.25% and 1.82%, respectively, indicating a recovery in market demand for specific mechanism-based stablecoins. PYUSD continues to maintain moderate growth, with a month-on-month increase of 2.7%. Notably, USD1 saw a significant increase in circulation of 63.05% in a single month, becoming the fastest-growing stablecoin this month, reflecting that market funds are structurally migrating towards new stablecoin products in the context of stagnant competition.

4. Price Analysis of Major Currencies

Bitcoin (BTC) Price Analysis

Bitcoin (BTC) Price Analysis

Bitcoin's price faced pressure and retreated near the 20-day Exponential Moving Average (EMA, approximately $90,521), effectively breaking below the previous upward trend line, indicating a shift in short-term structure from strong to weak.

From a trend and momentum perspective, the 20-day EMA has begun to flatten and show signs of a downturn, with the RSI operating below the zero axis, indicating bearish market momentum, with bears taking the initiative in short-term trading. At this stage, any rebound is more likely to be viewed as a technical correction, with prices expected to encounter sustained selling pressure in the moving average area.

In a bearish scenario, if BTC fails to quickly reclaim the moving average and falls back again, the first key support to watch is the $84,000 level. If this position is lost, the price may further test the $80,600 level, and market sentiment could significantly weaken. Conversely, if Bitcoin's price can regain the short- to medium-term moving averages and form an effective breakout, it would indicate a weakening of bearish momentum, and the market could strengthen again, testing the key resistance area at $97,924.

Ethereum (ETH) Price Analysis

Ethereum was previously operating within a symmetrical triangle consolidation structure, but the price has broken down below the support line, disrupting the original balance and indicating a bearish short-term trend.

From a technical perspective, a breakdown from a triangle typically signifies a completed directional choice, with the current price operating below the moving averages, showing limited rebound momentum. Bulls may attempt to push the price back into the triangle, but in the resistance area formed by the moving averages and previous support turned resistance, they are expected to face significant bearish pressure.

If ETH weakens again during the rebound, the ETH/USDT downward target will point to the $2,623 level, which will become a key battleground for bulls and bears. On the other hand, if the price can quickly reclaim the moving averages and return to operate within the triangle, caution should be exercised for a "false breakdown" scenario, where ETH may experience an accelerated rebound and test the upper resistance area of the triangle.

Solana (SOL) Price Analysis

Solana found significant support around $117 and began to rebound, indicating that there is some mid-term buying interest in this area, and the short-term structure has not completely deteriorated.

However, from a trend perspective, SOL is still operating below the main moving averages, and the current rebound is more inclined towards a technical correction. The 20-day EMA (approximately $131) will constitute the primary resistance; if the price encounters resistance and falls back in this area, the risk of a continued downward trend should be monitored.

In a bearish scenario, if the $117 support is effectively broken, SOL/USDT may accelerate its decline towards the strong support area around $95, at which point market volatility may significantly increase. If bulls can push the price to break through and stabilize above the moving averages, it would indicate a significant weakening of bearish momentum, and SOL may re-enter a range-bound oscillation pattern, with a short-term operating range to watch between $117 and $147.

5. This Month's Hot Events

1. World Liberty Trust Applies for U.S. National Trust Bank License with OCC

This month, World Liberty Financial, through its subsidiary World Liberty Trust, submitted a de novo application to the Office of the Comptroller of the Currency (OCC) to establish a national trust bank for the direct issuance, redemption, and custody of USD1 stablecoins. Currently, the circulation of USD1 has exceeded $3.3 billion, and plans are in place to offer free conversions between USD and USD1 upon launch, indicating an attempt to expand the circulation and use cases of stablecoins with minimal friction. This move signifies that stablecoin issuers are further aligning with banking regulatory frameworks, shifting the product narrative from "crypto asset tools" to "regulated digital dollar channels."

At the same time, relevant entities of World Liberty Financial have reached a cooperation intention with Pakistan to incorporate USD1 into a regulated digital payment system for cross-border payments and settlements. This arrangement reflects the reality of emerging markets prioritizing the introduction of dollar stablecoins to enhance cross-border settlement efficiency and reduce reliance on traditional clearing systems amid foreign exchange pressures and geopolitical financing constraints. Overall, if the license application is approved, USD1 will gain substantial expansion in compliance frameworks, institutional access, and cross-border payment scenarios, and whether its risk control and compliance capabilities can match the growth in circulation will be a key focus moving forward.

2. Escalation of the CLARITY Act for 2025 Digital Asset Market, Senate Progress but Increasing Divisions

The CLARITY Act (H.R. 3633) for the 2025 Digital Asset Market has made key progress at the Senate level. The U.S. Senate Agriculture Committee officially advanced the legislative process of the bill with a partisan vote of 12-11. Committee Chairman and Republican John Boozman stated that this is an important breakthrough after months of collaboration, saying, "Now is the time to push the bill forward." Core Democratic negotiator Corey Booker responded that while the progress is commendable, "there is still a lot of work to be done, and we hope to continue negotiations in the subsequent process."

However, the voting result was entirely along party lines, lacking Democratic support, which leaves the bill facing significant uncertainty before a full Senate vote. The current bill still needs to be reviewed by the Senate Banking Committee, where the version is progressing slowly due to more controversial provisions involving stablecoin yields, DeFi definitions, and regulatory jurisdiction. The White House plans to convene another coordination meeting next week to integrate the positions of the crypto industry, banking sector, bipartisan representatives, and regulatory agencies. If the bill ultimately passes in the Senate, it will be integrated with the version that has already passed the House with a high vote, and then submitted to the President for signature to become law.

The core goal of the bill remains to clarify the regulatory boundaries between the SEC and CFTC, provide a safe harbor for DeFi, and improve the regulatory framework for stablecoins, complementing the already effective GENIUS Act. The most controversial aspect remains the restriction on "passive yields" for stablecoins (rewards for merely holding), while retaining the "active yield" model linked to user on-chain behavior. Banking groups emphasize that passive yields could impact the deposit base and financial stability, while the crypto industry, represented by Coinbase CEO Brian Armstrong, argues that excessive restrictions on yields will weaken the competitiveness of U.S. stablecoins in the global market. The advancement of the Agriculture Committee is seen as a procedural breakthrough but further highlights the structural and long-term nature of bipartisan divisions.

3. X Bans InfoFi and New Algorithm Mechanism Impact

This month, X implemented systematic restrictions on several InfoFi projects, including banning accounts, reducing visibility, and cutting off certain data interfaces, leading to a single-day market cap drop of about 11.5% for the InfoFi sector, with KAITO dropping over 20% and COOKIE declining about 15%. The official stance is that even if API fees are paid, such third-party forms will no longer be accepted, indicating a complete denial of the InfoFi mechanism by the platform.

InfoFi projects convert social behaviors on X into tokenized rewards through external points, leaderboards, and other mechanisms, essentially functioning as "attention mining." Such mechanisms divert user behavior away from the platform's native recommendation and incentive systems, with the platform bearing the infrastructure costs while the value of attention is captured by external protocols. X is currently accelerating the advancement of its native creator incentive system (such as ad revenue sharing and Grok rewards), aiming to regain control over incentive and traffic distribution rights. This month, X publicly revealed the core logic of its new recommendation algorithm, which predicts user interaction probabilities based on large models, achieving "AI autonomous learning of user preferences" and reducing monopolistic exposure through author diversity scoring. This algorithm mechanism emphasizes enhancing content relevance and author diversity while weakening the impact of external interventions on recommendation flows. Under this ecological strategy, the automated interactions and low-quality content generated by the InfoFi mechanism are viewed as factors affecting user experience and recommendation quality. Therefore, this ban is not only a commercial rate dispute but is closely related to platform governance and algorithm recommendation strategy adjustments.

In response to the impact, Kaito has closed Yaps incentives and shifted towards cross-platform creator distribution and AI data analysis tools, while Cookie DAO focuses on B-end data services. In the short term, the valuation logic of related tokens and community confidence are under pressure; in the medium to long term, whether InfoFi can transform from a single social platform's attention incentive layer into an independent data and analysis infrastructure remains highly uncertain. Secondary market participants need to focus on on-chain indicators and strategic transformations rather than social noise.

6. Outlook for Next Month

1. Follow-up Progress on the CLARITY Act for 2025

The CLARITY Act has completed the advancement process in the Senate Agriculture Committee, but due to the partisan nature of the voting results and the slow pace of the Banking Committee's version review, the bill still faces significant resistance before passing the full Senate. In the short term, the multi-party coordination meetings led by the White House will be a key variable determining the bill's direction. If a compromise can be reached on stablecoin yield mechanisms, DeFi definitions, and regulatory jurisdiction, the bill may still achieve substantial breakthroughs within 2026; otherwise, the process may continue to spill over into 2027 and beyond.

From a market impact perspective, if the final version strictly limits passive yields, stablecoin projects will be forced to shift to active yield models (such as lending, market making, liquidity mining, etc.), raising user participation thresholds and potentially suppressing the expansion speed of stablecoins in low-friction scenarios like payments and storage. If market-based rewards are allowed to exist within a compliance framework, it will help accelerate the integration of blockchain with mainstream finance, enhancing the global competitiveness of the U.S. stablecoin system, but the premise is to simultaneously strengthen reserve transparency, risk disclosure, and liquidity regulation to prevent hidden leverage and decoupling risks. Overall, the next quarter will be a critical window for whether the regulatory path for U.S. digital assets shifts towards a "functional division + risk-layered regulation" model, and the outcome will directly impact the medium- to long-term structural evolution of stablecoins, DeFi, and the on-chain process of TradFi.

2. Launch of ERC-8004 and Collaboration with x402 to Promote Ecological Development

On January 28, the ERC-8004 standard was officially deployed on the Ethereum mainnet, entering a critical phase for ecological implementation in February. ERC-8004 complements the x402 micropayment protocol launched by Coinbase: the former addresses decentralized identity, reputation, and verification mechanisms for AI agents, while the latter provides HTTP-native stablecoin micropayment settlement capabilities, combining on-chain AI service discovery and value exchange, thus laying the foundation for a decentralized machine economy. Based on this combination, it is expected to promote autonomous agents to engage in real value exchanges in scenarios such as DeFi, data markets, and automated workflows, achieving a closed loop of "who can provide services, how to charge, and how to pay."

- Progress of the first batch of integration and pilot projects: Infrastructure components such as the x402 payment router, micropayment tools, and Agent management and operation platforms have begun deployment in testing environments or early mainnets.

- Increased activity in developer and cross-protocol collaboration: As standards stabilize, more development teams, such as DayDreams system projects, are attempting to integrate Agent identities, AP2 communication protocols, x402 payments, and ERC-8004 identity/reputation, forming a complete commercial Agent stack.

- Infrastructure projects attracting attention: The protocol layer ecosystem (e.g., payment facilitators, x402 tool libraries, Agent operation monitoring platforms, etc.) will see early user and developer feedback loops, which are crucial for assessing the performance and experience of standards in real-world use.

In the short term, as the ecosystem is still in its early stages, the actual transaction volume of x402 and the growth of Agent registrations may be small. However, as developer tools mature, infrastructure improves, and the demand for cross-chain Agent collaboration increases, this combination is expected to become the core technological path for building the next generation of decentralized AI service ecosystems.

3. Outlook for World Liberty Trust

With World Liberty Trust submitting an application for a national trust bank license to the OCC, the compliance and institutional access prospects for USD1 will become clearer. If the license is approved, USD1 will not only be legally issued, redeemed, and custodied under the U.S. federal regulatory framework but may also become an emerging compliant digital dollar channel for institutional clients and cross-border payments. This will significantly enhance the acceptance of USD1 within financial institutions, trading platforms, and corporate payment systems, increasing market trust and circulation activity.

In the short term, it is expected that the use cases for USD1 will expand to more institutional payments and corporate cross-border settlements, especially in digital payment projects in emerging markets (such as Pakistan) in collaboration with regulatory authorities, further demonstrating the advantages of dollar stablecoins in replacing traditional clearing systems and reducing friction in cross-border transactions. At the same time, the dollar-pegged attributes and "free conversion" mechanism may attract more individual and institutional users, thereby driving the growth of USD1 circulation and strengthening its position in the global payment ecosystem. However, it should be noted that there is still uncertainty regarding the license approval, and full implementation may take several months. Additionally, stablecoin operations must strictly comply with reserve management, monthly audits, anti-money laundering, and compliance penetration requirements. Whether the project's risk control and compliance capabilities can match the rapidly expanding market scale will be key to the sustainable development of USD1. Furthermore, changes in regulatory policies, the pace of cross-border cooperation, and market competition pressures (such as other dollar stablecoins or central bank digital currencies) may also affect its expansion pace and market share.

Therefore, next month, it will be important to focus on the OCC approval progress, the implementation status with Pakistan and other emerging markets, institutional access and user activity, as well as the project's risk control and compliance execution. These factors will directly determine USD1's competitiveness and sustainable development potential in the global payment, institutional application, and stablecoin ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。