The US dollar index surged rapidly, the US Treasury yield curve steepened, the declines in the three major stock index futures widened, and precious metal prices plummeted—a collective sell-off in the financial markets is responding to the possibility of a former Federal Reserve governor returning to the center of power.

On the evening of January 29 local time, US President Donald Trump announced his plan to reveal the nominee for the next Federal Reserve chair the following morning (January 30). He hinted that the nominee "comes from the list of candidates," someone well-known and respected in the financial community.

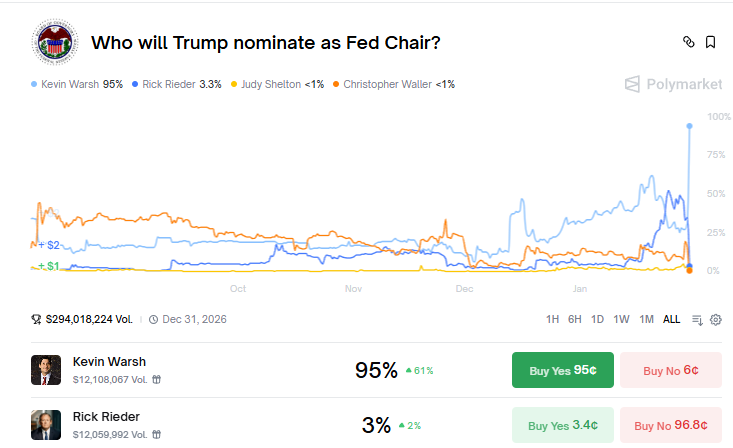

Almost simultaneously, multiple sources and prediction market data focused on the same individual: former Federal Reserve governor Kevin Warsh. The prediction market Polymarket showed that the probability of Warsh being nominated had soared to 95%.

1. Background of the Nomination

● The current Federal Reserve chair Jerome Powell's term will end on May 15, 2026. Since returning to the White House in early 2025, Trump has repeatedly criticized Powell's monetary policy and threatened to remove him from office.

● The tension between the two reached new heights recently. On January 9, the US Department of Justice served a subpoena to the Federal Reserve, threatening to file criminal charges regarding Powell's testimony before Congress in June 2025. Powell subsequently stated that the related accusations were an "excuse," claiming he was under investigation because the Federal Reserve "did not comply with the president's wishes" in setting interest rates.

● Trump has explicitly expressed his desire for interest rate cuts, stating that the current interest rates set by the Federal Reserve are "unacceptably high" and claiming that US rates "should be the lowest in the world." On the eve of the nomination on January 29, he criticized Powell on social media for "once again refusing to cut rates."

2. Final Candidates

● Trump's choice ultimately narrowed down to four final candidates. Besides Warsh, the other three are: current Federal Reserve governor Christopher Waller, BlackRock executive Rick Rieder, and White House National Economic Council director Kevin Hassett.

● All four candidates support lowering interest rates, aligning with Trump's clear criteria. However, there are significant differences in their policy inclinations and market friendliness. According to analysis from China Merchants Securities, the four candidates can be roughly ranked from "dovish" to "hawkish" as follows: Hassett, Rieder, Waller, Warsh.

● After Trump hinted on the 16th of this month that he hoped Hassett would remain in his current position, the nomination probability for this early favorite significantly decreased. The competition in the market mainly unfolded between Warsh and Rieder, with Warsh emerging as the most favored frontrunner at the last moment.

3. Frontrunner Warsh

● Kevin Warsh's resume spans the public sector, academia, and the investment world. He served as a Federal Reserve governor from 2006 to 2011, experiencing firsthand the response to the global financial crisis. This experience allowed him to be deeply involved in key communications between the Federal Reserve and the market. After leaving public office, he taught at Stanford University's business school while also serving as a visiting scholar at the Hoover Institution.

● More critically, he directly engaged in investment practice, becoming a partner at financier Stan Druckenmiller's family office. This three-dimensional background gives his criticism of monetary policy both theoretical depth and market insight.

● Warsh holds a comprehensive reflective attitude towards the "aggressive expansion era" of the Federal Reserve's balance sheet over the past fifteen years. While he supported the first round of quantitative easing (QE) introduced to address the crisis, he firmly opposed its normalization. He believes that subsequent rounds of QE distorted market signals and blurred the boundaries between monetary and fiscal policy, leading central banks into the quagmire of "fiscal dominance."

4. Unique Policy Combination

Deutsche Bank's analyst team pointed out that if Warsh is elected, his policy proposals may present a seemingly contradictory unique combination: "simultaneous interest rate cuts and balance sheet reduction."

● On one hand, interest rate cuts can respond to Trump's political pressure for easing and address potential economic weakness. On the other hand, balance sheet reduction embodies his long-held core principle: to "shrink" the Federal Reserve's massive balance sheet and return to more traditional monetary policy responsibilities.

● Warsh recently explained this logic in an interview: "If we let the printing press quiet down a bit, interest rates can actually be lower." He advocates for reducing the balance sheet to create space for lowering interest rates.

● However, the feasibility of this combination hinges on a key premise: the demand for reserves in the US banking system must be significantly reduced through regulatory reform. Under the current financial system structure, achieving significant balance sheet reduction in the short term without triggering market liquidity tensions poses a huge challenge.

5. Market Immediate Reaction

The news of the nomination triggered significant volatility in the financial markets. Due to Warsh's long-standing reputation as a "hawk," the market quickly began pricing in a "more traditional, less market-friendly" Federal Reserve chair.

● The US dollar strengthened significantly against almost all developed market currencies, with the dollar index, which measures the strength of the dollar, rising nearly 1%. This reversed its recent trend of weakening due to market expectations of "dollar depreciation."

● At the same time, US Treasury yields surged rapidly, causing the yield curve to steepen. Andrew Ticehurst, a senior strategist at Nomura in Australia, noted: "In this situation, we may see fewer rate cuts in the future."

● Risk assets were generally under pressure. The declines in the three major US stock index futures widened. The commodities market was hit hard, with gold prices plummeting nearly 4.8% during Friday's trading session. Prices of industrial metals like oil and copper also fell in tandem.

6. Future Core Challenge: $6.6 Trillion Balance Sheet

● Regardless of who takes over, they will face a specific and daunting task: how to manage the Federal Reserve's massive balance sheet of up to $6.6 trillion. This is a core legacy left by the predecessor and a focal point of future divisions. Warsh has long advocated for the Federal Reserve to maintain a smaller balance sheet, arguing that aggressive bond-buying programs have gone too far.

● Other candidates have a more moderate stance. For example, Rieder from BlackRock has stated that the Federal Reserve should stop shrinking its asset holdings to avoid destabilizing the financing markets. The next chair must navigate a market that is extremely sensitive to reserve conditions. The severe market volatility in 2019 and at the end of 2025 indicates that the Federal Reserve needs to strike a delicate balance between balance sheet reduction and maintaining market stability.

● Benjamin Goldberg, head of US interest rate strategy at TD Securities, pointed out: "The government is doing everything it can to push for lower interest rates, so neither hawkish interest rate views nor balance sheet views will be welcomed in this regard."

7. Ultimate Test of Independence

A deeper challenge lies in the unprecedented test of the Federal Reserve's "independence" and "credibility." The political pressure from Trump for significant interest rate cuts presents a potential conflict with Warsh's emphasis on discipline and a return to tradition.

● Warsh himself acknowledges the value of central bank independence but sharply points out that it is precisely the Federal Reserve's poor performance and role overreach that weaken the rationale for defending its independence.

● The market will immediately begin to "test": can he withstand the political pressure from the White House? How will he balance his commitment to rebuilding the Federal Reserve's anti-inflation credibility with potential interest rate cuts?

● For a chair who only has one vote in a Federal Open Market Committee (FOMC) composed of multiple members, implementing any significant policy shift is exceptionally challenging.

8. Confirmation Path After Nomination

Even if nominated, Warsh's appointment is not a done deal and still requires confirmation from the US Senate.

● Currently, this process has encountered political obstacles. North Carolina Republican Senator and Banking Committee member Thom Tillis has made it clear that he will block any Federal Reserve nominee from Trump until the Justice Department's investigation into Powell is concluded.

● Tillis stated: "The Federal Reserve nomination will not move forward until the investigation and potential prosecution of Chair Powell are completed." When Senate Majority Leader John Thune was asked whether confirmation would be possible without Tillis's support, he reportedly replied, "Probably not."

● This could put the Federal Reserve chair position in an awkward situation. If the nomination cannot be confirmed after Powell's term ends in May, the Federal Reserve may be led by an acting chair, a scenario the Trump administration would prefer to avoid.

The dollar index rebounded nearly 1%, gold fell nearly 5% from its highs, and US stock futures all declined—the market has already cast its urgent vote for a Federal Reserve chair who may usher in a new era of "interest rate cuts and balance sheet reduction" on the eve of Trump's official announcement.

Regardless of whether the nomination ultimately passes Senate confirmation, Warsh's lead itself has already signaled a message: the era when central bank independence was considered sacred and inviolable is facing profound challenges. The world's largest central bank is about to take a step filled with uncertainty amid political pressure, market expectations, and internal ideologies.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。