BTC dipped to the 81,000 level before rebounding to the 83,300 mark. This rebound has confirmed resistance at the close, and the subsequent downward trend is clear! From a technical perspective, the area around 83,300 is under pressure from the MA moving averages, with the hourly close showing weakness. Additionally, the current BTC daily Bollinger Bands are opening downward, and the moving averages are in a bearish arrangement. Coupled with the overall market's strong risk-averse sentiment, the rebound lacks volume support, serving only as a weak recovery after an oversold condition, not a trend reversal.

At present, the 82,700 position is the best entry point for short positions. If you miss this opportunity, it will be hard to find such a quality entry again! The first target is directly below 80,000, which is recognized by the market as a key support level. Once it effectively breaks down, the space below will open up completely, with no pressure until the previous low around 76,300.

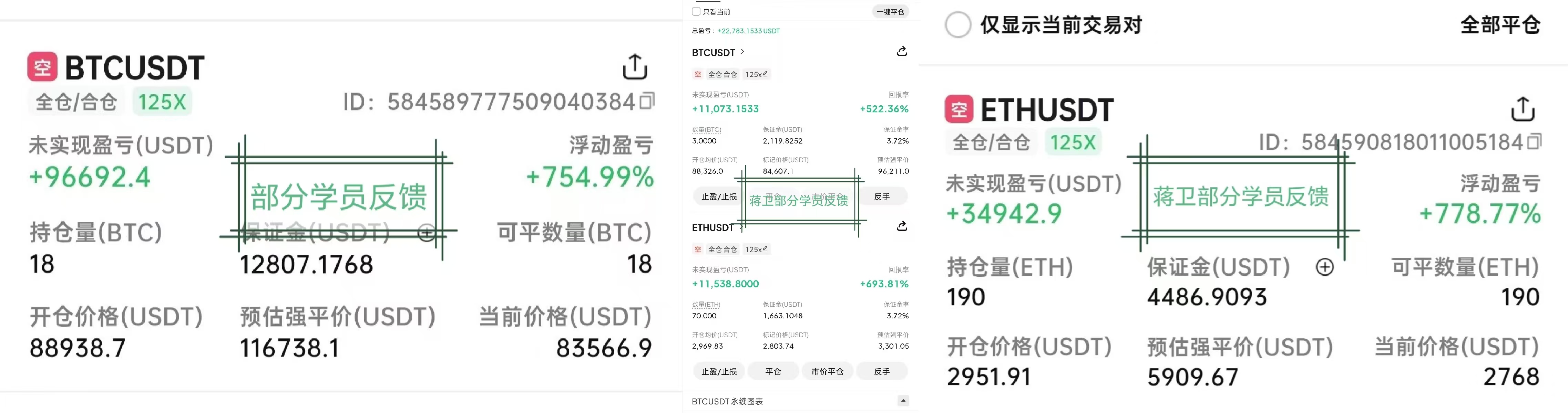

With the Spring Festival approaching, whether we can have a prosperous year depends on this precise short position! If you are still watching your position continuously shrink and feel helpless, longing for your account balance to increase and to experience the thrill of asset multiplication, the opportunity is right in front of you! We are recruiting a limited number of students before the Spring Festival, strictly controlling trading strategies throughout the process, accurately grasping entry and exit points, guiding you to align with the trend rhythm, and letting your account numbers dance, easily achieving asset appreciation before the Spring Festival!

Follow our public account, how to relieve worries, only Jiang Wei, a treasure analysis blogger with high emotional value, sharing trading education for free, bringing stable strength and clear guidance in the restless trading market, traversing three rounds of bull and bear markets and years of practical trading experience, specializing in naked K, trends, Dow Theory, Gann, harmonics, Chan theory, wave theory, and other technical analyses, gathering into unique personal insights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。