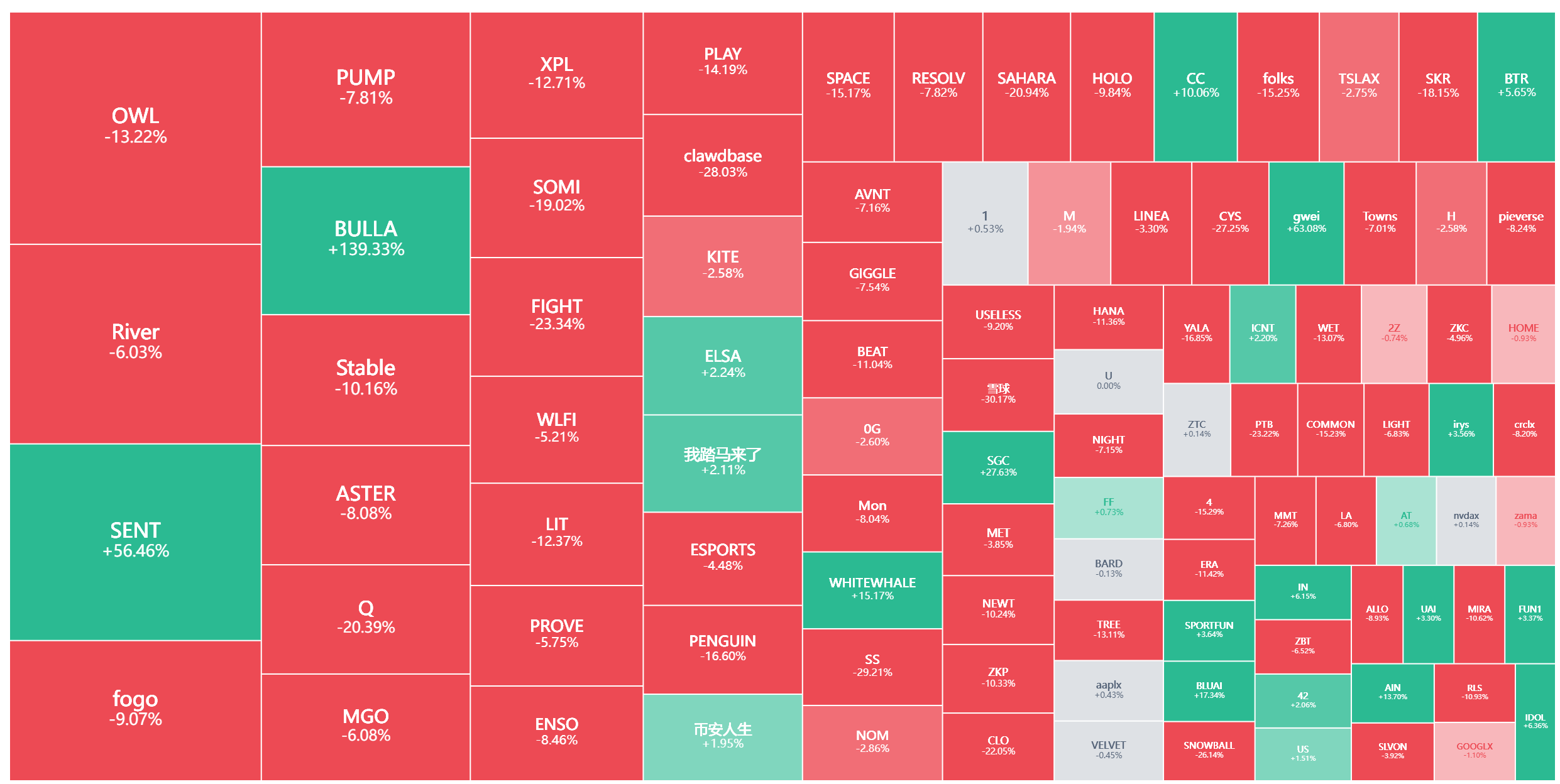

The lights in the Federal Reserve meeting room had just gone out when the crypto market experienced a nearly hour-long accelerated sell-off, with Bitcoin's price plummeting like a kite with a broken string. On January 30, Bitcoin underwent a sharp decline, dropping 1.51% in a short period and ultimately falling below the $86,000 mark. This drop occurred immediately after the Federal Reserve's Federal Open Market Committee meeting.

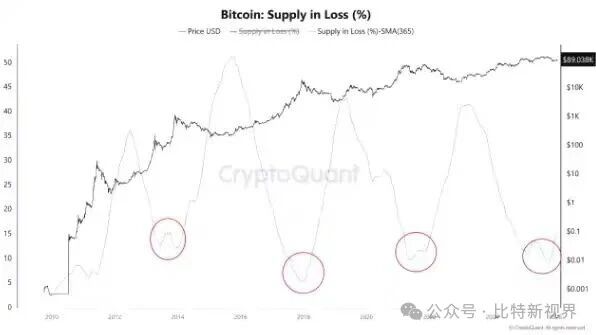

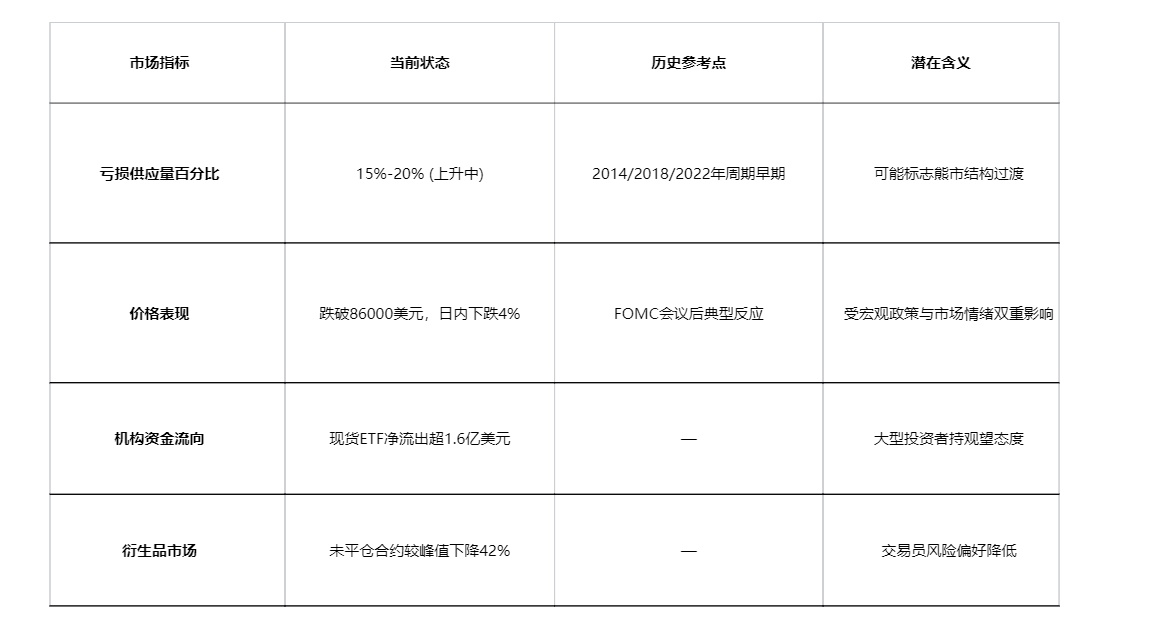

Meanwhile, on-chain data has detected a key indicator—the “percentage of Bitcoin in loss supply” has begun to rise again, currently increasing from 15% to 20%. This change is viewed by some analysts as a signal that the market may be transitioning to an early bear market structure.

1. Market Dynamics

● The cryptocurrency market experienced a sharp sell-off on January 29. This sell-off lasted about an hour, with Bitcoin's price dropping 1.51% and quickly falling below the important psychological level of $88,000.

● As the selling pressure continued, Bitcoin's price further declined, ultimately expanding the daily drop to 4%, with the price falling below $86,000. This drop occurred after the latest Federal Reserve meeting results were announced, and the market reacted swiftly.

● This downward pattern is not new. Looking back at data from 2025, Bitcoin experienced significant pullbacks after 7 out of the 8 FOMC meetings last year, with only one instance showing a brief increase.

2. On-Chain Signals

● Beneath the surface price fluctuations, a key on-chain indicator is sending warning signals. CryptoQuant analyst Woominkyu pointed out that the percentage of Bitcoin in loss supply has begun to trend upward again.

● This indicator measures the proportion of Bitcoin whose holding cost is higher than the market price relative to the total supply. Historically, an increase in this indicator typically marks the beginning of the early stages of a bear market. Losses begin to spread from short-term holders to long-term participants, indicating a market structure change that warrants caution.

3. Historical Comparison

Comparing the current situation with historical cycles, it can be observed that in the market cycles of 2014, 2018, and 2022, the percentage of loss supply began to rise before the market ultimately bottomed out. In these historical cases, prices continued to weaken during the period of this indicator's rise, and the true market bottom often formed only after the “percentage of loss supply” significantly expanded.

Although the current “percentage of loss supply” is still far below historical “surrender levels,” the directional change itself is significant.

4. Macroeconomic Background

● Senior market analyst Samer Hasn pointed out that Bitcoin's current pullback coincides with the Federal Reserve maintaining a hawkish stance. Investor interest in digital assets is cooling, and market momentum is rapidly dissipating.

● The latest Federal Reserve meeting statement indicates that the U.S. unemployment rate has shown some signs of stabilization, but inflation remains at slightly elevated levels. This statement reinforces market expectations that interest rates will remain high for some time.

● Rising macroeconomic uncertainty is causing funds to flow more towards traditional safe-haven assets like gold. Bitwise Chief Investment Officer Matt Hougan noted that gold prices have risen above $5,000 per ounce.

5. Capital Flows

● Institutional capital flows also show a cautious attitude. Recently, Bitcoin spot ETFs have seen net outflows for several consecutive days, totaling over $160 million. This indicates that large investors are not rushing to buy on dips but are choosing to wait for clearer macro signals.

● The derivatives market also shows signs of waning confidence. Data indicates that the size of open interest in crypto futures has declined by about 42% from historical highs, reflecting a significant decrease in traders' risk tolerance. Each time the price attempts to rebound, it faces new selling pressure, indicating that the current market structure remains fragile.

6. The “FOMC Curse”

● Market observers have noted an interesting phenomenon referred to as the “FOMC curse.” In the eight Federal Reserve meetings of 2025, Bitcoin experienced declines after seven of them, with a drop of as much as 9% following the December meeting.

● Analysts generally attribute this trend to the uncertainty surrounding interest rate adjustment expectations or the reverse effects of confirmed easing policies. This pattern seems to have reappeared after the first FOMC meeting of 2026.

After each meeting, the market seems to reassess the liquidity outlook, leading to sharp price fluctuations in the short term. This pattern has garnered widespread attention from traders.

7. Outlook

● The current market conditions suggest that Bitcoin may be transitioning to a bear market structure, rather than merely experiencing a temporary pullback within a bull market trend. Although the “percentage of loss supply” remains far below historical surrender levels, the directional change itself is significant.

● In the short term, with risk-averse sentiment prevailing and liquidity not showing significant improvement, Bitcoin may still face volatility pressure. The market is waiting for new catalysts to emerge to determine the next direction.

● Policy-level pressures remain a key variable. Federal Reserve Chairman Powell reiterated that decisions will be data-driven and did not signal an urgent need for rate cuts. Former Federal Reserve economist William English also stated that interest rates are likely to remain in the current range until there are significant changes in employment data.

The “FOMC curse” in the crypto market has once again been validated, with Bitcoin's price falling below $86,000. Meanwhile, the “percentage of loss supply” has risen to 20%, a key indicator that has shown similar trends in the early bear markets of 2014, 2018, and 2022.

Open interest in futures has decreased by 42%, and net outflows from spot ETFs have exceeded $160 million. When market indicators resonate with capital flows, this adjustment may be more profound than anticipated.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。