Original | Odaily Planet Daily (@OdailyChina)

"The big crash" is happening again.

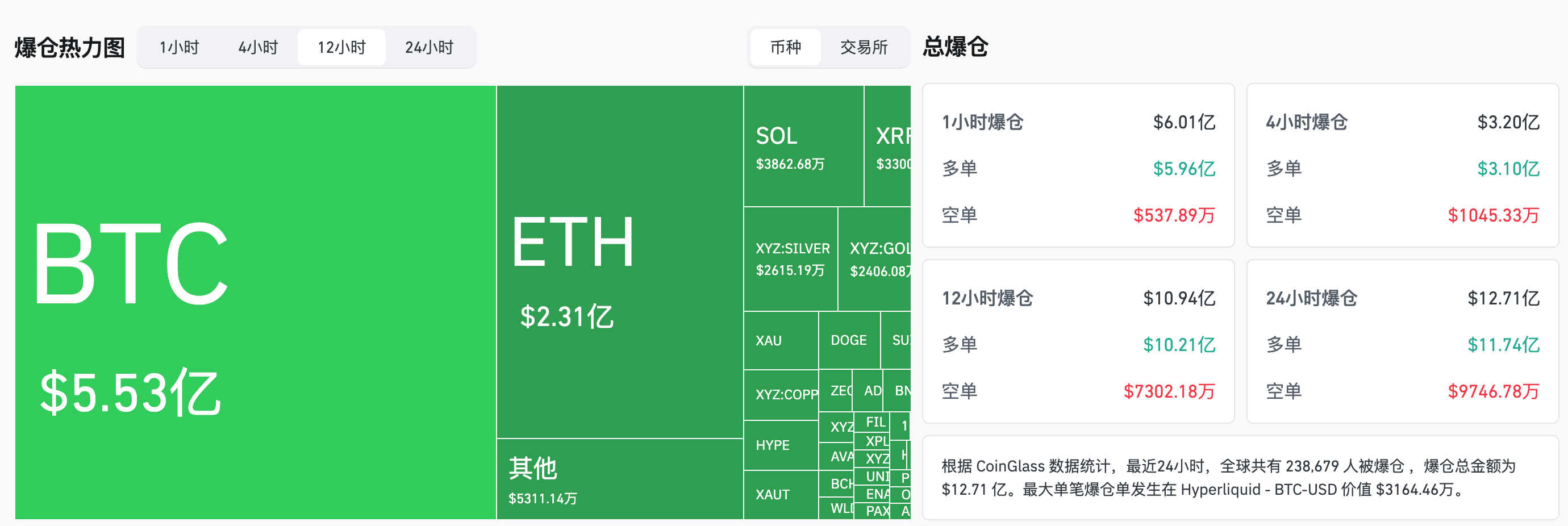

According to OKX market data, from last night to this morning Beijing time, BTC quickly fell from around $88,000, briefly dropping below $81,200, with a 24-hour decline of over 7%; ETH dropped from $2,940 to a low of $2,690, with a nearly 10% decline in 24 hours; SOL fell from $123 to around $112, with a 24-hour decline of over 8%. Coinglass data shows that in the past 12 hours, the market saw liquidations of $1.094 billion, with long positions accounting for as much as $1.021 billion; nearly 240,000 people were liquidated in 24 hours.

This drop was not triggered by a single negative factor, but rather the result of multiple factors being released simultaneously.

Middle East tensions suddenly escalate, geopolitical risks re-emerge in the market

The sudden escalation of geopolitical risks was one of the key background factors contributing to last night's market decline.

Recent news indicates that the U.S. aircraft carrier "Abraham Lincoln" and its strike group have entered a "full ship blackout" and interrupted communications. This action is typically seen as a standard procedure before significant military operations, leading the market to speculate that actions against Iran are entering a highly sensitive phase.

At the same time, Iran's statements have clearly shifted to a state of military readiness. Iran's First Vice President Ebrahim Raisi stated that since the current government took office, Iran has maintained a state of readiness and will not initiate war, but if conflict arises, it will defend itself firmly, emphasizing that "the outcome of war will not be determined by the enemy." He pointed out that preparations for a state of war must be made.

Although the situation has not yet escalated into substantial conflict, this "highly opaque, unverifiable, and unpredictable" state itself is enough to influence market behavior. In a context where liquidity is already tight and risk appetite is declining, the uncertainty of geopolitical factors is quickly factored into prices, prompting funds to reduce directional exposure rather than continue betting on high-volatility assets.

FOMC "hawkish landing," liquidity expectations re-priced

The decline in the crypto market cannot be separated from the Federal Reserve.

At the January FOMC meeting, the Fed kept the benchmark interest rate unchanged in the range of 3.50% to 3.75% and emphasized that the unemployment rate has stabilized while inflation remains elevated. The statement itself did not significantly exceed market expectations but completed a "closure of expectations" on an emotional level—the market's previous vague fantasies of short-term rate cuts or even a policy shift have been officially compressed or even eliminated.

For risk assets, such moments often do not appear in the form of "new negatives," but rather manifest as "the inability to continue to overdraw positives." Since 2025, Bitcoin has experienced corrections after multiple FOMC meetings, which is a repeated interpretation of this mechanism: it is not that policy suddenly turns hawkish, but that the market must acknowledge that liquidity will not arrive as expected.

When positions have already accumulated and leverage has been raised, this confirmation of "the shoe dropping" is enough to trigger risk release—it is not the first push that knocks over the dominoes, but rather causes all already precarious structures to lose support simultaneously.

Not just the crypto market is falling; U.S. stocks and precious metals are also "changing faces"

What is more concerning is that this decline is not a "one-man show" in the crypto market.

In the U.S. stock market, the decline in stock indices has become an important signal of weakening market risk appetite. The Nasdaq 100 index fell about 1.6%, the S&P 500 index dropped about 0.75%, and the Dow Jones Industrial Average also fell about 0.2%, with all three major indices under pressure, particularly the technology sector, which performed weakly, dragging down overall market risk appetite.

At the same time, the precious metals market, which was originally seen as a "safe-haven asset," also experienced significant volatility. After a recent strong rally, gold prices saw a sharp correction last night, with the market showing clear profit-taking; silver also quickly retreated from its highs, with a significant drop. This indicates that funds are not simply switching from risk assets to safe-haven assets but are overall reducing risk exposure in a high-volatility environment.

When stocks fall, crypto assets are under pressure, and precious metals also correct simultaneously, the signals released by the market are quite clear. Funds are simultaneously reducing exposure across multiple asset classes, and overall risk appetite is rapidly contracting.

In such an environment, Bitcoin naturally finds it difficult to stand alone. It is neither truly regarded as a safe-haven asset by the market, nor due to its high volatility, often becomes the first to be reduced when sentiment shifts to risk aversion.

Continuous outflows from ETFs significantly reduce the crypto market's absorption capacity

Changes in the funding landscape provide the final piece of the puzzle for this round of decline.

From the data of Bitcoin spot ETFs, funds are continuously withdrawing. Data shows that in just the past week, BTC spot ETFs have seen continuous net outflows, with several days recording outflows exceeding $100 million, with cumulative net outflows exceeding $1 billion.

More importantly, the withdrawal of ETF funds is not a one-time release but rather a continuous, multi-day, trend-based reduction. This means that institutional funds have not chosen to "buy the dip" during the correction but are more inclined to reduce overall risk exposure, waiting for clearer macro and market signals.

In such a funding environment, the market has not gained a "buffer." When prices decline, ETFs have not provided sustained buying power, and the market relies more on existing funds to digest selling pressure. Once key price levels are breached, selling behavior quickly dominates, while buying pressure is noticeably lagging, forcing prices to quickly drop to find balance.

Not a black swan, but a concentrated release of "forced risk reduction"

The essence of BTC's current decline is not triggered by a single sudden negative factor but is the result of the market re-pricing risk assets under the accumulation of multiple risk factors. The escalation of geopolitical uncertainty, the correction of macro liquidity expectations, and the continuous net outflows from ETFs have left the crypto market lacking stable structural support, ultimately triggering the market's proactive "braking" behavior.

When long-term funds and passive buying are absent, the market often breaks through key trend positions downward through price, forcing trend strategies and leveraged funds to exit passively, thus completing the first phase of risk clearance. In this process, Bitcoin fell below the market's highly watched 100-week moving average (around $85,000), a position that has acted as a "safety net" multiple times during adjustments since last year and is also the default defense line for many trend models and leveraged positions.

As a result, the current market has completed the first round of rapid deleveraging and emotional clearance, but true stabilization still relies on two conditions: first, whether key technical positions can be reclaimed and stabilized, and second, whether risk capital is willing to return to the market to participate in pricing. Until then, high volatility and low confidence may remain the main theme of the stage.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。