As January 2026 comes to a close, the crypto market, especially in the Bitcoin sector, shows clear signs of sluggishness. From the decline in trading volume on centralized exchanges to the surge of negative sentiment on social media, and the uncertainty in U.S. policy, these factors collectively shape a challenging monthly wrap-up. Bitcoin, as the core of cryptocurrency, often mirrors the pulse of the global economy. This article reviews the key dynamics of the crypto market in January based on recent data and explores its potential impact on the future.

Firstly, the spot trading volume on centralized exchanges (CEX) hit a low this month. According to Cointelegraph, the CEX spot trading volume in January reached only $1.1 trillion, the lowest level since July 2025. This decline reflects a weakening of investor participation, possibly influenced by seasonal holiday factors, macroeconomic pressures, or capital diversion. Bitcoin's price trended downward amid fluctuations this month, with traders more inclined to wait and see rather than actively engage. If this trend does not reverse by the end of January, it may inject more uncertainty into the February market, affecting overall liquidity.

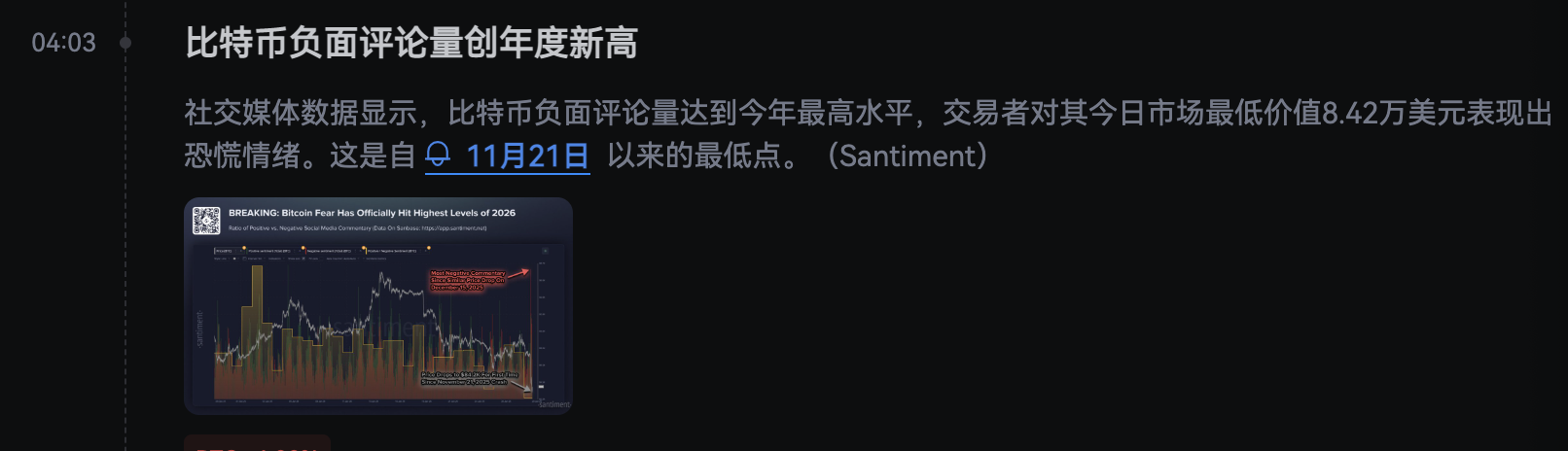

Meanwhile, market sentiment indicators reached a negative peak this month. Santiment data shows that the ratio of negative comments about Bitcoin on social media surged to the highest level since the beginning of 2026, with prices briefly dipping to a low of $84,200—marking the lowest sentiment level since November 21, 2025. The chart clearly depicts a sharp rise in the "Bitcoin Fear Index," a sentiment that often amplifies short-term sell-offs but may also signal the formation of a market bottom. As January comes to a close, this surge in fear reminds investors that the sentiment in the crypto market is highly cyclical, often followed by rebounds after extreme lows.

In this context, former U.S. President Trump's latest policy statement adds drama to the end of January's crypto market. He announced that he would reveal the nominee for the Federal Reserve Chair tonight Beijing time (tomorrow morning U.S. time), having previously planned to make the formal nomination next week, and emphasized that interest rates should be lowered by 2 to 3 percentage points to stimulate economic growth.

Powell's term will end in May 2026, and this change directly relates to the direction of monetary policy. Historically, a low-interest-rate environment is favorable for the inflow of funds into risk assets like Bitcoin. If new policies are implemented at the end of January, they could serve as a catalyst for a turning point in the crypto market; otherwise, tightening expectations may prolong the period of sluggishness.

In summary, reflecting on the crypto market in January, the trading weakness and emotional lows faced by Bitcoin are concerning, but the potential changes at the Federal Reserve may ignite a spark of hope.

As investors close out the month, they should assess risks and pay attention to macro signals—the crypto world is ever-changing, and January's "cold wave" may just be paving the way for a stronger recovery.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

The above information is compiled from online sources and does not represent the views of the AiCoin platform. It does not constitute any investment advice. Readers should exercise their own judgment and manage financial risks accordingly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。