Written by: Huang Wenjing, Yan Xuesong

Introduction

Looking back from early 2026, 2025 was a year of reshaping for the crypto world—Bitcoin reached new highs, key projects were launched, and the market steadily rose with rationality. A more profound transformation came from the maturity of global regulation: stablecoins, licensing, and anti-money laundering rules were clearly established in multiple countries, injecting much-needed certainty into the industry.

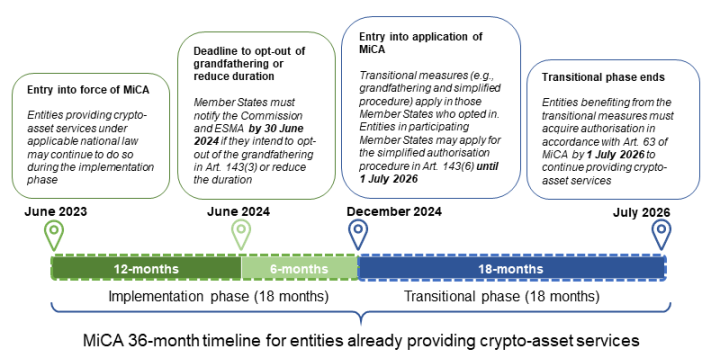

Among these, the EU MiCA regulation will be fully implemented by the end of 2024, entering a critical landing period in 2025. This unified framework covering 27 countries acts like a beacon, delineating compliance boundaries while illuminating new growth opportunities. As the transition period officially ended in the fourth quarter of last year, the European market has quietly deepened and restructured—68 new licensed institutions have entered the scene, with traditional VASPs successfully transforming into CASPs, alongside new forces making a strong debut.

Timeline of MiCA for licensed entities providing crypto asset services over 36 months

(Source: Latest guidance from ESMA official website)

This article will start from the latest regulatory trends, outline the types and characteristics of new licensed institutions, interpret the differentiated paths of various countries, and reveal the next evolutionary trends in the industry. It aims to help you penetrate the transformation and gain insight into the true pulse of the European market.

The Landscape of 68 New Licensed Institutions and the New Situation in the European Market

1. The Logic of Service Licensing: License ≠ All-Powerful

The core of the MiCA regulation is to set a unified entry threshold for crypto asset service providers across Europe. Licensed entities approved by national competent authorities (NCA) can legally operate throughout the EU via the "passport" mechanism (EU Passport). According to MiCA, licensed institutions can provide 10 types of services, including custody, operating trading platforms, exchange, order execution, investment advice, and more.

However, the scope of license authorization varies significantly, depending on the service combination chosen at the time of application. Common business logic includes:

- Platform-type services: Operating a trading platform usually requires supporting services like custody, exchange, and order execution to support a complete trading loop.

- Asset management-type services: Portfolio management often needs to be combined with order execution to achieve dynamic asset allocation.

- Independent services: Custody, investment advice, and transfers can also exist independently, suitable for institutions focusing on niche areas.

It is important to note that the above possible service combinations are not mandatory and only represent a typical business logic: large comprehensive platforms (like Coinbase, Kraken) usually apply for multiple services because they can support each other to create a closed-loop user experience. However, smaller or specialized institutions can focus on a single service, such as only providing custody wallets, independent advice, or cross-chain bridges, which is perfectly acceptable.

In practice, various business combinations mainly appear in scenarios where institutions want to provide "one-stop" services; if they only want to operate a very singular business or have budget constraints, they can completely avoid relying on other services, saving both money and effort. This also means that when an institution advertises that it holds a MiCA license, it is best not to assume that it can "do everything."

Understanding this helps us view the strategies and capabilities of newly licensed institutions more objectively and clarifies the following common misconceptions:

- Does holding a MiCA license mean complete compliance and no risk? — Not necessarily; the license only represents that it can conduct business within the authorized scope and does not exclude other operational and market risks.

- Does an institution advertising its MiCA license mean it has all service qualifications? — Not necessarily; its actual business may be limited to custody, exchange, or advice in a specific area.

- Does an institution providing portfolio management necessarily execute trade orders? — Not necessarily; the institution can achieve trade execution by collaborating with third-party licensed service providers.

2. Key Characteristics of Newly Licensed Entities in Q4

In the fourth quarter of 2025, 68 new licensed institutions emerged, directly resulting from the concentrated end of the MiCA unified regulatory transition period in most member countries. Institutions that previously relied on existing VASP systems faced a final deadline of "license or exit," leading to a wave of concentrated compliance applications and transitions.

This phenomenon is both a natural result of the regulatory transition period and reflects the strategic choices of institutions in adapting to new regulations—whether international giants or local newcomers, all completed their identity transitions before the deadline, reflecting a clear trend of layered evolution and ecological integration in the crypto industry.

- Total surge: The total number of licensed entities reached 133, with 68 new licensed entities in the fourth quarter—significantly higher than the first three quarters.

- Service concentration: The types of services mainly include custody, transfer, and exchange, with a low proportion of full-service/multi-service licensed entities and a high proportion of narrow authorizations.

- Regional concentration: About 60% are concentrated in Western Europe (42 entities in Germany, France, the Netherlands, Austria, and Ireland), while Eastern Europe and EEA countries (Liechtenstein) are becoming active.

- Rise of Northern Europe: The Nordic region saw a "surge": Finland increased from 1 to 5 entities in Q4, and Sweden went from none to having licensed entities.

- Cross-border activity: High utilization of the passport, with most institutions covering more than 10 EU countries.

The Layers of New Licensed Entities: Tension Between Emerging and Traditional

Overall, these new institutions can be roughly divided into three categories: giants, mid-tier, and new players. This classification is based on their scale, market influence, and breadth of services.

1. Giants: Leading Market Unity

Among the licensed institutions in the fourth quarter, the entry of industry giants is particularly noteworthy. These institutions typically tend to apply for more than 5 types of service permissions, building multifunctional "one-stop" platforms covering custody, trading, exchange, etc., to quickly respond to the demands of the EU unified market.

The UK digital bank Revolut obtained a license in Cyprus, offering 6 services including custody, trading platform operation, and fiat exchange, potentially bringing its over 50 million users into the crypto world. The global exchange KuCoin obtained 5 service licenses in Austria, covering core functions such as custody, exchange, and underwriting; meanwhile, Blockchain.com (Malta) and crypto bank AMINA EU (Austria) also entered the market as comprehensive service providers.

Characteristics:

- Economies of scale: These licensed entities typically enjoy international or continental-level reputations, with a large user base, strong capital, and mature technology. They are expected to quickly expand their operations and capture market share in the EU unified market.

- Internal integration: Many achieve market entry by establishing subsidiaries, strategically avoiding external risks.

2. Mid-Tier: Steady and Solid Power

Alongside the giants are some mid-tier licensed entities, which typically have stable and moderately sized user groups and mature technology in certain areas, previously relying on national-level VASP registrations.

For example, Bitonic B.V., established in 2012, is the oldest and largest local Bitcoin broker in the Netherlands, focusing on the local market with stable and reliable services, having almost never experienced major security incidents, earning the trust of individual customers. The company obtained its MiCA license on November 21, allowing it to provide custody, exchange, order execution, and transfer services, representing the standard development path for mainstream platforms in the Netherlands—most other new licensed institutions in the Netherlands also possess these service permissions.

Another typical case is Renta 4 in Spain, a traditional bank undergoing transformation, with a moderate scale and good reputation in the traditional investment field, which has been approved to provide custody and transfer services.

The advantage of these mainstream institutions lies in their deep understanding of the local market, typically choosing a moderate range of service combinations under controllable compliance costs, avoiding direct competition with large international platforms, thus becoming a trustworthy choice for ordinary users.

Characteristics:

- Local deepening before expansion: Services in a single country or gradually moving towards multi-passport.

- Moderate service combinations: 3-5 types of services.

- Lower risk: Already have a compliance foundation, with high user loyalty.

3. New Players: Rising Stars

Emerging or localized licensed entities are often smaller in scale, and their emergence gives the impression of a "makeup assignment" behavior, fearing to miss the last train of MiCA.

However, they also fill some local gaps. A typical representative is the 6 local banks in Germany (Volksbank Mittlerer Schwarzwald eG, Hannoversche Volksbank eG, VR TeilhaberBank Metropolregion Nürnberg eG, etc.), all of which were approved in December but can only provide order execution as a single service. The advantage of these emerging institutions lies in their flexibility and cost advantages.

Characteristics:

Narrow service: Focus on local crypto market pain points.

Potential risks: Small user base, low business volume, or yet to be developed, making them easy targets for future mergers or difficult to fulfill long-term compliance obligations.

Distribution of New Licensed Entities: Market Drivers Behind the Scenes

The institutional styles in different regions vary greatly, reflecting the differences in local economies, user habits, and regulatory environments. Western European countries like Germany, France, and the Netherlands dominate the new additions, while Eastern European countries like Slovakia, Slovenia, and Latvia are more retail-oriented in their services.

1. Regional Differences:

Eastern Europe: Retail Orientation and Concentrated Compliance Sprint

In Q4, Eastern European countries added a total of 10 licensed institutions, mainly from Slovakia, Slovenia, and Latvia. These institutions generally focus on retail service combinations, commonly seen as "custody + exchange + transfer" packages, with less involvement in operating trading platforms. For example, institutions like FUMBI in Slovakia hold more than 5 service permissions, while Latvia's BlockBen focuses on the niche market of "gold tokenization."

This phenomenon mainly stems from:

- Concentrated compliance transformation before the end of the transition period;

- The local market is primarily retail-oriented, with low institutional capital participation;

- Compliance costs are relatively low compared to Western Europe, attracting many local startups and small to medium-sized institutions;

- Limited regulatory approval resources, with Q4 focusing on processing backlog applications.

New Licensed Entities in Western European Countries: Taking France and Germany as Examples

Germany and France are the main representatives of new institutions in Western Europe. Germany added 16 institutions, the vast majority of which are traditional banks, providing only single services of order execution or transfer; France added 5 institutions, among which the crypto department of the "big three" French banks, Société Générale, only applied for custody and transfer services, showing a characteristic of "narrow compliance."

Although Western Europe has mature financial infrastructure and institutional capital, the high compliance costs have led many institutions to choose to streamline their service scope to control initial investments. This also indicates that the activity level of the crypto market is not entirely synchronized with the regional economic scale.

EEA Countries - Liechtenstein

The emergence of this new name is striking, with the country registering two licensed entities that both focus on custody services, giving a sense of a "small but refined" high-end positioning. The reason lies in its neutral and low-tax environment, which attracts private banks and asset management. Additionally, even though Liechtenstein is not an EU member, MiCA still applies, making the passport valuable; the market is niche and high-end, with investors mostly being professional players like family offices.

2. Industry Integration Trend: Invisible Restructuring Rather Than Obvious Mergers

Although there were no significant merger cases in the fourth quarter, the entire industry has actually been quietly integrating. Many giants choose to establish their own EU subsidiaries rather than acquiring others, allowing them to fully control their business while avoiding the complexities of due diligence and approval risks.

Reports indicate that throughout 2025, small institutions have been acquired by mainstream platforms, while in the fourth quarter, many opted to "run independently"—applying for licenses on their own before the end of the transition period.

Conclusion

According to incomplete statistics and actual data feedback, the success rate of MiCA applications has not been as high as imagined, and regulatory agencies still focus on substance: a license is not something that can be obtained by merely piling up application materials, but rather a natural result of a real and reliable business model.

- For investors, a MiCA license is not a one-time "amulet"; the license is just the starting point, not the endpoint. Obtaining a license does not mean that the business is necessarily mature; one must carefully examine whether a specific service exists and which countries the passport covers to use it with more confidence.

- For operators, the presence of many new entities in certain countries or regions does not necessarily mean lower regulatory difficulty; it may be a tailored business strategy or a stopgap measure by existing service providers.

The actual expenses for preparing a MiCA license should not be underestimated. Applicants might ask themselves: Do I really need this license? While a proactive attitude towards compliance is commendable, understanding one's positioning and long-term goals may be a wiser move. I hope this article helps you identify opportunities in the European crypto market amidst the transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。