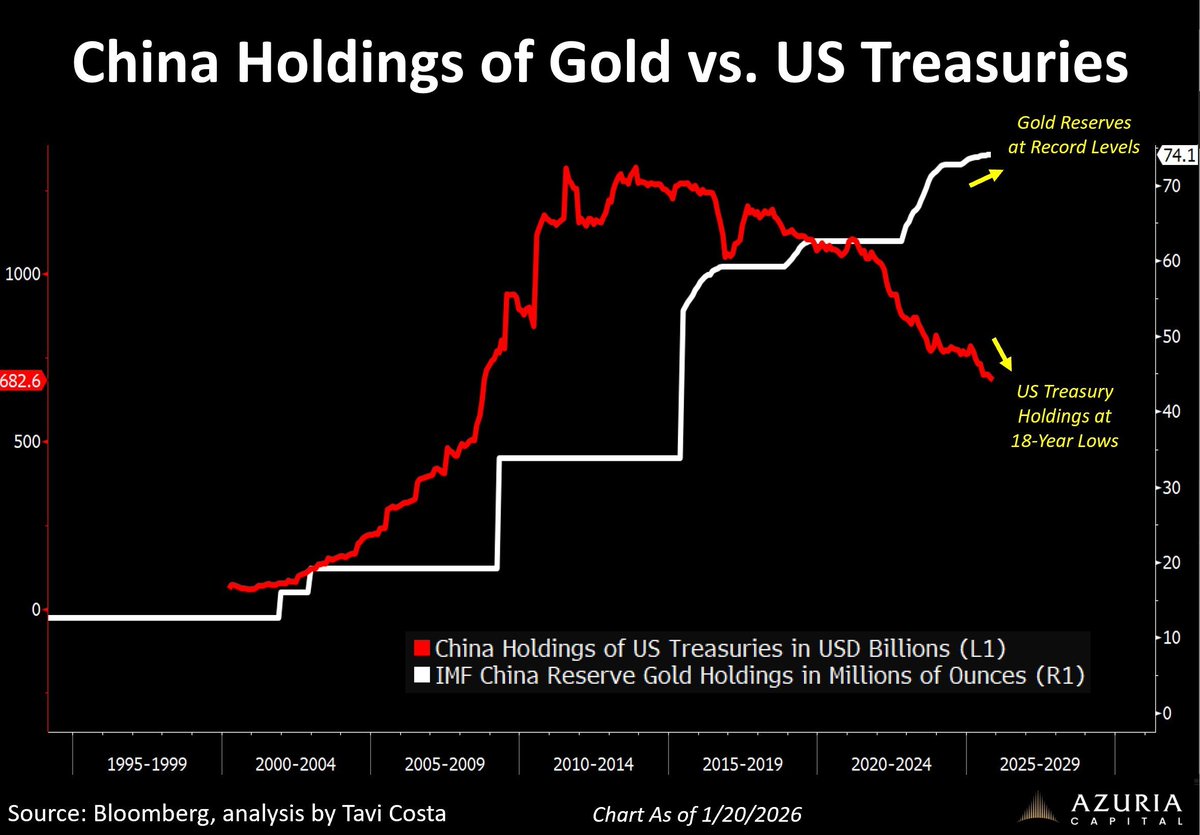

Still, I do not believe that gold can continue to weaken. The data shows that China is massively selling U.S. Treasuries while significantly increasing its gold holdings. This reflects not only market FOMO but is more likely a long-term reallocation of foreign exchange reserves, gradually switching from credit assets with obvious counterparty and policy risks to more neutral, counterparty risk-free hard assets.

Especially in the context of frequent geopolitical conflicts, the weaponization of financial sanctions, and the politicization of the dollar system over the past few years, gold's role is no longer that of a traditional "safe-haven asset," but rather resembles a "credit hedge" at the national level. U.S. Treasuries remain one of the most liquid assets globally; for national reserves, the greatest fear is not short-term volatility but rather being "unable to access them at critical moments," especially for China. Gold, on the other hand, is precisely the type of asset that can bypass counterparty credit.

If central banks around the world continue to purchase gold as a hedge against U.S. Treasuries, then the probability of gold continuing to strengthen is not negligible.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。