I still don't think this is the main reason for the decline. Of course, the trigger is the results of the earnings season, which is definitely true, especially with Microsoft's significant drop. However, attributing the decline of gold, silver, and even cryptocurrencies solely to high leverage may not be correct.

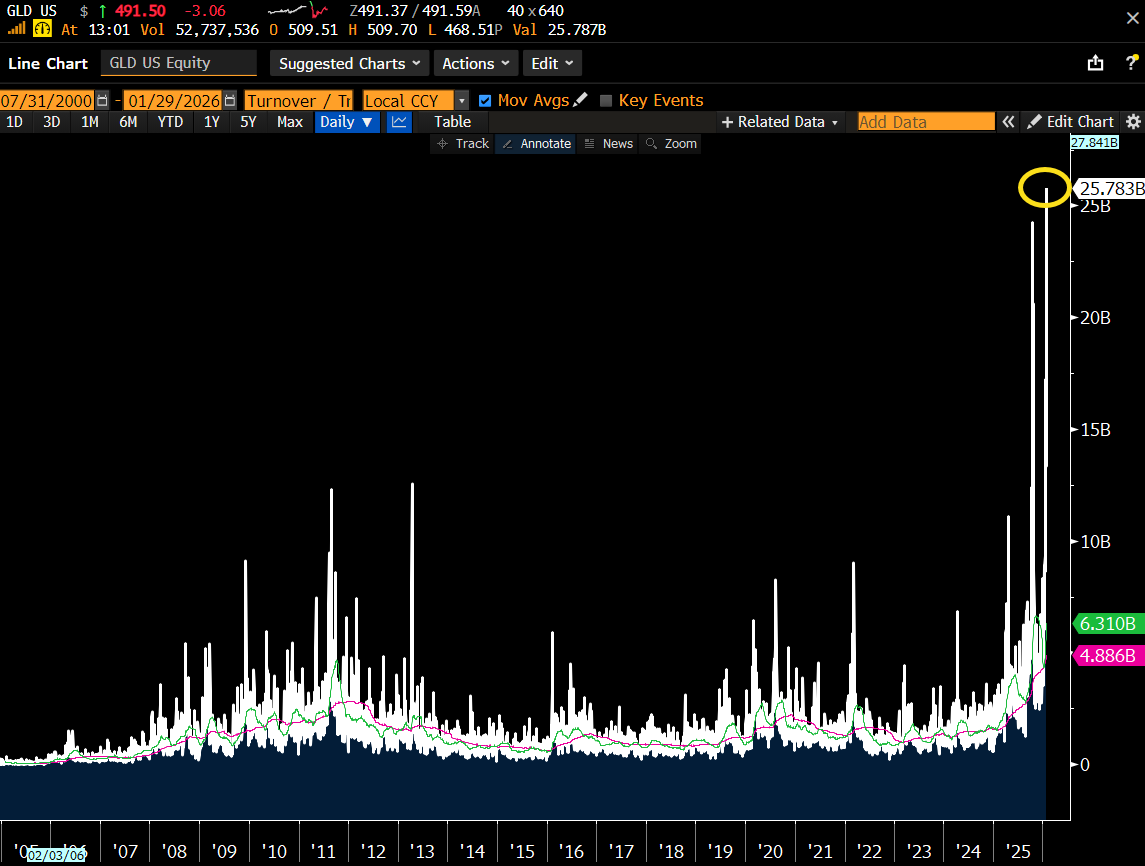

Additionally, the viewpoint that gold and silver are in a bubble has indeed been prevalent in the last couple of days. However, from the perspective of capital flow, there is still a large amount of money entering gold and silver. Just today, the trading volume exceeded $25 billion for gold, while silver was around $20 billion. This data explains why gold can rebound immediately after a significant drop.

For investors, there is still a strong FOMO (Fear of Missing Out) regarding gold. I don't know if gold will weaken next, but what I do know is that the trading volume has reached an all-time high, and the rolling wheels are still pushing gold forward.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。