Good evening everyone, I am Xin Ya. Yesterday went quite well, but as you have seen, the positions given were just right. This is the scalpel of the cryptocurrency market.

Today, let's do a brief review. On the evening of the 28th at 11 PM, Bitcoin dipped down to around 88,800, and the first candlestick of the rebound closed at the divergence point of 89,500, while the highest point of the rebound was at the pressure zone of 90,500. Here, it faced selling pressure again. We mentioned yesterday that the range of 89,500-90,500 is a damping zone, and the entry and replenishment points given during the day were quite extreme, weren't they? After Bitcoin touched 90,500, the subsequent two rounds of pressure saw the bears first reduce their volume. After failing to hold above 89,500, they then increased the pressure. Our target given yesterday was around 87,500. We mentioned that whichever side breaks first will determine the direction of continuation. The problem is, neither side has broken, so the market will continue to consolidate. Currently, we prioritize handling the fluctuations, leaning towards a downward movement.

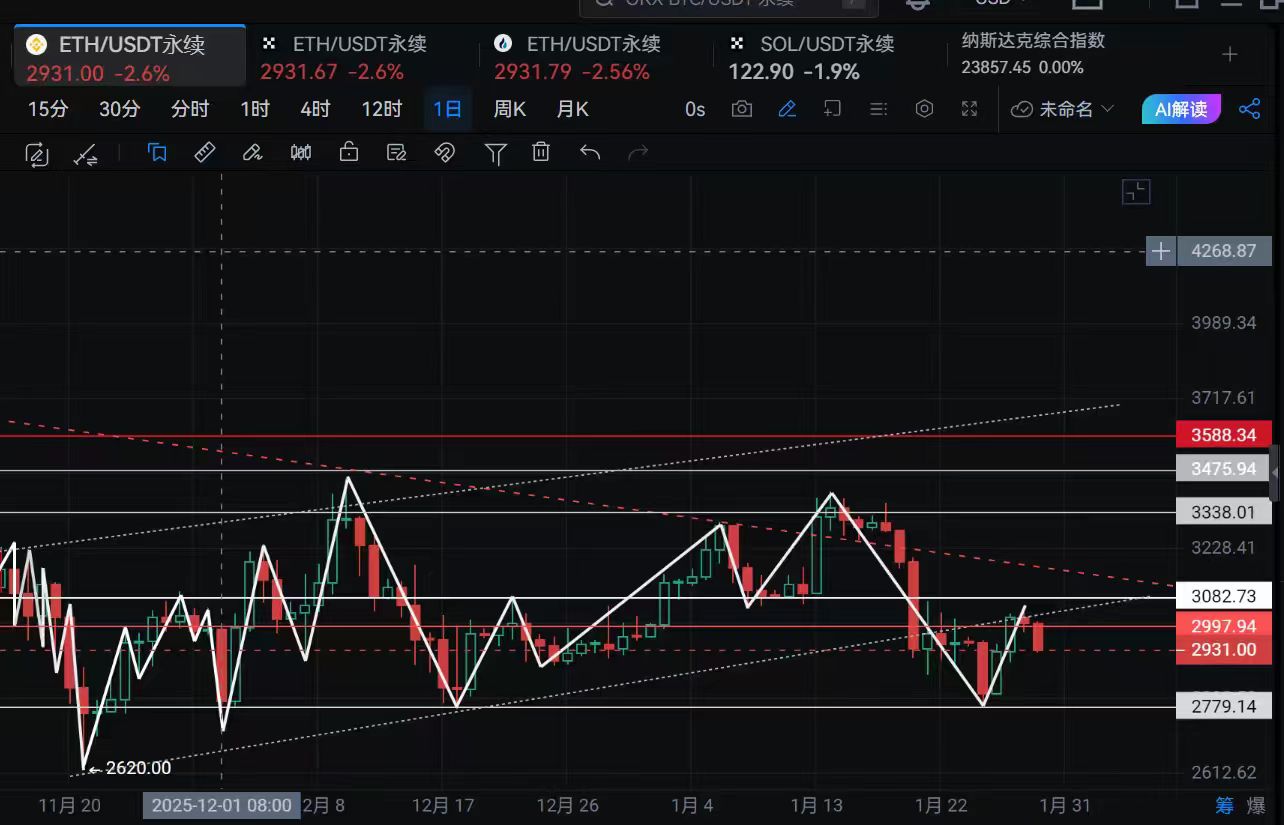

During the night session, Ethereum first dipped to around 2,980, and after a back-and-forth in the rebound process to around 3,040, it tested downward. During the day, it fell to a low of around 2,930. This is a bit narrower than our expectations. You can check the thoughts I provided yesterday, which were to target around 3,050 for entry and 2,920 as the target. Well, the actual movement is still somewhat in line with the range.

Actually, there isn't much to look forward to in the market. January has transitioned, and the current path that best aligns with the interests of market makers is to first take a hit or to decline gradually, shaking off the bulls during a rise before the New Year. The interest rate cut does not meet most expectations, but precious metals are rising. Since the emotions in the financial market can influence each other, we cannot be overly bearish.

We can only short based on the segmented range of fluctuations, which allows for a large margin of error. Currently, the one-hour EMA 120 and 144 are around 88,900, while Ethereum's one-hour EMA 30, 120, and 144 are concentrated around 2,980. We can continue with yesterday's thoughts: short at 88,800, add at 89,500, and look for 85,800-86,200 below. For Ethereum, short at 2,960-2,980, and look for the second segment expectation from yesterday, around 2,860. Handle the rebounds based on the actual market conditions and plan your stop-loss according to your position size.

Walk with giants, WeChat public account: Xin Ya Talks About Trading

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。