Original Title: ETH: The Scarce Asset in AI Applications

Original Author: @GarrettBullish

Translated by: Peggy, BlockBeats

Editor's Note: As AI reshapes the software industry, most companies struggle to truly benefit. Ethereum has chosen a different path. This article centers on ERC-8004, explaining why ETH and AI are not merely additive but symbiotic: AI requires a trustworthy, immutable settlement and collaboration foundation, which Ethereum provides as a key capability.

By establishing a verifiable identity and reputation system for AI agents, ERC-8004 enables cross-organizational AI-to-AI collaboration and brings new growth logic to DeFi, RWA, and on-chain activity.

The following is the original text:

With ERC-8004 set to launch on the mainnet, we believe this marks a critical juncture for Ethereum, comparable to the "iPhone moment"—not only is it an important milestone in Ethereum's development, but it also signifies that ETH is becoming one of the core beneficiaries of the AI wave at the application layer.

At this point in time, most publicly listed software companies are being reshaped or even directly disrupted by AI; in contrast, ETH's positioning is becoming increasingly prominent: it is becoming an indispensable and scarce core asset for AI-native applications.

We will systematically outline the multiple values brought by the deep integration of ETH and AI applications, including its enhancement of Ethereum's profitability, its promotion of RWA (real-world assets) on-chain, and its role in driving overall on-chain activity; and we will contrast this with the reality of the traditional software industry—where only a handful of companies are clearly benefiting from AI, while more enterprises are being impacted or even replaced by AI.

The relationship between ETH and AI is not a simple addition but a deep symbiosis: Ethereum provides a trustworthy, decentralized, and immutable settlement and collaboration mechanism for AI; AI injects more intelligent, efficient, and truly autonomous application forms into Ethereum.

The core advantages brought by this integration

Providing a higher degree of trust and decentralized foundation for AI

Current mainstream centralized AI (such as OpenAI, Google, Meta) generally faces issues like opacity, black-box models, and censorship risks. Elon Musk's recent public criticism of Meta acquiring WhatsApp data is a reflection of this structural concern.

Ethereum is addressing these issues:

The identity, reputation, and behavior of AI agents are recorded on-chain, achieving verifiability, composability, and portability (through ERC-8004 and similar standards).

True machine-to-machine (M2M) payments and collaboration become possible without intermediaries.

Decentralized storage + on-chain proof effectively prevents data tampering and theft.

Enhancement of Ethereum's utility and productivity

AI agents can autonomously execute complex tasks (such as trading, risk management, market prediction), significantly increasing the frequency and complexity of on-chain interactions.

The Ethereum Foundation's dAI team (established in 2025) has clearly positioned Ethereum as the preferred settlement layer for AI agents.

Dynamic smart contracts become a reality: they can adjust in real-time based on time and conditions (such as floating-rate lending, automated insurance).

New economic models

AI agents can independently generate revenue (through reasoning fees, gaming, social interactions) and pay Gas themselves, forming a closed-loop on-chain economic system.

This form, known as the "Robot Economy," is expected to become the next core narrative following DeFi and NFTs.

Contribution to ETH revenue

Ethereum's core revenue sources: Gas fees + Blob fees → partial destruction (EIP-1559) → deflationary pressure.

AI agents will drive:

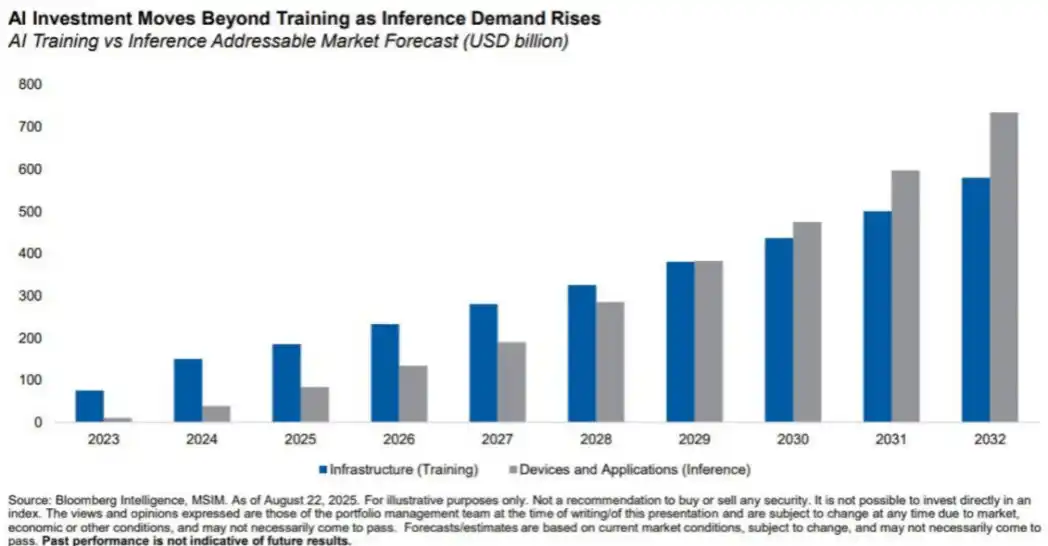

Explosive growth in transaction volume and frequency (microtransactions at the minute level);

Significantly increased transaction complexity (identity verification, cross-agent collaboration, complex contract calls).

Institutional forecasts indicate:

By the end of 2025, AI agents may contribute 15–20% of DeFi transaction volume;

Gas usage may see a 30–40% month-over-month increase in 2026.

Conclusion: The scale of fees and destruction will significantly increase, thereby enhancing ETH's economic model.

Contribution to RWA and overall on-chain activity

AI can automate valuation, compliance, risk monitoring, and dynamic pricing, greatly enhancing the operational efficiency of RWA.

Institutional-level RWA (such as BlackRock-related funds) require reliable, auditable automated mechanisms, which AI agents can fulfill.

AI agents trading autonomously 24/7 → higher transaction counts, deeper liquidity, and potential new peaks in TVL.

Outlook: AI-driven on-chain activity may become the second-largest source of fees after stablecoins.

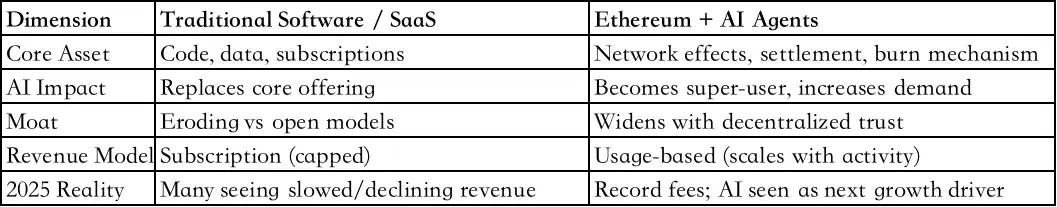

Why software companies are being disrupted while ETH can benefit

Most software companies are forced to "add AI features," but intelligence itself is being commoditized (1+1=1).

Ethereum sells "trustworthy settlement"—a capability that AI agents need most but cannot replicate themselves. The more they use it, the stronger the network effect (1+1 > 2).

ERC-8004: A Key Standard

ERC-8004: Trustless Agents

Proposed: August 2025, currently in the final draft stage

Priority: The Ethereum Foundation's dAI team has clearly listed it as a strategic focus; experimental deployments have been conducted across multiple L2s and ecosystem projects.

Core Objective: To enable agents from different developers/organizations to discover each other, assess trustworthiness through transferable reputation, and collaborate securely on-chain and off-chain without prior trust.

This is the layer missing from the open agent—agent economy: "identity card + public credit record."

Why ERC-8004 is Ethereum's AI application "iPhone moment"

ERC-8004 is an Ethereum Improvement Proposal (EIP) designed specifically for the trust issues of autonomous AI agents, officially titled ERC-8004: Trustless Agents.

This proposal was formally introduced in August 2025; as of January 2026, it remains in Draft status but has been clearly identified as a strategic focus by the Ethereum Foundation's dAI (decentralized AI) team and has begun experimental implementation in several L2s and ecosystem projects.

Core Objective

Without any existing trust relationships, enable AI agents from different organizations and developers to: discover each other; assess each other's trustworthiness; collaborate securely to complete on-chain and off-chain tasks.

This is the essential infrastructure needed to achieve a truly open agent—agent economy.

ERC-8004 essentially constitutes the foundational layer for Ethereum in the era of AI agents: a combination of trustworthy identity cards + public credit records + third-party notarization.

It allows agents to have composable, transferable, and verifiable on-chain identities for the first time, which is likely the most critical standard determining whether the "agent economy" can truly be established on Ethereum.

How to understand this statement:

"Ethereum is in a unique position to provide security and final settlement for AI—AI interactions."

This statement can be broken down into several layers:

The dual meaning of "Secures" and "Settles"

Secures—providing a secure, verifiable, and immutable trust foundation

Agent identity: Who is taking action?

Reputation: Has this agent been reliable in the past? Is there a record of malicious behavior?

Auditability of actions: Were the promised outcomes executed correctly?

ERC-8004 provides a trust layer for cross-organizational agent interactions without prior trust through three types of on-chain registries—identity, reputation, and validation.

Settles—providing the infrastructure for final value settlement and payment

High-frequency micropayments between agents (reasoning fees, task rewards, penalties, etc.)

Stablecoin and ETH payments

Economic incentives and constraints (staking—penalties, stake-and-slash)

Relying on a combination of L1 + L2 architecture, Ethereum becomes a neutral, programmable financial layer, ensuring payments are irreversible, transparent, and composable.

Why do "AI—AI interactions" need such a platform?

In the future agent economy, most interactions will be machine-to-machine rather than human-to-machine, for example: trading agents requesting RWA pricing from valuation agents, content generation agents hiring verification agents, auditing output results, logistics agents automatically settling fees with payment agents.

These interactions share common characteristics: extremely high frequency (calculated by seconds/minutes), very small individual amounts (from a few cents to a few dollars), permissionless, cross-organizational, and without intermediaries.

Traditional centralized platforms (such as OpenAI API, Google Cloud) can technically support this but will introduce lock-in risks, censorship risks, and data monopolies. Ethereum provides a neutral, verifiable, globally accessible alternative.

Why is Ethereum in a "unique position"?

From the perspective of 2026, Ethereum has structural differentiated advantages over other blockchains across multiple dimensions.

Why can't Solana benefit equally?

Solana does have some overlapping capabilities but has not reached the completeness and "uniqueness" of Ethereum:

Solana is extremely fast and cost-effective, making it very suitable for high-frequency AI reasoning and micro-interactions (as demonstrated by decentralized GPU projects like Nosana and io.net).

However, it still has shortcomings in the three most critical aspects of AI—AI interactions: there is currently no official or ecosystem-level standardized trust framework similar to ERC-8004, the historical stability and degree of decentralization of the network are still viewed as weaknesses by institutions, and the settlement layer is more focused on high throughput execution rather than maximum security and finality.

It can be likened to this: Solana is more like a "highway" for AI agents (throughput and cost); Ethereum is more like a "bank + SWIFT" for the AI agent economy (final settlement and transferable trust).

The judgment of the Ethereum Foundation is that once AI agents begin to manage assets of real economic value, collaborate across companies, and require irreversible economic commitments, they will ultimately anchor the most critical trust and settlement on the most secure, neutral, and highly integrated blockchain.

This is the core logic behind Ethereum's claim of a "unique position."

Of course, by 2026, ecological competition will still be ongoing. If Solana significantly improves its stability and decentralization level after Firedancer and introduces comparable trust standards, it still has a chance to catch up. However, as of January 2026, Ethereum is undoubtedly leading this narrative and actively setting the rules.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。