Written by: Bitget Wallet

Summary: This report reviews key changes closely related to daily finance in the on-chain ecosystem of 2025 from the perspective of wallets, and explores the evolution direction of on-chain finance in 2026 based on this foundation.

TL;DR

Over the past 20 years, fintech has completed the evolution from digitization (1.0) to mobilization (2.0) and is now entering the Fintech 0 Phase based on blockchain. On-chain finance will reconstruct the financial system from the perspective of clearing and settlement, making the flow of funds cheaper, faster, and more globally accessible.

Wallets are evolving from mere asset management tools to the main entry point for users to handle diverse daily financial affairs, gradually becoming common financial applications covering transactions, payments, and asset management, frequently appearing in daily life and fund flows, forming a user-centered on-chain daily financial experience.

Stablecoin Payments: Stablecoins have become an important infrastructure for global value settlement, deeply embedded in B2B2C cross-border payments, local payment networks, and card organization systems. Wallets will become the unified front end and routing nodes for stablecoin payment capabilities.

AI: With the maturity of protocols like x402, AI agents will have the ability to autonomously complete payments and transactions within an authorized framework, driving a qualitative change in the frequency and form of value exchange. Wallets will become the execution and risk control layer for agent financial behaviors.

Privacy: Privacy will become the default premise supporting payments, asset management, and institutional on-chain activities. Privacy capabilities will be integrated into major wallets as infrastructure functions rather than achieved through a single privacy asset.

On-chain Credit: On-chain credit will gradually move away from a single over-collateralization model, beginning to establish a layered system around user long-term behavior, time dimensions, and performance stability. Wallets will provide cross-chain and cross-cycle continuity data support in this process.

RWA: RWAs will shift towards tradable and composable financial instrument forms, with RWA Perps and RWA × DeFi becoming key increments. Wallets are becoming an important channel connecting on-chain users with global assets, providing users with global asset exposure.

Perp DEXs: Perp DEXs will enter a competitive phase focused on stability, efficiency, and user retention, with native Perp trading within wallets becoming a high-frequency usage scenario, significantly enhancing user stickiness.

Prediction Markets: Driven by major real-world events such as the World Cup and the U.S. Congressional midterm elections, prediction markets will enter a period of accelerated expansion, with front-end functional innovations prioritizing event discovery, signal judgment, and convenient ordering rather than liquidity aggregation.

Meme: Some attention from Meme trading may be diverted to prediction markets. Wallets will optimize through features like address relationships and cluster analysis to help users more efficiently identify sentiment and fund trends.

Transformation of Wallets: From On-chain Entry to Daily Financial Vehicle

For a long time, crypto wallets were primarily seen as an entry point and operational tool for on-chain traffic, with core functions focused on asset storage, connecting decentralized applications, managing contract authorizations, and performing basic operations like swaps. They mainly addressed how users enter the on-chain space and complete basic interactions, without directly supporting complete financial use cases.

This perception began to change significantly in 2025. As the scale of stablecoins continued to expand and the on-chain trading and settlement infrastructure gradually matured, real use cases such as payments and yield began to appear and be repeatedly validated on-chain, leading to a transformation in the role of crypto assets. They were no longer just used for passive holding or speculative trading but were increasingly used for actual financial behaviors such as payments, yield management, and cross-border flows. In this process, the positioning of wallets also elevated, gradually evolving into the core application for carrying out on-chain daily financial activities.

Today's crypto wallets are taking on a role similar to the "front end of on-chain daily finance":

The main interface for users to manage stablecoin balances and fund flows

A key payment tool connecting real-world payment networks and on-chain systems

Executing trades and managing risks for various assets like Meme, RWA, and prediction markets

The role of wallets is evolving from a simple asset management tool to the main entry point for users to handle diverse daily financial affairs. This change is not triggered by a single product innovation but stems from the overall evolution of user expectations for wallets. Early users participated in airdrops, tried DeFi protocols, and completed basic trades through wallets; then, swap and cross-chain capabilities became standard; later, yield management and asset portfolios gradually became important needs. Wallets are no longer just tools for completing on-chain operations; more and more users are beginning to rely on wallets to handle daily financial affairs, using them as common financial applications covering transactions, payments, and asset management, frequently appearing in daily life and fund flows.

The change in the role of wallets is also closely related to the evolution of the financial system itself. From a more macro perspective, the financial infrastructure over the past twenty years has roughly gone through three stages: initially, the digitization of financial services, moving banking online; then, mobilization, where new financial applications significantly improved the user experience, but the underlying clearing and settlement tracks did not fundamentally change; and now, finance is entering the third stage, where on-chain finance based on blockchain will reconstruct the financial system from the foundational track level, making the flow of funds cheaper, faster, and more globally accessible.

Compared to the previous two stages, the changes in On-chain Finance come from the transformation of financial access methods and underlying structures. Based on a permissionless open network, global users can access the same financial system at lower costs and higher efficiency; the composability of assets and smart contracts allows financial products and applications to be built and iterated in shorter cycles; in this system, users and institutions use the same rules and infrastructure, and finance is no longer just a service provided by institutions but gradually evolves into an open system that anyone can participate in and build.

As financial infrastructure migrates on-chain, the use cases for wallets are also continuously expanding. Functions that were originally scattered across bank accounts, payment applications, trading platforms, and crypto tools are beginning to be integrated through the same wallet application, forming a user-centered on-chain daily financial experience. More and more users are entering the on-chain space, not just for speculation or yield considerations, but hoping to reduce their reliance on traditional centralized financial systems in fund management, cross-border flows, and value storage. Non-custodial solutions are becoming an important starting point for on-chain finance, as users seek more direct control over their assets and the ability to freely use these assets globally.

In this context, wallets become a key observation point for understanding the real usage of on-chain activities. Questions such as why users enter on-chain, which assets they primarily use, which behaviors are sustainable, and which scenarios are forming real adoption often cannot be fully answered through data from exchanges or single protocols. Wallets are naturally positioned at the intersection of all on-chain behaviors, able to more directly reflect users' real financial activities on-chain.

Based on this, this report will start from the perspective of wallets, briefly review key changes closely related to daily finance in the on-chain ecosystem of 2025, and explore the evolution direction of on-chain finance in 2026.

2026 Outlook: The Real Unfolding of On-chain Daily Finance

1. Stablecoin Payments

2025 is a turning point year for stablecoin payments to be truly accepted by the mainstream financial system. From the IPO of Circle to the passage of the U.S. "Genius Act," the compliance boundaries of stablecoins are gradually being clearly defined. If 2024 was still a stage of mutual exploration between regulation and the market, then in 2025, the three major global economies constructed a "legislation + licensing + enforcement" system, collectively pushing stablecoins from the past gray area to a widely adoptable compliant financial infrastructure layer:

North American Market: The formal passage of the U.S. "Genius Act" in July 2025 became a milestone for the year. This act established a federal regulatory framework for payment stablecoins and issuer access requirements, truly breaking down the capital barriers between traditional banks and on-chain issuers.

Asian Market: On August 1, 2025, Hong Kong's "Regulatory Regime for Stablecoin Issuers" officially came into effect. This regulation not only brought stablecoin activities under the supervision of the Monetary Authority but also attracted several institutions, including Standard Chartered and JD.com, to actively layout Hong Kong dollar stablecoins during the subsequent licensing phase; Japan initiated a pilot program for yen stablecoins.

European Market: With the "MiCA Act" entering its first full year of comprehensive implementation, euro stablecoins bid farewell to the plight of liquidity scarcity in 2025, beginning to land on mainstream exchanges. EU member states like Germany launched stablecoins based on their national regulations under the MiCA framework, and the UK initiated a pilot for pound stablecoins.

Driven by the establishment of three compliance frameworks and the explosion of on-chain demand, the stablecoin market has welcomed a significant revaluation. From a macro data perspective, the issuance volume and on-chain trading activity of stablecoins reached historical highs in 2025:

Breakthrough market size growth: The total market capitalization of stablecoins rose from $205 billion at the beginning of the year to $308 billion by the end of the year, with a net issuance increase of $103 billion throughout the year, an increase of over 50%.

Leap in on-chain settlement volume: The total on-chain transaction volume reached an astonishing $33 trillion for the year, with stablecoins having substantially surpassed some national fiat currencies, becoming a settlement network for global value flows.

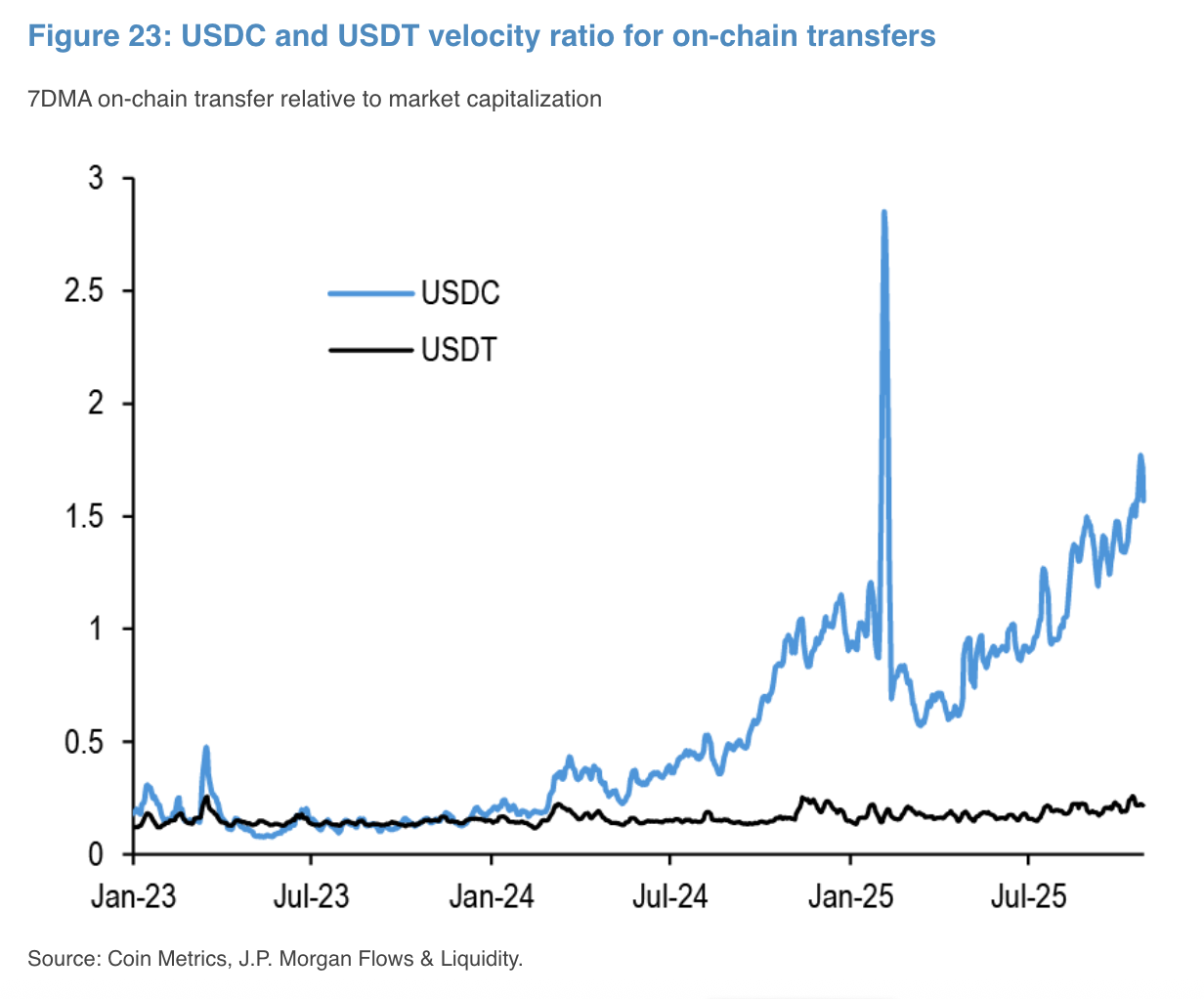

It is also noteworthy that in 2025, a significant structural reversal occurred in the market: although USDT still leads in market capitalization, USDC's on-chain annual transaction volume ($18.3 trillion) surpassed USDT's ($13.3 trillion) for the first time. This change is mainly attributed to USDC's higher capital reuse rate in DeFi protocols and the preference of European and American institutions to use the more compliant USDC for large settlements and cross-border payments after the "Genius Act" came into effect.

Metrics

Amount

Data Source

Total market capitalization of stablecoins at the beginning of the year

$205B

DefiLlama

Total market capitalization of stablecoins at the end of the year

$308B

DefiLlama

Net issuance of stablecoins in 2025

$103B

DefiLlama

Total on-chain transaction volume of stablecoins (for the year)

$33T

Bloomberg

Total on-chain transaction volume of USDC (for the year)

$18.3T

Bloomberg

Total on-chain transaction volume of USDT (for the year)

$13.3T

Bloomberg

In terms of application scenarios, the most significant feature of 2025 is the integration with the traditional financial system, where traditional finance and payment networks began to deeply embed stablecoins into key links of funding channels:

Brokerage and Account Systems: New Channels for Compliant Deposits. Interactive Brokers has officially allowed retail customers to use stablecoins to fund personal brokerage accounts, indicating that stablecoins have broken through the purely internal circulation and are now directly serving the funding entry point for traditional securities trading.

Payment Networks: Reconstruction of the Settlement Layer. Stablecoin settlements are becoming standard for card organizations and payment giants. After acquiring the stablecoin infrastructure company Bridge, Stripe has launched stablecoin products; PayPal has expanded PYUSD to the Stellar network, precisely targeting cross-border small payments and on-chain payment scenarios; Visa has also announced a gradual rollout of USDC settlement capabilities in the U.S.

Emerging Markets: Real Demand Amid Currency Dilemmas. New-generation Neobanks represented by BVNK and Mesh are acting as a bridge connecting on-chain assets with real-world consumption, providing a new cross-border funding solution of "on-chain storage, global payments" for users in high-inflation regions like Argentina and Turkey through services similar to bank IBAN accounts.

Looking ahead to 2026, we believe the adoption rate of stablecoins in payments is expected to rise further, with breakthroughs anticipated on the following three levels:

Substantial demand for cross-border payments will stem from the large-scale implementation of the B2B2C model on the commercial side. The market is establishing a standardized hybrid architecture that combines fiat currency at the front end with stablecoins at the back end. Such solutions deeply integrate the stablecoin settlement layer into local instant payment networks like Brazil's PIX or Mexico's SPEI through API interfaces, efficiently completing cross-border fund transfers while keeping user perception invisible.

Payment Finance (PayFi) will reshape the time value and flow logic of funds. Stablecoins are transcending their role as mere value carriers and are integrating with DeFi protocols to evolve into programmable funds with yield-generating capabilities. This allows funds in the payment settlement intermediary to no longer remain idle but to automatically capture on-chain yields, achieving a coexistence of liquidity efficiency and asset returns.

Non-U.S. dollar stablecoins will synergistically explode with the on-chain foreign exchange market. With the rollout of compliant stablecoins led by central banks in nine countries, including the Eurozone, in the second half of 2026, non-U.S. dollar stablecoins are expected to usher in a new situation. These assets will move beyond being merely trading assets to play a crucial role as local funding entry channels (Local Rail), working alongside U.S. dollar stablecoins to build a diverse and interconnected on-chain currency market system that meets the real demand for global multi-currency commercial settlements.

In light of these trends, wallets will take on increasingly clear distribution roles within the stablecoin payment system:

Unified Entry for Payment Capabilities: As compliant stablecoins deeply integrate with traditional payment networks, users and merchants will no longer directly interact with the underlying on-chain protocols. Wallets will become the main interface for carrying and invoking stablecoin payment capabilities, shielding users from on-chain complexities while completing transfers, consumption, and settlements.

Interface Layer Between On-chain Funds and Real Payment Networks: By integrating card organizations, Virtual Account systems, local payment networks (such as PIX, SPEI), and the stablecoin settlement layer, wallets will serve as key nodes connecting on-chain assets with real funding channels, enabling the usability of stablecoins in the real economy.

Programmable Payment and Fund Dispatch Execution Layer: As PayFi and stablecoin wealth management gradually mature, wallets will take on the functions of dispatching and managing funds during the payment process, allowing settlement funds to not only meet payment efficiency but also automatically capture on-chain yields.

Multi-currency Settlement and Routing Hub: With the development of non-U.S. dollar stablecoins and the on-chain foreign exchange market, wallets will become the switching and settlement routing layer for multi-currency stablecoins, optimizing currency selection, exchange rate conversion, and settlement paths in the background, maintaining a unified and simplified user experience.

2. AI and the Agency Economy

The intelligent economy is entering a new stage of deep participation by agents, where value exchange will no longer rely entirely on human proactive operations but will begin to be autonomously completed by AI agents within established authorization and rule frameworks. However, due to the lack of native, low-friction value transfer mechanisms on the internet, traditional account systems and subscription-based charging models struggle to adapt to the characteristics of high-frequency, on-demand, cross-service calls, which has long constrained the autonomous execution capabilities of AI in real commercial scenarios.

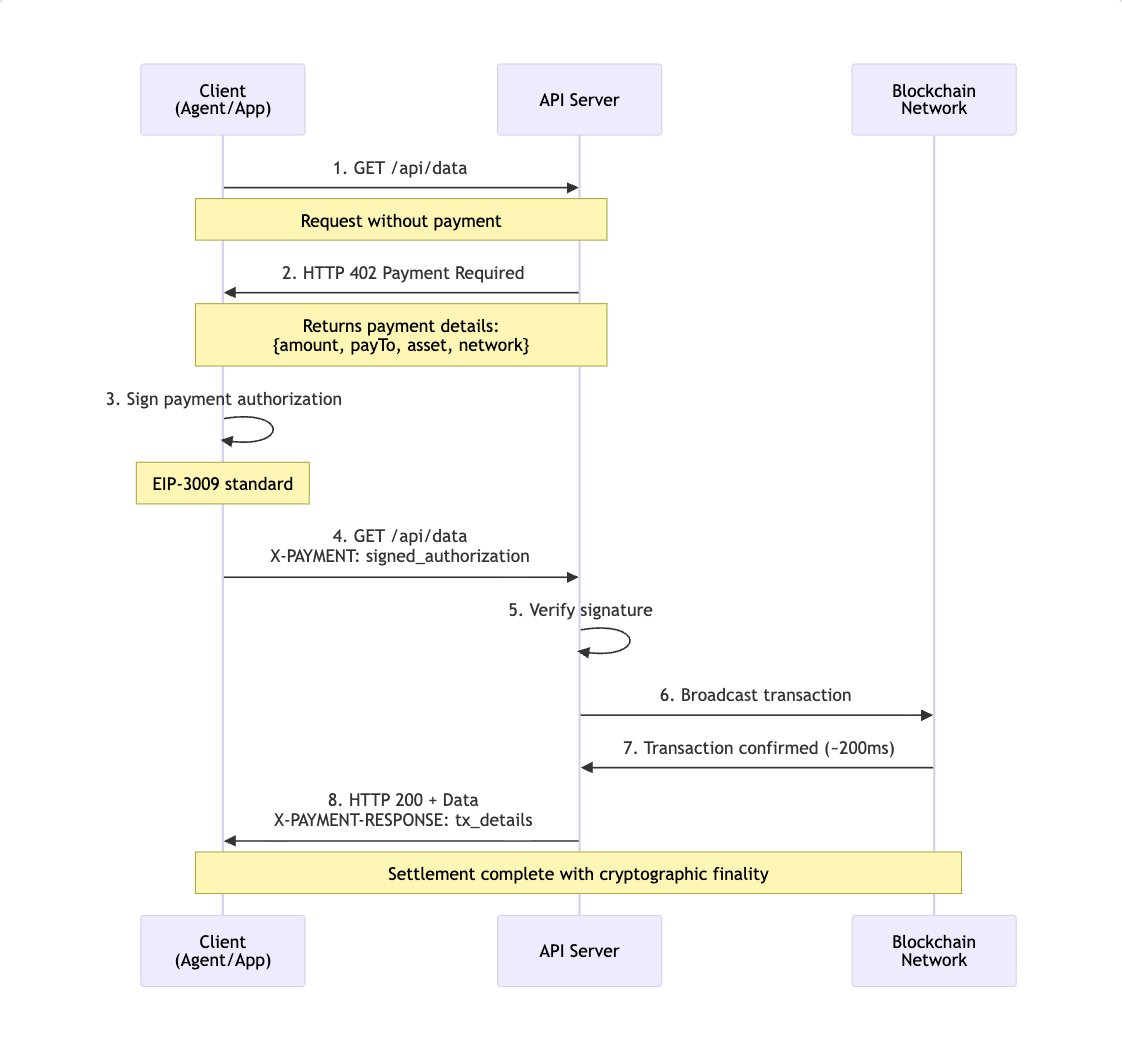

This issue saw structural progress in 2025. The x402 protocol, driven by institutions like Coinbase and Circle, embedded stablecoin payments into HTTP requests and service call processes in a standardized manner for the first time, establishing the basic form of the AI-Native Payment Layer. By reactivating the HTTP 402 (Payment Required) status code, x402 enables AI agents to complete payments and settlements like calling an API, without the need for additional account systems or human intervention, fundamentally changing the process where payments must be externalized in the machine economy. This change also shifts AI's business model from subscription-based services aimed at human users to on-demand, intent-based payments for agents, allowing agents to dynamically purchase data, computing power, or service interfaces based on task needs, activating a large number of previously hard-to-price long-tail resources.

As x402 completed its V2 upgrade at the end of 2025, improvements in latency, session reuse, and automatic discovery may lay the groundwork for larger-scale deployment in 2026, which could become a year of accelerated growth for Agentic Commerce. AI is gradually transitioning from assisting decision-making to becoming a real economic participant executing specific commercial actions on behalf of individuals or enterprises. The behavior path on the consumer side may shift from "search—compare—order" to "authorize—verify—confirm"; many high-repetitive processes on the enterprise side, such as reconciliation, procurement, and supply chain collaboration, will also begin to meet the conditions for systematic takeover by agents.

Source: x402 Developer Documentation

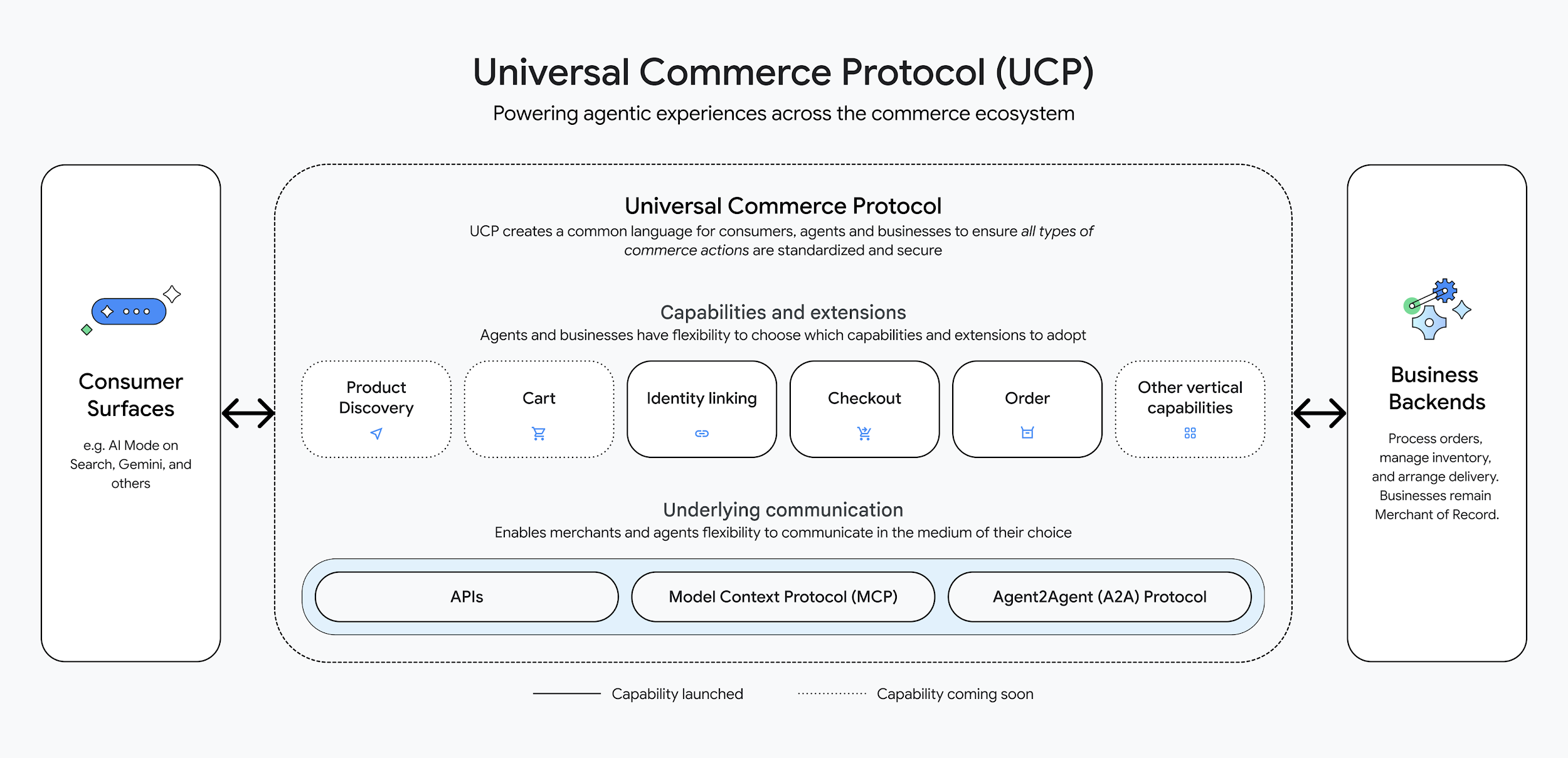

This trend is being echoed at a broader standards level. The Universal Commerce Protocol (UCP) recently proposed by Google marks the beginning of mainstream technology systems establishing unified standards for "agent-understandable commercial interfaces." UCP aims to create open interfaces between product discovery, transaction intent expression, and settlement processes, enabling AI agents to complete the full loop from decision-making to transaction across platforms. UCP is responsible for expressing commercial semantics, while x402 takes on the value settlement function, forming a layered collaborative relationship that will provide clearer technical paths for automated transactions between agents and between agents and merchants.

Source: Google Official Twitter

As a large number of non-human entities begin to hold funds and participate in transactions, new trust and compliance issues arise. The traditional KYC system centered on natural persons struggles to directly cover the complex scenarios of the agency economy, and KYA (Know Your Agent) will become a key topic of market discussion and resolution in 2026, with the ERC-8004 protocol expected to be widely adopted. Without sacrificing privacy, KYA needs to establish verifiable identity identifiers for agents, encrypting them with the underlying authorized entities, scope of authority, and boundaries of responsibility, and combining code audits and behavior monitoring to establish a new balance between efficiency and risk. This trust framework will not only fulfill compliance functions but also become an important prerequisite for agents to further participate in complex financial activities.

Meanwhile, wallets will gradually evolve from tools that only serve human operations to the execution layer for AI agent financial behaviors, serving as the default entry point for agents participating in economic activities under user authorization:

Unified Funding Entry and Settlement Hub: By integrating multi-chain assets, stablecoins, and payment protocols, wallets can provide agents with consistent fund management and payment capabilities, allowing them to complete cross-chain settlements and value transfers without perceiving the differences in underlying networks while executing tasks.

Visualization of Agent Behavior and Risk Perception Interface: Wallets are naturally positioned at the intersection of user assets and agent behaviors, capable of aggregating and displaying the real-time operations, historical performance, and key risk indicators of agents, helping users understand "what the agent is doing, based on what decisions, and what risks are being undertaken," establishing a clear cognitive boundary between automated participation and risk control.

KYA Execution and Security Buffer Layer: As the KYA mechanism gradually takes shape, wallets can serve as execution nodes for agent identities and permissions, managing identification, authority constraints, and monitoring for abnormal behaviors of agents accessing the ecosystem; when the system detects operations or abnormal fund flows that exceed authorized limits, wallets can introduce necessary risk control or manual verification without interrupting the overall automated process, providing a safety net for user assets.

3. Privacy

In 2025, privacy re-entered the core discussion area of the crypto market, with privacy assets represented by ZEC experiencing several phases of strength throughout the year, making privacy a frequently mentioned topic. In a long-standing on-chain environment where transparency is the default assumption, this price performance itself resembles a preemptive expectation, reflecting that the market is reassessing the necessity of privacy in the next stage of the crypto financial system.

From a longer-term perspective, assets can carry privacy preferences but struggle to solve the issue of privacy consistency across protocols, applications, and user levels. When privacy needs shift from being "a choice for a few users" to "a prerequisite for most scenarios," the coverage capability and scalability of a single asset path begin to show limitations. To achieve large-scale adoption on-chain, privacy needs to be embedded as an infrastructure capability, existing in a low-friction, composable, and default-available manner, rather than relying on isolated assets or applications for delivery.

This judgment received systematic responses from the Ethereum ecosystem in the second half of 2025. The Ethereum Foundation elevated privacy to a long-term strategic goal at the ecosystem level, clearly stating that privacy should become a "first-class property" of the Ethereum ecosystem. Around this goal, the foundation simultaneously promoted several organizational and roadmap adjustments, including the establishment of privacy clusters and institutional privacy task forces, restructuring the PSE team, and releasing a privacy technology roadmap for the coming years, categorizing privacy work into three directions: private writing, private reading, and private proof, corresponding to key scenarios such as transaction and contract interactions, on-chain data access, and data validity verification.

Source: Ethereum Foundation Official Website

Looking ahead to 2026, privacy urgently needs to transition from experimental research to systematic implementation in real usage demands:

For Web2 Users: Privacy is a default expectation. Bank transfers, securities accounts, and corporate financial systems do not require users to accept complete transparency of assets and transaction paths; the high transparency of on-chain states instead creates psychological and usability barriers.

For Native Web3 Users: In certain scenarios, users wish to conceal their holding assets, trading strategies, governance positions, or address associations to avoid passive exposure of their behavioral trajectories.

For Institutions and Real Asset On-Chain Scenarios: Privacy is a prerequisite. Without minimal disclosure and controllable access mechanisms, traditional assets, contracts, and identity data cannot be securely migrated on-chain.

In the context of implementing on-chain privacy, three main technical routes have currently formed within the Ethereum ecosystem. We expect that stealth addresses and privacy pool models are more likely to be widely adopted by mainstream applications first:

Stealth Addresses (represented by ERC-5564): By generating one-time addresses for recipients, the correlation between addresses and identities is reduced, providing basic privacy protection for scenarios such as payments, airdrops, and salary disbursements without changing existing asset forms and account models.

Zero-Knowledge Privacy Pools (zk-SNARK Privacy Pool): By aggregating multiple transactions into an anonymous pool and using zero-knowledge proofs for verification, strong concealment of the source, destination, and transaction amounts is achieved, suitable for financial and asset management scenarios with high privacy requirements.

Privacy-native Chains: Introducing a default privacy assumption at the protocol layer, making transactions and states naturally exist in an uncorrelated environment, maximizing the reduction of explicit privacy operations from the user experience. Currently still in the experimental stage, facing issues of ecological fragmentation, complex cross-chain interactions, and high integration costs with mainstream assets and DeFi systems.

Against the backdrop of gradually converging performance and costs, privacy will begin to exhibit strong user stickiness and network effects. In a public state, cross-chain migration incurs almost no additional costs; once entering a privacy environment, migration will inevitably introduce risks associated with identity, time, and behavior correlations, leading users to prefer remaining in existing privacy scenarios.

In this evolutionary path, wallets will become one of the most realistic landing points for privacy capabilities:

Privacy is not a function that can be simply layered at the application level; it needs to be systematically integrated throughout the entire process from the user opening the wallet, reading on-chain data, signing transactions, to identity interactions.

As private reading and private writing capabilities advance, wallets will gradually take on the first line of privacy boundaries for users' on-chain behaviors, ensuring that asset queries, transaction initiations, and contract interactions no longer inherently expose complete behavioral trajectories.

As capabilities like private proofs mature, wallets will become important execution nodes for "minimal disclosure" data circulation, helping users balance trust and privacy in identity verification, asset proof, and compliance scenarios.

4. On-Chain Credit

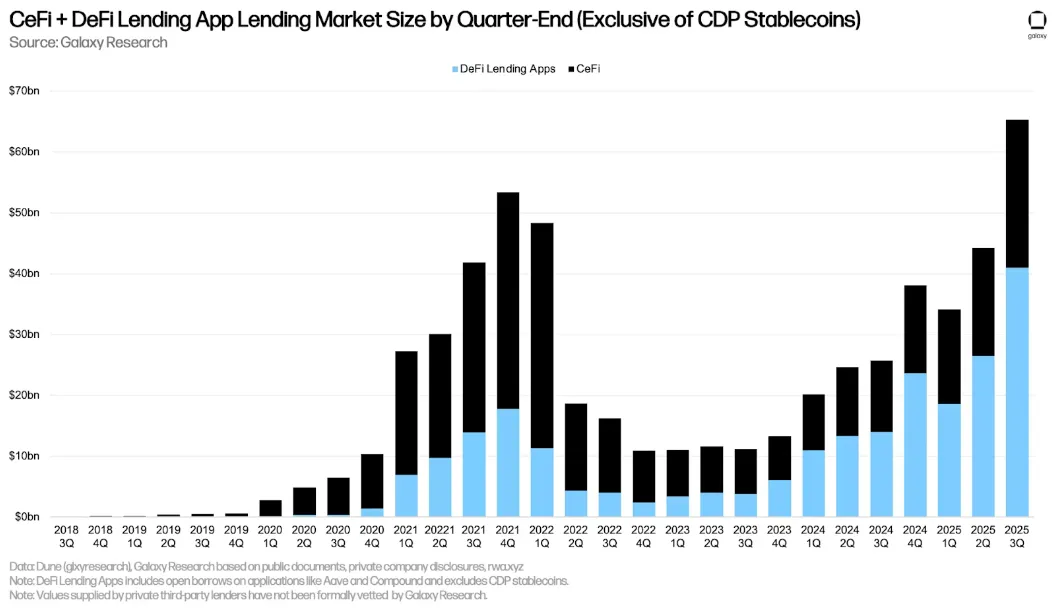

For a long time, on-chain credit has primarily revolved around "whether collateral assets are sufficient." While this design provided necessary security cushions for protocols during the cold start phase of DeFi and facilitated rapid expansion of the lending market, the limitations of this judgment method have begun to emerge as on-chain activities extend from simple transactions and arbitrage to payments and asset management scenarios: the true credit value and risk differences of on-chain participants are difficult to effectively distinguish.

A large number of on-chain lending activities essentially revolve around leverage, arbitrage, circular borrowing, and position management, resembling an efficient fund scheduling mechanism rather than a time-value exchange based on real financial needs. DeFi has effectively operated a highly liquid market system that emphasizes rapid entry and exit and immediate risk pricing, serving high-frequency, short-cycle, strategy-oriented funds, while lacking effective identification and incentives for long-term, stable usage behaviors. This leads to a mixed treatment of long-term users and short-term speculators in risk pricing and usage permissions, forcing protocols to raise collateral rates to cover overall uncertainty, reducing capital efficiency and making it difficult for real on-chain behaviors to solidify into identifiable credit premiums.

On-chain lending has reached a scale of billions of dollars, but structurally relies mainly on collateral, with the lack of credit being a systemic issue rather than insufficient demand. Source: Galaxy Research

Looking ahead to 2026, on-chain credit is more likely to gradually land in the form of embedded capabilities. As on-chain finance expands from speculative use to payments, consumption, and asset management, credit systems that can identify and serve long-term real users are more likely to form stickiness and scale. Practices represented by 3Jane and Yumi show that the first step of the credit system often lies in user identification and stratification, requiring the extraction of stable, continuous, and explainable behavioral trajectories from on-chain noise to model on-chain credit:

Time Dimension and Behavioral Stability: Credit is viewed as a state that updates over time, with protocols continuously observing features such as asset volatility ranges, interaction frequencies, fund turnover rhythms, historical performance, and risk events, mapping these features to permissions, limits, and risk control thresholds. Changes in credit and behavior are updated synchronously, facilitating the preemptive control of risks in the behavioral chain and reducing the uncertainties brought by one-time credit grants.

Building Reputation and Identity Layers: First, complete user identification and profiling stratification, then map reputation to product permissions and experience differences, such as lower friction costs, higher operational limits, wider risk control boundaries, or better fee structures. The advantage of a reputation layer leading is that risk exposure is controllable, allowing the system to complete user stratification and long-term incentives under lower financial risks, providing a data foundation and risk control experience for more complex credit products in the future.

In this evolutionary process, the importance of the wallet layer will begin to emerge. A single protocol or chain can only capture local fragments of user behavior, while the establishment of a credit system relies on cross-chain, cross-protocol, and cross-cycle data continuity. As the aggregation entry for all on-chain interactions, wallets naturally gather multi-chain asset distributions, long-term interaction trajectories, and payment authorization behaviors, positioning them closest to a comprehensive view of the user in the current ecosystem. Whether to regard users' long-term behaviors as core assets and build differentiated permission systems and service experiences based on this will become an important foundation for applications to establish long-term user relationships and competitive barriers.

5. RWA

The development of RWA received a policy boost in 2025, with the SEC holding four consecutive crypto regulatory roundtables from April to June, focusing on "asset on-chain" in the May meeting and discussing the development path of the RWA asset tokenization market. SEC Chair Gary Gensler proposed new ideas for tokenization regulation around "asset issuance, asset custody, and asset trading" in his keynote speech, clearly stating: "Securities tokenization can revolutionize old traditional models and benefit the U.S. economy."

With Ondo Finance completing its SEC review by the end of 2025, the regulatory environment has significantly improved. The SEC's proposed "Innovation Exemption" allows compliant entities to pilot securities tokenization within a regulated sandbox, indicating a shift in regulatory focus from pure risk defense to institutional acceptance and limited experimentation. This establishes a clearer legal foundation for asset issuance and clears key legal obstacles for the large-scale entry of traditional financial institutions.

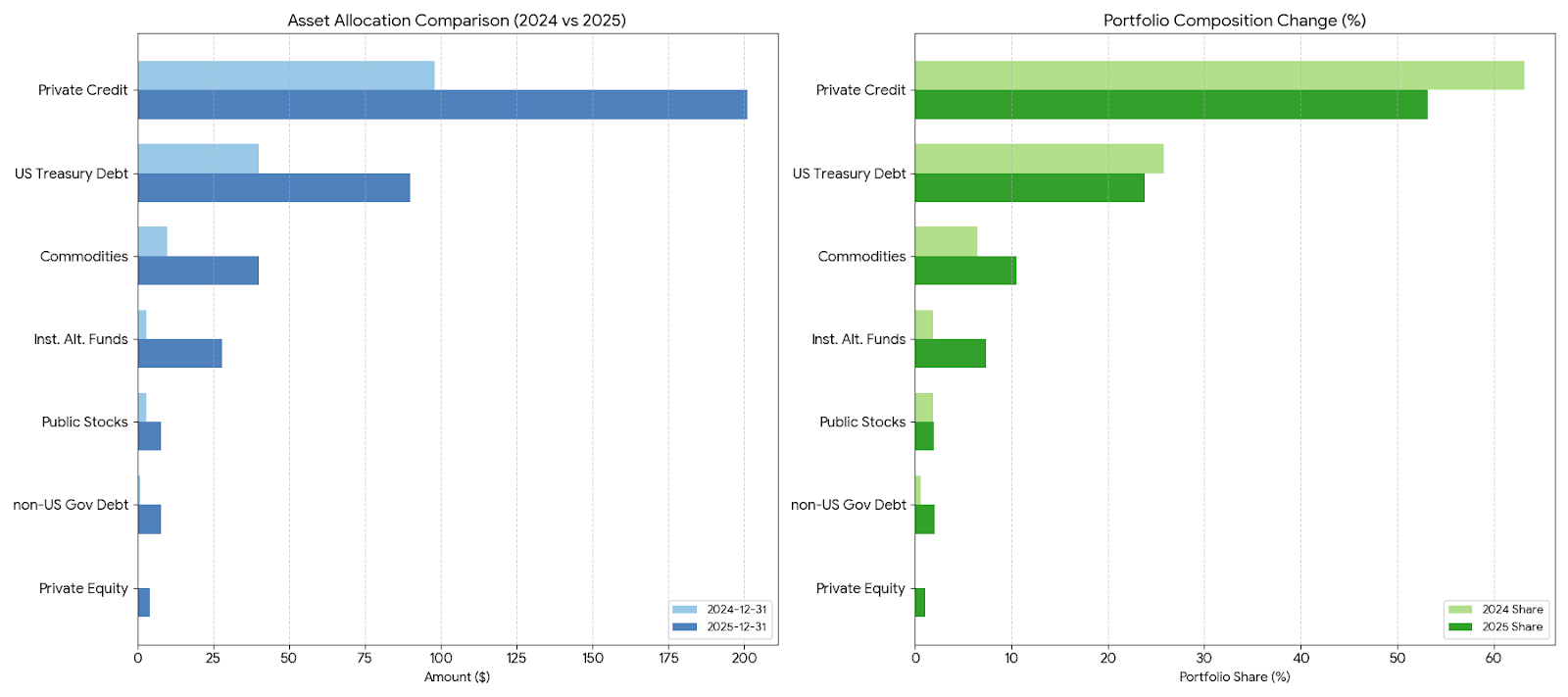

From the end of 2024 to the end of 2025, all tracks of RWA achieved positive growth, while fund flows underwent a significant structural shift:

Asset scale doubled: The total market stock skyrocketed from $15.5 billion to $37.7 billion in just one year, an overall growth of 2.4 times.

Position structure shifted from single-pole concentration to diversified balance: The proportion of private credit decreased from 63.2% in 2024 to 52.8%, with incremental funds diversifying into other tracks.

Alternative assets became the new growth engine: Institutional alternative funds (approximately 9 times growth) and non-U.S. government bonds (approximately 8 times growth) became highlights of annual growth, reflecting a shift in investor risk preferences from single stable returns to seeking diverse Alpha.

All-weather anti-inflation system: The scale of commodities grew approximately 4 times year-on-year (rising to 10.6% share), combined with private equity completing its build-up from zero to one, the RWA market began to form a "stocks + bonds + commodities + alternatives" composite structure, laying the foundation for building all-weather strategies on-chain.

Due to adjustments in data statistical standards on the rwa.xyz platform, the data in this table is derived from the author's original standards.

TCG (Trading Card Game) as a representative of the long-tail asset form of RWA also showed relatively bright market performance in 2025. For example, scarce cards (like 1st Edition Charizard) gradually reflected significant liquidity premiums in on-chain transactions. These assets have relatively low correlation with traditional stock and bond markets, and the non-financial premiums brought by cultural and collectible attributes make them a meaningful alternative asset option within the RWA system, providing investors with a more diversified portfolio with a dispersion effect.

It is expected that in 2026, based on the further establishment of a compliant framework, the market focus will shift from simply "asset on-chain" to deeper "trading business," particularly RWA perpetual contracts and RWA×DeFi will become core growth points:

(1) Evolution of Trading Forms: The Rise of RWA Perps and Synthetic Assets

In 2026, the key variable for RWA is shifting from "whether assets are on-chain" to "how to trade." As oracle and Perps DEX infrastructure matures, the boundaries of RWA begin to be reshaped by synthetic assets. Under this logic, RWA is no longer limited to custodial physical or legally secured assets but evolves into "any data stream with a fair price can be traded." In addition to stocks and bonds, private company valuations, macroeconomic indicators (such as CPI, non-farm payrolls), and even weather data can bypass physical delivery restrictions through synthetic structures and be transformed into on-chain trading targets, making Everything Perpetualized a reality.

(2) Improvement of Fund Efficiency: DeFi Composability and All-Weather Strategies

In 2026, the competitive focus of the RWA track will shift from asset issuance to fund efficiency. With the underlying infrastructure being connected, the integration of RWA assets and DeFi protocols will deepen further, and "yield + hedging" is expected to become a new model. For example, with Aave's Horizon protocol, investors can earn stable returns while holding government bond RWA and use it as collateral to establish macro hedging positions on-chain. This model reduces idle funds and truly unleashes the potential of RWA, retaining the safety cushion of TradFi while gaining the liquidity leverage of DeFi, creating a truly all-weather investment portfolio.

(3) Expansion of Asset Categories: Non-U.S. Dollar Assets and Fixed Income Systems on-Chain

In terms of asset categories, the expansion direction of RWA will no longer be limited to the U.S. dollar asset system. With the trend of U.S. dollar depreciation, non-U.S. dollar assets are expected to become an important direction in 2026, including European stocks, Japanese stocks, South Korean stocks, and assets related to major foreign exchange markets (such as G10 currencies other than USD). At the same time, the on-chain presence of money market funds and more fixed-income derivatives will further enrich the on-chain low-volatility asset pool, providing more optional dimensions for asset allocation and trading on the wallet side.

From the wallet perspective, the core value of RWA lies not in whether a single asset is successfully on-chain, but in whether it can be naturally integrated into users' daily asset allocation and trading behaviors. As trading forms evolve from holding-centric RWA to tradable and combinable RWA, wallets are becoming an important channel connecting users with global assets, providing users with diversified asset exposure beyond local markets and single currency systems, and driving on-chain finance from crypto asset management to a broader cross-market asset allocation.

6. Perpetual Contract Trading

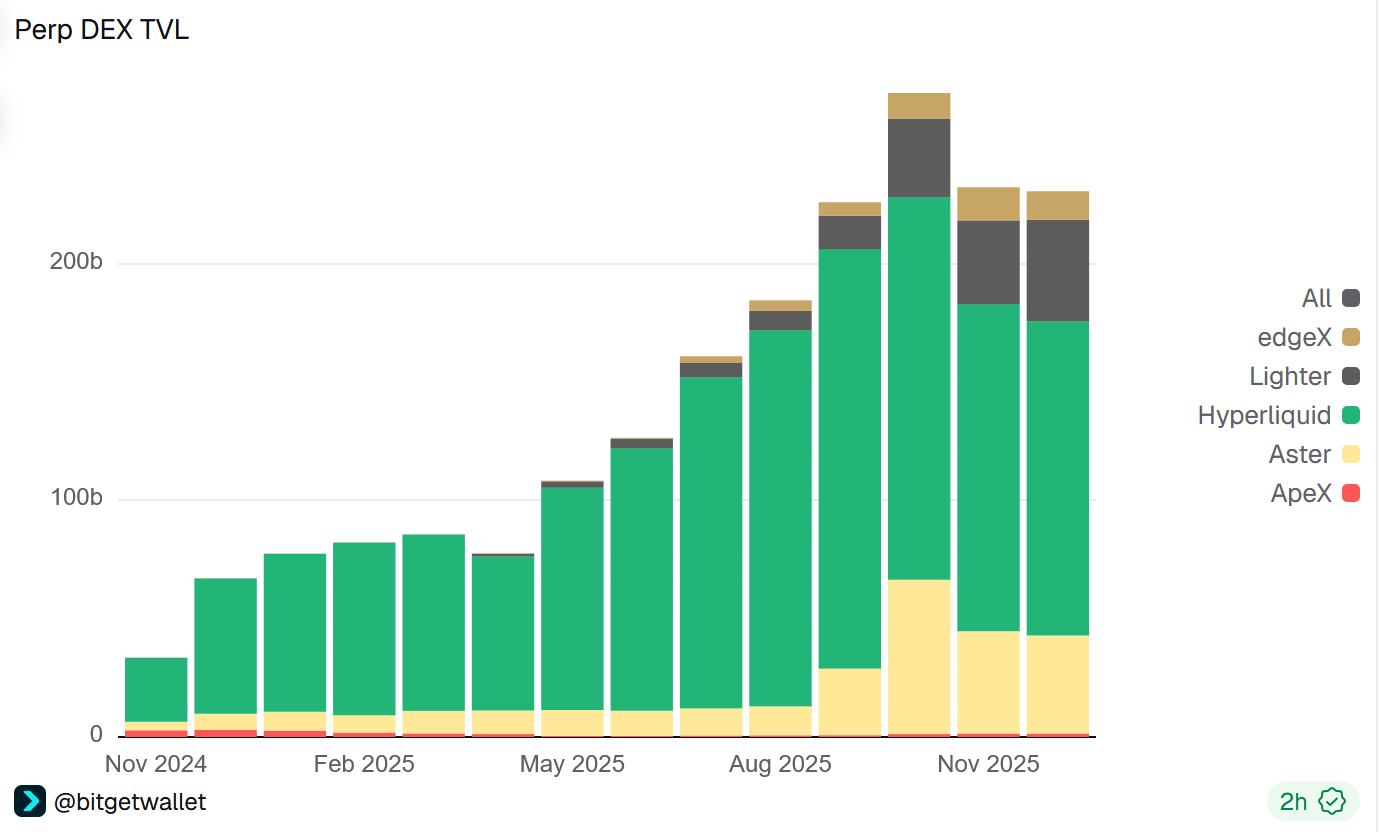

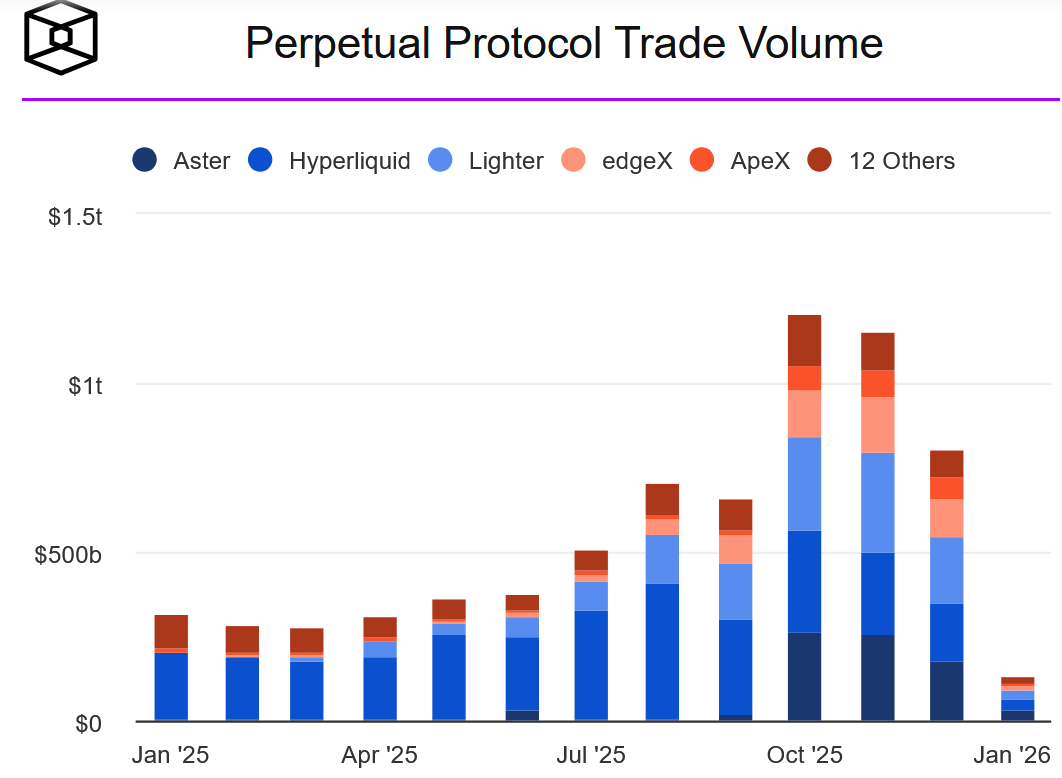

2025 is a key turning point for liquidity changes in on-chain decentralized perpetual contract trading (Perp DEX), with Perp DEX experiencing explosive growth in both capital scale and trading activity.

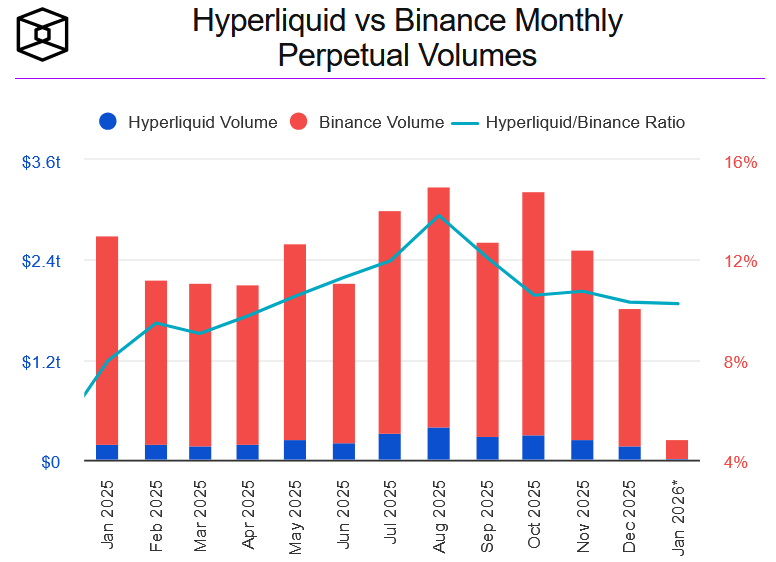

In absolute terms, the industry's TVL demonstrates a strong capacity for capital accumulation, stabilizing above $230 billion since its peak in October; in terms of trading volume, from the second half of 2025, mainstream protocols have seen monthly trading volumes exceed $500 billion, with peaks in October and November consecutively breaking the $1 trillion mark, proving that on-chain liquidity depth is sufficient to accommodate institutional-level funds.

From a relative structural perspective, the ratio of Perp DEX to CEX contract trading volume has risen from 6.34% at the beginning of the year to nearly 20% at the peak in November. Taking the leading Hyperliquid as an example, its monthly derivatives trading volume ratio with Binance increased from 8% to nearly 14% over the year. This series of data indicates that, with the improvement of infrastructure and changes in user habits, Perp DEX has broken through liquidity bottlenecks and is gradually challenging traditional spot DEX, becoming the next generation core liquidity pool for on-chain funds.

Source: Dune Analytics

Source: The Block

Source: The Block

Another significant feature of the Perp DEX track in 2025 is the rapid restructuring of the competitive landscape. The market has transitioned from the absolute monopoly of Hyperliquid at the beginning of the year to a multipolar competition in the second half of the year. According to The Block data, by mid-2025, Hyperliquid's trading volume share fell below 60% for the first time, with new players like Aster and Lighter starting to capture market share in specific user groups and trading scenarios through incentive activities. However, this change does not imply a substantial shake-up of leading liquidity; perpetual contract trading inherently possesses strong network effects and scale effects. The deeper the liquidity and the lower the slippage, the more likely it is to become the long-term main venue for traders. Historically, whether in the CEX or DEX space, the derivatives track often exhibits a "stronger getting stronger" structural characteristic, and how the second tier can form a self-circulating liquidity flywheel remains a core challenge it faces.

Looking ahead to 2026, there are still 20-30 Perp DEX projects awaiting gradual TGE advancement. Trading mining, incentive rewards, and market-making subsidies are more reflective of the competition for existing users rather than substantial market expansion. Against the backdrop of overall derivatives demand stabilizing, the competitive focus of Perp DEX is expected to gradually shift from traffic expansion to efficiency, stability, and user retention. Matching efficiency, system stability under extreme market conditions, capital carrying capacity, and sustained depth of mainstream trading pairs will become key variables determining the long-term positioning of protocols.

At the application level, through native integration with leading Perp DEXs like Hyperliquid, wallets have validated the feasibility of in-app derivatives trading (In-App Perps) in terms of real users and trading levels. Perp DEX is becoming an important incremental scenario for trading within wallets, allowing users to complete Perp orders, risk control, and asset management within the wallet, evolving into a more natural usage path.

Bitget Wallet

Phantom

MetaMask

Rabby

Cumulative Trading Volume

$27.7 billion

$26 billion

$2.2 billion

$500 million

Daily Active Users

800–1,200

4,000–6,000

800–1,500

150–300

Note: Data sourced from Dune, as of December 31, 2025; different wallets exhibit structural differences in user scale, trading frequency, and asset preferences, with cumulative trading volume and daily active users reflecting their relative positions in the in-app perpetual contract trading scenario.

As the front end closest to users' assets and decision paths, wallets will play a more important role in distribution and reception within the Perp DEX ecosystem. In the context of diminishing wealth effects from new coins and large transactions gradually returning to core assets like BTC/ETH, Perp trading within wallets also provides users with more frequent and continuous reasons to use the platform. For wallets, Perp trading is no longer just a functional supplement but a key scenario connecting on-chain liquidity, enhancing user stickiness and usage frequency. It is expected that in 2026, as infrastructure further matures and user habits continue to shift, the deep integration of Perp DEX and wallets will become a long-term structural trend in the on-chain derivatives market.

7. Meme

Looking back at 2025, memes remained one of the most important attention gateways on-chain. The emergence of Trump coins, Web2 celebrity coins, Pump.fun live streams, and the Chinese meme wave constituted multiple rounds of varying levels of active cycles, releasing a certain wealth effect during these phases. In these structural markets, many users downloaded wallets for the first time, completed on-chain transactions for the first time, and understood gas fees, slippage, and failure rates for the first time, making memes the most direct and lowest-threshold entry point for users into the on-chain world.

From the internal user and trading data of Bitget Wallet, this trend is particularly evident: new users in 2025 accounted for about 65% of all trading users and contributed nearly 61% of the total trading volume. Memes genuinely played the role of "new user entry—first transaction—high-frequency usage" in on-chain enlightenment, with the periodic warming of their markets often directly corresponding to increases in wallet downloads, address creation, and swap activities.

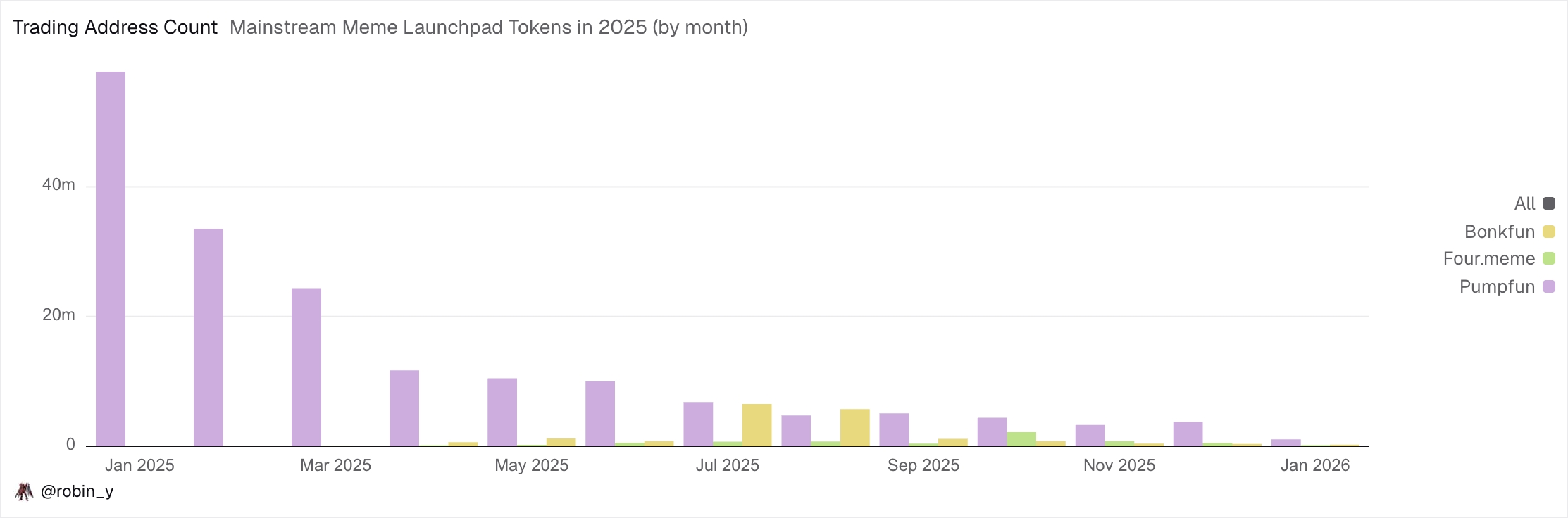

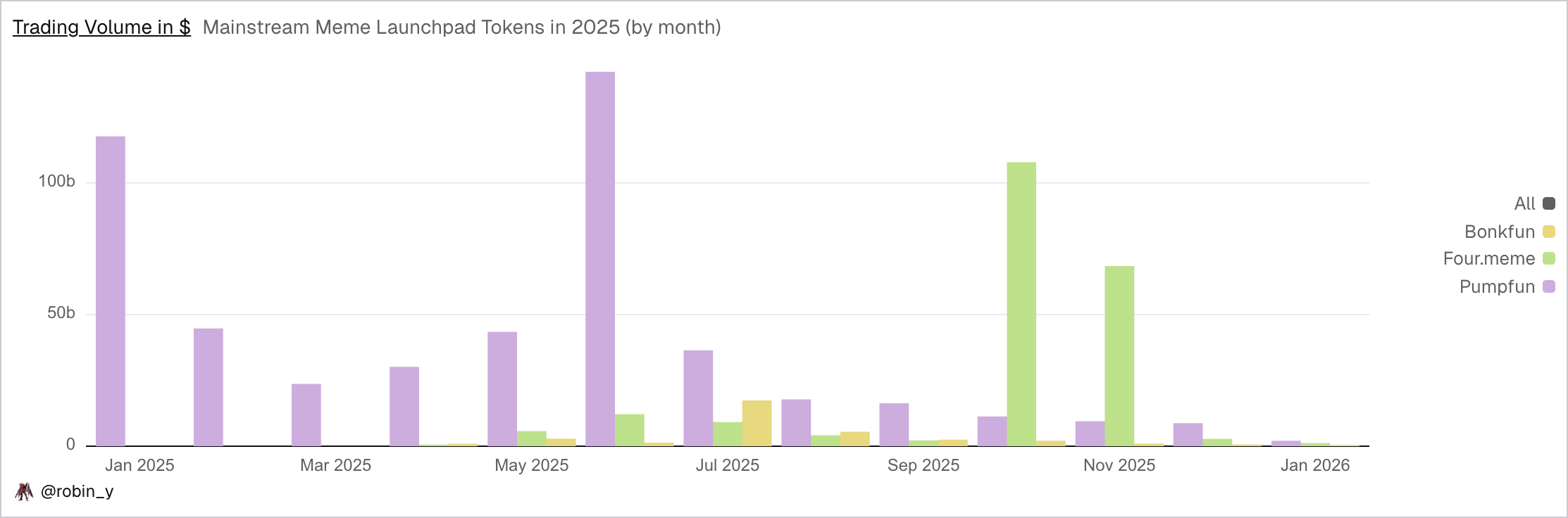

However, from the trading volume and number of trading addresses of major meme launchpads, the repeated emergence of meme hotspots has not correspondingly led to a sustained recovery of overall on-chain liquidity. The kind of meme season that covered the entire market, like the Trump coin at the beginning of 2025, is becoming increasingly difficult to replicate. In 2026, memes are more likely to present structural markets: periodic speculative opportunities around specific hotspots and narrative windows.

Source: Dune Analytics

Source: Dune Analytics

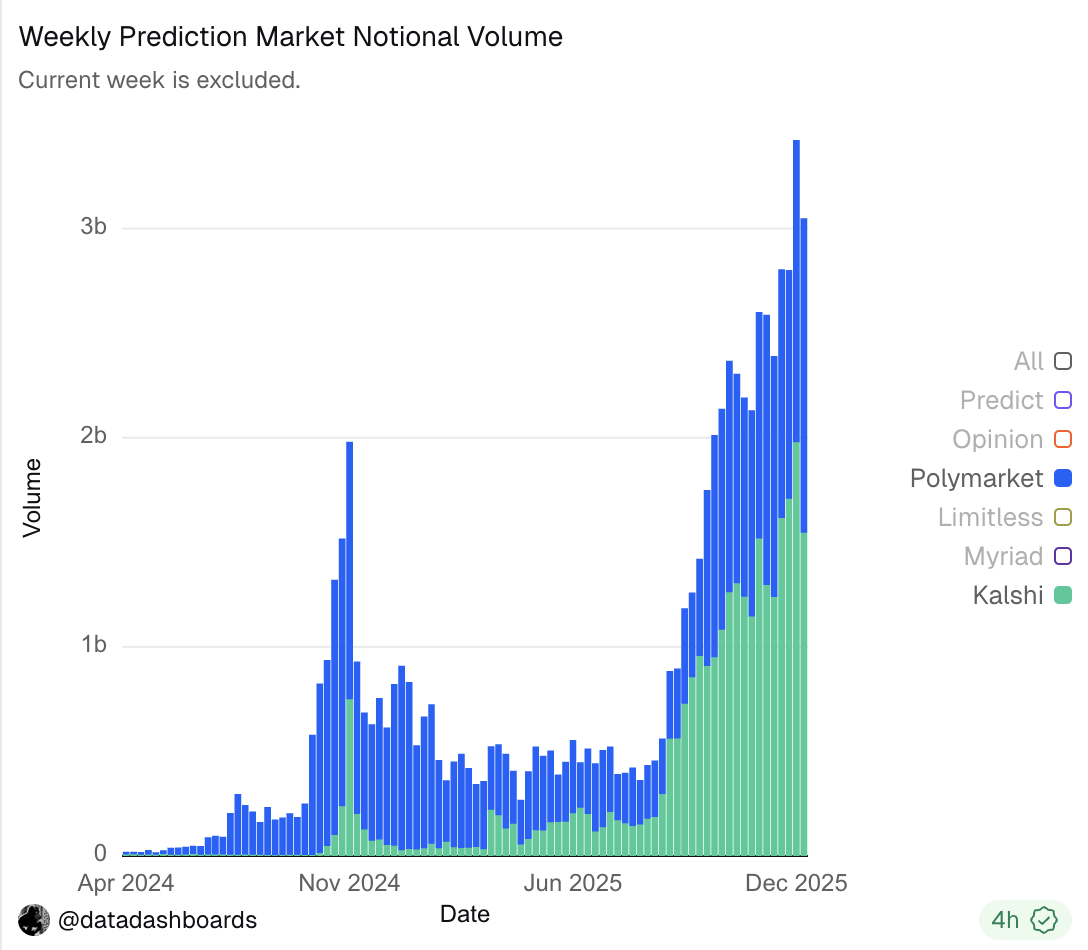

Another uncertainty in the meme market in 2026 comes from the diversion of new forms of "hot assetization." Pump.fun quickly transforms hotspots into tokens, while Polymarket turns hotspots into topics and odds; both are essentially competing for the same type of attention and risk preference. As prediction markets lower the participation threshold for hot events, offer more direct expressions, and present product forms closer to public understanding, memes may face further diversion of attention and on-chain liquidity in certain scenarios.

In the ongoing evolution of memes, more and more projects are continuously attempting to attract external incremental users through multiple channels, shifting memes from an asset form centered on internal consensus to more diffuse and clearly defined cultural symbol outputs, and trying to create reverse influences in real-world events and public topics. Meanwhile, although various launchpads have validated the advantages of fair issuance and efficiency, there is still room for improvement in creator incentive mechanisms, long-term value retention capabilities, and the continuous introduction of non-crypto users.

However, it is undeniable that the fair launch, permissionless on-chain issuance, and participation methods represented by memes will remain one of the most attractive and vital experiments in the crypto world. Future expectations still lie in the upgrade of its value layer: whether it will remain in a highly zero-sum short-term PVP game or have the opportunity to produce a phenomenon-level meme that can carry cultural expression and creator participation, attracting a broader external user base.

From the product and tool perspective, meme trading itself may find it difficult to achieve disruptive innovation and will enter a phase centered on "intelligence and refinement." Trading tools are helping users enhance their perception of on-chain activities and make faster, more stable decisions in an environment of declining liquidity through more detailed data presentation, more intuitive risk warnings, and more proactive intelligent services. Address relationship and cluster analysis products will become increasingly popular, becoming a basic configuration for more users, providing the general public with more transparent and understandable analyses of on-chain behavior, which will be a key direction for the continuous optimization of trading tools and wallet functions in the next stage.

8. Prediction Markets

In 2025, prediction markets completed a key leap from being a niche product in crypto to a prototype of mainstream financial applications, with overall trading scale and participation significantly increasing. Currently, the monthly trading volume of mainstream prediction markets has stabilized above $10 billion, with a cumulative trading volume exceeding $40 billion for the year. Although its absolute size is still significantly smaller than that of mature financial markets like stocks and futures, as an independent new asset form, prediction markets have shown an outstanding growth trajectory and have entered a clear phase of accelerated expansion.

As trading depth increases and participation structure improves, its functions are undergoing substantial changes. In more and more scenarios, the prices reflected are no longer just opinions or sentiments, but rather information that some participants have grasped but have not yet publicly confirmed. The flow of funds itself has become a carrier for information release, allowing the market to form price signals in advance of factual disclosures.

The evolution of contract structures further reinforces this trend. As prediction markets expand from simple binary judgments to more granular event splits and combination pricing, their prices begin to possess financial significance that can be referenced. In certain cases, when the market size is large enough and stakeholders are highly attentive to price changes, prediction markets may even influence the behavior of event participants, making the price signals themselves one of the variables affecting real-world decisions.

From a broader perspective, prediction markets can be understood as a more mature attention trading mechanism:

Meme trading is essentially a game of narratives and emotions, with its connection to real events often being indirect and unstructured, relying on developers or communities for subjective interpretation and mapping, lacking a unified, reusable event structure, making it easier for similarly named assets to circulate in parallel, and discussions often limited to the crypto circle.

Prediction markets, on the other hand, use highly defined real events as trading targets, transforming publicly relevant events in the real world (politics, macroeconomics, industry dynamics, celebrity events, sports, etc.) into tradable and verifiable probability assets based on clear occurrence conditions and settlement rules (such as whether it occurs, when it occurs, and in what form it occurs).

In this sense, prediction markets not only possess stronger communicability and discussion value but also exhibit significant positive externalities: researching issues, obtaining information, and judging trends can be transformed into economic returns through market mechanisms, and earlier, clearer result signals themselves hold strong social value.

Source: Dune Analytics

The predictive accuracy of prediction markets is significantly surpassing that of traditional Wall Street analyst systems, image source Kalshi Research.

2026 will be a year of high event concentration. A series of major events with clear outcome nodes, such as the World Cup and the U.S. Congressional midterm elections, will continue to provide high-quality, sustainable trading targets for prediction contracts. With trading scale already expanded, platform capabilities maturing, and compliance pathways gradually clarifying, the dense occurrence of real-world events is expected to create a significant amplification effect on prediction markets, driving them into a broader growth phase in 2026.

As the number of underlying platforms increases and event coverage gradually improves, the competitive focus of prediction markets is also shifting: from whether they have market supply capabilities to who can serve as the main trading entry for users. At this stage, user experience, information organization methods, and trading efficiency are beginning to become key differentiating factors among platforms.

Looking ahead to 2026, prediction markets are more likely to see innovations first at the interface and product levels, rather than achieving complete integration at the liquidity aggregation level. This judgment stems from the structural characteristics of prediction markets: events are highly fragmented, and different platforms lack unified standards for defining the same event, option splits, and settlement rules; differences in account systems, fund custody, and order logic across platforms also make it difficult to achieve seamless cross-platform matching and fund merging like DEXs.

In this context, the core needs of most retail users still focus on event discovery, quick judgment, and convenient order placement itself, rather than cross-platform odds comparison or complex arbitrage execution. At the current stage, a more realistic and feasible evolutionary direction for prediction markets may be the unification of information and interface layers: by providing more efficient event screening, odds display, and position management, they can reduce users' cognitive and operational costs, thereby enhancing overall decision-making efficiency.

As the front end closest to users' assets and decision paths, wallets naturally have the conditions to become the main entry and distribution layer for prediction markets. As prediction markets expand from crypto-native users to a broader consumer base, their strong correlation with real-world events will continue to amplify this entry value. We look forward to witnessing the role of wallets evolve from merely a collection of trading functions to the core entry point for event-driven daily financial behaviors.

Conclusion

In summary of the above observations, we believe that on-chain activities in 2026 will continue to shift from being transaction-driven to usage-driven, transitioning from reliance on periodic market conditions and traffic to reusable, retainable daily financial behaviors. In this process, wallets will gradually evolve into the core front-end application connecting users, on-chain systems, and the real financial world. Based on this judgment, we summarize the evolutionary paths of the eight major directions for 2026 into the following three trend points:

- Stablecoin payments and AI agent consumption drive the extension of value exchange networks, with wallets becoming the settlement routing layer between on-chain and real economies.

With the continuous breakthroughs in regulation, issuance scale, and adoption rates of stablecoins, they have become an important component of the global value clearing network and are beginning to be deeply embedded in cross-border B2B2C payments, local instant payment systems, and card organization clearing systems; the launch of protocols like x402 has enabled AI agents to independently complete payment transactions under established authorizations, significantly expanding the participants and frequency of value exchanges; these two changes will jointly drive the flow of on-chain value from crypto-native scenarios to the real economy and automated business models. By integrating stablecoin systems, real payment networks, and multi-chain assets, wallets will provide users with currency exchange, path orchestration, and fund scheduling functions, gradually evolving into the core settlement routing layer connecting on-chain and real economies.

- Privacy and credit enter the preparation stage for large-scale adoption, with wallets becoming the infrastructure layer for long-term financial relationships on-chain.

As the proportion of payment and asset management scenarios in on-chain activities continues to rise, privacy and credit are shifting from marginal issues to prerequisites for realizing daily finance. Privacy will no longer be just a preference for a minority of users but will gradually become a necessary default capability to support the large-scale adoption of crypto; on-chain credit will also move away from a single collateral logic, beginning to establish a layered system around users' long-term behavioral trajectories, time accumulation, and performance stability; the realization of these two demands relies on continuous cross-chain, cross-protocol, and cross-cycle data. As the aggregation entry for users' on-chain behavior, wallets will begin to bear the practical implications of privacy boundaries and credit status, providing infrastructure support for long-term, reusable on-chain financial relationships through systematic integration of asset queries, transaction initiation, identity interactions, and permission controls.

- Meme, RWA, Perp, and prediction markets reshape the structure of on-chain trading assets, with wallets becoming the main trading reception layer.

The diversification of on-chain trading asset categories will comprehensively cover different users' risk preferences and investment needs. Memes, as important attention assets on-chain, will continue to present structural markets; the incremental trading scale and capital depth on-chain will gradually shift towards asset categories with more financial attributes and real-world anchoring, such as RWA, perpetual contracts, and prediction markets. RWA will evolve into freely tradable and combinable DeFi financial tools to meet the needs for stable returns and diversified allocations; Perp DEX, after improvements in liquidity and stability, will continue to attract high-frequency and professional traders; prediction markets will provide new risk exposures for opinion-expressive and information-driven users through event probability pricing. Users' trading and asset management behaviors will increasingly concentrate in wallets that can simultaneously offer multiple asset choices and a unified, permissionless operational experience, making wallets gradually become the main entry point for global asset allocation and cross-market trading.

These outlooks are merely a phase of sorting and expression and may not constitute definitive answers. The industry is still rapidly changing, many paths have yet to be solidified, and many questions remain far from fully discussed. We hope that this report systematically presents Bitget Wallet's observations and thoughts on on-chain daily finance for 2025-2026, providing the industry with some continuously verifiable and discussable reference perspectives.

Whether you are a crypto-native builder, researcher, developer, or a participant from traditional finance and technology sectors, we look forward to ongoing communication with you, continuously calibrating judgments through open discussions, refining understanding through practical feedback, and working with more like-minded individuals to promote the development of on-chain finance towards a more authentic and sustainable direction, reshaping the global financial infrastructure for the next era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。