Recently, the overall cryptocurrency market has been experiencing wide fluctuations, but Hyperliquid (HYPE) has shown an extremely strong independent trend. HYPE skyrocketed from around $22 to a peak of $34.8 within just three days, with a cumulative increase of over 60%.

1. Data Review: Volume, Price, and Open Interest Resonance

Unlike most short-cycle tokens that experience a surge, HYPE's recent rise has been supported by extremely solid trading data:

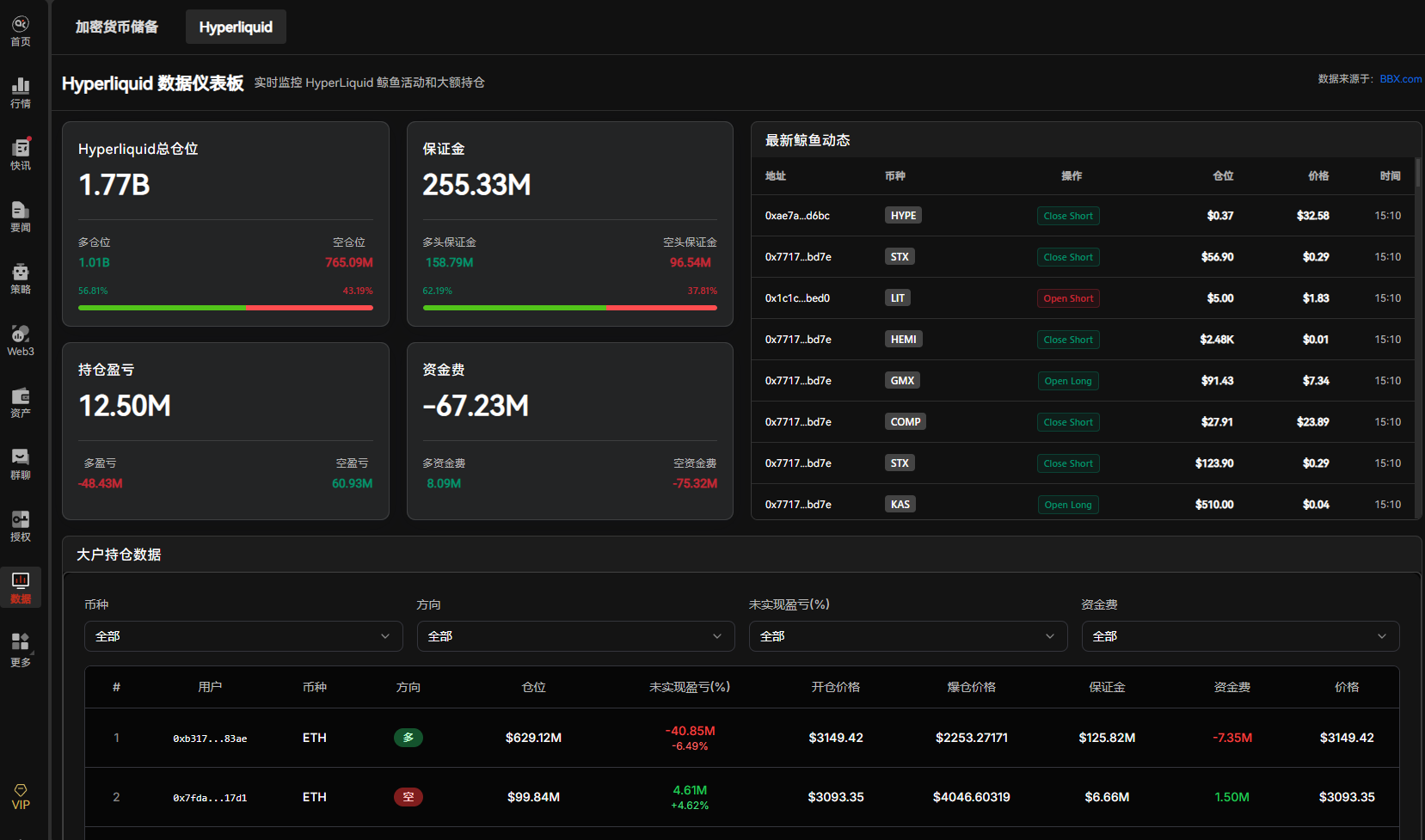

- Record Trading Volume: In late January, Hyperliquid's total daily trading volume exceeded $1.78 billion, setting a new historical high.

- Surge in Open Interest (OI): Driven by HIP-3 (permissioned open market), the OI in related markets skyrocketed from $260 million a month ago to a range of $790 million to $930 million, also setting a historical high.

- Price Resilience: HYPE quickly rose from over $20 to about $34.8 within three days, then retraced to oscillate in the $32–33 range, still at a high level.

2. Core Logic: Why is Silver the Core Catalyst for HYPE?

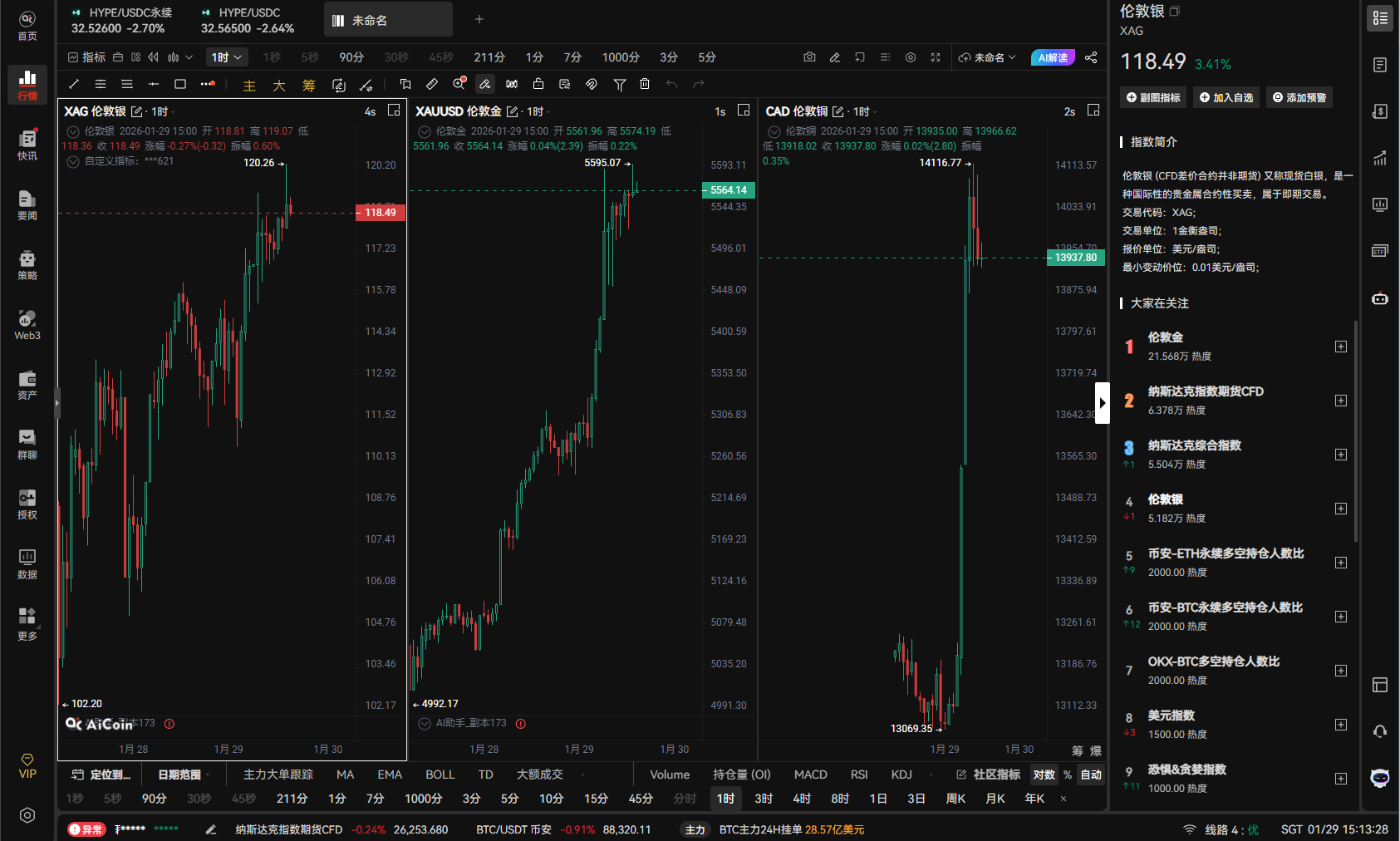

Hyperliquid introduced the commodity and RWA (real-world asset) markets through the HIP-3 framework, with the true core variable being commodity perpetual contracts, especially silver.

- Silver perpetual contracts saw a 24-hour trading volume exceeding $1.2 billion, with this single commodity accounting for the vast majority of the platform's trading volume.

- During certain periods, silver's trading volume surpassed that of mainstream crypto assets like Bitcoin and Ethereum, becoming one of the platform's most active markets.

- Concurrently, commodity contracts for gold, copper, natural gas, etc., also recorded trading volumes ranging from tens of millions to over a hundred million dollars, forming a clear resonance in the commodity sector.

This indicates that funds are not merely "speculating on silver," but viewing Hyperliquid as a decentralized commodity derivatives exchange to express their judgments on precious metals and macro commodity trends.

3. How Does High Trading Volume Reflect on HYPE's Price?

HYPE's rise is not simply a case of "token price following platform popularity," but stems from the positive feedback mechanism of its token economic structure.

- Real Growth in Fees: High-frequency trading of commodities and crypto perpetual contracts generates continuous and substantial fee income.

- Buyback/Distribution Mechanism: The vast majority of the platform's fee income is used to buy back HYPE or distribute to stakers. High-frequency commodity trading has generated massive cash flow, directly enhancing HYPE's Real Yield attributes.

- Staking Threshold: According to current HIP-3 rules, third-party teams deploying new markets must stake 500,000 HYPE. As more commodity markets like gold, copper, and natural gas go live, the institutional demand for HYPE's passive locking is increasing.

As trading volume, OI, and revenue models strengthen in sync, some funds have begun to view HYPE as a "growth stock of the platform" rather than merely a functional token. The resulting cycle is:

Trading volume increases → Fee income rises → Buyback/distribution expectations improve → HYPE's cash flow attributes enhance → Price and market cap rise → Attracts more funds and traders.

This round of HYPE's explosive growth reaffirms that "trading authenticity" is the long-term moat for Web3 products. When a DEX allows traders to operate silver contracts as smoothly as in the US stock market, its token is no longer just a speculative symbol, but a share of the ecosystem's dividends.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group Chat - Wealth Group:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。