Just a few hours before the Federal Open Market Committee (FOMC) meeting, I wrote an article titled [How to Interpret the Fed's Rate Cut Signals: Interpreting Tonight's FOMC Meeting Through Market Data], providing a simple analysis of the magnitude and depth of potential rate cuts.

At the end of the article, I drew a clear bearish conclusion and established a short position in Bitcoin and a long position in gold.

Now that the FOMC meeting has concluded, the market reaction is as we predicted. Let’s analyze it in detail.

The Fed's Latest Meeting Decision and Rate Policy Background

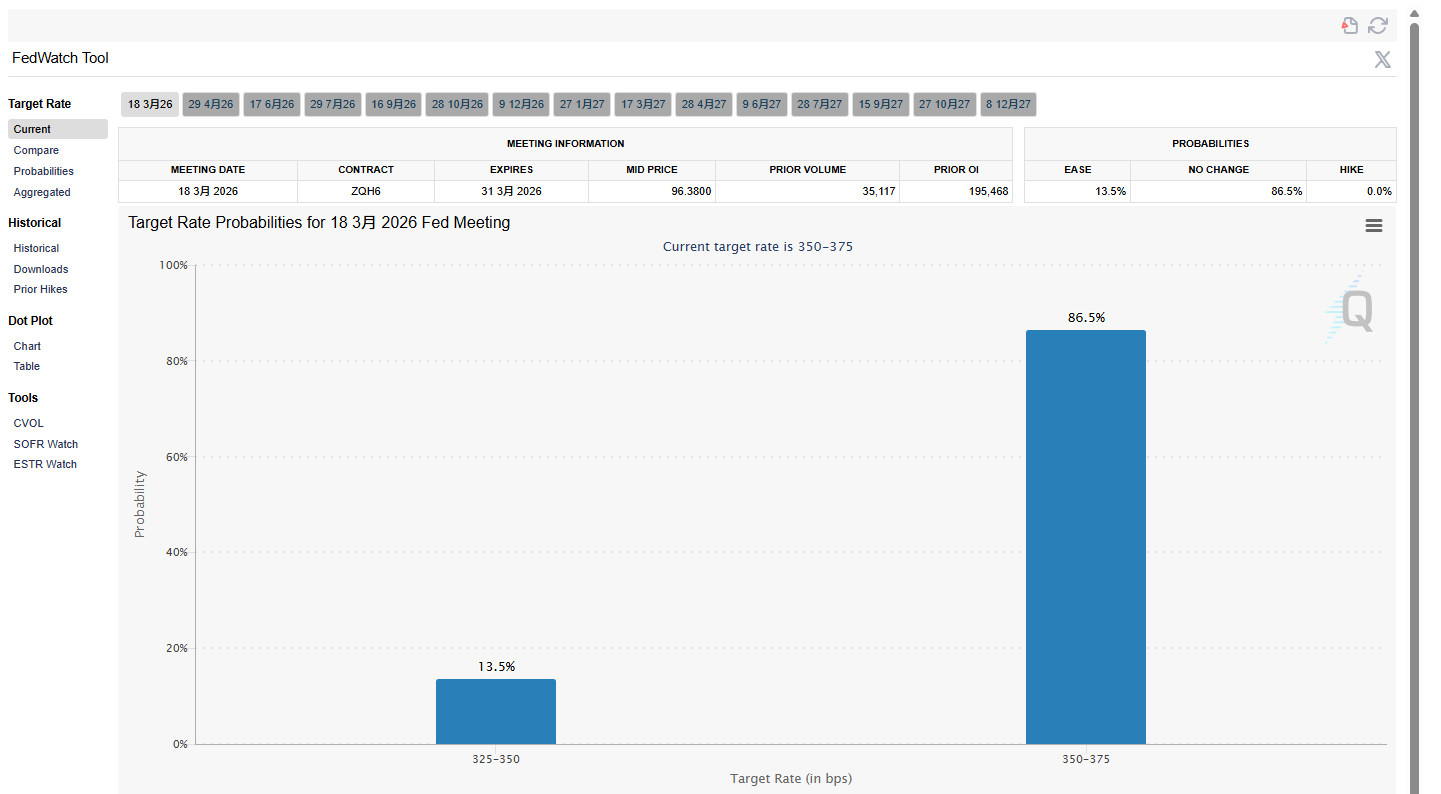

The decision from the Fed's most recent FOMC meeting aligned with widespread market expectations, but its implications are far more complex than anticipated. The decision-makers voted to keep the federal funds target rate unchanged at 3.50% to 3.75%, continuing the pause in rate hikes after multiple cuts in 2025. Although the final outcome was expected, the message conveyed was anything but neutral.

This meeting effectively confirmed that the Fed is not prepared to accelerate its monetary easing policy. Officials emphasized that sustained and convincing evidence is needed to show that inflation is steadily moving towards the 2% target before any further adjustments to policy can be made. As a result, investors were forced to reassess their previous expectations for a faster and smoother rate-cutting cycle.

The timing of the decision is also crucial. Global markets were already in a state of high uncertainty, and strong economic data from the U.S. reduced the urgency for stimulus measures, while fiscal and geopolitical risks continue to accumulate. In this context, the Fed's pause sends a signal of caution rather than reassurance.

Jerome Powell's Press Conference and Fed Policy Signals

In the post-meeting press conference, Chairman Jerome Powell reiterated the stance of patience and restraint. He stated that the U.S. economy is robust, pointing out stable economic growth and a stabilizing labor market, with no signs of sharp deterioration. At the same time, Powell acknowledged that inflation rates remain above target levels and that progress across sectors is uneven.

Notably, Powell did not provide clear guidance on the timing of future rate cuts. He emphasized that monetary policy decisions will still depend on economic data, and if inflationary pressures persist, the committee is prepared to maintain current rates for a longer period. The market interpreted this lack of forward guidance as a signal that easing policies are unlikely to be implemented in the short term.

Powell reiterated that the Fed's goal is not asset prices. He emphasized that the Fed's focus remains on price stability and full employment. While this stance aligns with the Fed's long-standing principles, financial markets are increasingly reliant on expectations of liquidity easing.

Post-FOMC Meeting Rate Expectations

Before the meeting, the futures market reflected strong expectations for rate cuts in the coming months. After the Fed's statement and Powell's remarks, these expectations significantly weakened. This shift did not eliminate the possibility of future rate cuts but raised the threshold for taking action.

This adjustment is crucial because the market reacts not only to policy measures but also to changes in expectations. Even without rate hikes, signals of a prolonged pause in rate increases can tighten financial conditions by supporting the dollar, maintaining high real yields, and suppressing risk appetite.

In fact, the Fed reinforced the view that liquidity conditions will remain constrained in the short term. This is undoubtedly a disadvantage for assets sensitive to monetary expansion.

Gold Prices' Reaction to the Fed Meeting and Macroeconomic Uncertainty

Gold emerged as one of the most obvious beneficiaries following the FOMC meeting. After the decision was announced, gold prices continued to strengthen, reflecting a renewed demand for safe-haven assets amid policy uncertainty.

Unlike growth or speculative assets, gold does not rely on economic expansion or profit growth momentum. When investors seek to hedge against inflation risks, geopolitical tensions, or policy uncertainty, gold often performs well. Although the Fed's cautious tone was not overtly hawkish, it heightened concerns that tightening policies may last longer than expected.

Additionally, broader macro factors have also enhanced gold's appeal. Ongoing debates surrounding U.S. government funding and escalating geopolitical tensions have increased demand for traditional safe-haven assets. In this context, gold's role as a store of value has once again been highlighted.

For research on gold, please refer to the article I wrote on January 6, 2026. After writing the article, I also purchased spot gold and low-leverage long contracts.

Recently, prices of gold, silver, and other precious metals have surged significantly, leading some investors to hesitate at high levels. For investment advice regarding the current price points, please stay tuned for my upcoming article.

Bitcoin Price Decline After Fed Decision

Bitcoin's reaction was starkly different from that of gold. Within hours of the FOMC decision announcement, Bitcoin's price fell from approximately $89,631 to $88,649, reflecting a slight but noticeable risk-off sentiment in the market.

Although this movement was not drastic, it is significant in its context. Bitcoin had previously been fluctuating within a fragile range, and the Fed's statements eliminated potential catalysts for recent gains. As market expectations for imminent rate cuts diminished, traders' willingness to maintain aggressive long positions also weakened.

This reaction highlights a long-standing reality: despite Bitcoin being viewed as a hedge against fiat currency devaluation, it still behaves like a liquidity-sensitive risk asset during periods of monetary policy uncertainty. When the outlook for easing policies dims, the cryptocurrency market often faces short-term pressure.

Why Did Gold Outperform Bitcoin After the FOMC Meeting?

The differences between gold and Bitcoin reflect structural differences in investor behavior. Gold is widely regarded as a defensive asset, typically rising when confidence in monetary or fiscal stability wanes. In contrast, Bitcoin's status is more complex, straddling the line between macro hedge and speculative asset.

Institutional investors frequently adjust their gold allocations as part of their overall risk management strategies. However, cryptocurrency allocations tend to be more tactical and are more sensitive to changes in short-term liquidity expectations. Therefore, even when Bitcoin is in a consolidation or downtrend, gold may still rise during periods of market uncertainty.

This divergence does not negate Bitcoin's long-term development prospects, but it underscores the importance of timing in macro conditions. In the short term, liquidity conditions continue to play a dominant role in the price movements of cryptocurrencies.

Other Macro Risks Beyond the FOMC Meeting

The FOMC's decision does not exist in isolation. Several other risk factors are converging, adding greater pressure to an already fragile market environment.

A key concern is the potential government shutdown in the U.S. Ongoing fiscal negotiations have heightened the risk of funding interruptions, which could undermine investor confidence and exacerbate volatility in financial markets.

Meanwhile, geopolitical tensions remain high. Developments in U.S.-Iran relations once again introduce uncertainty into energy markets and the global security landscape. Any escalation of the situation could complicate the inflation outlook and suppress economic growth expectations.

These interwoven risks make the market more susceptible to negative surprises and reduce tolerance for speculative positions.

FOMC Risk Management and Market Outlook

Overall, the recent FOMC meeting once again conveyed a message of caution. The Fed remains focused on controlling inflation, even if it means maintaining a tightening monetary policy for a longer period than the market expects. Meanwhile, fiscal uncertainty and geopolitical risks continue to cast a shadow over the economic outlook.

Gold may continue to benefit from this environment, especially as uncertainty intensifies. However, Bitcoin and the broader cryptocurrency market may still remain volatile, with short-term trends influenced by changes in liquidity expectations and macroeconomic news.

In this context, rigorous risk management is essential. While the long-term development trend remains solid, the short-term situation favors patience and vigilance over aggressive strategies.

The above views are from @AAAce4518

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。