$135 billion, this is the amount Meta (META.M) plans to spend in 2026.

The Q4 2025 performance and Q1 2026 guidance both exceeded expectations, providing some relief to shareholders who have been anxious about being "left behind." However, at the same time, the full-year capital expenditure (CapEx) for 2026 is set to soar to $135 billion, nearly double that of last year, raising concerns about whether this will be another aggressive gamble.

Surprisingly, the market seems to have chosen to buy in, with Meta's stock price soaring over 10% in after-hours trading and continuing to rise in night trading.

Meta Stock Price Data Source: Yahoo Finance

The answer lies within this earnings report: at least at this stage, it shows the market that AI investments are not just a future vision but are already tangibly improving the core cash cow—advertising business. Thus, Wall Street has begun to bet on a narrative reversal for Meta and is willing to back this super investment plan.

Ultimately, "daring to spend money, daring to go all in" has always been the essence of Meta and Zuckerberg. This also means that winning could lead to a significant narrative reversal; losing, at least under the current financial structure, is unlikely to evolve into an uncontrollable disaster.

I. Earnings Report Quick Read: Performance & Guidance "Double Exceeds Expectations"

From the results, this is an earnings report capable of changing market sentiment.

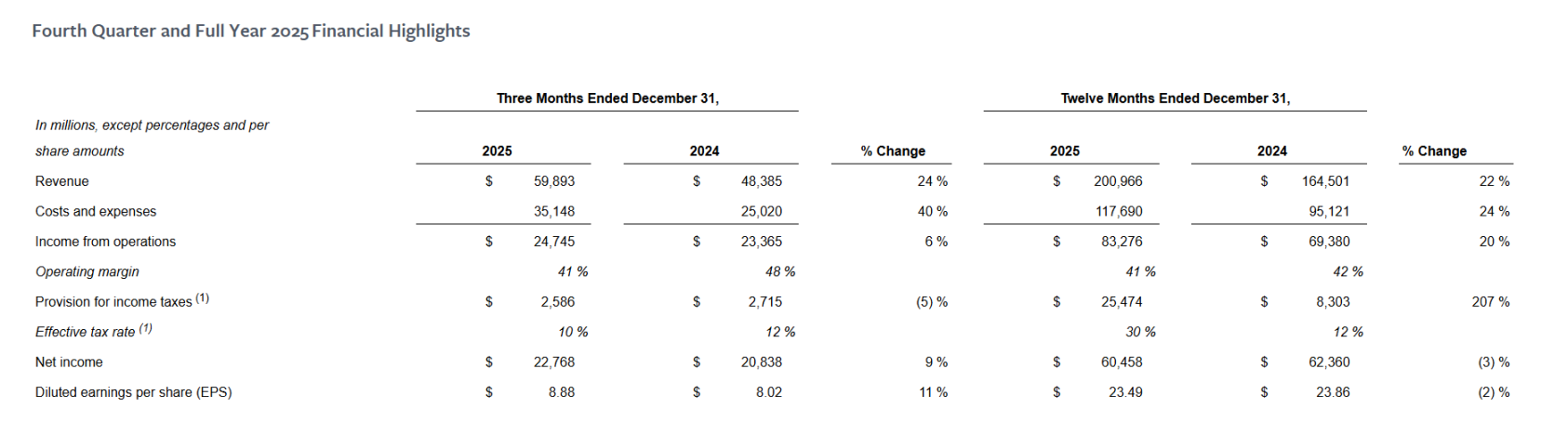

The core financial metrics for Q4 2025 almost all exceeded expectations: revenue reached $59.893 billion, a 24% year-over-year increase, surpassing the market expectation of $58.6 billion; net profit was $22.768 billion, a 9% year-over-year increase; diluted earnings per share (EPS) was $8.88, an 11% year-over-year increase, exceeding the market expectation of $8.23.

It can be said that whether in terms of revenue growth resilience or profit release pace, Meta has delivered a solid and stable Q4 report card.

Looking at the full year, the growth logic remains valid: total revenue for 2025 was $200.966 billion, a 22% year-over-year increase; operating profit was $83.276 billion, a 20% year-over-year increase, with core metrics still maintaining double-digit expansion.

The only "contradictory" aspect is that the full-year net profit recorded $60.458 billion, a 3% year-over-year decline, but this change is not due to a deterioration in the main business, but mainly stems from one-time tax factors—due to the impact of the "Big and Beautiful Act," the company recognized approximately $16 billion in one-time non-cash income tax expenses.

Excluding this factor, the full-year net profit and EPS would still achieve considerable growth, thus explaining the apparent contradiction between the full-year data and the strong quarterly performance.

Source: Meta

Meanwhile, operational metrics also exhibited typical characteristics of "volume and price rising together":

- Daily active users (DAU) of family apps reached 3.58 billion, a 7% year-over-year increase, in line with market expectations;

- Ad impressions increased by 18% year-over-year; the average price per ad increased by 6% year-over-year;

- Average revenue per user (ARPU) was $16.73, a 16% year-over-year increase;

This set of data points to one conclusion: Meta's advertising engine has not only not stalled but is continuously evolving in efficiency and monetization capability.

Additionally, what truly stimulated a shift in market sentiment was not just the already realized exceeding expectations performance but also the management's optimistic guidance for the future: Meta expects Q1 2026 revenue to reach $53.5–56.5 billion, corresponding to a year-over-year growth of 26%–34%, significantly higher than the market's previous growth expectation of about 21%. This pricing implies that management believes the high prosperity of Reels will continue, and the commercialization progress of Threads is better than the market's previous cautious expectations.

With the advertising fundamentals stable, this guidance also directly reinforces the market's confidence in the sustainability of AI-driven advertising efficiency improvements.

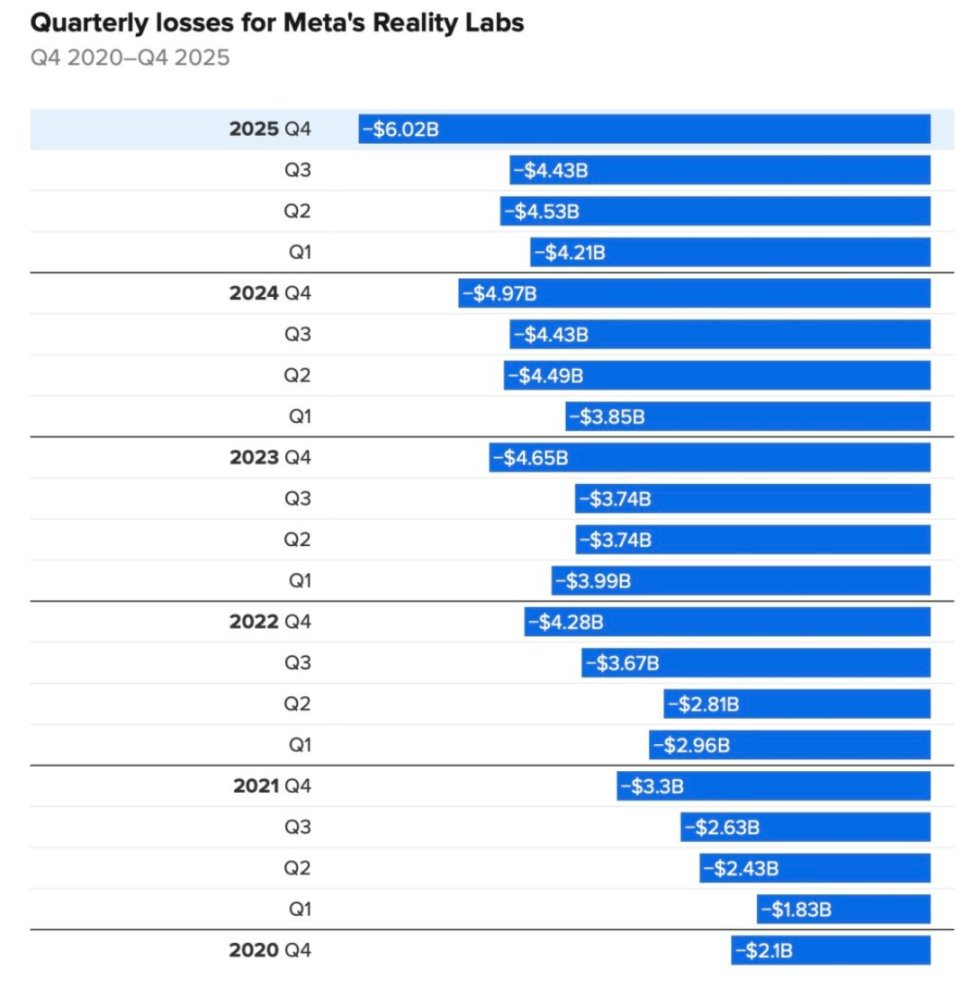

Details of Reality Labs' losses over the past five years

Of course, it is worth mentioning that the "metaverse" remains Meta's bleeding edge, with its metaverse division Reality Labs recording an operating loss of $6.02 billion in Q4, a 21% year-over-year increase, with revenue of $955 million, a 13% year-over-year increase. Since the end of 2020, this division's cumulative operating losses have approached $80 billion.

However, unlike before, Reality Labs' role in this earnings report is no longer the core variable influencing the company's overall narrative and is gradually being marginalized.

II. Social Fundamentals Stable, AI Deepens "Moat"

At least at the core business level, AI has indeed begun to create real monetary value for Meta (META.M).

In a way, unlike Google (GOOGL.M or Microsoft (MSFT.M, Meta is currently the most direct player whose "AI investment directly feeds back into the main cash flow" has been validated by its earnings report.

This is first reflected in the systematic improvement of advertising efficiency, thanks to AI being directly embedded in the recommendation and advertising delivery systems, leading to a 6% year-over-year increase in the average price per ad and an 18% surge in impressions in Q4. Management has repeatedly emphasized that the upgrades to AI recommendation algorithms and delivery systems have significantly improved ad conversion rates and delivery efficiency.

Among them, Instagram Reels saw a more than 30% year-over-year increase in viewing time in the U.S. market, becoming the core engine driving advertising inventory and monetization capability.

Secondly, the acceleration of WhatsApp commercialization is also noteworthy, as Meta plans to fully introduce ads into WhatsApp Stories within this year, which is seen as the next potential billion-dollar revenue growth point for the company, and a key step in expanding the AI recommendation and advertising system to more traffic scenarios.

Overall, against the backdrop of ongoing external competition from TikTok and others, Meta's social fundamentals have not weakened; instead, through deep embedding of AI in recommendation and advertising systems, it has further deepened its moat.

Source: Meta

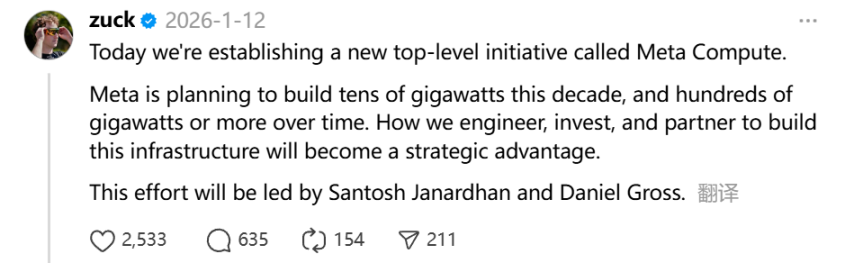

Looking back over the past year, Meta's actions in the AI direction have been nothing short of aggressive—from spending billions to acquire a stake in Scale AI, bringing in Alexandr Wang to lead the "Superintelligence Lab (MSL)," to continuously hiring high-salaried talent, restructuring the AI organizational framework, spending billions to acquire Manus, and launching Meta Compute, planning to build tens of GW-level computing and power infrastructure within this decade…

This series of actions has led many to recall a familiar script: aggressive investment, grand narrative, long return cycles. In other words, we seem to see "Zuckerberg of the Metaverse era" again.

However, unlike the metaverse period, management has provided a clear bottom-line expectation this time, stating that even with significantly increased infrastructure investment, operating profit in 2026 will still be higher than in 2025, and the cost growth path of the massive investment in 2026 is highly transparent, mainly concentrated on computing power, depreciation, third-party cloud services, and high-end technical talent.

In short, within Meta's strategic framework, AI is not just a technology narrative betting on the future but a real tool that is continuously improving the main cash flow. The logic is not complex: when AI is deeply embedded in recommendation and advertising delivery systems, even a slight marginal improvement, such as making 3.6 billion users stay a few more seconds each day or increasing ad conversion rates by 1%, will be rapidly amplified into considerable, repeatable cash flow increments based on Meta's current traffic scale and advertising base.

It is precisely under this high-leverage structure that the efficiency improvements brought by AI are genuinely offsetting or even covering the annual capital expenditure of up to $135 billion. In other words, Wall Street is no longer afraid of Meta burning cash, to some extent because it has already seen the real monetary benefits brought by AI.

Interestingly, from a more macro perspective, in Silicon Valley's AI arms race, besides being busy exporting computing power, models, and tools, selling "shovels and tools" to the world, another path is the Meta model—internalizing AI as the heart of its business system, directly amplifying existing traffic and monetization engines.

It is this model, which does not rely on selling new products externally but achieves returns by enhancing its own monetization efficiency, that makes Meta's AI investment path distinctly different from other large tech companies that focus on large models or cloud services for monetization logic. This is also why the market has begun to reassess Meta's pricing foundation:

AI here is not a long-term story waiting to be realized but a real variable that can continuously and quantifiably feed back into the main cash flow through the advertising system.

This may also be the fundamental reason the market is willing to reprice Meta.

III. Aggressive All-In, A War That Cannot Be Lost?

"Superintelligence" has become one of the most frequently mentioned keywords by Zuckerberg and Meta's management.

Zuckerberg did not hide his ambition during the earnings call: "I look forward to advancing personal superintelligence for global users," which has become a long-term strategy for Meta encompassing talent, computing power, and infrastructure.

First, looking at the capital expenditure figures, as mentioned above, Meta has embarked on a full-blown aggressive all-in strategy, with total operating expenses for 2026 expected to reach $162–169 billion, a year-over-year increase of 37%–44%, significantly higher than the market buyers' previous expectation range of about $150–160 billion.

At the same time, Meta is also signaling to the market through actions that it is making "trade-off signals." This month, media reports revealed that it plans to cut about 10% of Reality Labs' workforce, involving approximately 1,500 employees. This means that the metaverse-related business is being further compressed to free up resources for AI and core operations.

More strategically significant is Meta's reclassification of computing power and infrastructure. On January 12, Zuckerberg personally posted that "a new top-level strategic project called Meta Compute has been launched." According to disclosed information, Meta plans to invest at least $600 billion in data centers and related infrastructure in the U.S. by 2028.

However, Meta's Chief Financial Officer Susan Li later clarified this figure, stating that the investment is not solely for AI server procurement but covers the construction of domestic data centers in the U.S., computing power and power infrastructure, as well as the additional employees and supporting costs needed for U.S. business operations.

Objectively speaking, in terms of talent density, computing power scale, and infrastructure strength, Meta's investment in AI is already comparable to, or even exceeds, that of major competitors in certain dimensions.

Of course, this path is inherently a double-edged sword. If revenue growth, advertising efficiency, or new model progress cannot consistently outpace cost expansion, market tolerance will quickly diminish, and both valuation and profit expectations may face backlash.

In other words, this is not an experiment that can afford repeated trial and error; it is a strategic war that, once initiated, is difficult to turn back from.

In Conclusion

As early as a September 2025 blog episode, Zuckerberg candidly stated that if ultimately thousands of billions of dollars are wasted, it would be very unfortunate. However, on the other hand, the risk of falling behind in the AI wave could be even greater for Meta.

"For Meta, the real risk is not whether the investment is too aggressive, but whether there will be hesitation at critical moments," this statement, in today's context, can almost be seen as a footnote to all of Meta's strategic actions over the past year.

Of course, history will not be easily forgotten. In the last metaverse narrative, Zuckerberg also chose to bet early and push forward with full force, but the final outcome did not meet the market's initial expectations.

The difference this time is that Meta holds the densest and most commercializable user traffic entry point in the world; and AI is directly reshaping the connection efficiency between people and content, and between people and commerce in unprecedented ways.

As for whether the $135 billion is a historic strategic leap or yet another costly lesson, the answer still requires time to reveal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。