Deep within a Cold War-era nuclear bunker in Switzerland, over 1 ton of gold is transported through heavy steel doors into this highly secure vault every week. The owner here is not a central bank of a sovereign nation, but Tether, the world's largest stablecoin issuer.

As of January 2026, Tether has hoarded approximately 140 tons of gold, with a total value reaching $23 billion to $24 billion.

The company is continuously purchasing gold at an astonishing rate of 1-2 tons per week, making it one of the largest private holders of gold in the world, surpassing the reserves of central banks in countries like South Korea and Greece.

1. Gold Hoarding Action

● Switzerland is home to about 370,000 Cold War-era nuclear bunkers, most of which are now abandoned. However, one nuclear bunker in Switzerland is bustling with activity, receiving over 1 ton of gold weekly into its highly secure vault protected by multiple heavy steel doors.

● The owner of this vault is Tether, the world's largest stablecoin issuer, whose CEO, Paolo Ardoino, describes it as a “James Bond-style place, simply crazy.” Tether's gold holdings have reached approximately 140 tons, with a total value of about $23 billion to $24 billion at current market prices.

● This scale places Tether among the largest gold holders globally, and beyond central banks, exchange-traded funds, and large commercial banks, Tether is now the largest known private gold holder.

● The speed at which Tether is accumulating gold is remarkable. In just the past year, the company has purchased over 70 tons of gold, a volume that nearly exceeds the annual purchases of all single central banks globally. Only the Polish central bank's increase of 102 tons during the same period surpasses Tether.

2. Reserve Transfer

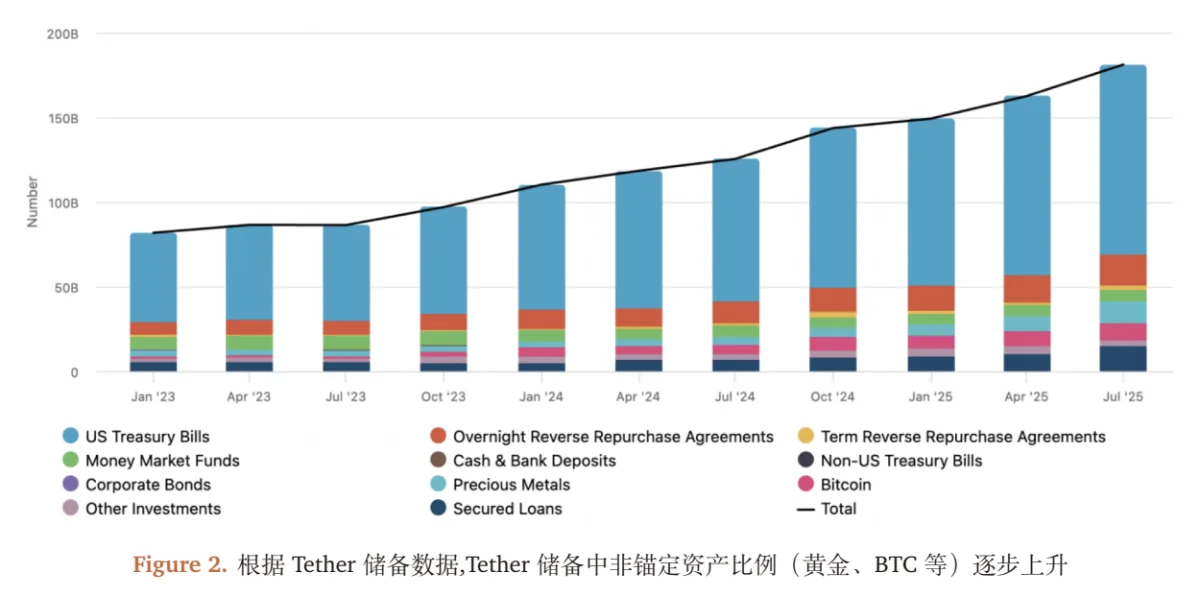

● Behind Tether's gold hoarding is a strategic asset allocation adjustment logic. In recent years, the company has gradually adjusted its reserve structure, reducing reliance on dollar assets and increasing allocations to “hard assets” like gold and Bitcoin.

● This shift primarily stems from the need for inflation hedging. During the Federal Reserve's interest rate hike cycle from 2022 to 2024, the purchasing power of the dollar declined, making gold a traditional inflation hedge and Bitcoin a form of “digital gold,” which became Tether's core assets for hedging inflation risks.

● Additionally, there are considerations for enhancing returns. As the anticipated bull market for gold and Bitcoin materializes in 2025, Tether has gained substantial paper profits from the price increases of these assets. By the third quarter of 2025, Tether's gold reserves had appreciated by approximately $4.8 billion.

● Tether's business model is based on its issuance of the dollar stablecoin USDT. The company issues USDT in exchange for real dollars, then invests these funds in U.S. Treasury bonds, gold, and other assets to earn interest and trading profits.

● However, with the possibility of the Federal Reserve lowering interest rates, the traditional bond yield model faces challenges. Market predictions indicate that by December 2026, the federal funds rate could drop from the current 3.75-4% to 2.75-3.25% with over a 75% probability.

● Such a rate decline could reduce Tether's annual income by over $15 billion—more than 10% of its current annual net profit. To address this challenge, Tether has accelerated its transition to hard asset allocations.

3. From Hoarding to Trading

● Ardoino is not satisfied with merely purchasing gold; he has grander plans—to make Tether a trading participant in the gold market, directly competing with traditional banking giants like JPMorgan and HSBC that dominate the market.

● To achieve this goal, Tether has recruited two of the most senior gold traders from HSBC Holdings to help manage its activities in the gold market. The addition of these traders signifies that Tether is no longer content with passive gold holdings but plans to establish “the world's best gold trading platform.”

● Ardoino stated that the company is exploring how to actively trade its gold holdings, including capturing arbitrage opportunities when there are significant deviations between futures costs and physical gold prices. This trading strategy will be designed to “maintain a very long physical gold position,” enhancing returns through trading activities while holding a substantial physical gold reserve.

● Purchasing approximately $1 billion worth of physical gold each month is a logistical challenge in itself. Ardoino revealed that Tether buys gold both directly from Swiss refineries and from the largest financial institutions in the market, with a large order potentially taking months to arrive.

4. Gold Empire

● Tether's gold footprint is not limited to physical gold. The company has also issued a gold-backed token called Tether Gold (XAUT), which holders can redeem for physical gold. This token currently corresponds to approximately 16.2 tons of gold, valued at over $2.24 billion, capturing more than 60% of the global gold-backed stablecoin market.

● Additionally, Tether has launched a smaller denomination version of the token called Scudo, further lowering the investment threshold. Ardoino predicts that XAUT “is very likely” to reach a market circulation of $5 billion to $10 billion by the end of 2026. If this goal is achieved, Tether may need to purchase over 1 ton of gold weekly just to support XAUT.

● Tether's bullish stance on gold has also led it to acquire shares in gold royalty companies. These companies specialize in purchasing revenue streams from gold miners, providing Tether with another form of gold exposure.

● Tether holds shares in nearly all medium-sized Canadian-listed royalty companies, including Elemental Royalty Corp, Metalla Royalty & Streaming Ltd, and others.

5. Rating Controversy

● Tether's reserve transformation has not been without controversy. In November 2025, S&P Global downgraded Tether's ability to maintain the peg of USDT to the dollar from “limited” to “weak.” The agency noted that the proportion of high-risk assets in Tether's reserves has exceeded 24%, including Bitcoin, gold, secured loans, and corporate bonds.

● S&P believes that these assets may not be quickly liquidated in a “panic run” scenario, jeopardizing Tether's ability to ensure that its dollar stablecoin USDT always retains a value of $1. Meanwhile, the U.S. “Genius Act” stablecoin regulations took effect last year, limiting stablecoin reserves to cash and cash equivalents (such as government bonds), explicitly excluding gold.

● To address this regulatory environment, Tether launched USA₮ on January 27, 2026, a dollar stablecoin compliant with U.S. federal regulations, specifically designed for the U.S. market. USA₮ is issued by Anchorage Digital Bank, which is federally licensed in the U.S., and is fully backed by dollars or dollar equivalents, differentiating it from Tether's globally circulating USDT.

6. Market Impact and Future

Tether's large-scale gold purchases have attracted market attention. Analysts at Jefferies Financial Group noted in a report that Tether, as an “important new buyer” in the gold market, likely contributed to the significant rise in gold prices last year.

● However, John Reade, chief strategist at the World Gold Council, stated that while Tether's purchases will impact gold prices, they are just a small part of the reason for gold's remarkable rise. “They are a component of the rise, but by no means the whole story,” Reade pointed out. Overall, central banks and exchange-traded fund investors purchased over 1,500 tons of gold last year.

● Ardoino describes Tether's role in the gold market as akin to that of a “central bank” and predicts that geopolitical changes will lead to the emergence of dollar alternatives backed by gold. He specifically noted that Tether's dollar stablecoin users in emerging markets “are those who love gold and have always used gold to protect themselves from long-term currency devaluation by their governments.”

● As the price of gold surpasses $5,300 per ounce, Tether's gold empire is expanding at an unprecedented pace. Ardoino stated that the company plans to continue purchasing gold at a rate of 1-2 tons per week in the coming months and will assess demand quarterly.

● Tether's gold strategy reflects a broader trend—seeking new avenues for asset protection and value storage outside the traditional financial system. Ardoino predicts, “My view is that some countries are buying large amounts of gold, and we believe these countries will soon launch tokenized versions of gold as a competing currency to the dollar.”

The Swiss nuclear bunker vault storing gold opens its heavy steel doors weekly to welcome a new batch of gold bars. Tether's gold holdings have surpassed those of many central banks, with these gold reserves valued at over $23 billion at current market prices.

Gold prices continue to fluctuate near historical highs, having risen over 30% this year, and the global gold market is undergoing a structural transformation.

Whether traditional ETF investors, central banks, or new digital financial giants like Tether, all are flocking to the same ancient asset—gold—in this uncertain era. Against the backdrop of challenges to dollar hegemony and escalating geopolitical tensions, gold's status as the “ultimate currency” seems to be gaining new vitality in the digital age.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。