Original Author: Stacy Muur

Original Compilation: Deep Tide TechFlow

Introduction: With the tremendous success of Hyperliquid, the perpetual contract decentralized exchange (Perp DEX) sector has entered a fiercely competitive stage. The crypto market experienced significant volatility in 2025, yet the trading volume in this field surpassed $1.2 trillion.

This article, written by senior researcher Stacy Muur, systematically outlines 8 Perp DEX projects with active reward programs that are worth paying attention to in 2026, and details practical strategies for low-risk trading volume manipulation and airdrop acquisition through funding rate arbitrage. This is a rare guide for investors looking to carve out a share in the trillion-dollar derivatives sector, helping them avoid pitfalls and seize opportunities.

Full Text:

This guide covers 8 leading Perp DEXs with active reward programs that are worth farming, along with proven strategies and tools. Are you ready? Let's begin.

Introduction

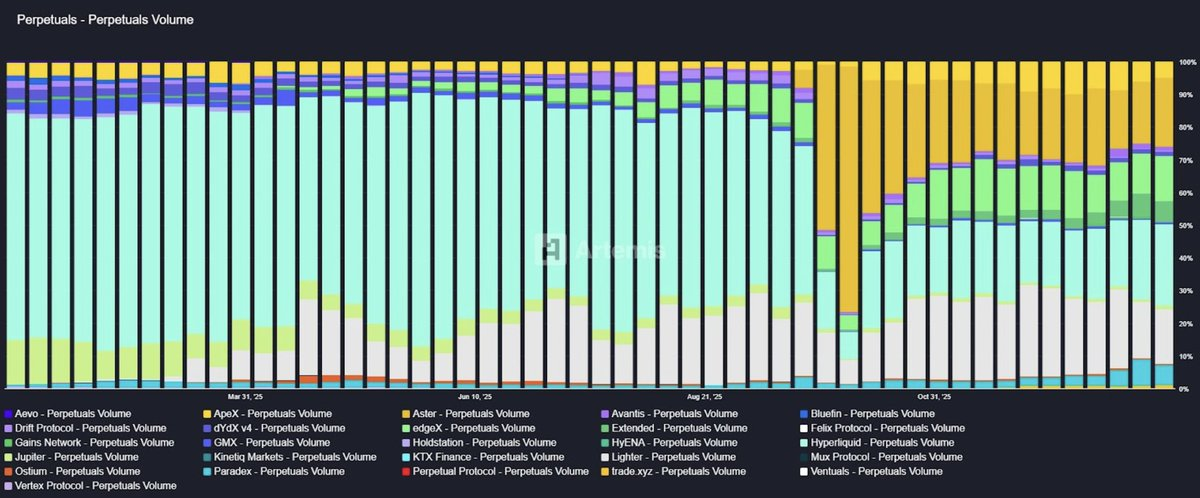

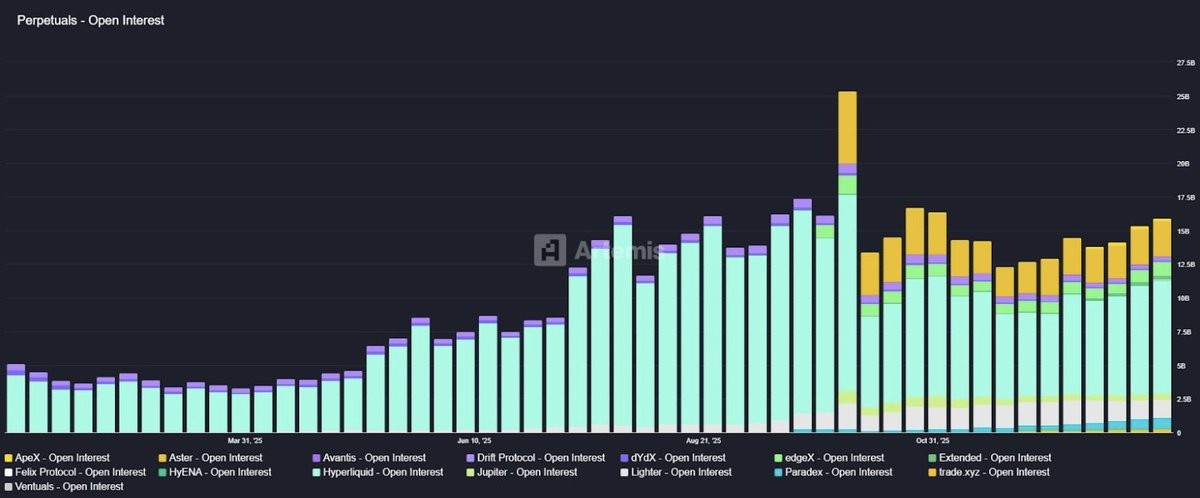

Since the launch of Hyperliquid, Perp DEXs have entered the most competitive phase. The trading volume in this sector grew from $647.6 billion in 2023 to over $1.2 trillion in 2025, and even during the market crash from October 10 to 11, 2025, its market share in global perpetual futures trading rose to 26%.

Caption: Data source Artemis

At that time, Hyperliquid accomplished what was thought to be impossible. They established a truly competitive exchange against Binance and captured over 70% of the decentralized perpetual contract trading volume.

However, new Perp DEXs have begun to emerge, with new platforms appearing daily.

But why are we seeing so many on-chain perpetual contracts now? Is it because of Hyperliquid's tremendous success?

While that is indeed true, and Perp DEXs have become a lucrative sector, the fundamental reason is that before 2025, competition among Perp DEXs was primarily technical. It relied on more powerful L1s, advanced ZK proof systems, and higher throughput DA (data availability) layers. But in 2025, competition shifted from technology to incentives.

The current state of the industry shows that the pressure from emerging Perp DEXs is increasing, as they offer considerable latency, lower fees, and attractive incentive programs.

Caption: Data source Artemis

Today, Hyperliquid's market share has dropped to around 20%, and new platforms pose a substantial threat. For example, Variational not only attracts users through airdrop/reward programs but also garners attention and users through trading loss refunds.

In October 2025, trading volume reached a record $1.2 trillion, nearly double the total from the previous month. This was primarily driven by incentives, namely reward programs and airdrops. This sector has become one of the most successful narratives in the airdrop game. Protocols are preparing to distribute millions of dollars in airdrops to guide liquidity and user activity.

This article analyzes various opportunities in the Perp DEX space and highlights practical strategies for seizing opportunities.

8 Perp DEXs to Watch

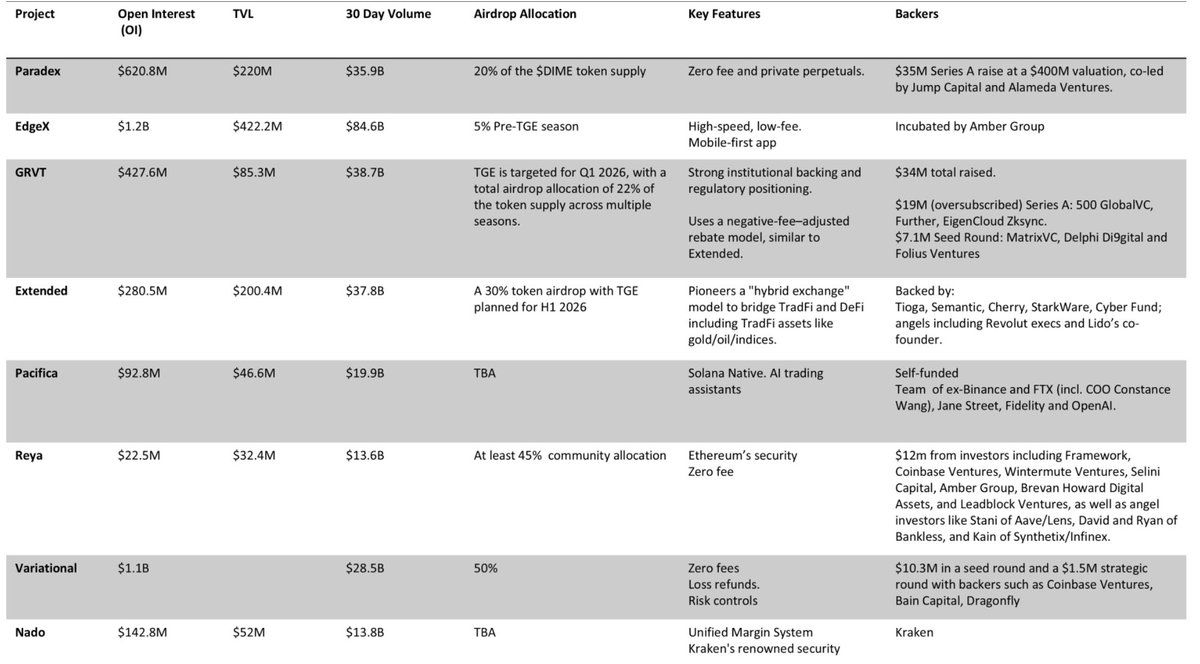

The main risks associated with Perp DEXs are that some platforms have no intention of issuing tokens, and some ultimately hold no value and are not worth the time (for example, those that exist primarily to extract user trading fees). Therefore, the core question is never "Can I farm it?" but rather "Is it worth farming?"

This section identifies Perp DEXs worth investing time in based on data from DefiLlama as of January 16, 2026, considering trading volume, open interest, user growth, and fee economics.

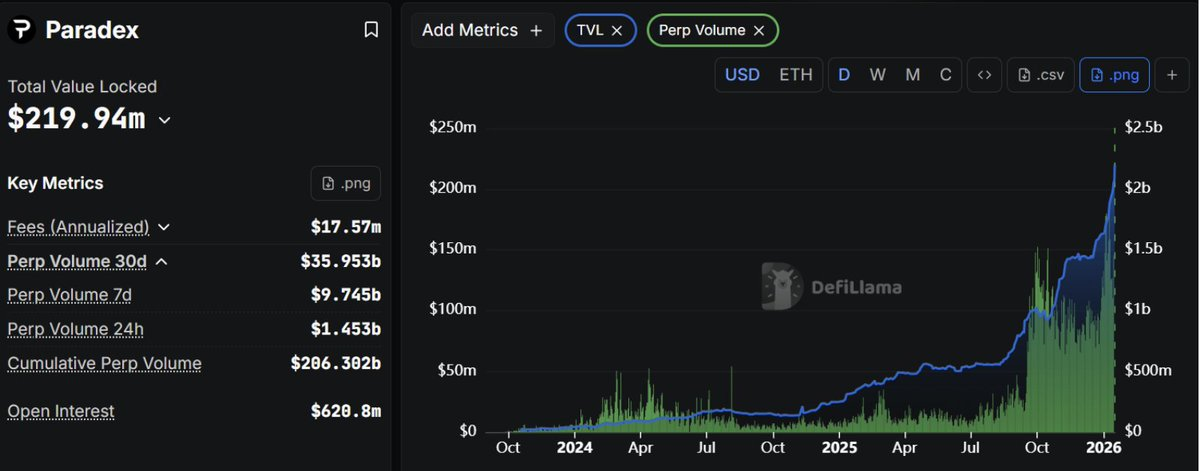

1. Paradex V2

Paradex is a privacy-focused Perp DEX built on the first application chain of Starknet. It offers zero trading fees, deep liquidity covering hundreds of crypto assets and pre-market assets, and atomic settlement, while providing institutional-level privacy features through a mobile-optimized interface.

Architecturally, it is designed as a unified DeFi ecosystem (Paradex Ecosystem), consisting of the Paradex exchange, Paradex chain, and XUSD (a native synthetic dollar powered by the $DIME token).

Core Features:

- Up to 50x leverage across multiple markets

- Low fees: Maker 0.02%, Taker 0.05%

- Full margin functionality

- Utilizes Ethereum-level secure ZK-Rollup technology

Caption: Source Defillama

Paradex has shown impressive growth to date:

- TVL: Approximately $220 million (up nearly 6 times from $25 million at the beginning of 2025)

- Cumulative trading volume: $206 billion

- Open interest: Approximately $620 million

- 30-day trading volume: $36 billion

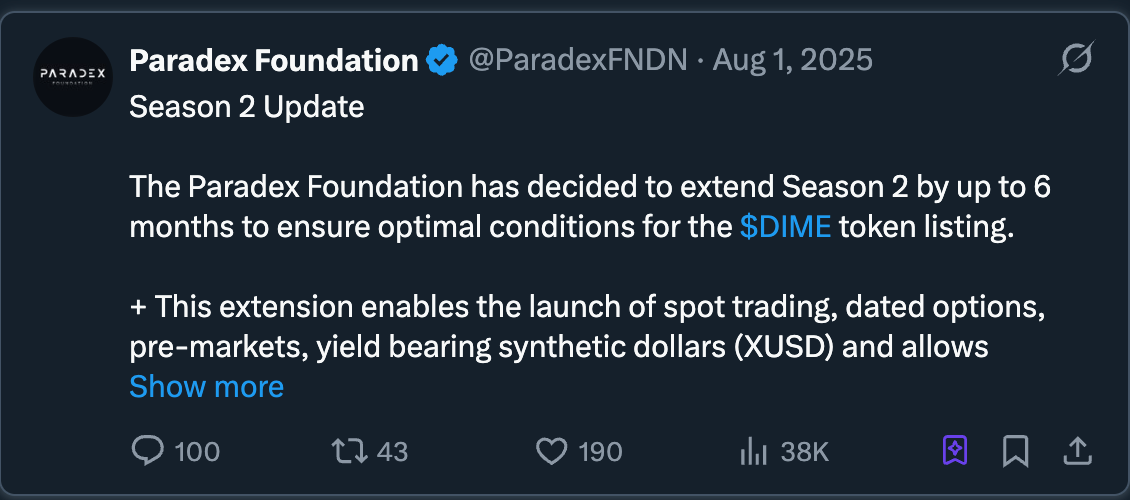

Reward Program:

The Paradex Foundation has decided to extend the second quarter by up to 6 months to ensure the best conditions for the $DIME token launch. This extension will support spot trading, options trading, pre-market trading, and the launch of yield-bearing synthetic dollars (XUSD).

The pre-heating phase of the airdrop event and the first season will run from February 1, 2024, to January 2, 2025. Paradex is currently in the second season, distributing 4 million XP (points) to active traders every Friday.

How to Participate:

- Register on Paradex and set up an account, connecting an EVM-compatible wallet.

- Set a nickname. Link X/Discord for anti-witch checks and to gain community XP boosts.

- Deposit USDC and start trading.

- Earn holding XP (for holding positions), fee XP, and even liquidation XP.

- Provide liquidity by depositing USDC into the treasury to earn treasury XP.

- Share your referral link to earn 10% XP from invitees. Invitees can receive a 5% XP bonus.

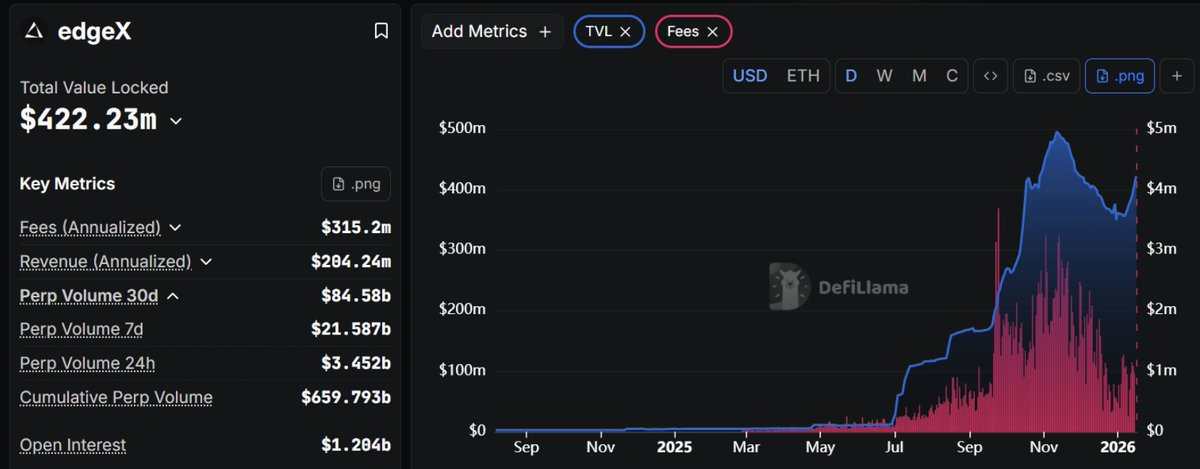

2. edgeX

edgeX is a Layer 2 exchange offering perpetual and spot trading. It was initially incubated by Amber Group on StarkEx ZK-rollup and launched as a ZK-rollup-based Perp DEX, currently transitioning to EDGE Chain: an Ethereum L2 designed for high-throughput financial applications.

Core Features:

- Built on StarkNet (zk-Rollup), fast settlement speeds

- Up to 50x leverage

- Maker 0.02% / Taker 0.05% (one of the cheapest Perp DEXs)

- Based on a central limit order book (CLOB) model

Market Performance:

- Weekly trading volume: $21.59 billion

- 30-day trading volume: $84.58 billion (consistently in the top 5)

- Open interest: $1.2 billion

- TVL: $422 million

Reward Program: edgeX recently concluded a 27-week "Open Season" reward program. The Pre-TGE season started on January 7, 2026, aimed at organically using the platform through XP rewards. XP is distributed weekly until TGE (expected to occur on or before March 31).

How to Participate:

- Create your own trading account https://pro.edgex.exchange/referral/MUUR

- Deposit and start trading. Prioritize spot trading to enjoy a 3x XP multiplier on trading volume.

- Trading directly on the edgeX mobile app grants a 1.2x XP bonus.

- Holding MARU tokens unlocks an additional 1.05x–1.15x XP multiplier. Registering as a Messenger provides a 1.05x–1.1x XP boost.

- Losses from perpetual contract trading account for 10% of XP distribution. Increase total trading volume, as it contributes 60% to the weekly XP allocation.

3. GRVT

GRVT (pronounced like "Gravity") is a Perp DEX established in 2023, built within the zkSync ecosystem using a modular ZK Stack architecture. It operates as an L3 Validium application chain optimized for high-performance perpetual contract trading while inheriting Ethereum-level security through zero-knowledge proofs.

Core Features:

- Privacy-focused exchange

- Combines self-custodied Layer 2 (ZK/Validium) settlement layer with off-chain CLOB

- ZKsync Atlas enables high-performance perpetual contracts to be compatible with Ethereum's composability

- L3 design allows GRVT to prioritize throughput and latency without sacrificing cryptographic proofs

Growth Metrics:

- TVL: Approximately $85 million

- Cumulative trading volume: $214.21 billion

- Open interest: Approximately $427 million

- 30-day trading volume: $38.7 billion

Reward Program: After a long development period, GRVT officially launched its incentive system in 2024, currently in Season 1, rewarding users for contributing to trading activity, liquidity, and open interest.

How to Participate:

- Register an account and deposit funds.

- Open positions to earn points, with an emphasis on maintaining positions as their weight is increased.

- Participate in the referral program to earn additional trading fee rebates.

4. Extended

Extended (formerly X10) is a high-performance perpetual contract DEX built on Starknet by the former Revolut team. While initially focused on perpetual contracts, the protocol is expanding to a unified margin model, supporting spot trading and integrated lending.

Core Features:

- Hybrid architecture: off-chain CLOB for matching and risk control + on-chain settlement

- Offers up to 100x leverage on crypto and traditional financial (TradFi) assets

- Unified margin through XVS treasury shares, integrating lending and liquidity

- Market includes synthetic traditional financial assets

Market Performance:

- TVL: $200 million

- 30-day trading volume: $37.8 billion

- Open interest: $280 million (up 45.2% year-to-date)

Reward Program: On April 30, 2025, Extended launched its reward program, distributing 1.2 million points weekly between traders and liquidity providers (LPs).

How to Participate:

- Deposit and open positions to generate trading volume.

- Earn an additional 20% in points by providing liquidity to the treasury while earning APY.

- Unlock referral links after reaching $10,000 in trading volume, earning 10% commission and 2.5% in points from referrals.

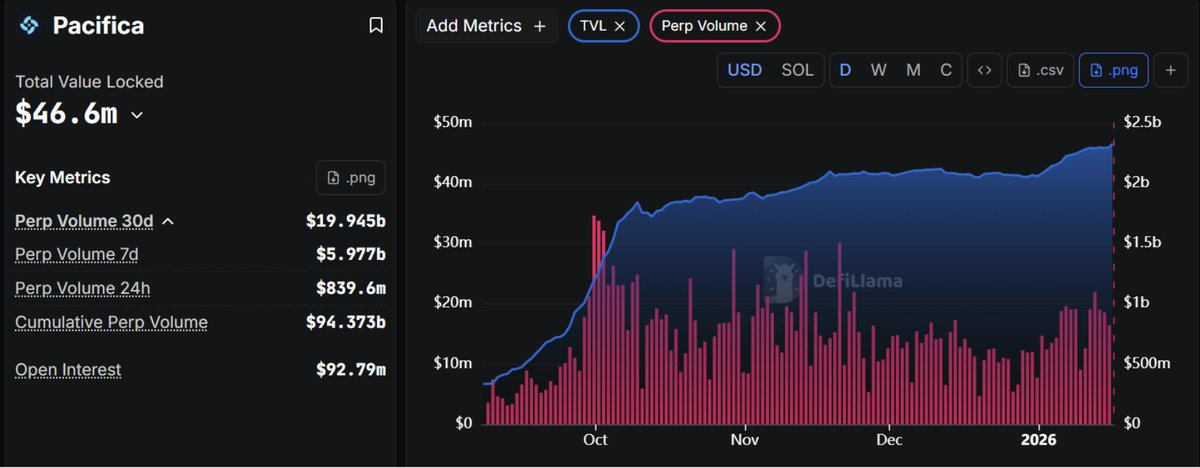

5. Pacifica

Pacifica is a Solana-native hybrid Perp DEX currently in closed testing. Despite being in its early stages, it has already attracted significant trading volume, sometimes even surpassing established Solana DEXs like Jupiter and Drift.

Given the previous successful airdrops from Solana perpetual contract protocols (like Drift and Zeta) and Pacifica's self-funding status, the likelihood of meaningful airdrops for this project is above average.

Core Features:

- Hybrid architecture: off-chain CLOB + Solana on-chain settlement

- Up to 50x leverage

- AI trading assistant

- Liquidation care points enjoy bonuses

Market Performance:

- 24-hour trading volume: $839 million

- 30-day trading volume: $1.995 billion

- Open interest: $92.8 million

Reward Program: Pacifica launched a continuous trading points bonus on January 2, 2026, offering up to 23% additional points. After trading continuously for 5 days, the bonus increases by 2% daily, up to a maximum of 10%.

How to Participate:

- Use an invitation code to enter the closed testing.

- Connect your wallet, deposit funds, and open positions.

- Join the referral program to obtain your own access code.

6. Reya

Reya developed by Reya Labs, is a trading-optimized modular L2 based on a custom implementation of Arbitrum Orbit. Reya is not just a single DEX; it is a foundational execution layer with shared liquidity, allowing multiple trading frontends to build on it.

By centralizing liquidity at the network layer, Reya aims to address the issue of liquidity fragmentation.

Core Features:

- Dedicated ZK Rollup for trading

- Strong security, enabling verifiable order execution and settlement through ZK proofs

- Features rUSD (yield-bearing stablecoin), powered by Reya's unified liquidity framework

Market Performance:

- 30-day trading volume: $13.7 billion

- Cumulative trading volume: $95.7 billion

- TVL: $32.4 million

Reward Program: Reya Chain Points (RCP) are used to track contributions and will convert to $REYA at TGE (Token Generation Event). Trading activities typically earn the highest rewards, with points distributed every Monday at noon (GMT).

How to Participate:

- Deposit or cross-chain USDC.

- Deposit liquidity into the LP treasury via the "Stake" tab, converting rUSD to srUSD, locking funds to earn loyalty points and 4.8% APY.

- Open trading positions to increase trading volume and maximize points.

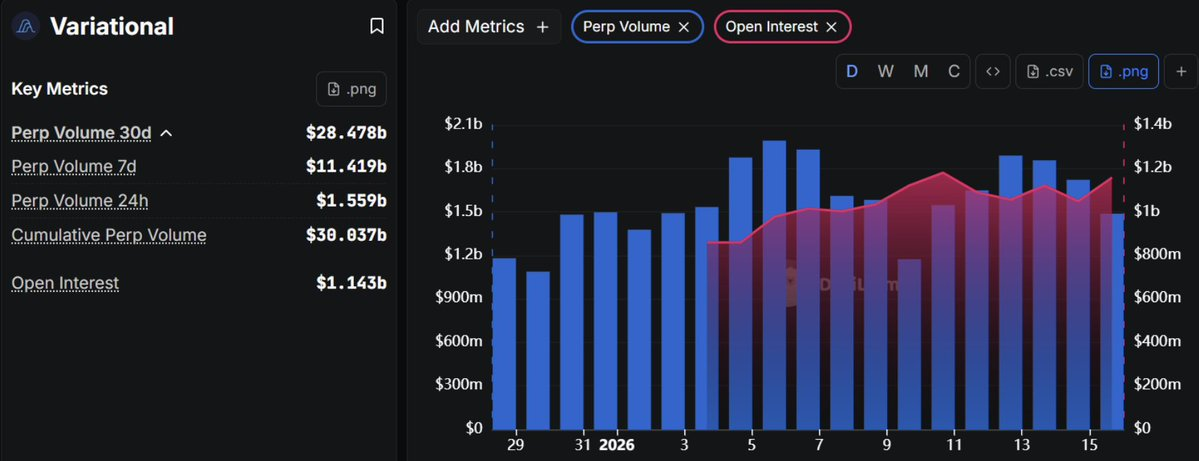

7. Variational

Variational is a peer-to-peer perpetual contract and generalized derivatives trading protocol built on Arbitrum. It automates the complete cycle from trading to settlement.

Variational operates two main applications: Omni (a leveraged perpetual contract trading platform for retail users) and Pro (an advanced trading platform for non-linear derivatives).

Core Features:

- P2P quoting model (RFQ) instead of an order book

- Vertically integrated market maker called Omni Liquidity Provider (OLP)

- Zero fees

- Loss refunds

In 2026, Omni evolved from a testnet to become one of the largest periodic platforms in cryptocurrency, attracting attention with its loss refund feature.

Growth Metrics:

- Cumulative trading volume: $30 billion

- Weekly trading volume: $11.4 billion

- Open interest: $1.1 billion (top 5 in Perp DEXs)

Reward Program: Variational Omni officially launched its loyalty program. Users earn base points based on activity. Points are distributed every Friday at 00:00 UTC.

How to Participate:

- Register an account and deposit funds.

- Earn points by generating trading volume.

- Rewards based on the activity level over the past 30 days include enhanced loss refund probabilities, point bonuses, and other benefits.

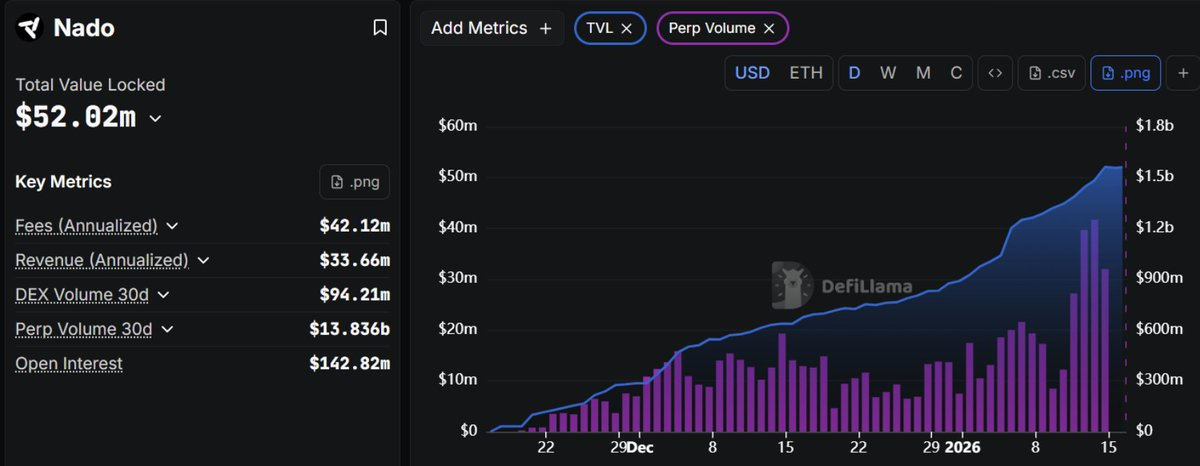

8. Nado

Nado is built on Ink (Kraken's Ethereum L2) and is an all-in-one CLOB DEX that integrates spot, perpetual contracts, and money markets. It is currently in private testing (Private Alpha) and is limited to invited users.

Core Features:

- Integration of spot and perpetual contracts under a unified margin model

- Nado's liquidity providers (NLP) deploy idle funds to the order book to earn APY

- Order matching time is only 5–15 milliseconds

Market Performance:

- 30-day trading volume: $13.8 billion

- TVL: $52 million

- Open interest: $142 million

Reward Program: After the private testing ends, the platform will open for airdrops.

It is currently unclear whether Nado will conduct platform-specific airdrops, but it is certain that early users will receive airdrop point rewards from Ink.

Practical Strategy: Funding Rate Arbitrage

The perpetual contract market has become the largest financial market by trading volume in cryptocurrency. Weekly open interest (OI) often exceeds $5 billion.

When farming Perps, it is recommended to use lower market cap altcoins to generate higher reward points than high market cap assets, although this carries risks.

For inexperienced users or those unwilling to take risks for airdrops through active trading, funding rate arbitrage is a proven strategy that can generate trading volume while maintaining profitability or at least breaking even.

What is Funding Rate Arbitrage?

Funding rate arbitrage is a typical cash-and-carry trade form in the perpetual futures market.

Funding rates are essentially the cost of holding a position. When the funding rate is positive, long positions must pay funding fees to short positions; when the funding rate is negative, shorts pay longs. In most perpetual contract markets, funding rates typically remain positive.

How the Strategy Works:

- Open a long position on one DEX.

- Open an equivalent short position on another DEX.

- Capture funding rate profits.

- Simultaneously generate continuous trading volume for point accumulation and reward acquisition.

In simple terms, assume:

- BTC spot price: $50,000

- BTC perpetual contract price: $50,100

- Funding rate: +0.01% every 8 hours (positive)

You need to do the following:

Open a long position of $10,000 in BTC on one DEX while opening a short position of $10,000 in BTC on another DEX.

This way, regardless of whether the BTC price rises or falls, your profits and losses will offset each other (hedge). However, since the funding rate is +0.01%, your short position will receive a funding fee every 8 hours:

$10,000 × 0.01% = $1 (every 8 hours).

If the rate remains stable: daily earnings of $3, monthly earnings of $90. All of this is unaffected by significant price fluctuations in BTC.

The reason for choosing different DEXs rather than opening long and short positions on the same platform is to avoid Sybil detection and potential blacklist risks. Funding rate arbitrage allows users to farm across various Perp DEXs without relying on price fluctuations.

This strategy is effective because it can generate profits even under moderate leverage. Additionally, traders do not need to worry about volatile markets and can easily generate continuous trading volume to accumulate points.

Core Risks to Understand:

While funding rate arbitrage reduces risk exposure, it is not foolproof. Some risks are unavoidable, such as the short side being liquidated or the funding rate turning negative. Therefore, the following practical steps must be taken to further mitigate risks:

- Continuously monitor positions: Actively manage open positions to avoid liquidation.

- Set stop-loss (SL) and take-profit (TP): This is a hard safeguard against liquidation, especially for short positions.

- Avoid high leverage.

Funding Rate Bots and Tools:

Tracking funding rates can be very labor-intensive. Tech-savvy "farmers" often use bots, but less experienced airdrop users can also benefit from the following tools. These tools can visualize the best funding rate arbitrage opportunities between major Perp DEXs.

For example, they will display annualized returns (APR) and the specific actions required to achieve that return (e.g., going long on one exchange and shorting on another).

- @LorisTools**: A complete dashboard and filter that aggregates funding rates from CEX and DEX platforms, very effective for discovering cross-exchange arbitrage.

- @Arbitraxdexs**: Still in development, but can be used to view token APRs, spreads, and funding rate differences between exchanges.

- @cexchange_sh**: Features a built-in funding rate arbitrage aggregator focused on rate strategies between DEX trading pairs.

- @fundingviewapp**: A funding rate arbitrage strategy searcher. It helps traders identify historically profitable arbitrage pairs and calculates average APR over multiple time periods.

- @p2parmyhere**: Another arbitrage scanner integrated with analytical tools to identify funding rate differentials between exchanges. It also provides real-time spread scanning, historical rate tables, and alert functions.

- @dextrabot**: An automated platform focused on acquiring airdrop points and copy trading on perpetual contract DEXs like Lighter, Aster, Hyperliquid, Extended, and Variational, emphasizing low-cost strategies like delta-neutral bots and grid trading.

Conclusion

The year 2025 is crucial for Perp traders and exchanges from all perspectives. From successful airdrops to the market crash on October 10-11 (one of the largest single-day market crashes in crypto history), the automatic deleveraging (ADL) cycle was triggered, leading to significant losses even for traders employing funding rate arbitrage strategies.

However, Perp DEXs are still on the rise, but this time traders should be more cautious. The core lesson is that where you trade is just as important as what you trade. Be sure to read the documentation of new exchanges carefully to avoid becoming a victim of harvesting exchanges.

This article provides you with the tools needed to start your journey of farming on Perp DEXs; beyond that, experience and discipline will guide you.

Critics often point out that most emerging protocols just want to be the "next Hyperliquid." Personally, I don't see this as a problem. The competitors of Perp DEXs are not each other, but their centralized counterparts (CEX). As Perp DEXs continue to grow, opportunities still exist, but the barriers to entry will only increase over time.

Remember, the biggest regret in the crypto industry is "fading trends."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。