After enduring Powell's speech and reviewing several earnings reports from U.S. stocks, overall, the market's reaction to Powell was not significant. One reason is that Powell has only two meetings left as chairman, and even if he continues to serve as a governor, he will not attend press conferences anymore. Therefore, many of the questions this time were more about gossip, and there weren't many actual inquiries about monetary policy. Powell's responses in this regard were still the same old lines.

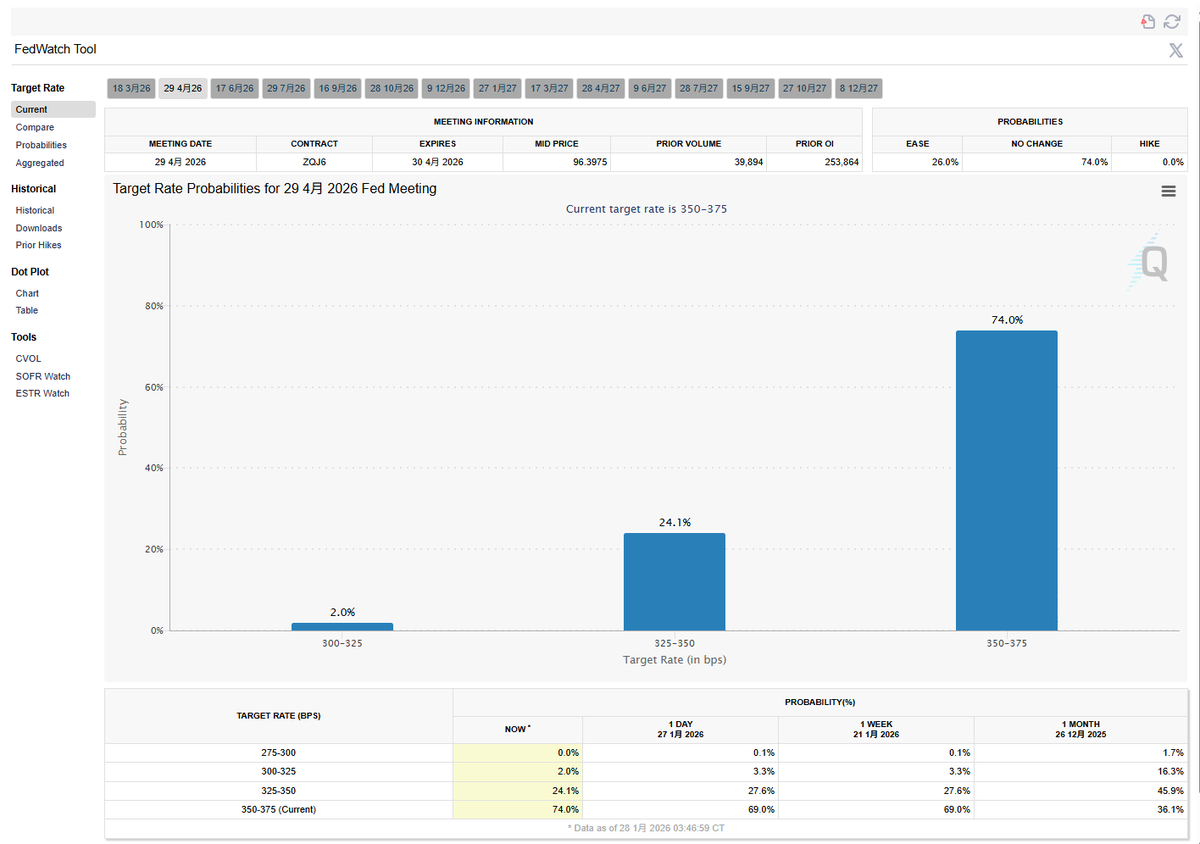

He maintains a steadfast 2% target, looks at the data, and does not make predictions. Thus, the market's focus remains on Powell's successor, and the expectation of no interest rate cuts in January is already well established. Even the dot plot for March is unlikely to generate much excitement. Currently, according to CME's forecast data, the expectations for interest rate cuts in March or even April are very low, and it is highly likely that we will have to wait until the Federal Reserve chair changes.

I initially estimated that if Powell made a hawkish statement today, Trump would announce the next candidate for the Federal Reserve chair. However, Powell's remarks were relatively mild, so I guess Trump won't take any action for now. After Powell's speech, there were earnings reports from Tesla and Meta. Tesla's fourth-quarter revenue fell short of expectations, while Meta's fourth-quarter revenue exceeded expectations. Personally, I don't think this will have a significant impact on the overall market.

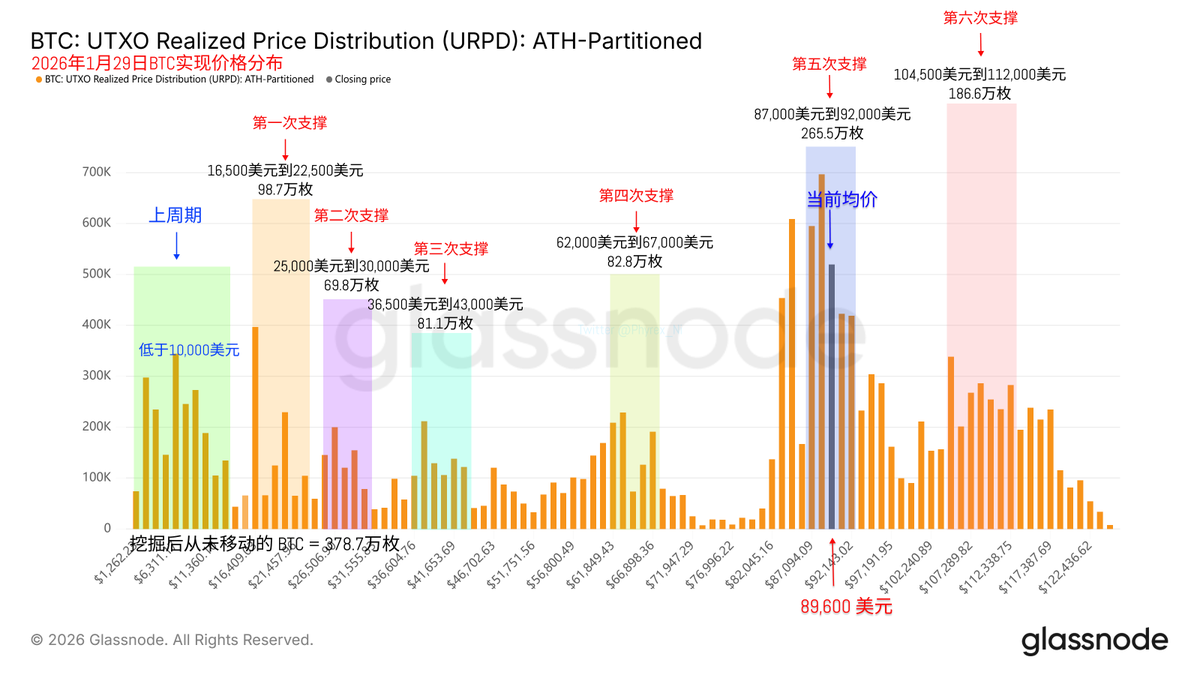

Looking back at Bitcoin's data, the turnover rate remains stable, indicating that investor sentiment is also stable. The Federal Reserve's interest rate decisions and meetings have not caused significant emotional fluctuations among investors, and the turnover mainly consists of short-term investors. The $90,000 curse continues. It seems we will have to wait for a breakthrough positive development.

Based on URPD data, I adjusted the fifth support level to the range of $87,000 to $92,000. It is not yet 100% stable, so let's observe for a while. Currently, the market's focus is still on Trump, as tariffs and the Federal Reserve's decisions will ultimately fall on him.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。