Recently, the United States has been affected by snowstorms, leading to a tight electricity supply. Not to mention the power gap for AI computing centers, electricity has become the most important underlying asset for the next three years, and the competitor for electricity with AI is $BTC.

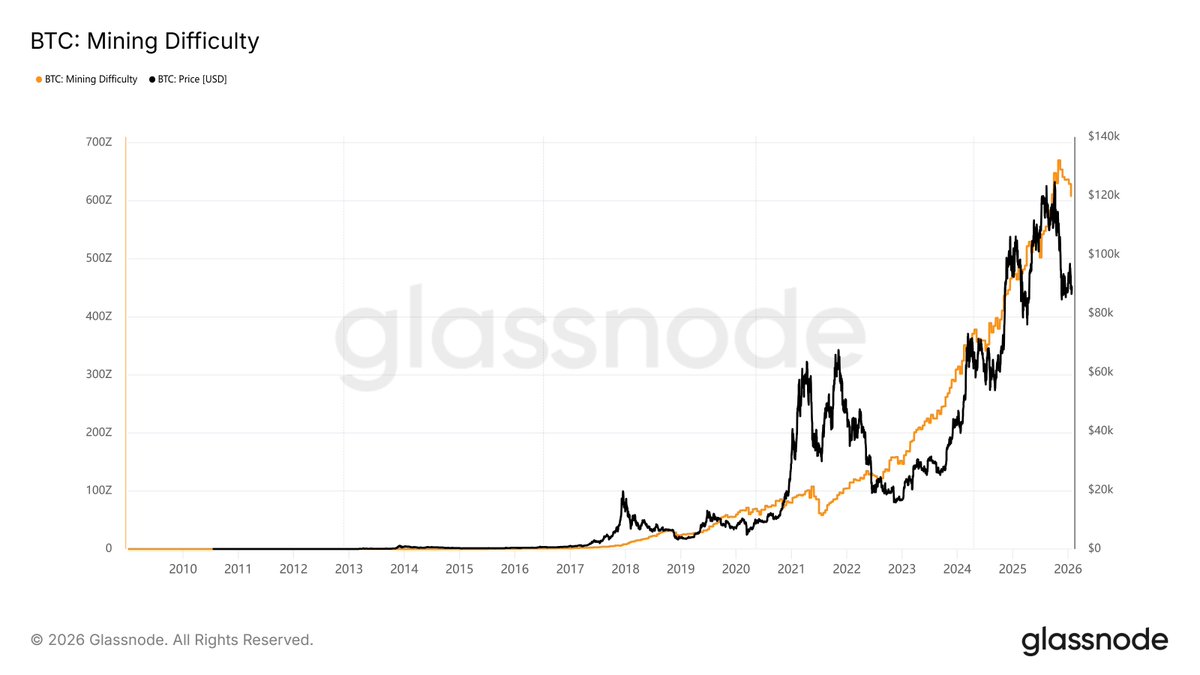

This heavy snowfall has also caused a decline in Bitcoin's hash rate, which has dropped nearly 13% in the past two weeks. Especially in the U.S., BTC mining sites are interruptible, meaning that when there is an urgent demand for electricity, power companies can directly shut down the electricity used for mining.

This is also why I will continue to watch power stocks in 2026. AI, computing power, and Bitcoin are all major consumers of electricity. Currently, BTC is still at the bottom of the electricity food chain.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。