Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

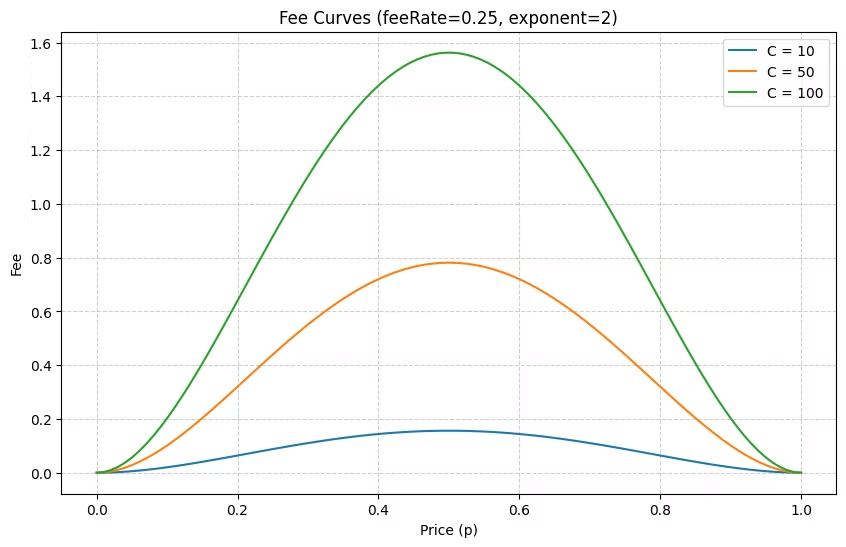

On January 6 of this year, Polymarket officially began charging transaction fees for the "15-minute cryptocurrency price fluctuations" market, with specific fee rates changing in real-time based on market odds — the closer the odds are to 0% or 100%, the lower the fee; conversely, the closer the odds are to 50%, the higher the fee, which can reach up to 1.56%.

This is the first time Polymarket has stopped its completely free model (Polymarket charges a 0.01% fee for the U.S. market) and started charging transaction fees for a specific type of market, excluding the U.S. market. Now that three weeks have passed, there is a certain observable data sample, and it is time to make a rough estimate of Polymarket's revenue potential.

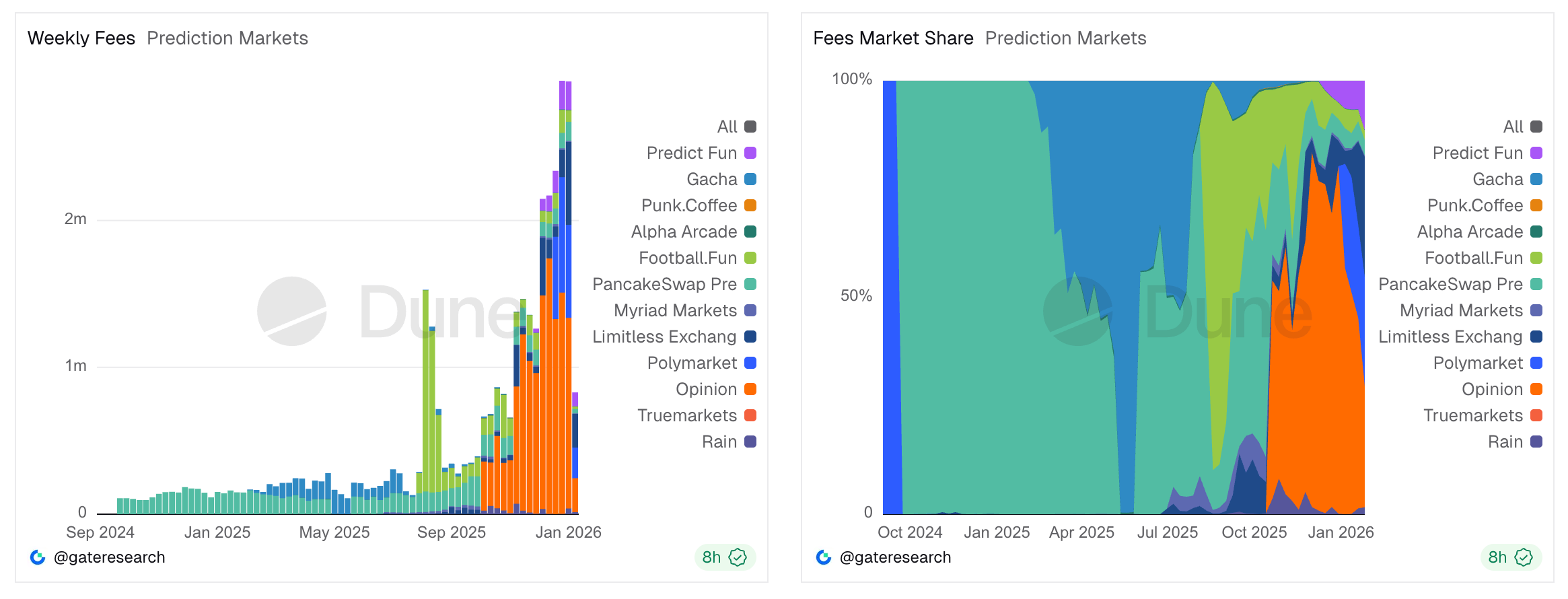

First, let's look at the most intuitive scale of fee income. According to data compiled by Gate Research on Dune, since the introduction of this fee, Polymarket has accumulated approximately $2.19 million in fee income, averaging about $730,000 per week — based on this data, if the trading volume and activity structure in related markets remain unchanged, it is expected to bring in about $38 million in revenue for Polymarket annually.

It is foreseeable that the scope of Polymarket's fees will not be limited to just the "15-minute cryptocurrency price fluctuations" category. Since officially charging for this category, Polymarket had long maintained a completely free model while also having to subsidize market liquidity out of its own pocket. At the end of last year, Coplan himself admitted that Polymarket was operating at a loss… but we have seen too many such "burning money" stories in the internet market. As Polymarket's user habits and market position gradually stabilize, it would not be surprising to charge for more markets in the future.

- Odaily Note: For more on Polymarket's revenue issues, refer to the previous issues of Odaily's tea talk column “Odaily Editorial Tea Talk (January 7).”

Assuming Polymarket will continue to use the current fee structure in other markets, we may glimpse the theoretical revenue ceiling for Polymarket at the current trading volume level by comparing the trading volume of the "15-minute cryptocurrency price fluctuations" market with the total trading volume across the Polymarket platform — the more fee-charging markets there are, the higher the revenue will naturally be.

Data analyzed by Odaily shows that in the past week, the total trading volume of the "15-minute cryptocurrency price fluctuations" market on Polymarket was approximately $159 million (of the four major tokens, BTC accounted for $114 million, ETH for $30.29 million, SOL for $8.93 million, and XRP for $5.73 million), which represents about 9.1% of Polymarket's total trading volume of approximately $1.75 billion in the past week — based on this ratio, it is estimated that if Polymarket introduces a similar fee model across all markets at the current trading volume level and structure, it could bring in $418 million in annual revenue for the platform.

It should be noted that the above estimates are based on historical data, and the actual revenue situation for Polymarket will inevitably vary due to various factors — first, Polymarket has only been charging fees for three weeks, and the sample size is still relatively small; second, Polymarket may not necessarily apply a similar rate mechanism in other markets, and differences in user trading habits across different markets may lead to variations in the final fee results under a dynamic rate mechanism; third, and most importantly, Polymarket is still in a strong growth phase, and it is expected that as the concept of prediction markets becomes more widespread, coupled with potential spikes from the 2026 World Cup and midterm elections, platform trading volume will continue to grow in the future.

However, even considering the uncertainties mentioned above, one trend is quite clear — Polymarket is proving the revenue potential of this new business model of prediction markets, which is no longer a novel concept but a truly sustainable business with significant revenue potential.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。