Not long ago, I read an open letter from Jocy, the founder of IOSG, to the Chinese Crypto OG. In the letter, Jocy quoted a saying from Buffett: "In the next 100 years, ensure that the cathedral is not swallowed by the casino."

Jocy used this metaphor to describe the dilemma of the crypto industry: on one side is the grand cathedral built with code and ideals, and on the other side is the huge casino filled with speculation and hype.

Just a few days after this letter was sent, a developer named Peter Steinberger became an overnight sensation for his open-source AI project, Clawd bot, developed in his spare time.

However, on the very day the project went viral, a group of cryptocurrency speculators, unbeknownst to Peter, quickly issued a meme coin named CLAWD, which at one point was inflated to a market cap of 16 million dollars. Subsequently, Peter tweeted that he would absolutely not issue any cryptocurrency and would not participate in any meme coins, asking "Crypto Folks" to stop harassing him.

The speculators believed that Peter's statements led to a crash in the coin's price. They hijacked his GitHub account during the project's renaming process and launched a frenzied online attack and personal harassment against him, demanding that Peter take responsibility for the scam created by the speculators themselves.

This was perhaps the moment I least wanted to admit that I was a part of the crypto industry.

The entire crypto industry is experiencing a major collapse. The prosperity of the casino has not only failed to give back to the cathedral but is actively destroying those who are trying to build the cathedral.

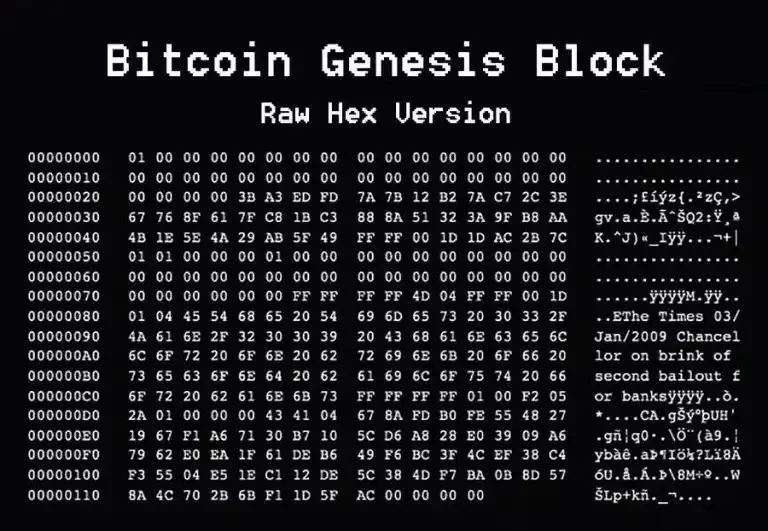

From the moment Satoshi Nakamoto mined the genesis block of Bitcoin in 2009 to 2026, what has happened in the crypto industry over these seventeen years? How has the cathedral built with code and ideals been transformed step by step into a casino filled with the sounds of dice and wails?

The Bell of the Cathedral

To answer this question, let us first return to the starting point, back to the era when the bell still rang clear.

For a long time after the birth of Bitcoin, the mainstream narrative of this industry was about building. The early participants were mostly cypherpunks, libertarians, and tech geeks, obsessed with the decentralized utopia envisioned by Satoshi Nakamoto, and trying to add bricks to this cathedral with lines of code.

Even the most famous memecoin in the industry, Dogecoin, initially shone with the brilliance of idealism.

In December 2013, two software engineers, Billy Markus and Jackson Palmer, who worked at IBM and Adobe respectively, decided to create an "absurd" cryptocurrency to satirize the increasingly rampant speculation in cryptocurrencies at the time. Markus slightly modified Bitcoin's code, changed the font to a comical style, and replaced Bitcoin's icon with a Shiba Inu meme that was popular on the internet. Thus, Dogecoin was born.

"It was created just for fun," Markus recalled in an open letter years later, "We had no expectations or plans."

But this joke unexpectedly gave rise to one of the most unique communities in the crypto world. Early Dogecoin players did not care about the price fluctuations; they were enthusiastic about a tipping culture, using Dogecoin, worth less than a cent, to upvote content they liked on social media. They conveyed joy, kindness, and creativity in this almost free way.

In 2014, they raised $30,000 worth of Dogecoin to help the Jamaican bobsled team, which could not gather funds, to compete in the Sochi Winter Olympics; they raised funds for water-scarce areas in Kenya to build wells; they even sponsored a NASCAR driver named Josh Wise, allowing a car with a Shiba Inu logo to race in the most popular auto racing events in the U.S.

"Joy, kindness, learning, giving, empathy, fun, community, inspiration, creativity, generosity, foolishness, and absurdity," Markus defined the true value of Dogecoin in his open letter, "If the community embodies these things, then that is true value."

This is one of the most touching portrayals of the cathedral era. In that time, people believed that the power of consensus could turn a joke into a force for good.

This enthusiasm for building reached its peak during the DeFi Summer of 2020. Builders on Ethereum created a decentralized financial world without permission or trust using smart contracts. From the decentralized exchange Uniswap to lending protocols Compound and Aave, financial applications were built like Lego blocks, and the total value locked (TVL) in the entire crypto world skyrocketed from less than $700 million to $11.76 billion in just one year. A new financial paradigm was rising on the horizon.

Until 2021, when things began to feel a bit off. That year, in the wake of the COVID-19 pandemic, global central banks initiated unprecedented money printing, with the U.S. alone launching an economic stimulus plan of up to $5 trillion. Trillions of hot money flooded into the market, searching for any asset to speculate on. Cryptocurrencies became the craziest main course in this liquidity feast.

Bitcoin's price rose by 788% in a year, and Ethereum surged by 1264%. According to surveys, young Americans aged 25 to 34 invested half of their stimulus checks into cryptocurrencies and the stock market.

Money had never been so cheap; the dream of getting rich overnight had never felt so real.

The bell of the cathedral was gradually drowned out by the sound of dice rolling in the casino.

The Tyranny of the Mob

French social psychologist Gustave Le Bon made a razor-sharp observation in his work "The Crowd":

"Once an individual becomes a member of a group, their actions no longer bear responsibility. At this point, everyone exposes instincts that would be restrained when alone. … The crowd is impulsive, changeable, and irritable. It is entirely governed by unconscious motives."

In the crypto world after 2021, when the community was no longer bound by a shared vision and values but merely by the fragile interest of shared holdings, "community-driven" quickly devolved into "the tyranny of the mob."

The first to be sacrificed was the spiritual totem of Dogecoin, its creator Billy Markus.

As Dogecoin was hyped up hundreds to thousands of times during the frenzy of 2021, Markus's social media inbox was flooded with messages, with people frantically demanding that he "do something" to make their Dogecoin more valuable.

They did not care that Markus had sold all his Dogecoin back in 2015 after being laid off, which only netted him a used Honda; they also did not care that Markus's mother was about to lose her house due to an inability to pay the mortgage.

They only cared about themselves.

"When I see things like price manipulation, greed, and scams," Markus wrote in his open letter, "I am not angry, just very disappointed."

If the attacks on Markus were merely the prelude to this tyranny, then the assault on Vitalik Buterin escalated the farce to its first climax.

In May 2021, SHIB, without any communication, directly transferred 50% of the total token supply to Vitalik's public wallet address, which at the time had a nominal value of $8 billion. Their calculation was very clever; Vitalik is recognized as a "god" in the crypto world, and as long as he does not sell, it is equivalent to providing the strongest credit endorsement for SHIB; if he sells, a large number of tokens would be destroyed, which would also be beneficial.

This was a carefully designed moral kidnapping. They placed Vitalik in a dilemma, where no matter how he chose, it seemed he could only serve the interests of the speculators.

But Vitalik decisively rejected this sacrifice. He donated $1.3 billion worth of SHIB to an Indian COVID-19 relief fund, destroyed most of the remaining tokens, and sold off a large amount of the animal meme coins he received as "donations," making real donations to charitable organizations.

He acted like a patriarch cleaning house, trying to awaken those immersed in the meme frenzy with repeated sell-offs. From 2021 to 2025, he repeatedly sold and donated the meme coins he received, turning them into animal welfare funds, biotech research funding, and disaster relief funds. He even publicly called for, "I hope meme coin creators can donate directly to charities instead of sending coins to me."

But his resistance seemed so powerless in the face of collective speculative desire. The followers quickly found new explanations for his actions: "Vitalik is helping us destroy tokens, this is good news!" "Vitalik is marketing; he actually supports us!"

In the crowd logic described in "The Crowd," all facts can be distorted to serve the collective's emotions and fantasies.

If the sacrifice of Vitalik still carried a hint of religious absurdity, by 2026, when the iron fist of tyranny struck Peter Steinberger, the developer of Clawd bot, it had evolved into a blatant kidnapping.

The speculators no longer needed the endorsement of a god; they could directly "create" a god and then tie him to their chariot. When Peter refused to endorse the CLAWD scam they issued, he transformed from a celebrated hero into a traitor that must be eliminated. Account hijacking, verbal attacks, private message harassment… all means were employed, just to force him to submit.

They acted in the name of the community while practicing tyranny, with the only agenda being the K-line.

When a community in an industry devolves from a collaborative network based on shared ideals to a violent machine based on shared positions, what scale of disaster can it create?

11.6 Million Bullets

The answer is: a collective suicidal prosperity.

According to the annual report released by the crypto data analysis company CoinGecko, in 2025, the crypto world created 11.9 million new tokens. This means that, on average, more than 32,000 new "assets" were born every day. Correspondingly, another set of data shows that in the same year, 11.6 million crypto projects met their demise.

In comparison, during the peak of the bull market in 2021, the number of failed projects that year was 2,584. In four years, this number increased by 4,489 times.

When issuing tokens becomes an industry, what we get is not diversity of value, but the scale of garbage.

The occurrence of this disaster is the result of the combined effects of technological advancement, macroeconomic liquidity, and human greed. On one hand, new-generation public chains like Solana have increased transaction speeds by 100 times while reducing costs by 1,000 times. The emergence of tools like pump.fun, which allow for the issuance of tokens for just a few dollars, has lowered the barrier to creating a blockchain to a single mouse click. The progress of technology has inadvertently provided a perfect breeding ground for the scale of disaster.

On the other hand, the unprecedented global liquidity surge from 2020 to 2021 fundamentally changed the market's risk appetite. When money no longer holds value, and the returns on traditional value investments are pitifully low, people begin to frantically chase volatility. Whether an asset has value is no longer important; what matters is whether it can provide enough volatility to satisfy people's desire for quick wealth.

Thus, we witnessed the most absurd scene in the crypto world: the entire industry rushed to meme-ify itself.

Those social applications claiming to disrupt Web2, those blockchain games asserting to build the metaverse, and those star projects basking in the halo of Layer 2 scaling solutions—all their tokens exist solely as chips traded by retail investors in the secondary market.

When a Layer 2 token has no essential difference in functionality from a Shiba Inu coin, we must admit that within the casino, everything is a meme.

These 11.6 million tokens that have gone to zero are like 11.6 million bullets shot toward the future of the crypto world. Each one declares to the world that this industry is untrustworthy. And when the incentive mechanisms of an industry tilt entirely toward speculation rather than innovation, what price will those who truly want to build the cathedral have to pay?

The Death of Builders

They are experiencing a triple death.

The first death is the social death of body and spirit.

The experience of Clawd bot developer Peter Steinberger is just a microcosm of the plight of countless builders. When a developer invests months or even years of effort to create a truly valuable and popular product, what they receive may not be flowers and applause, but a group of sharks smelling blood.

They turn your project, your name, and your reputation into chips in their casino. If you comply, you become an accomplice to the scam; if you resist, you become an enemy that must be eliminated.

The second death is the death of the idol of the spiritual leader.

Vitalik's resistance is a Don Quixote-style tragedy. He tries to use his personal power to combat the decline of an industry. He sells off repeatedly, donates repeatedly, and publicly calls for change, but what he receives in return is mockery from the mob and intensified kidnapping.

When the good deeds of a spiritual leader in an industry are interpreted by gamblers as good news, that industry loses its last shred of moral cover.

In this twilight of idols, the spiritual lighthouse is completely extinguished.

The third death is the death of capital in top-level design.

When the casino image of meme coins becomes the most prominent label of the entire industry, even the smart money attempting to make long-term value investments begins to hesitate. In 2025, Eddy Lazzarin, the Chief Technology Officer of the top crypto venture capital firm a16z crypto, publicly stated on social media: "Meme coins are harming the long-term vision of many builders. It looks at best like a high-risk casino."

This is not just a complaint from an executive; it is a dangerous signal. It means that the top-level designers of the industry are losing confidence in the future. When capital is no longer willing to fund cathedral projects that require long-term investment and only wants to chase short-term casino games, the source of innovation is completely cut off.

More critically, the proliferation of meme coins provides the perfect ammunition for global regulatory agencies. It labels the entire industry as fraudulent, money laundering, and high-risk speculation, unjustly harming those projects and enterprises that have worked for years toward compliance. In 2025, collective lawsuits against platforms like pump.fun have already begun to invoke the U.S. RICO Act, which was originally used to combat the Mafia.

We once gazed at the stars, dreaming of a world changed by code; now we are mired in the mud, searching for the next hundredfold coin among animal and celebrity avatars. When builders are exiled, when spiritual leaders are dissolved, when both capital and regulation signal red lights, what do we have left?

The sound of bells, dice, and sighs, all resonate in our ears

Seventeen years ago, Satoshi Nakamoto quoted a headline from The Times in the genesis block, aiming to create a fair financial world without excessive currency issuance and without banks doing harm.

Seventeen years later, when a developer is attacked for creating something valuable, we must admit that this industry is proving itself unworthy of a future at an alarming speed.

When this frenzy recedes, what will be left is a vast wasteland of trust. On the ruins, will we choose to continue playing this gambling game of survivor bias, or will we choose to return to our original intentions, to recognize, follow, and become those who still insist on ringing the cathedral bell amidst the ruins?

This will be a question that every participant in the crypto world cannot avoid. The sounds of bells, dice, and sighs will continue to echo over this industry for a long time.

For a long time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。