1. Does the rise in gold affect Bitcoin?

Yesterday, two polls were initiated.

The first question was: Do you think the decline in Bitcoin is influenced by the rise in gold?

The poll results showed that only 22% believed there was "no influence," while the majority thought there was "some influence" or "a significant influence."

The conclusion is quite clear— the rise in gold has indeed diverted market funds to some extent, impacting Bitcoin.

Recently, the significant rise in gold has attracted a large amount of capital from non-traditional precious metal markets, with many investors starting to trade gold spot or futures.

2. Current trading strategy for gold

My advice is simple:

Gold is still in a primary upward wave, and I do not recommend considering short positions in futures trading.

This market situation is essentially the same as the unilateral upward phase of Bitcoin, clearly driven by major funds rather than retail investors pushing up prices.

In this case, just remember one principle:

Do not try to catch the bottom, and do not try to catch the top.

If you have not been paying long-term attention to products like gold, participating rashly now is often just driven by emotions, belonging to the "fear of missing out" category, and such opportunities are not suitable for you.

3. Is it time to be bullish or buy gold now?

The second poll question was: Are you willing to be bullish or buy gold at this stage?

More people chose "unwilling, feel the price is too high."

This choice is perfectly fine.

You may miss this market opportunity, but you also will not lose money in the market due to a lack of understanding or participation.

Not understanding means not participating, which is itself a correct choice.

4. Comparison of Bitcoin and precious metals market capitalization

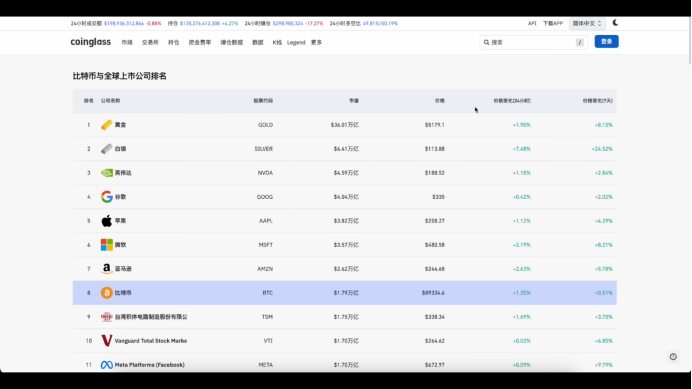

Currently, the market capitalization of gold has reached 36 trillion, silver's market capitalization is about 6.4 trillion, and silver's increase is even more exaggerated.

Bitcoin's current market capitalization is about 1.79 trillion, and its ranking in the financial derivatives market has dropped to eighth place.

The gap is very obvious for both silver and gold.

Personally, I believe:

Bitcoin will definitely experience a strong market phase similar to that of gold and silver in the future.

But the key is— the time is not yet right.

5. Why is now not the time for Bitcoin?

As the leader of the crypto market, Bitcoin will certainly have a very strong rally in the future, but not now.

At least we need to wait for gold to reach a high position, and after a consolidation or sideways movement at that high, funds may flow back into the crypto market.

Currently, the biggest characteristic of the crypto market is only one:

Extremely poor liquidity.

6. Signals behind the actions of exchanges

Recently, it is evident that:

The trading volume of altcoins continues to be sluggish.

Mainstream exchanges are starting to list US stock spot, futures, and contracts.

The market is highly focused on whether Tesla perpetual contracts will be listed on January 28.

All these phenomena actually point to the same issue:

Exchanges are trying to alleviate the pressure of insufficient liquidity.

If high-volatility products are not introduced to attract trading funds, the liquidity of some exchanges may continue to deteriorate.

7. Clear attitude towards altcoins

To give a direct conclusion:

I do not recommend paying attention to altcoins anymore.

Anyone who encourages you to dollar-cost average or "DC" into a certain altcoin can be directly blocked.

At this stage, altcoins have no value worth researching or participating in.

If you must choose, focus only on two:

Bitcoin first, Ethereum second.

8. Current structural judgment of Bitcoin

From a 4-hour perspective, Bitcoin is still in a weak adjustment phase after a decline, with the rebound strength clearly weak.

We have repeatedly mentioned before:

The core resistance level above is in the range of 90,000-91,000.

As long as this range is not effectively broken, the overall strategy remains:

Short at high points, targeting the previous low.

The defensive position can be set above 91,000.

9. Structure and strategy of Ethereum

Although Ethereum has rebounded recently, the key resistance range above is at 3,050-3,100.

This position has been validated multiple times in historical structures for its resistance effectiveness and is still valid.

Compared to Bitcoin, Ethereum's rebound is stronger, and structurally it is more suitable for looking for short opportunities.

The defensive position can be set above 3,100.

10. Summary of viewpoints

Long-term outlook for the crypto market is positive.

The focus is on Bitcoin, not altcoins.

At this stage, the timing is not right.

Bitcoin may still experience a new decline.

Follow me, join the community, and let's progress together.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。