RWA is reshaping on-chain finance, but who are the real winners?

Written by: OAK Research

Translated by: Tia, Techub News

The tokenization of Real-World Assets (RWA) is often seen as a multi-trillion dollar business opportunity. Perhaps so. But this is not the most important question today, as it obscures a more fundamental issue for 2026: once assets are transferred on-chain, who will truly capture the value?

In 2025, the status of RWA underwent a transformation. Tokenization, which had long been limited to experimental projects, has now become a mature on-chain market. The total value of RWA grew from approximately $3 billion in 2022 to over $35 billion by the end of 2025, primarily due to the entry of institutional investors and the increasing demand for on-chain yield products backed by regulated assets.

This growth has profoundly changed the landscape of on-chain finance. Today, project teams are building products around asset custody, issuer control, identity verification, and transfer rules. Secondary market liquidity increasingly relies on the existence of compliant trading venues, the ability to transfer assets across platforms, and the management of regulatory constraints across jurisdictions.

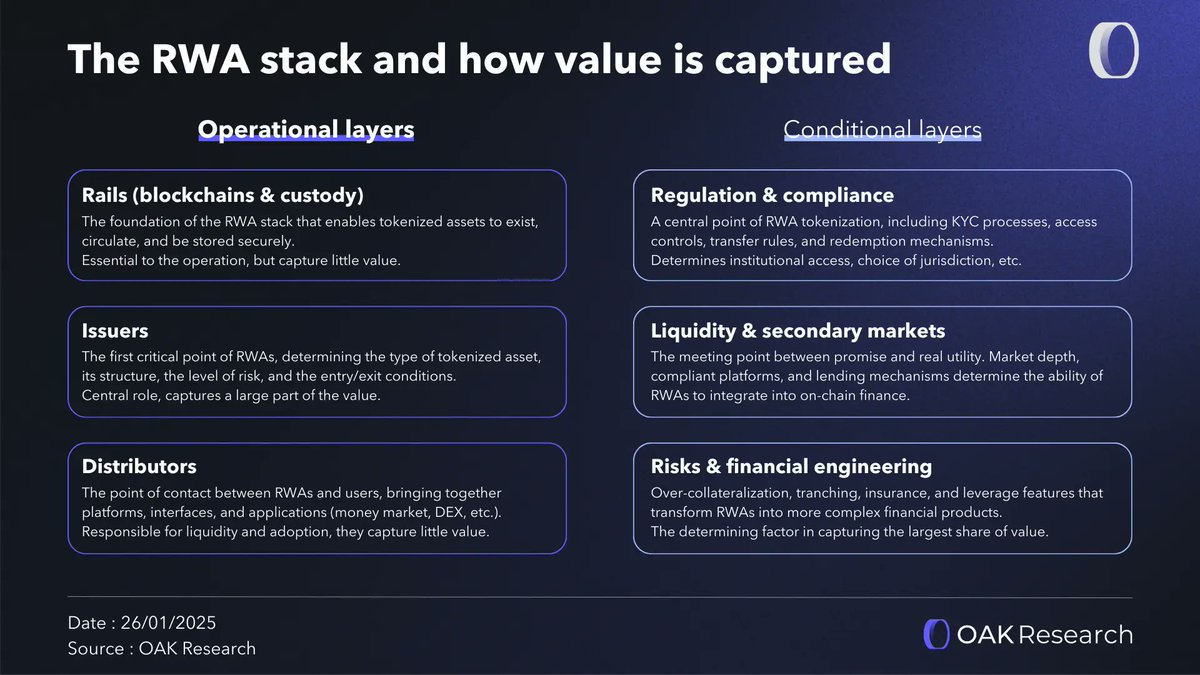

Therefore, risk-weighted assets (RWA) are not a single, homogeneous asset class. They depend on a series of interdependent hierarchies that cover various aspects, from blockchain and custody to distribution platforms. All these layers are crucial for the normal operation of the system, but they acquire value or power in different ways.

By 2026, understanding RWA (Risk Asset Architecture) will not only involve analyzing which assets are tokenized and why, but also identifying the control points within that architecture and how economic value flows and redistributes among different participants. This is the goal of this article.

Overview of the RWA Stack

The RWA (Risk-Weighted Assets) industry does not rely on a single type of participant but is composed of multiple different layers, each playing a specific role in transforming traditional assets into usable on-chain investment tools. All these layers are essential for the operation of the system, but their share in value capture varies.

Some correspond to clearly identifiable operational entities (blockchain, custodians, issuers, etc.), while others represent horizontal functions that determine whether the former can be deployed correctly, attract capital, and operate at scale.

Operational Layer

The operational layer includes participants directly involved in the issuance, circulation, and acquisition of risk-weighted assets (RWA). They operate the RWA market on a daily basis, concentrating most of the control points and capturing a significant portion of the value created.

- Rails (Blockchain and Custody)

The foundational layer of the RWA architecture is the infrastructure layer (Rails). It includes blockchain and custody solutions that enable the existence, circulation, and secure storage of tokenized assets. This layer ensures value transfer, near-instant settlement, and synchronization between the underlying assets and their on-chain representations.

It is indispensable but will tend to standardize over time. As the market matures, value will concentrate on those infrastructures deemed the safest and most robust. The underlying architecture (Rails) is crucial for system operation, but its value is relatively low compared to higher layers in the tech stack.

- Issuance Layer

The issuance layer is the first key control point in the RWA architecture. Issuers decide which assets are tokenized, how they are structured, the acceptable risk levels, and under what conditions investors can enter or exit.

Whether it is U.S. Treasury bonds, private credit, equities, or commodities, all these products rely on off-chain legal and financial structures that must be accurately reflected on-chain. Issuers provide not just the assets; they also guarantee the legal and economic soundness of everything built upon them.

- Distribution

Distribution channels include platforms, applications, and interfaces (money markets, decentralized exchanges, etc.) that provide investors access to risk-weighted assets (RWA). They determine which products are visible, accessible, and user-friendly, as well as the ease of capital deployment.

In practice, the assets attracting the most capital inflow are not necessarily the most complex but rather those that are easiest to access and best integrate into existing user workflows. Distribution channels directly impact the popularity, liquidity, and speed of expansion of assets. Whoever controls the access channels ultimately controls the flow of capital.

Regulatory Layer

The regulatory layer does not correspond to a single entity or clearly defined category. They are horizontal standards that determine the functionality of the operational layer, establish trust, and sustainably create value.

- Regulation, Compliance, and Redemption Mechanisms

Regulation is a core component of RWA tokenization. KYC processes, access controls, transfer rules, and redemption mechanisms do not disappear with the advent of blockchain; they must be properly integrated into products.

This layer determines whether institutional investors can participate, the recognition of token-related rights, and the ability to operate at scale across multiple jurisdictions. Therefore, the choice of jurisdiction is one of the most strategically significant decisions, as regulatory frameworks vary significantly across different jurisdictions.

In our year-end report, we detail the differences in risk-weighted assets (RWA) across various jurisdictions: the United States, the European Union, Singapore, the United Arab Emirates (UAE), and offshore jurisdictions.

- Liquidity and Secondary Markets

Liquidity is the intersection between the theoretical prospects of tokenization and its actual utility. An asset may be perfectly structured and compliant, but if it cannot be traded, used as collateral, or exited easily, its actual value remains limited.

The depth of the secondary market, the existence of compliant platforms, and lending mechanisms determine whether risk-weighted assets can fully integrate into financial strategies. With liquidity, other layers can truly function.

- Risk and Financial Engineering

Risk management and structuring are the ultimate determinants of value realization. Over-collateralization, tranching, insurance, and leverage transform simple assets into more complex financial products to meet the needs of different investors.

Historically, the financial industry has captured a significant portion of value. In the risk-weighted asset (RWA) system, this layer is still under construction, but it represents one of the main long-term value creation levers.

Main Types of Tokenized Assets

After outlining the structure of the RWA stack, we can observe how this logic is specifically applied to the different asset classes already on-chain. Not all asset classes exhibit the same maturity or value capture potential, but each reflects specific aspects of tokenization.

Stablecoins

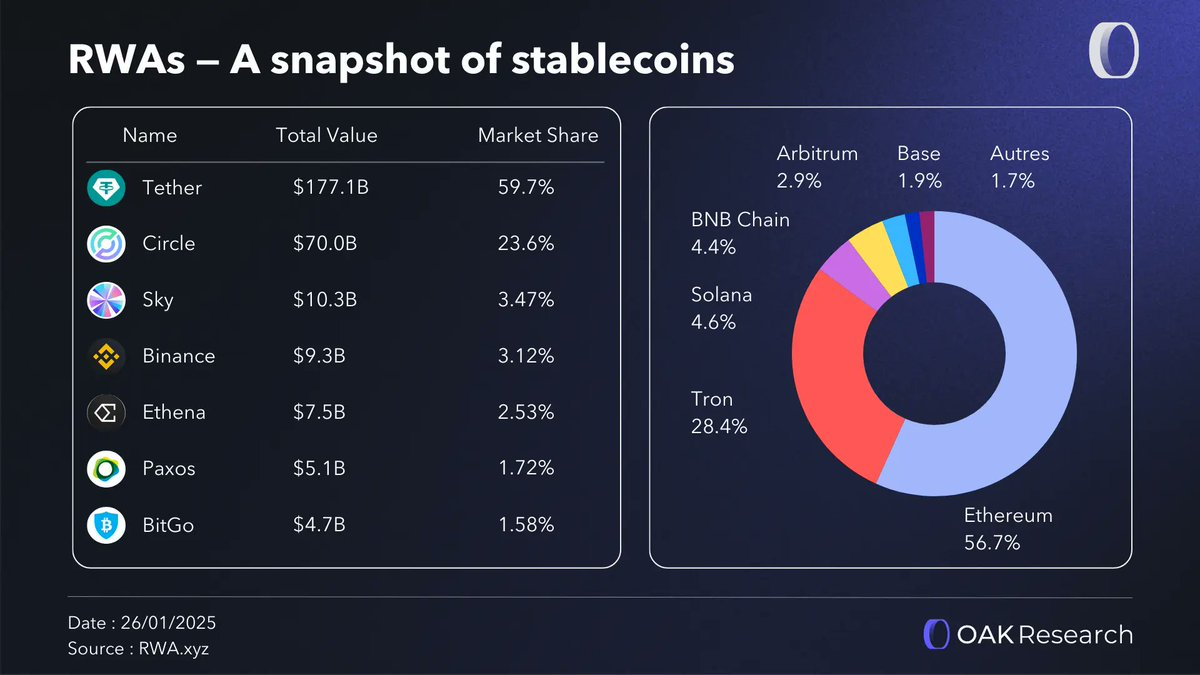

Stablecoins are the cornerstone of the RWA market. They play a central role in almost all on-chain transaction processes related to real-world assets, serving as the accounting unit, payment medium, and settlement tool for most tokenized products.

Stablecoins were initially seen as simple digital dollar equivalents, but they have undergone significant changes. A large portion of stablecoins is now backed by high-quality physical assets, primarily short-term U.S. Treasury bonds. This structure explains both their stability and why they are increasingly favored by institutional investors, as they view stablecoins as tools that are liquid, predictable, and compliant with operational constraints.

Thus, stablecoins play a dual role in the RWA architecture. On one hand, they are the primary liquidity channel, allowing capital to flow in and out of the ecosystem. On the other hand, through their reserves, they represent one of the most widely used cases of tokenization, corresponding to a substantial portfolio of effectively tokenized sovereign debt.

In fact, stablecoins are not just products; they are infrastructure. They ensure the continuity of settlements, market liquidity, and the connection between traditional finance and on-chain finance. Therefore, they occupy a structural share of the value created across the entire RWA market.

Ethena is a decentralized protocol that supports various stablecoins, the most well-known of which is USDe, a synthetic dollar backed by a delta-neutral strategy, with annual yields ranging from 5% to 15% depending on market conditions.

In September 2025, Ethena announced the launch of a new service: Ethena Whitelabel, an infrastructure for stablecoin-as-a-service that allows any blockchain, application, or wallet to issue stablecoins while minimizing the technical complexities typically involved.

This is a significant innovation as it addresses the tax issues surrounding stablecoins. The stablecoin industry is currently dominated by two companies, Tether and Circle, which hold 95% of the market share. More importantly, these two companies have generated billions in revenue due to their massive collateral sizes.

In contrast, while blockchains, protocols, and users facilitate the existence and circulation of stablecoins, they are unable to capture any value from it. This leakage of value outside the ecosystem is a major issue, and it is precisely what Ethena aims to address with USDe.

U.S. Treasury Bonds

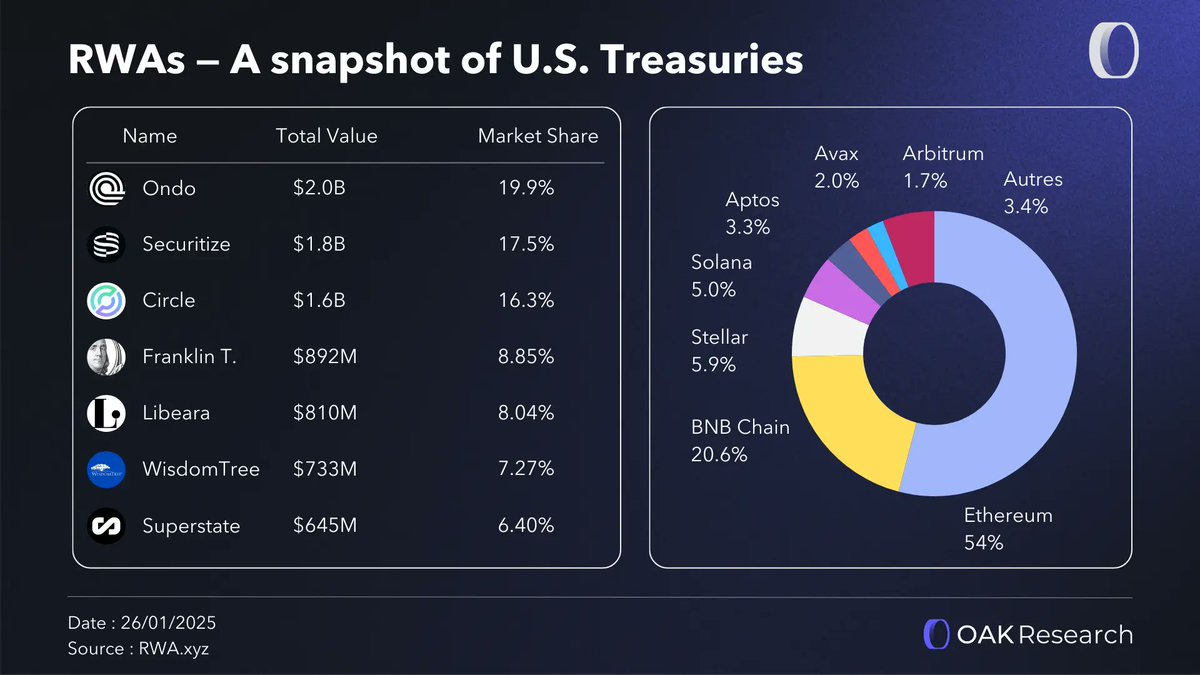

Tokenized U.S. sovereign debt is currently the most mature and significant component in the risk-weighted assets (RWA) space. By transforming the safest and most liquid assets in the global financial system into tokens, issuers provide investors with a continuous channel for capital acquisition, near-instant settlement, and partial ownership.

The primary use of these products is clear: to provide safe, yield-generating, and regulatory-compliant collateral assets within on-chain financial protocols. Tokenized Treasury bonds enable cryptocurrency investors to directly access the yields of U.S. sovereign debt without relying on traditional financial channels.

Since the Federal Reserve's policy rate exceeded the yields of most stablecoins in 2023, institutional interest in such products has significantly increased. The attractive yields, sustained liquidity, and collateral utility have gradually established tokenized Treasury bonds as a reliable alternative for on-chain treasury management.

Some key metrics:

Since the beginning of 2023, the market capitalization of leading tokenized treasury products has grown from nearly zero to nearly $9 billion.

Tokenized treasuries achieved a growth of $4.4 billion in 2025 (+85%).

BlackRock's U.S. Dollar Institutional Digital Liquidity Fund (BUIDL) dominates the market, followed by Circle's USYC and several products from Ondo.

Ethereum leads in the adoption of tokenized treasuries, followed by Arbitrum, Polygon, BNB Chain, and Solana.

Despite strong growth from companies like WisdomTree, Franklin Templeton, and Centrifuge, Securitize remains the leading tokenization provider.

This section perfectly illustrates how value is shifting from pure technology infrastructure providers to issuers capable of building simple, regulated, and easily integrable products.

BlackRock's U.S. Dollar Institutional Digital Liquidity Fund (BUIDL) is the first tokenized fund launched by BlackRock. It brings traditional institutional money market fund strategies on-chain, combining daily yield distribution, multi-link access, and deep liquidity provided through partners like Securitize and Circle.

BUIDL is distributed through @Securitize—a U.S. regulated platform. This allows it to target institutional clients with a higher minimum investment, a stable net asset value fixed at $1, and daily on-chain yield payments. The fund is deployed across multiple blockchains (Ethereum, Solana, Avalanche, Arbitrum, Optimism, Polygon, and Aptos) via @wormhole.

BlackRock's tokenized fund currently manages over $2.5 billion in assets, confirming that despite a very limited number of holders (only 93 investors), institutional investors have provided strong support.

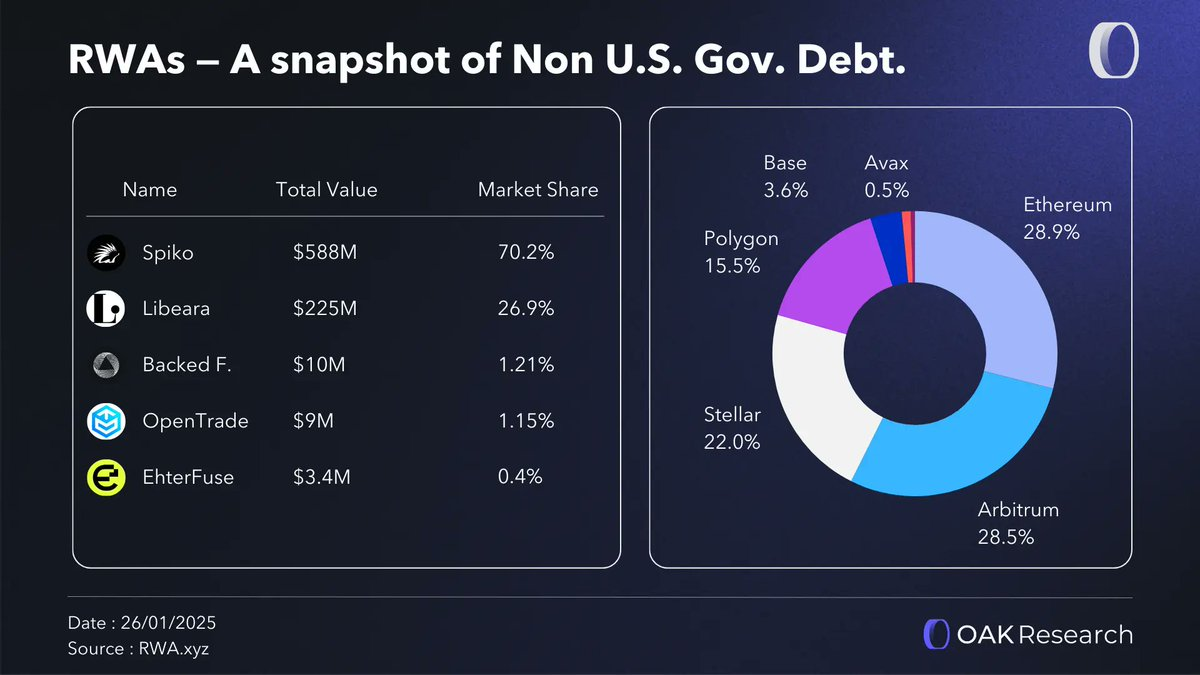

Non-U.S. Sovereign Debt

The tokenization of non-U.S. sovereign debt extends the advantages of U.S. Treasury bonds to other public issuers. It simplifies access to foreign government bonds while significantly reducing the operational complexity of cross-border investments.

In traditional markets, purchasing foreign sovereign debt involves multiple intermediaries, settlement restrictions in specific jurisdictions, and sometimes lengthy settlement delays. Tokenization makes these assets more accessible, speeds up settlement, enhances capital efficiency, and maintains a regulatory framework suitable for institutional investors.

Although this niche market remains relatively small, it reflects a clear trend toward geographic diversification of risk-weighted assets. The value capture in this niche largely depends on the issuer's ability to navigate local regulatory frameworks and provide products that global investors can understand and use.

The non-U.S. sovereign RWA market is primarily dominated by issuers based in Hong Kong (67% market share) and France (30%), corresponding to the major tokenized funds identified in this category, with ChinaAMC in Asia and Spiko in Europe.

Spiko is a French fintech company founded in 2023, now the largest issuer of euro-denominated tokenized money market funds in Europe. It enables businesses to allocate treasury funds into funds backed by French, UK, and U.S. government bonds.

In January 2026, the company announced it had obtained MiFID investment management status granted by the EU's financial regulatory authorities (ACPR and AMF), allowing it to fully comply with regulations and provide services across the EU.

Spiko is one of the fastest-growing protocols in 2025. Its total locked value (TVL) grew from $130 million to over $730 million within a year. These assets are allocated to the Spiko Euro Fund ($523 million), Spiko Dollar Fund ($202 million), and the Spiko Pound Fund launched in December.

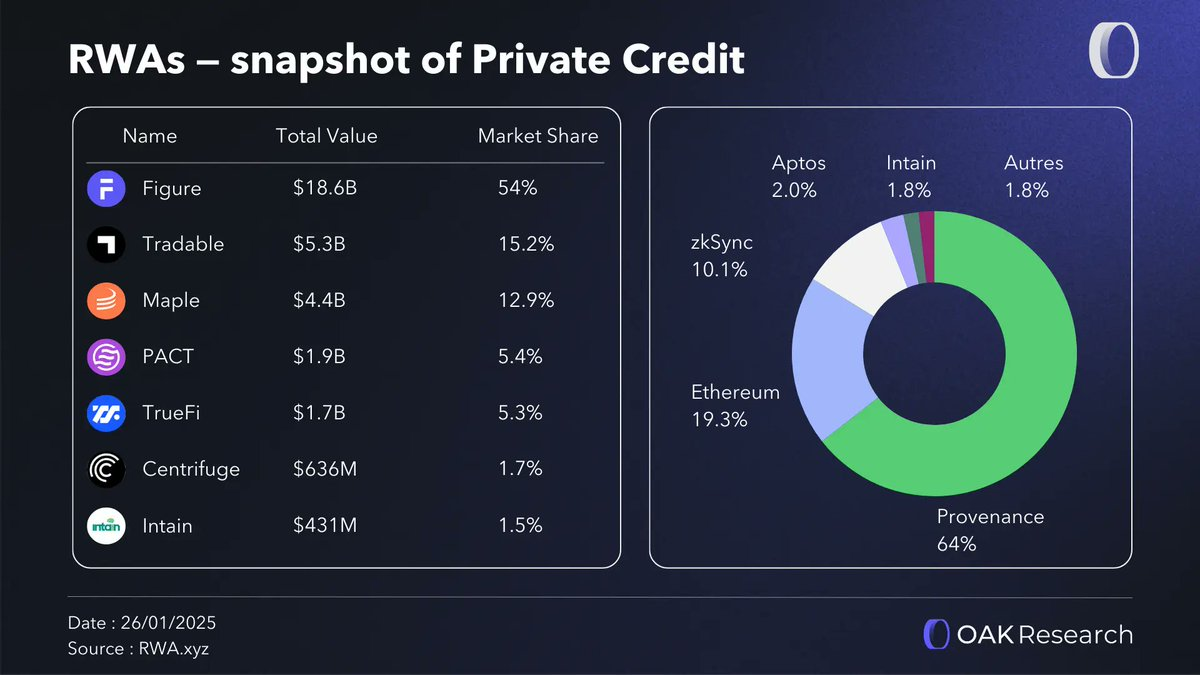

Private Credit

Private credit is one of the areas with the greatest potential for tokenization. Due to its historically poor liquidity and limitation to professional investors, on-chain trading, with advantages like cash flow transparency and automated loan monitoring, is particularly suitable for tokenization.

Tokenization allows non-public debt instruments (such as corporate loans or trade finance) to be transformed into smaller, more tradable units. It enhances liquidity for lenders, broadens financing sources for borrowers, and enables real-time tracking of collateral, repayment schedules, and cash flows.

This section emphasizes a key aspect of the risk-weighted asset (RWA) structure: value lies not only in the underlying assets but also in the ability to construct, analyze, and manage risk. As the market matures, differentiation increasingly relies on the quality of underwriting and the reliability of the structures built.

Maple is a vivid example of the market demand for on-chain financial products backed by private credit. The protocol offers permissioned funding pools based on BTC lending, as well as permissionless funding pools based on syrupUSDC and syrupUSDT. This allows Maple to serve both KYC-compliant institutional clients and cryptocurrency-native users.

In 2025, Maple achieved significant growth. It managed over $4.5 billion in assets (an 800% increase), with total institutional borrowing reaching $1.7 billion and revenue nearing $11.7 million (a 370% increase).

One of Maple's key advantages is its deep understanding that RWA product distribution is a crucial component, as mentioned earlier. The protocol creates tangible use cases for syrupUSDC and syrupUSDT through integration with emerging blockchains and major partners.

In 2025, Maple deployed its products across multiple ecosystems: on @solana through @kamino and @JupiterExchange, on @Plasma through @MidasRWA, on @arbitrum through @0xfluid, @eulerfinance, and @aave; and recently, it has also been deployed to @base via Aave.

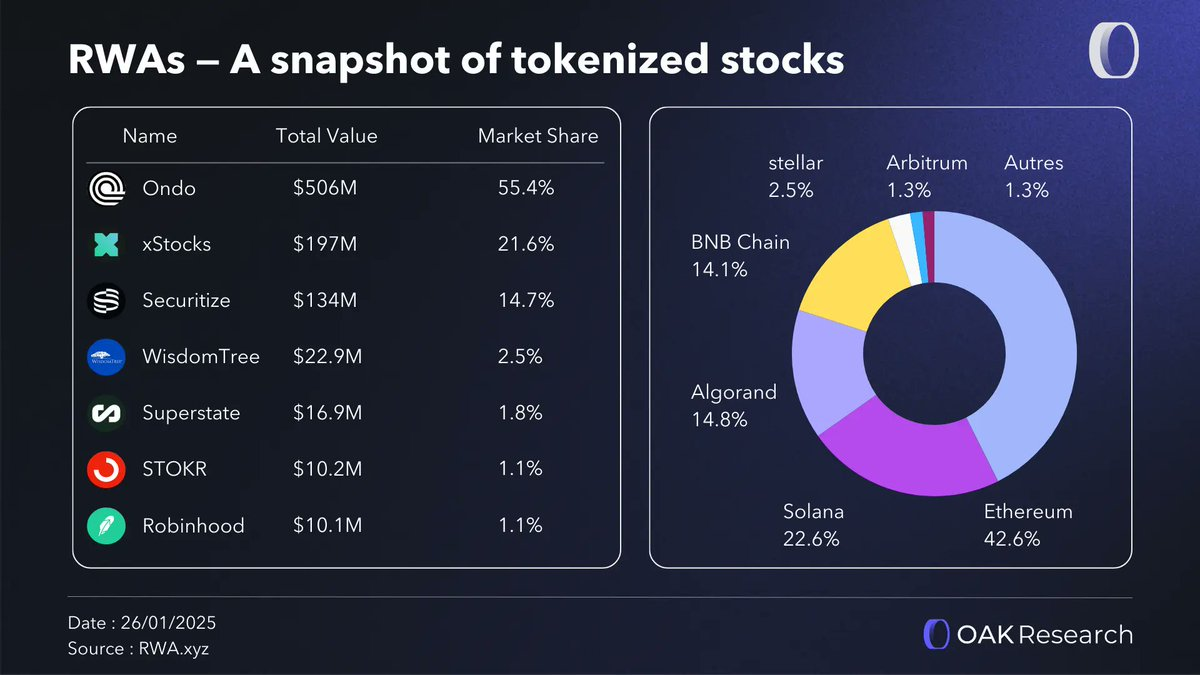

Tokenized Equity

Tokenized equity is a digital representation of shares in publicly traded or privately held companies, allowing for continuous trading outside traditional trading hours and faster settlement. For publicly listed stocks, these tokens are typically backed by custodial shares. For private equity, tokenization simplifies the management of equity structure tables and enables compliant secondary market trading.

The main driver of this niche market is the demand for asset exposure rather than yield generation. It attracts a broader, often retail-oriented user base and highlights the core role of distribution and user experience in value capture.

Tokenized equity indicates that even when the underlying assets are well-known, their value is more reflected in the ability to organize access, liquidity, and compliance rather than in the assets themselves. Currently, most trading activity is driven by perpetual markets, although initiatives are underway to integrate the spot ownership of tokenized equity into on-chain finance.

The heat in this sector was first ignited by the announcement from @RobinhoodApp, followed by @BackedFi launching related products with @xStocksFi and @OndoFinance Global Markets. The number of holders of tokenized stocks far exceeds that of other tokenized asset classes, surpassing 100,000 holders within a year. This indicates that the field is primarily driven by retail investors, whose core demand is more about gaining asset exposure rather than pursuing yield.

From the perspective of the perpetual contract market, growth is mainly reflected in the HIP 3 system of @HyperliquidX, focusing on tokenized stocks, especially in markets like @tradexyz and @markets_xyz, where daily trading volumes have exceeded $800 million.

Backed Finance is an infrastructure provider that issues on-chain representations of traditional financial assets, including stocks, ETFs, and bonds. Acquired by @krakenfx, the company launched xStocks in June 2025, offering tokenized stocks backed by real shares held by Swiss custodial partners.

xStocks is now integrated into several centralized platforms, including Kraken, Gate, Bybit, and Bitget, and is available on Ethereum, Solana, and Tron. Currently, over 70 assets have been tokenized through xStocks, managing assets worth $215 million, with nearly 60,000 holders. This accounts for 23% of the tokenized stock market.

Major Winners of RWA in 2026

By 2026, the question is no longer whether tokenization will continue to grow, but rather where the true concentration of value lies as the market expands. Tokenized assets are growing exponentially, but value capture remains uneven. It is primarily determined by three types of participants who control issuance, distribution, and trust.

Stablecoin Issuers

Stablecoin issuers are expected to remain the primary beneficiaries of RWA growth. Even in more challenging market environments, the total supply of stablecoins typically grows mechanically with the increase in payments, trading, and tokenization volumes.

In addition to serving as settlement tools, stablecoins are increasingly used by on-chain institutions as collateral, cash management tools, and cash management solutions. As the regulatory environment in the U.S. and Europe becomes clearer, this sector will continue to attract new participants while solidifying the positions of existing market leaders.

- Notable Players: @tether, @circle, @ethena_labs, @SkyEcosystem, @Paxos, @PayPal

Tokenized Financial Asset Issuers

Tokenized financial asset issuers include asset management companies, fintech companies, and eventually sovereign institutions. Their role is to provide the infrastructure necessary for issuing tokenized assets while reducing operational complexity and shortening settlement cycles.

Their main advantages lie not in cost reduction, but in distribution control, traffic management, and the creation of ongoing revenue. Those issuers who lay out early and establish reliable on-chain strategies are more likely to capture a disproportionate share of liquidity and institutional attention.

- Notable Players: @Securitize, @xStocksFi, Unit, @SuperstateInc, @maplefinance, @Spiko_finance, @OndoFinance

Custodians

Custodial institutions may be the most critical and underestimated beneficiaries in the institutional tokenization process. As institutions increasingly interact with on-chain assets, the demand for secure, compliant, and insured custodial solutions becomes inevitable.

In the world of tokenization, custody goes far beyond simple asset safekeeping. Custodians now offer staking, governance, collateral management, reporting, and compliance services. Institutions are unlikely to build these capabilities themselves, further solidifying the strategic position of existing service providers.

By 2026, the tokenization process should continue to accelerate, but the ultimate winners may not necessarily be the companies with the most tokenized assets. Value will concentrate in the hands of those who control key layers of the technology stack, manage market access, and can establish sufficient trust to achieve scalable operations.

- Notable Players: @coinbase, @Anchorage, @BitGo, @CopperHQ, @Fireblocks, @ZodiaCustody

Distributors

For any RWA issuer, the core challenge lies in how to allow users to easily enter and exit the market. Many projects attempt to tokenize private credit, real estate, or alternative investments on-chain, but they generally face the common issue of persistent liquidity shortages.

If investors cannot exit tokenized assets at any time, they do not actually hold liquid assets. Instead, they rely on other buyers to take over their positions. A lack of sufficient liquidity means that tokenization does not address the core issue of capital access but merely shifts the problem elsewhere. Therefore, market depth and sustainability are necessary conditions for the sustainable growth of RWA.

This is precisely where distributors come into play. They correspond to secondary markets and protocols, enabling tokenized assets to be traded, sold, used as collateral, lent, yield-generating, or leveraged. They transform static assets into truly usable financial building blocks.

In this category, money markets play a core role. Protocols like Aave, Morpho, Euler, Spark, and Kamino enable holders of tokenized assets to deploy them into more advanced investment strategies. By facilitating lending and collateral reuse, these protocols enhance both the individual utility of RWAs and the overall market liquidity.

Certain decentralized exchanges (DEXs) also play a key role in this dynamic process. Platforms such as Uniswap, Jupiter, and Fluid, especially after tokenized assets begin to natively integrate into the DeFi space, facilitate price discovery and asset circulation.

Finally, there is a unique institution worth special mention. Pendle is not positioned as a traditional secondary market but as a yield structuring platform. By enabling the separation and trading of future cash flows, Pendle provides a suite of powerful tools for optimizing, hedging, or amplifying the risk exposure of tokenized assets.

As the RWA market matures, distributors are increasingly becoming one of the most important control points in the entire technology stack. They ultimately determine the degree of adoption, liquidity of tokenized assets, and whether they can establish themselves as true financial instruments.

- Notable Players: @Aave, @eulerfinance, @Morpho, @Kamino, @JupiterExchange, @Uniswap, @sparkdotfi, @pendle_fi

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。