A legislative game defining the future of digital assets in the United States for the next decade is reshaping the regulatory landscape with a clearly delineated "five-step chess" approach, moving from ambiguity to quantifiable standards.

In front of the Senate Agriculture Committee, the timing of the hearing for the "CLARITY Act" has changed several times, ultimately settling on this Thursday.

This back-and-forth not only reflects the complexity of the legislative process but also highlights the importance of this bill as a "watershed" for cryptocurrency regulation in the U.S. The bill itself is well-structured, with core content divided into five parts (Title I - Title V), covering definitions, issuance, regulation, and innovation support, thereby constructing a complete regulatory loop.

I. Legislative Process: The Game from the House to the Senate

● The legislative journey of the "Digital Asset Market Clarity Act" (CLARITY Act) began in 2025. In mid-last year, the U.S. House of Representatives passed the bill with an overwhelming majority (294 votes in favor, 134 votes against).

● The bill then entered the Senate review stage, which is currently the focus of news. According to the latest congressional legislative tracking records, the revision game in the Senate version is particularly critical.

● Senate Banking Committee Chairman Tim Scott released the latest revised text on January 12, 2026, following bipartisan negotiations, which adjusted the content compared to the original version from the House.

For example, it further strengthened the criminal liability constraints on stablecoin issuers and refined the verification procedures for "blockchain maturity."

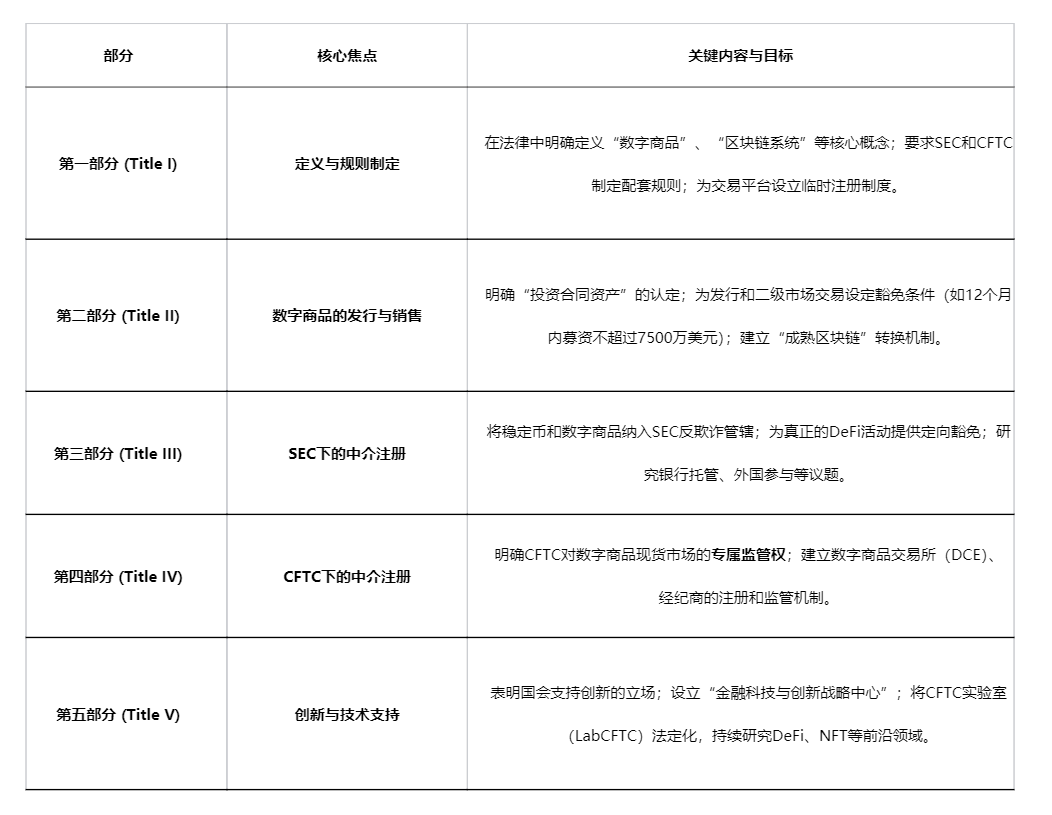

II. Core of the Bill: A Clear Five-Part Regulatory Framework

The text structure of the "CLARITY Act" serves as its logical framework, aiming to systematically address regulatory ambiguities. The core content and objectives of its five parts are as follows:

III. Key Innovation: A Paradigm Shift from "What Is It" to "Who Controls"

● The most significant breakthrough of the bill is the introduction of a "control-based maturity framework," which fundamentally changes the logic of regulatory judgment. It no longer gets entangled in the qualitative debate of "whether a certain token is a security," but instead shifts to assessing the objective fact of "who controls the blockchain system."

● A project wishing to transition its native asset from "security" to "digital commodity," thereby escaping the strict regulation of the SEC and entering the CFTC framework, must prove that it meets the "mature blockchain" standard. This typically means that no single entity can control the network, for example, the total governance voting rights held by all related parties must not exceed 20%.

● This framework provides projects with a predictable, objective compliance evolution path: transitioning from centralized control during the startup phase (subject to securities-like regulation) to decentralized governance in the mature stage (subject to commodities-like regulation).

IV. Far-Reaching Impact: Reshaping Markets, Protecting Innovation, and Clarifying Rights and Responsibilities

● A "safe harbor" for DeFi and developers: The bill provides crucial legal exemptions for decentralized finance (DeFi). As long as the protocol does not custody user assets or act as a financial intermediary, its developers, node operators, and front-end interface providers do not need to register with the SEC or CFTC. This removes the "sword of Damocles" that has long hung over DeFi developers.

● Strict regulation of centralized institutions: In contrast to the exemptions for DeFi, the bill imposes clear registration and compliance requirements on centralized exchanges, brokers, and other intermediaries. They must register with the CFTC as "digital commodity exchanges" and comply with traditional financial-level rules regarding capital reserves, customer asset segregation, and anti-fraud measures, aimed at preventing a repeat of FTX-style tragedies.

● Empowerment of traditional finance and users: The bill provides a legal basis for traditional financial institutions like banks to engage in cryptocurrency asset business, opening the door for traditional capital compliance entry. At the same time, it explicitly clarifies users' self-custody rights at the federal legislative level, ensuring individuals' freedom to conduct peer-to-peer transactions using non-custodial wallets.

V. Controversies and Challenges: An Unfinished Path and Power Struggles

Despite widespread support, the "CLARITY Act" still faces controversies and challenges.

● Regulatory coverage gaps: The bill primarily focuses on "digital commodities" and does not provide clear regulatory pathways for tokenized securities, derivatives, and other assets. While it exempts DeFi from federal intermediary regulation, it does not fully prioritize the diverse regulatory laws of various states (such as New York's BitLicense), which may lead to compliance fragmentation.

● New challenges for anti-money laundering (AML): The bill imposes the requirements of the Bank Secrecy Act on centralized intermediaries. However, critics point out that cryptocurrency assets can be transferred directly without intermediaries, leaving loopholes for law enforcement. How to effectively monitor illegal fund flows in a decentralized environment without infringing on privacy remains a challenge that the bill has not fully addressed.

● Political power struggles: The bill requires 60 votes to pass in the Senate, meaning it must garner significant Democratic support. Some Democratic lawmakers, such as Elizabeth Warren, have warned that the bill could be used by large companies to evade SEC regulation. Former CFTC Chairman Timothy Massad has also publicly stated that the bill's provisions on anti-money laundering are "not sufficient."

Looking out from the hearing room of the Senate Agriculture Committee this Thursday, the cryptocurrency market's trends flicker on the screens. Analysts on Wall Street and developers in Silicon Valley are all waiting for a clear signal. The "Fintech and Innovation Strategy Center" established in the fifth part of the bill has yet to open its doors, but the blueprint has been drawn.

Behind this door may lie a new regulatory era dominated by quantitative characteristics rather than qualitative narratives.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。