Changes in Bitcoin On-Chain Data for Week 4 of 2026 — Weaponization of Tariffs

The past two weeks can be described as Trump's tariff weeks. After last week's tariff TACO on Greenland, Trump has once again begun to threaten tariffs on Canada and South Korea. Meanwhile, the Supreme Court, which can balance Trump's IEEPA tariffs, is currently in recess, with the next hearing not scheduled until February 20. During this period, Trump's tariff policy remains one of his biggest weapons.

Recent Bitcoin Price Trends

From the actual results, the price of $BTC has remained in a volatile trend over the past two weeks. However, if we extend the timeframe, we can see that Bitcoin's price has been fluctuating around $90,000 for the past two months, and once it breaks above $90,000, various situations arise that cause it to drop back down.

The so-called $90,000 curse does not seem to have been completely lifted, but considering the recent influx of capital into the U.S. stock market, with the S&P 500 continuously breaking historical highs, if this trend continues, Bitcoin, which has a high correlation with the stock market, should find it not too difficult to break free from the $90,000 constraint. The challenge lies in the fact that BTC behaves like a leveraged tech stock, which means it can drop even more when it falls.

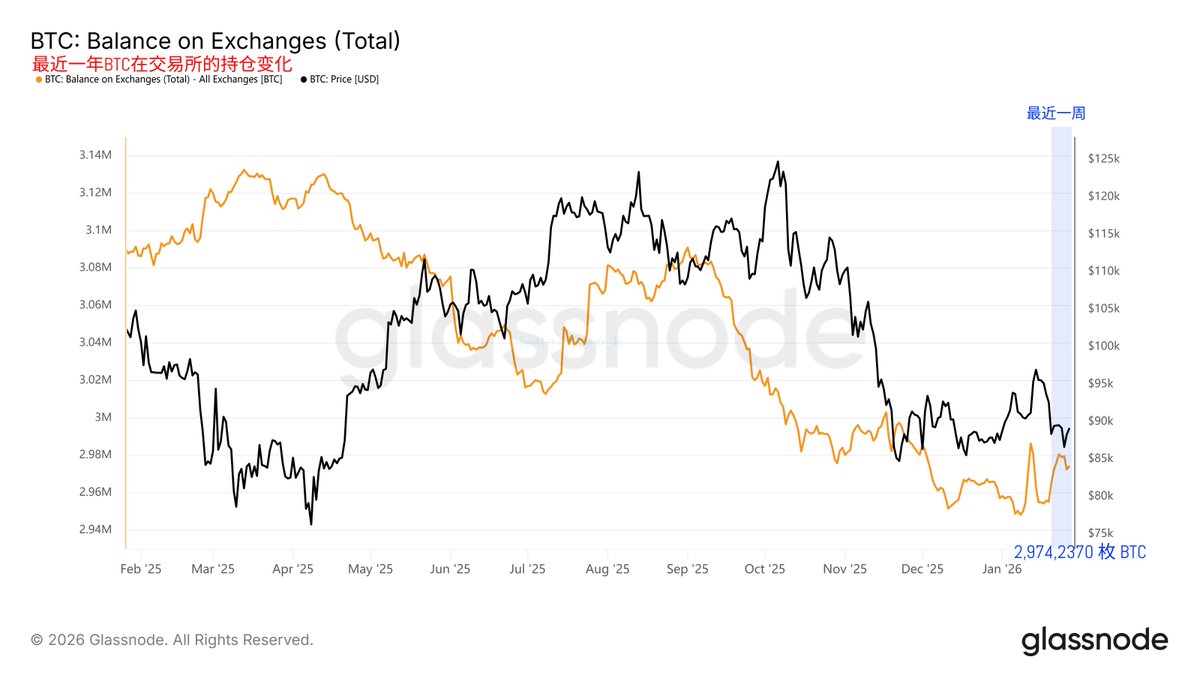

Bitcoin Inventory on Exchanges Over the Past Year

Since we know that investors are actively buying U.S. stocks, believing that the stock market will perform well in 2026, at the very least, BTC sell-offs should not be too significant. Even if investors buy less, the selling volume is unlikely to be large. Data from Bitcoin inventory on exchanges shows that despite the continuous negative news over the past week, the amount of Bitcoin transferred to exchanges for sale is not substantial, with only about 20,000 more BTC transferred compared to last week's low.

Although approximately 19,000 of these transferred coins have not yet been absorbed, this inventory is not enough to impact the changes in spot prices, and the current inventory on exchanges remains at a relatively low level.

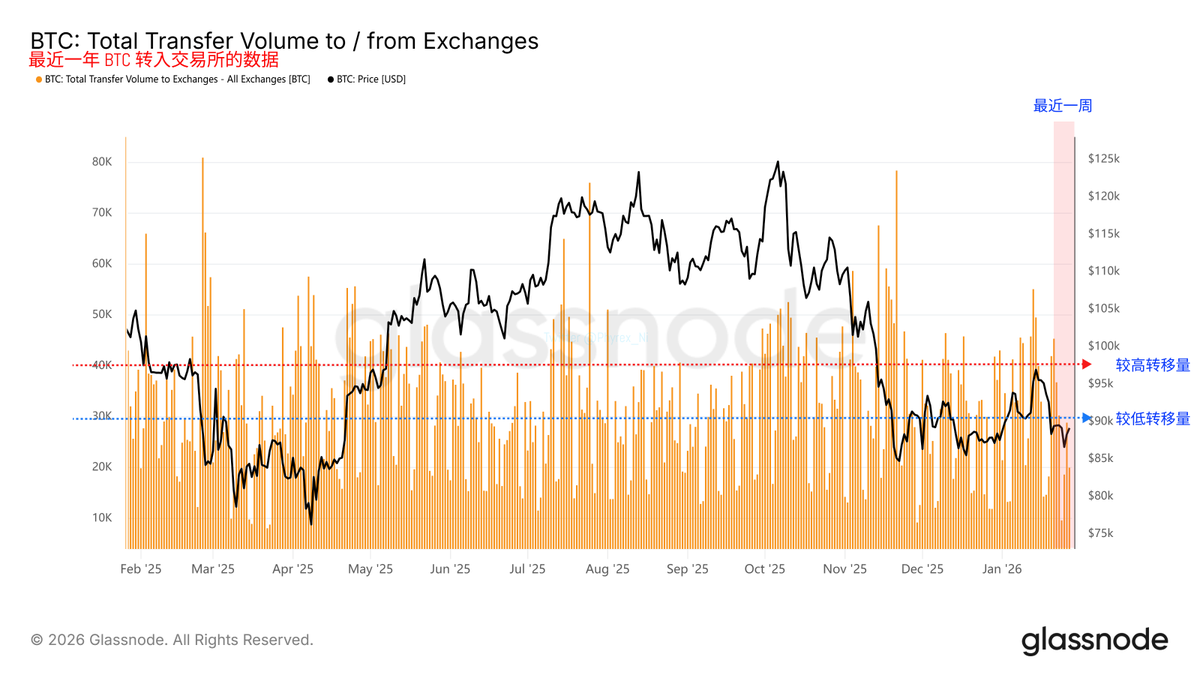

Bitcoin Transferred to Exchanges Over the Past Year

Moreover, looking at the data from the past three weeks regarding Bitcoin transferred to exchanges, the slight panic selling caused by tariffs seems to have almost ended. During the three working days of this week, the amount of $BTC transferred to exchanges has reached a very low level, indicating that sell-offs do not significantly impact prices; rather, it is more likely due to low buying volume.

In fact, data from Bitcoin spot ETFs also shows that two weeks ago, just before the Greenland tariffs, U.S. spot ETFs had a net inflow of over 15,000 BTC. However, in the past week, under the threat of tariffs on Greenland and Canada, U.S. investors experienced a net outflow of over 15,000 BTC, which perfectly offsets the previous inflow. This indicates that traditional investors are currently more in the realm of speculation regarding cryptocurrencies, and there is still a gap to bridge with the purchasing power of the "Federal Reserve."

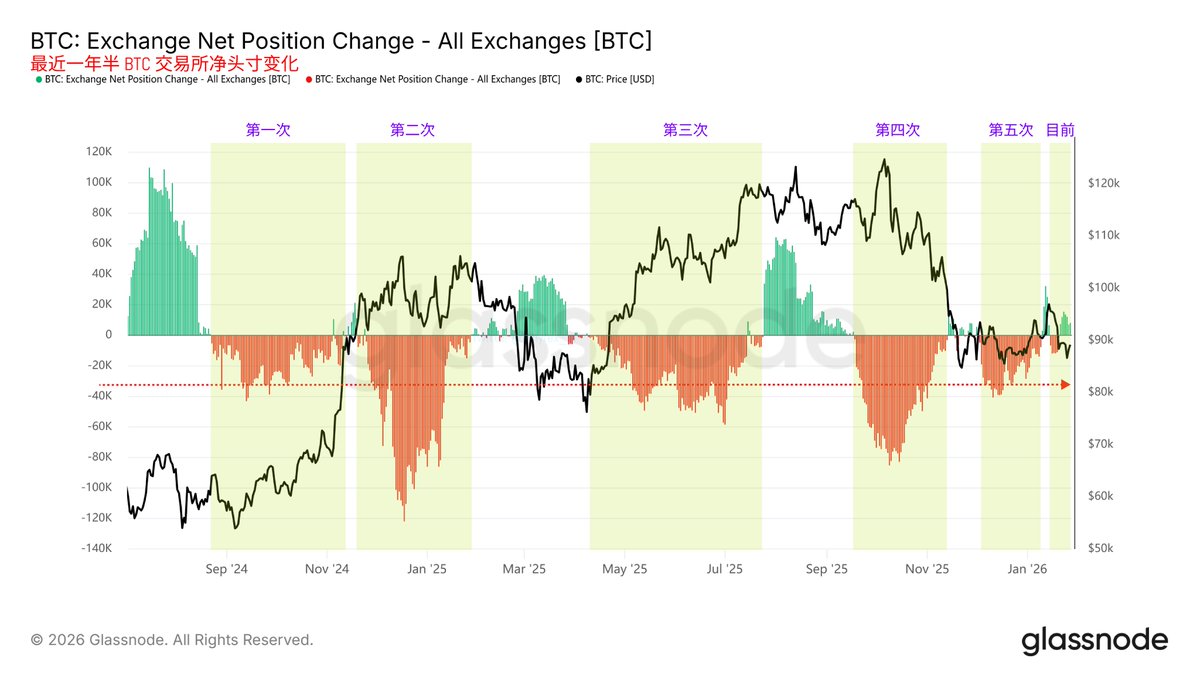

BTC Positions on Exchanges Over the Past Year and a Half

In previous weekly report data, I have often used the 30-day change in exchange inventory as a measure of purchasing power. It is evident that the recent data, particularly from the fifth large-scale withdrawal from exchanges, indicates that the purchasing power was not very strong, lasted for a short time, and the amount withdrawn was also low, which shows that Bitcoin's actual liquidity remains poor.

In recent days, however, there has been a net inflow situation. With fewer transfers to exchanges, a net inflow can only indicate that purchasing power is extremely low.

This situation also occurred in the second half of last year, indicating that Bitcoin's rise was not due to a significant increase in purchasing power, but rather a decrease in sell-offs. Currently, if sell-offs continue to decrease, it will greatly assist in the upward volatility of the $BTC price, and the likely reason for the reduction in sell-offs is the positive momentum in the U.S. stock market.

This week's focus should be on the Federal Reserve's interest rate meeting. However, with the countdown to Powell's departure, the last three interest rate meetings have been just that. Even if Powell continues to serve as a governor at the Federal Reserve, it cannot change the fact that Trump's confidants will convey dovish sentiments during press conferences.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。