Good evening everyone, I am Xin Ya. A few days have passed since the last update, and the pressure at 91200 is manageable. If it goes up a bit more and then drops, could it be a three-eat situation?

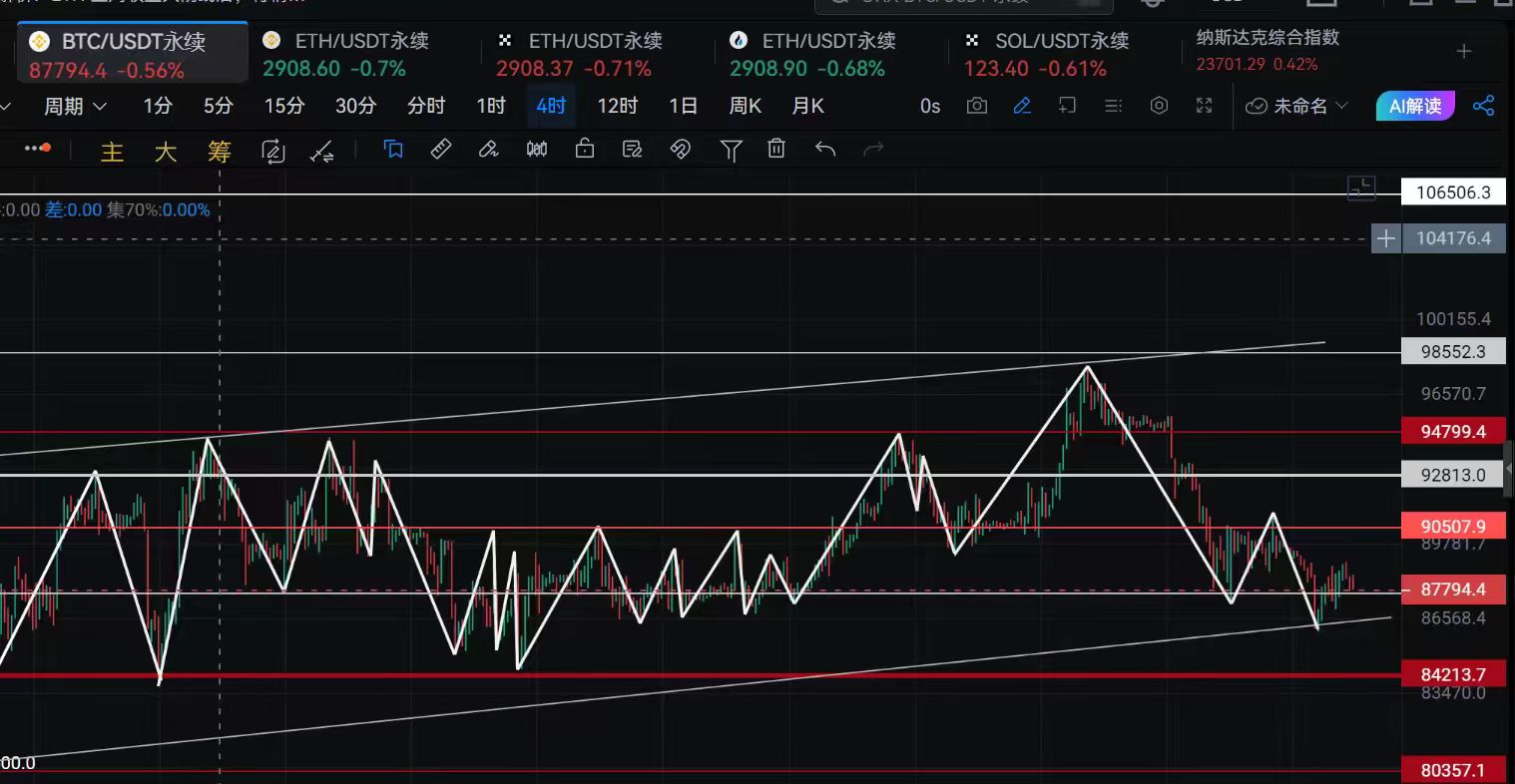

Since the evening of the 23rd, Bitcoin started to rise, and at eleven o'clock, three waves of buying pressure pushed the price up to around 91200, where it faced resistance. The following four hourly candlesticks brought the price back to the starting point. For the next two days, it oscillated around the one-hour EMA30. Since 91200 is also near the one-hour EMA120 and EMA144, there is strong resistance, and the four-hour EMA120 and EMA144 are very close to each other. Such key positions facing resistance have always been significant for the market. After failing to stabilize above the one-hour EMA30, the market was first pushed down.

Starting from ten o'clock on the evening of January 25, Bitcoin experienced six consecutive hourly bearish candles, which was also the last bearish candle of the four-hour six consecutive bearish candles. This sell-off caused Bitcoin to drop by two thousand points, reaching around 86000. The weekend's market actually had no significant meaning; it was purely a liquidity suppression, merely testing support without any upward advantage. Monday was a day of repair with nothing noteworthy. Since five o'clock today, there have been six consecutive hourly bullish candles, but after facing resistance at the one-hour EMA120 around 89000, it produced eight consecutive bearish candles, with the lowest price around 87800, which is below the one-hour EMA30 but above the starting point of the bullish candles. This indicates that the market will first consolidate. Since the weekend sell-off tested once, and Monday tested once, further tests will likely prioritize upward testing.

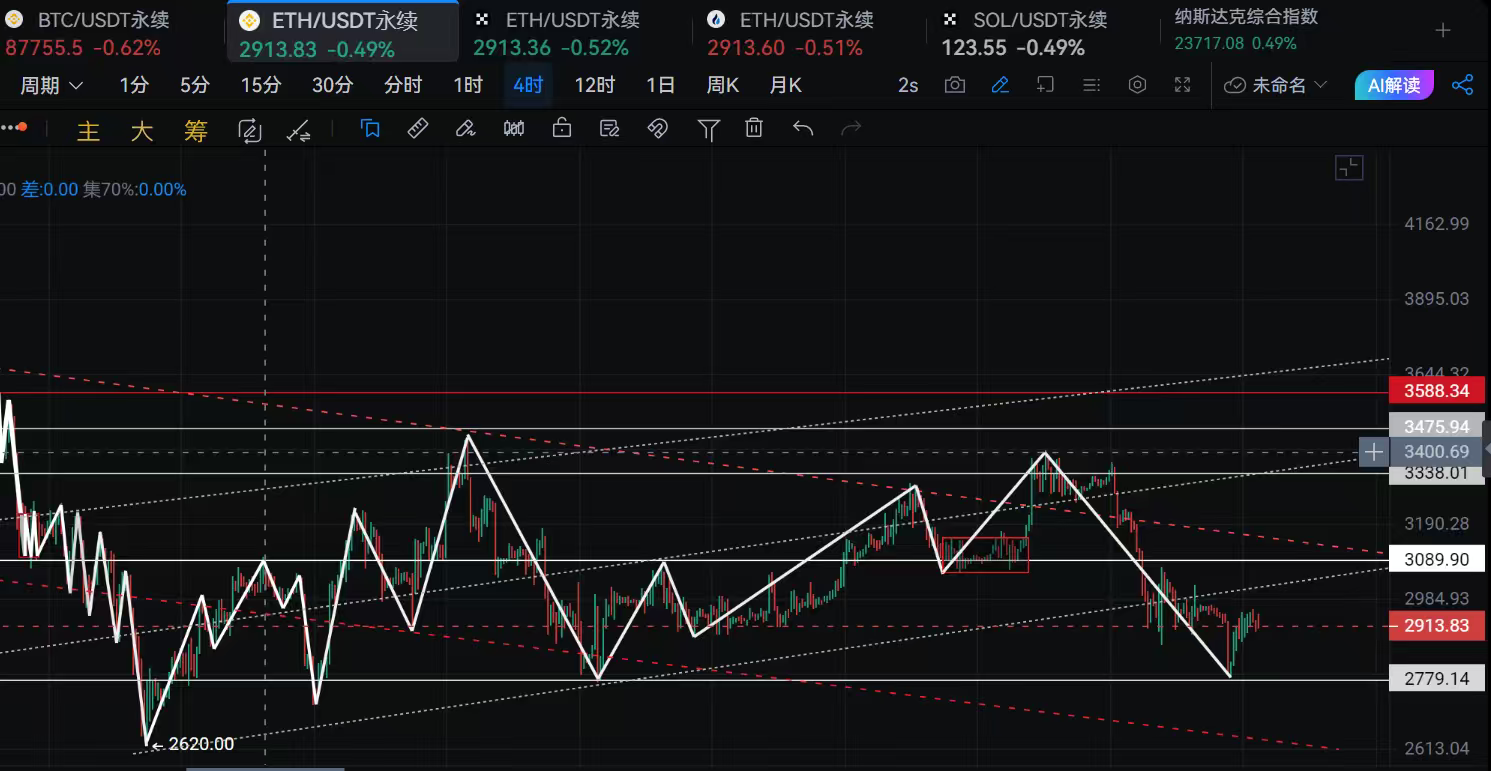

Ethereum's trend is somewhat independent and complex. Starting from the evening of the 25th, there were eight consecutive hourly bearish candles, with the price dropping from around 2940 to a low of around 2780, a drop of 250 points. It took twenty-four hours to return to the starting point. During this time, there were three concentrated buying waves, each exceeding the volume of the sell-off. On the evening of the 26th, it faced resistance at the one-hour EMA120, retracing while bouncing off the EMA7 and EMA30. Throughout this process, it frequently faced resistance at the EMA120. The current hourly candle just rose but faced resistance again, indicating clear competition among the main players. The first sell-off was to find support, while the subsequent upward tug-of-war saw buying pressure not increasing, high points not holding, and retracements not breaking through, purely a reaction to the market sentiment. If I were the main player, after facing resistance at ten o'clock, I would first sell off to test the lowest point of the weekend's bullish candle. This might also be the thought of the market makers. The impact of the bullish and bearish candles at ten o'clock on the evening of the 26th, although the second bearish candle did not engulf the bullish one, followed by a small three bullish candles, has already been digested by the frequent resistance and oscillation, so it does not need to be specifically marked.

We should focus on the one-hour EMA144 around 89200 and the four-hour EMA144 around 90800 above, while paying attention to 86800 and 85800 below. For Ethereum, we focus on 2945 and 3000 above, and the range of 2850-2880 below, as well as 2780.

Currently, Bitcoin and Ethereum have clearly different frequencies in their market makers. After oscillating and digesting, they will unify direction. Both high selling and low buying are possible, with Ethereum expected to mainly oscillate in the range of 2838-2942. Set stop losses thirty points away, and it is advisable to handle multiple high-frequency short positions. Bitcoin will consolidate and digest around the large range of 85500-89500. For Bitcoin, focus on high-frequency buying, operating in two segments: enter at 86500, add at 85500, and set a stop loss at 85000.

Supporting a bountiful year, WeChat Official Account: Xin Ya Talks About Trading

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。