Original Title: Silver Moon

Original Author: @abcampbell, Ex Bridgewater

Original Compilation: SpecialistXBT, BlockBeats

Editor's Note: This article analyzes how irreversible industrial demand, rigid supply bottlenecks, and strategic capital flows have become the driving forces behind the surge in silver prices, while calmly pointing out potential risks such as the rebound of the dollar and technological substitutes, providing investors with a "weather vane" to observe the true strength and weakness of the market.

The following is the original content:

It has been a month since we last discussed silver.

A month ago, the annual increase in silver prices was 45%.

Do you remember I mentioned that the situation was about to become "terrifying"?

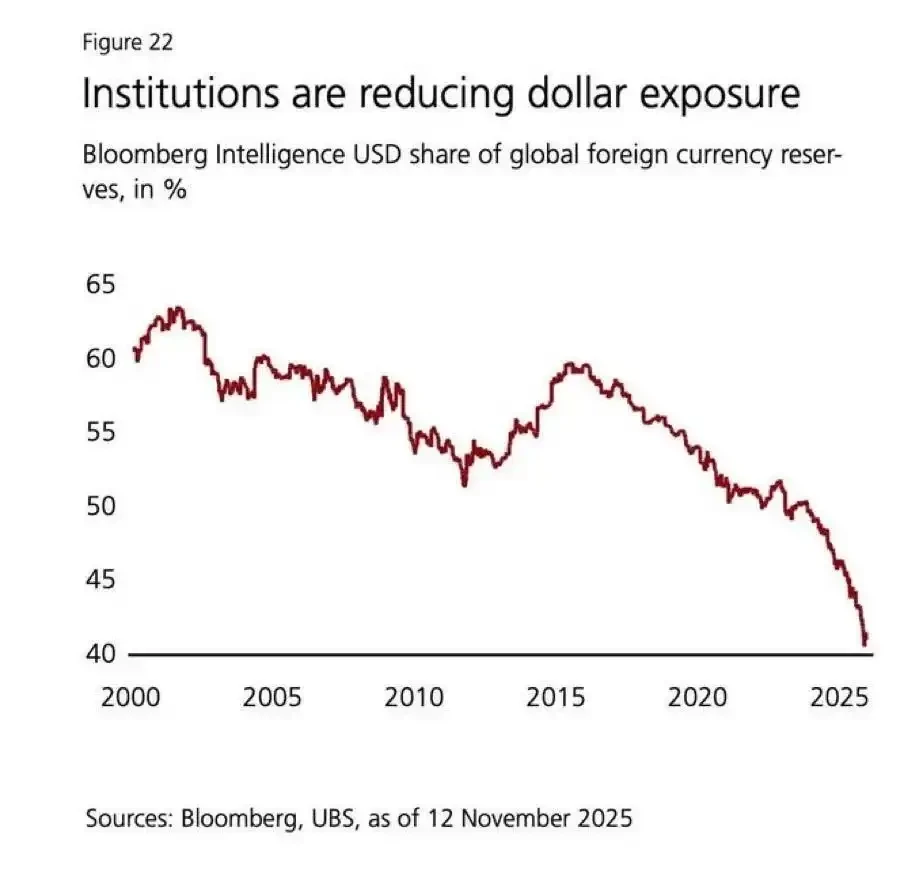

Over the past year, silver trading has experienced a transformation from obscurity to a remarkable bull market, culminating in a change significant enough to alter the course of history. The driving factors we pointed out years ago—rigid demand from solar energy, rigid supply due to mining dynamics, Veblen-style speculative capital flows, strategic purchases by investors to diversify dollar risk, capital flight from emerging markets due to concerns about the banking system, and strategic stockpiling behaviors—have all manifested and are now in full swing.

However, this surge feels less like a celebration and more like a doomsday clock ticking away. This is not directed at silver itself, but at the dollar and the global order it supports. It is a signal that the world our descendants will live in will be vastly different from the world of our forebears.

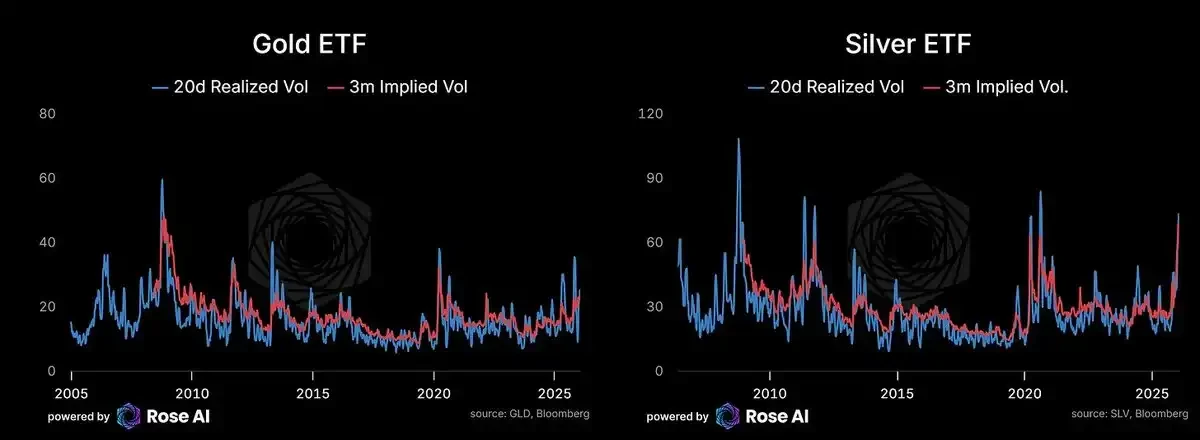

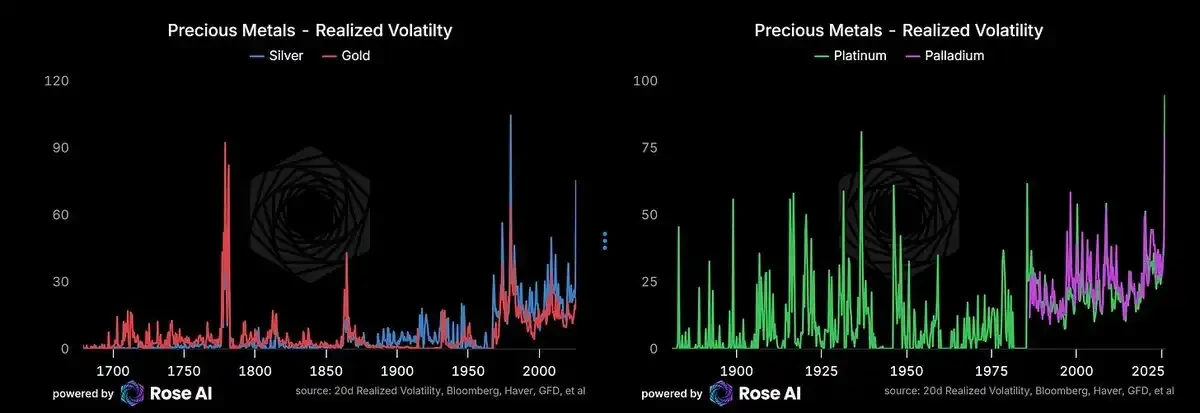

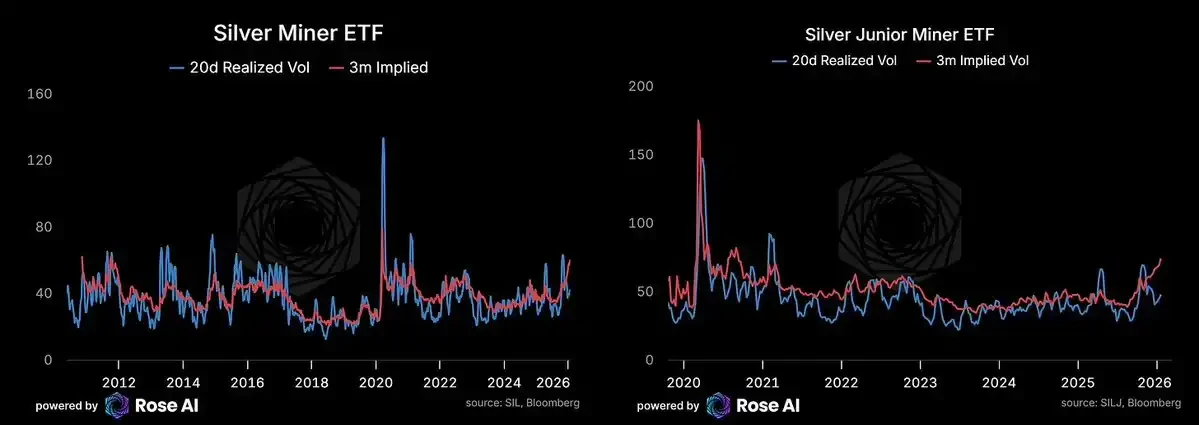

The options market is pricing in a volatility of over 4% for the coming months, and it is expected to remain at 3% in the foreseeable future. This has been corroborated by realized volatility. In recorded history, there have only been two periods of higher volatility for silver: during the Hunt brothers' manipulation in 1981 and during the American Revolutionary War (when volatility stemmed from local currency collapse against the pound, rather than price changes of the metal itself).

Gold volatility has also risen—this aligns with broader currency devaluation trades, diversification of funds flowing out of emerging market currencies, and the trend of countries seeking alternatives to government bonds in their reserve portfolios.

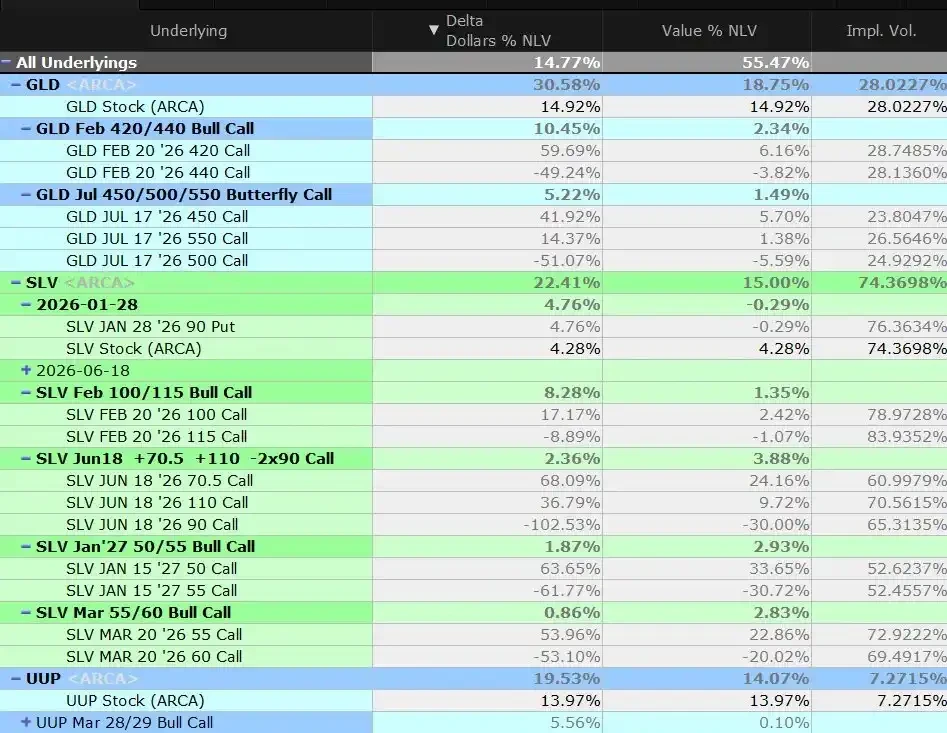

In short: we have reallocated gold, and last week, when spot prices broke through the middle strike price, we closed out just over half of our butterfly arbitrage positions, while still maintaining a long position.

At the same time, we maintain short positions in U.S. stocks and U.S. bonds/credit, along with a small portion of long dollar positions to hedge against some of the dollar short risk implied in our metal holdings.

What Drives It

In a market where solar/AI demand leads to structural supply shortages, capital flight from China remains a core short-term driver.

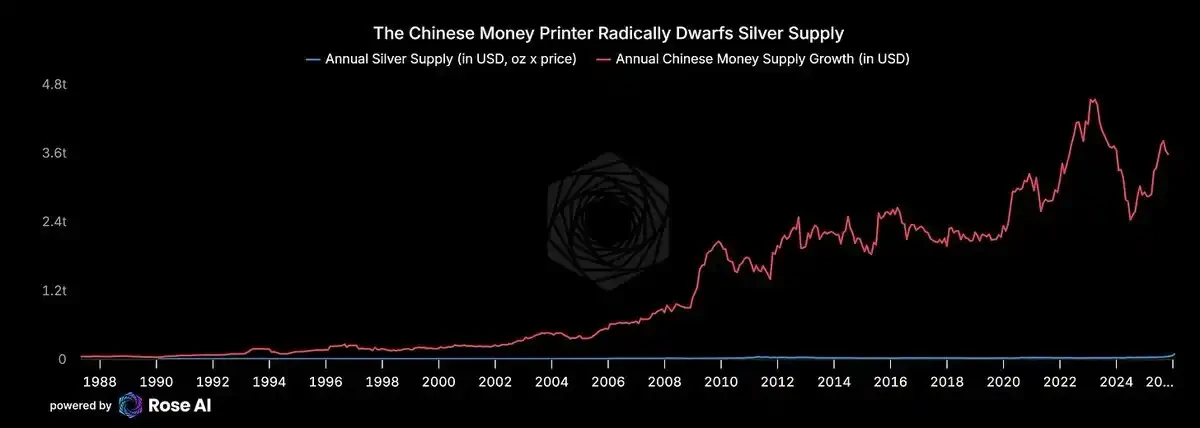

Looking back at why we entered this trade—seeking assets that can appreciate due to capital flight from China. Including recycling, global silver supply is only about 1 billion ounces per year. At $100/ounce, this is a market worth hundreds of billions. Meanwhile, China's "money printer" adds about $3 trillion in bank deposits each year. Since it is now common knowledge that real estate is no longer a safe store of wealth, even a slight shift in savings behavior could disrupt the silver market.

This is exactly what you are witnessing.

If you are a wealthy Chinese family, would you want to put more money into a zombie banking system with trillions in hidden losses? Or would you prefer to buy physical silver at high prices and bear the risk of a 30% pullback? When your other option is to deposit in a technically insolvent bank, the answer is obvious.

Chinese real estate bonds are being sold off again. Stocks in our "worst banks in China" basket are also turning down.

Funds from India and the Middle East are also flowing in. If you are an Indian oligarch, would you want to hold a currency that has depreciated over 20% against the dollar since 2020?

European institutions are finally waking up. If you are a European pension fund with 40% of your assets allocated to U.S. bonds and stocks (many of which are illiquid and overvalued—such as private equity, venture capital, and private credit), you have been underweight in metals for years. Now, you have both political diversification reasons, and your investors are questioning why you missed this wave.

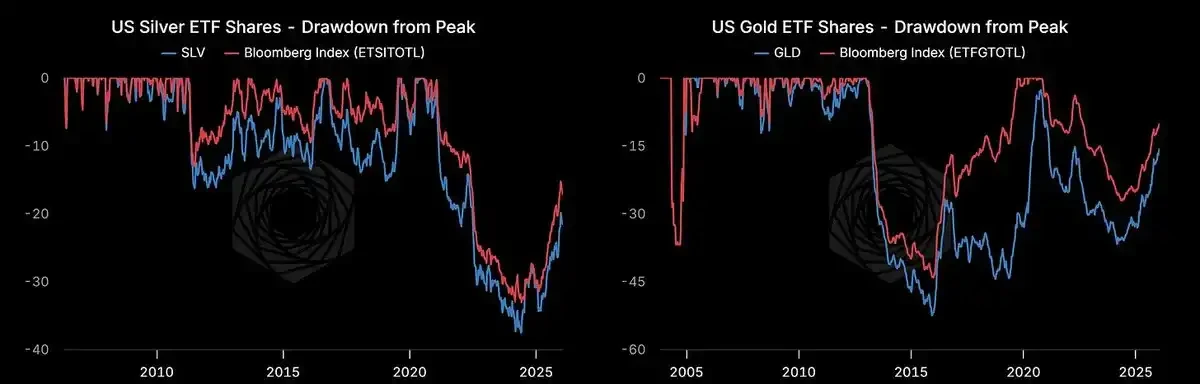

Official purchases seem inevitable. Asian demand appears to be endless. The rebalancing trades that suppressed retail demand at the end of last year are now a thing of the past. ETF inflows are strong, but still below historical highs.

At this moment, the question seems to be not whether the government will establish a strategic reserve of silver, but when it will begin.

Why We Remain Bullish

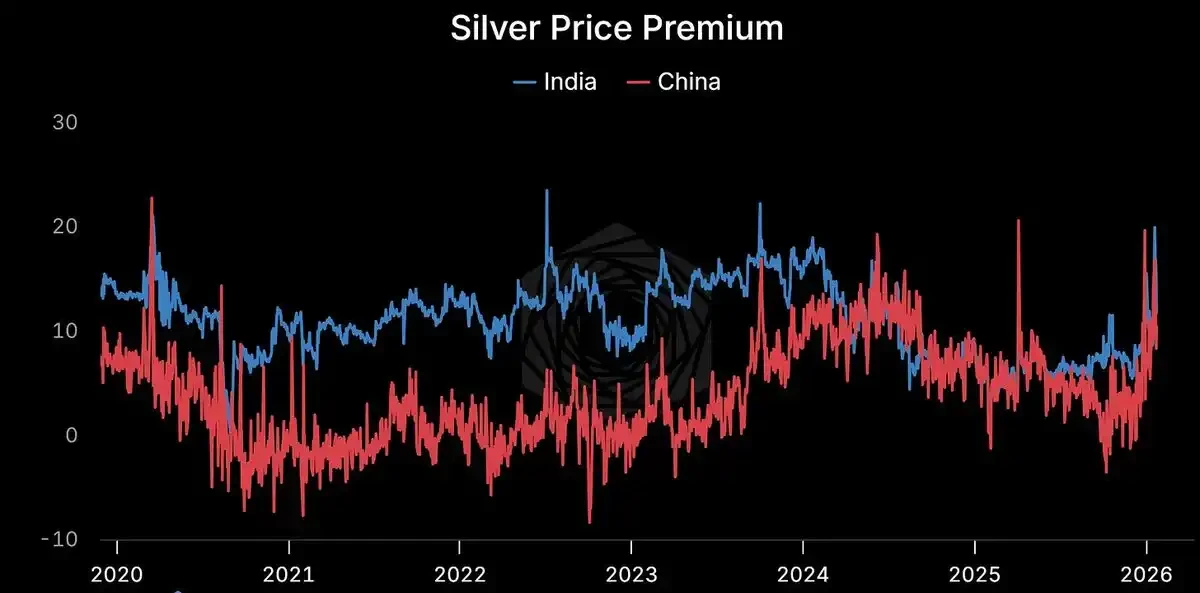

Premiums persist.

Shanghai: $114/ounce. COMEX: $103/ounce. A premium of over 10%. It persists. Structurally.

When physical prices diverge so significantly from paper prices, one side must be wrong. History tells us that it is usually not the physical.

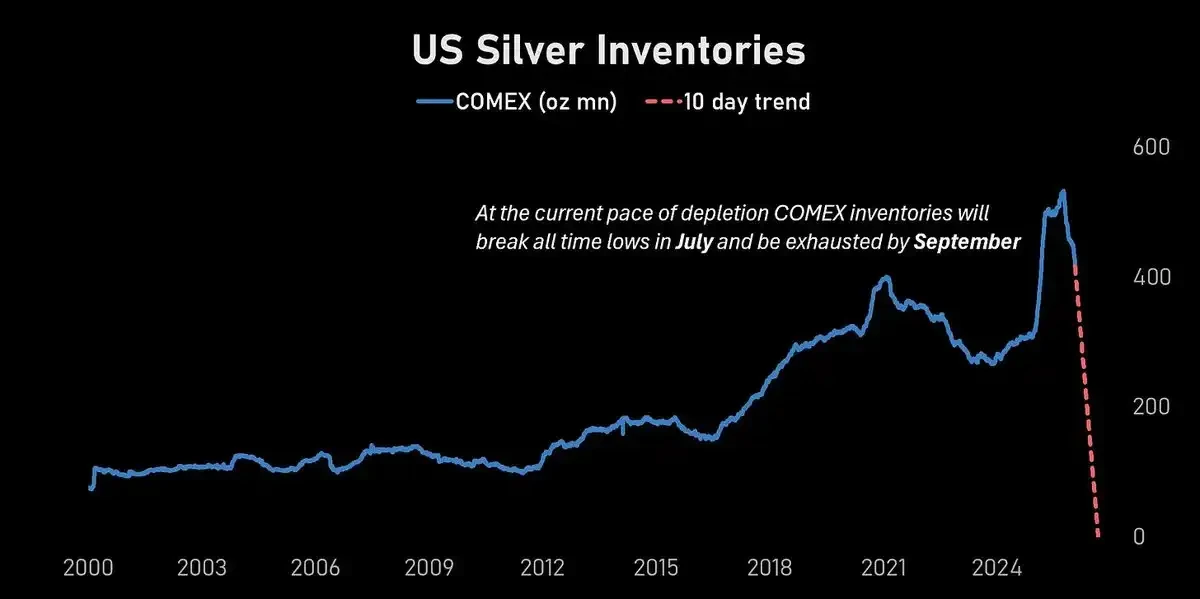

COMEX inventories are plummeting.

At the current consumption rate, COMEX inventories will hit historical lows in July and will functionally run out before September.

In a market with an annualized volatility of 70%, it is hard to see that far ahead. But the direction is clear.

ETF fund flows still have room to grow.

U.S. silver ETF shares are rising, but are still about 20% lower than the peak in 2021. We have not yet reached a frenzy stage.

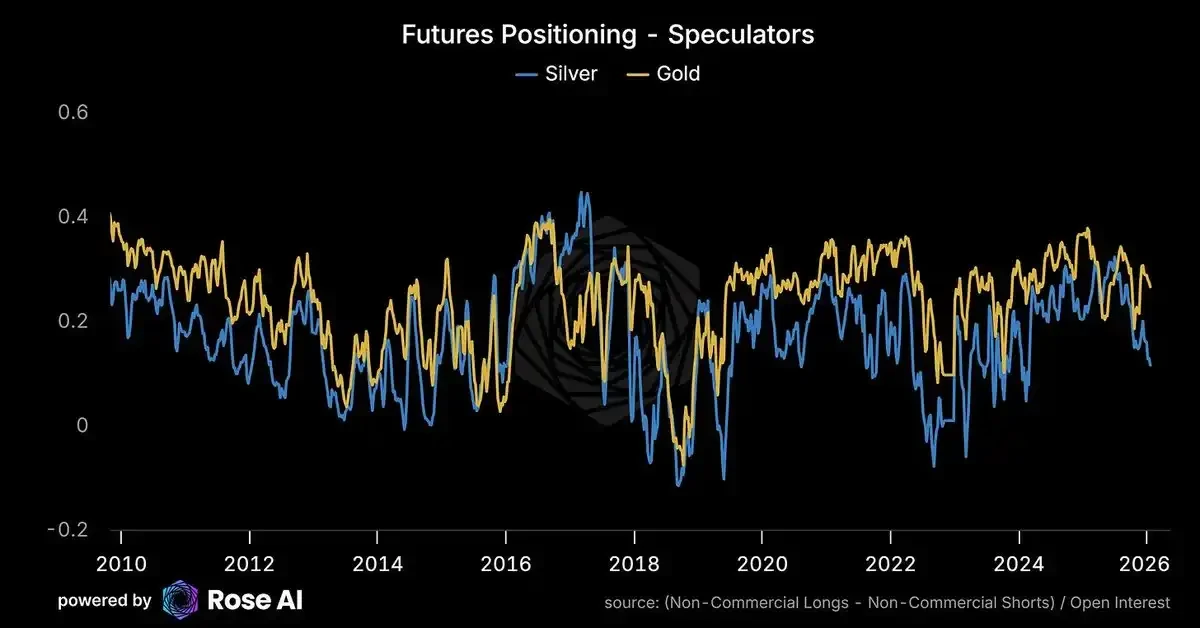

Speculative positions are not crowded.

Western speculators have actually reduced their long positions and attracted shorts as prices broke through historical highs. Positions are not extreme.

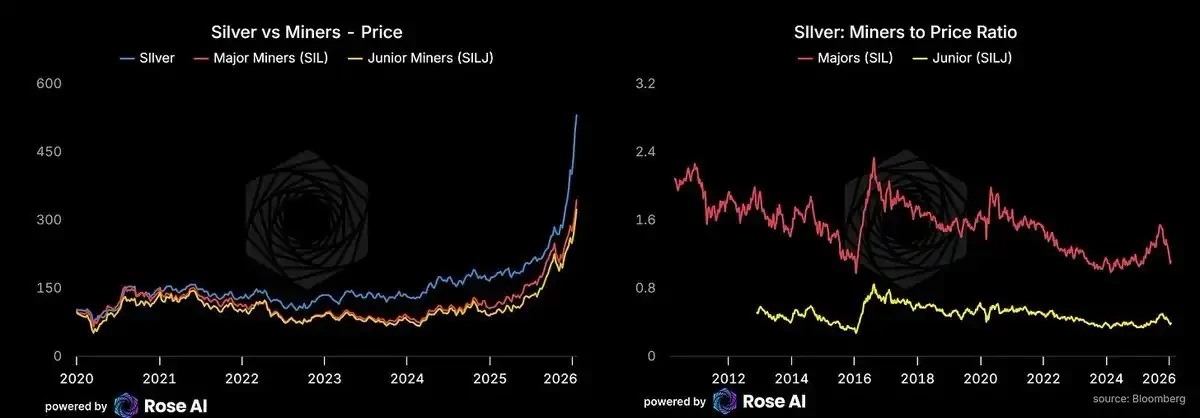

Mining stocks are lagging.

Mining stocks are catching up, but are still underperforming the underlying commodities themselves. If energy prices remain low (watching the Strait of Hormuz), mining stocks may have a catch-up rally. We are going long primary miners through stocks rather than options—mining options appear expensive relative to realized volatility.

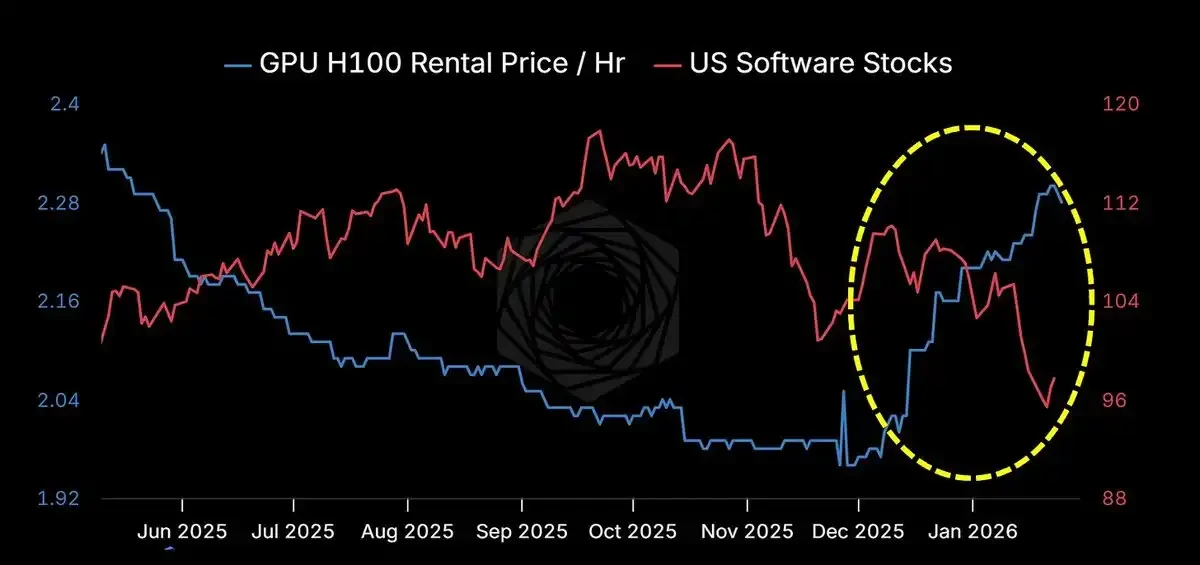

AI Accelerates Further

Claude Code and its imitators/branches (Codex, Ralph Wiggins, Clawdbot) are showcasing the true nature of "agents." The focus is not on complex workflows, but on crossing the trust threshold: you grant machines full access to your computer, files, and applications. Hackers and enthusiasts are racing to buy Mac Minis. I have built an agent framework (hoping to release it this month). Memory sticks are sold out. Rental prices are soaring, while traditional SaaS businesses are languishing. Perhaps software devoured the world, and then GPUs devoured software.

The manifestation of cash flow will take time, but the machine age has arrived. More machines mean more data centers. More data centers mean more power demand. More power demand means more solar energy.

More solar energy means more silver.

Potential Risks

A strong dollar is a recent risk.

The recent rise has been exacerbated by a weak dollar. If the U.S. economy continues to grow robustly, the large expectations for rate cuts implied in the two-year interest rate curve may be removed, pushing the dollar higher. The recent weakness of the dollar has undoubtedly intensified this latest surge.

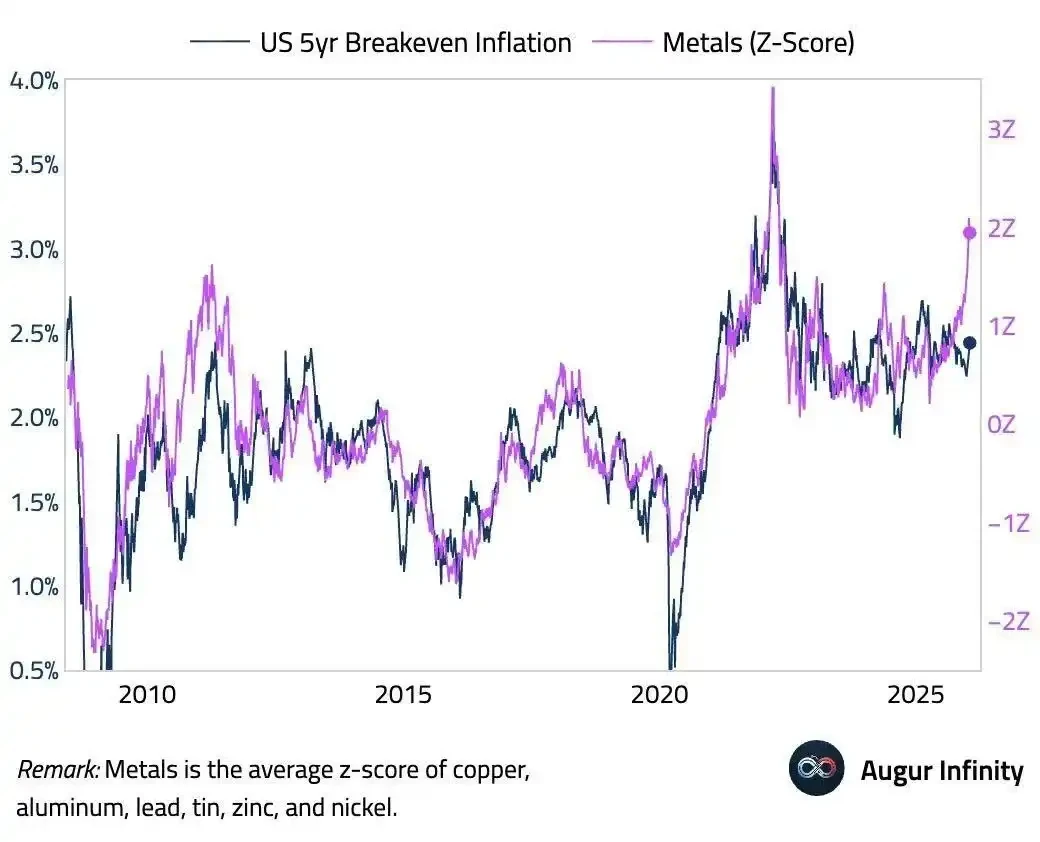

A strong dollar + high prices = panic exit for weak holders. Those speculators who chased prices above $100 are different from Chinese families who started accumulating from $30. Weak holders will cut losses and exit during a sharp reversal. If the chart below is correct, we are seeing an extreme dislocation between metal prices and the breakeven inflation rate. This could realign through rising interest rates/dollar and falling metal prices.

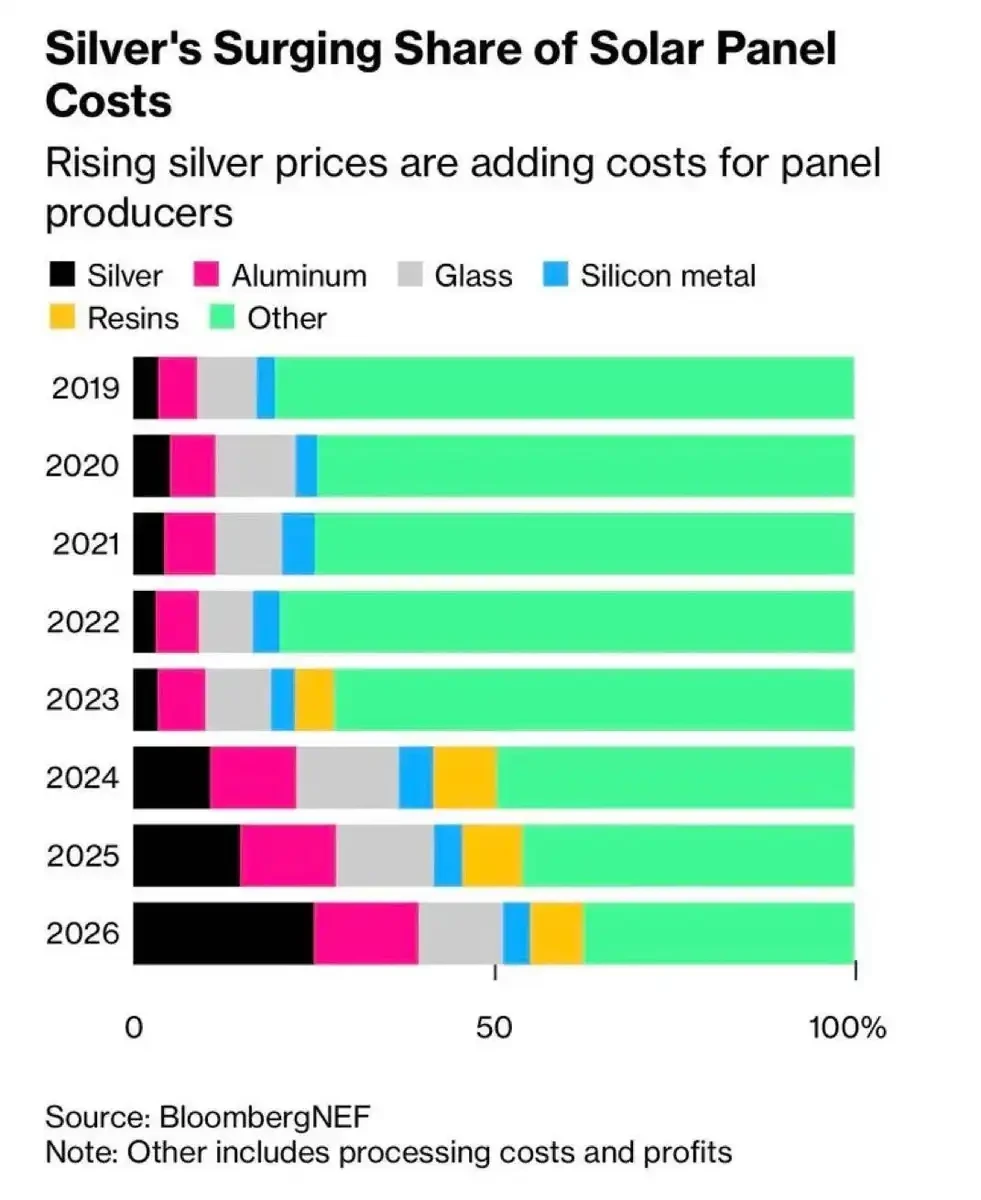

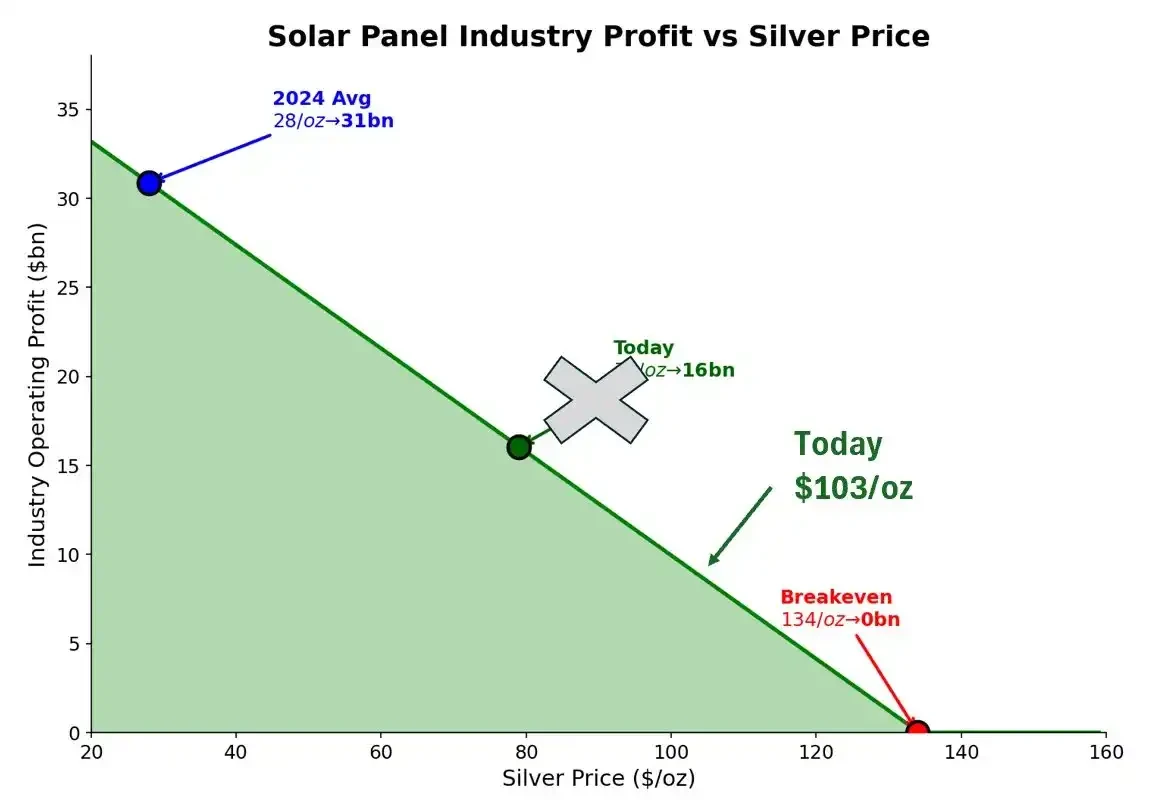

Silver prices are beginning to erode profits in the solar industry.

At a price of $103/ounce, this is no longer a negligible error for panel manufacturers. We are approaching the pain threshold.

At $28/ounce (average price for 2024), the industry's profit is $31 billion. At today's $103, profits could shrink to $8-10 billion. The breakeven point is at $134/ounce—only 30% away from the current price. In a market with 70% annualized volatility, this is not a comfortable cushion.

Copper substitution is accelerating.

Currently, prices are $22 lower than $125 (at which point the payback period for copper substitution investments drops to under a year). At that time, every board meeting will discuss conversion issues.

The economics are screaming "convert immediately." But physics tells us that it will take at least a few more years to achieve half the conversion. This is the time window.

Where does marginal supply come from?

Not from miners—supply is rigid and takes years to develop. Not from shorts—this is a physical market; you can't issue more metal like you would high-priced stocks. That leaves only recycling and melting jewelry. If anyone knows good silver recycling companies, please contact me.

Our Focus

Signals:

The persistent premium in Shanghai = structural demand, not noise.

The rate of COMEX inventory consumption = if it accelerates, the risk of a short squeeze in near-month contracts increases.

Dollar direction = a strong U.S. economy lifts the dollar index, cleansing weak holders.

Mining stocks catching up = when mining stocks start outperforming spot, retail investors are entering.

Official statements = the first central bank to announce the establishment of a silver reserve will trigger a buying frenzy.

Framework:

Focus on capital flows, not prices.

If Eastern physical demand continues to buy while Western speculators flee due to a strong dollar, that is accumulation. Buy on dips.

If Eastern premiums collapse while COMEX inventories stabilize, the short squeeze is being resolved. Take profits.

Trading Strategy

Prices are high. There is still demand for upward volatility.

When spot prices broke through the middle strike price, we closed half of our butterfly arbitrage. This structure was designed for this market, and we have profited.

Remaining positions:

Long gold through stocks and call spreads.

Long silver through stocks, call spreads, and post-roll butterfly arbitrage.

Long primary miners through stocks (not options—they're too expensive).

Long the dollar through UUP to hedge metal risk exposure.

Short SPY, HYG, TLT through put options and stocks.

We are long the near-month (March) COMEX contracts and short the June contracts—betting on inventory decline. May need to roll.

Net exposure: remain long, but through options. As spot prices rise, adjust the strike price. Wait for official and institutional buyers to catch up with price trends.

Core Conclusion

As prices rise parabolically, we are gradually reducing Delta risk exposure. But until we see any of the following combinations occur:

a) China actively addresses the real estate debt crisis.

b) The U.S. shifts towards fiscal responsibility.

c) The world becomes more peaceful (Ukraine, Taiwan, Iran).

d) Non-U.S. Western elites reach some agreement with the U.S.

… we will remain bullish. Although we will allocate some downside protection.

The driving factors that brought us here—capital flight, currency devaluation, solar demand, supply constraints—have not changed. They are still accelerating.

Silver at $103 is not the end. It may not even be the midpoint.

We are starting to see these same dynamics spread to other metals. Particularly copper, which is receiving significant attention from investors who missed the silver rally and are making rough estimates. The situation is not as dramatic as silver—copper does not have the same monetary/Veblen characteristics—but the story of AI power demand is real, and the supply constraints are similar. We are also long copper. More details to follow.

The silver moon is high, everyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。