Author: FinTax

Basic Positioning of CARF

CARF is a multinational tax information automatic exchange framework for crypto assets, with crypto asset service providers as the reporting entities, aimed at supporting tax authorities in various jurisdictions to obtain information related to crypto transactions of their taxpayers.

Global Implementation Progress and Timeline

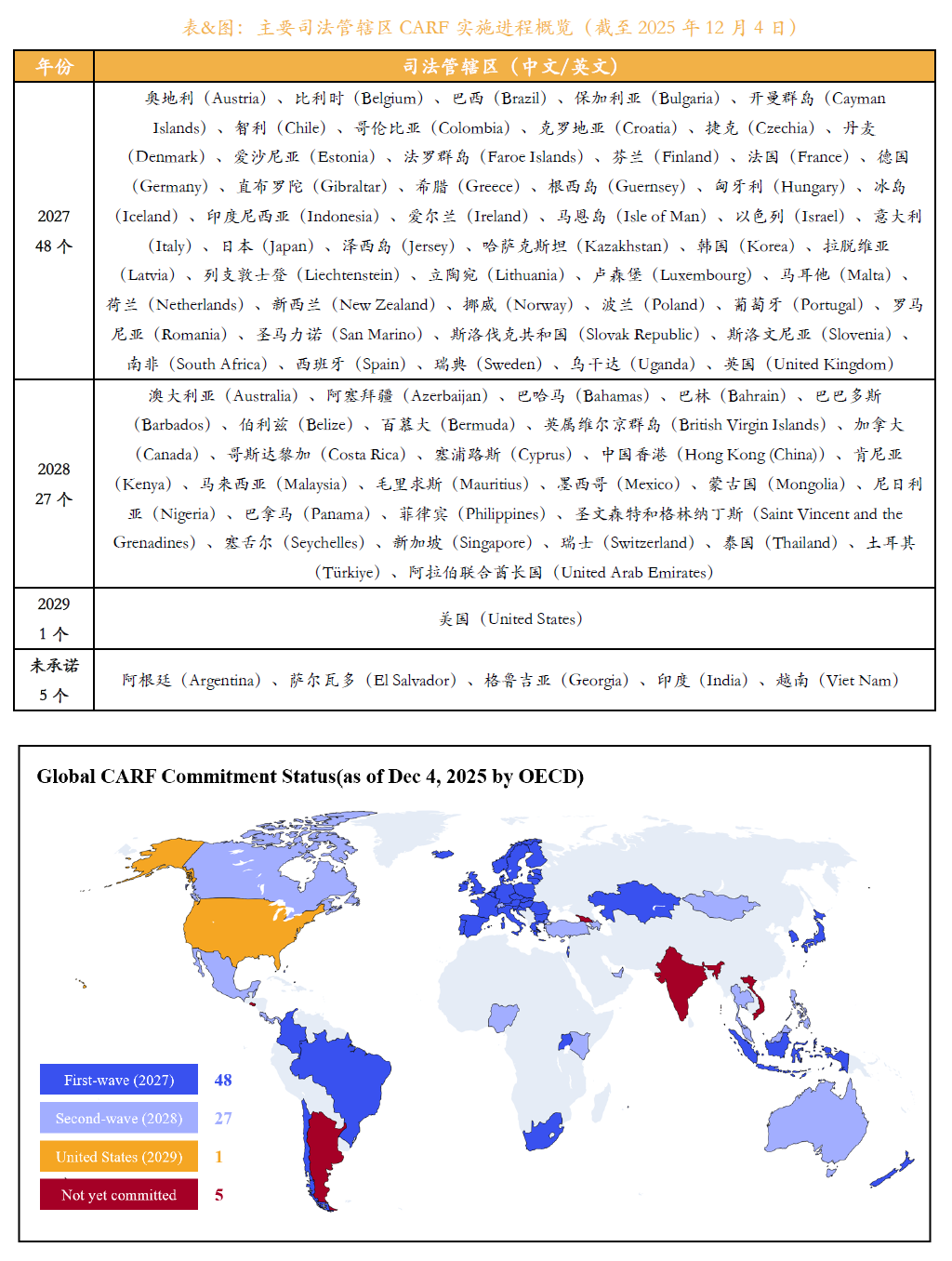

According to information released by the OECD Global Forum, by the end of 2025, 76 countries and regions have committed to implementing CARF, and the system will be rolled out in batches.

The first batch of jurisdictions plans to initiate the first automatic information exchange in 2027, mainly including the UK and EU member states; the second batch of jurisdictions plans to fully implement it in 2028, including Singapore, the UAE, and Hong Kong, China.

According to the system arrangement, the collection of relevant transaction data will start one year in advance. From 2026, crypto asset service providers will need to systematically organize reportable transaction information.

Hong Kong, China: Clearly Committed and Progressing as Scheduled

In the above arrangements, Hong Kong has clearly committed to implementing CARF and will advance related work according to the international timetable.

Hong Kong plans to start collecting crypto asset transaction data from 2027 and will conduct automatic tax-related information exchanges with other cooperating jurisdictions in 2028.

Crypto asset service providers operating under Hong Kong's regulatory framework must establish corresponding data compliance and reporting mechanisms, and relevant reportable transactions will be included in the cross-border information exchange process.

Mainland China: No Commitment and Not Within the Implementation Scope

In contrast, Mainland China has not yet made a commitment to implement CARF.

As of now, Mainland China is not included in any implementation batch of CARF and has not been listed by the OECD as a jurisdiction that, while relevant, has not yet committed to participation.

Under the current regulatory framework, Mainland China adopts a strict restrictive attitude towards cryptocurrency trading activities, and there are no legitimate crypto asset service providers within the country that can be included in the CARF reporting system. Therefore, there are no institutional conditions for participating in the regular information exchange of CARF in the short term.

Future Possibilities and Realistic Judgments

It should be noted that Mainland China has fully implemented CRS since 2018 and has mature experience in financial account information exchange.

If there are adjustments to the regulatory policies for crypto assets in the future, Mainland China has the conditions to connect with CARF at both the institutional and technical levels.

However, given the current policy environment, the likelihood of Mainland China joining this framework in 2027 and in the following years remains low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。