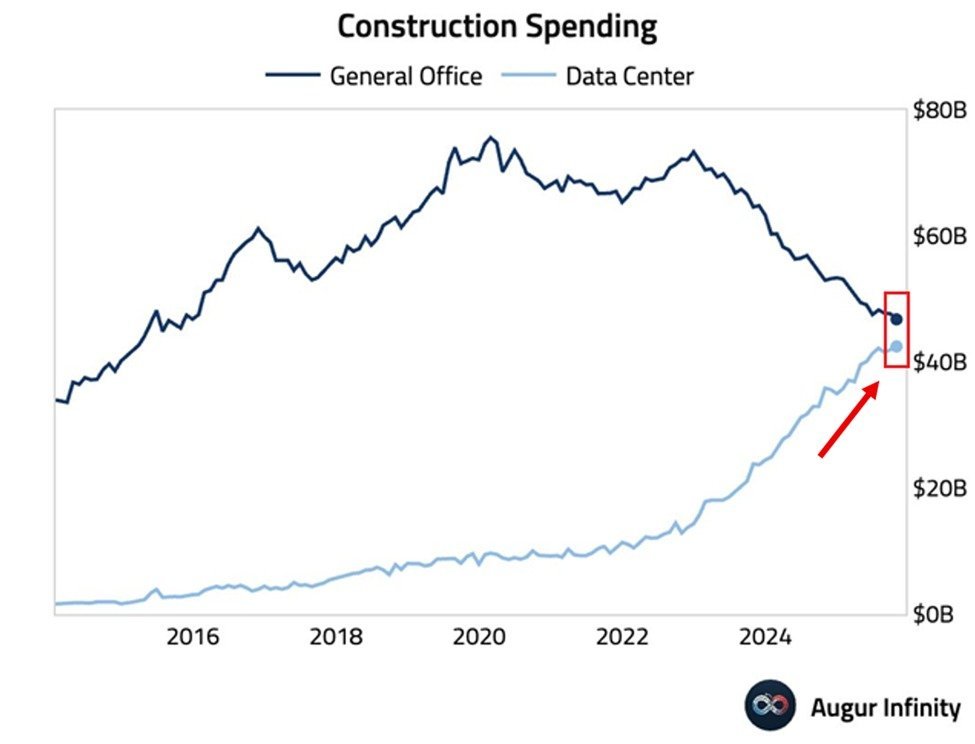

It is evident that the construction volume of data centers in the United States has significantly increased over the past three years. On the surface, this indicates a rising demand for computing power centers, but more practically, it shows that the U.S. is shifting its new capital expenditures from service-oriented spaces to infrastructure that serves AI.

Office buildings are no longer the carriers of economic expansion; data centers are. In the past, the prosperity of a city was determined by population and office density, but now it is determined by electricity, grid connectivity, cooling, and fiber optics, which dictate how much computing power a region can support.

More critically, the expansion of data centers essentially treats electricity as raw material and computing power as the product. The increase in data center construction is merely a result; what is truly rising is the competition for grid resources.

I am personally very optimistic about U.S. power stocks in 2026.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。