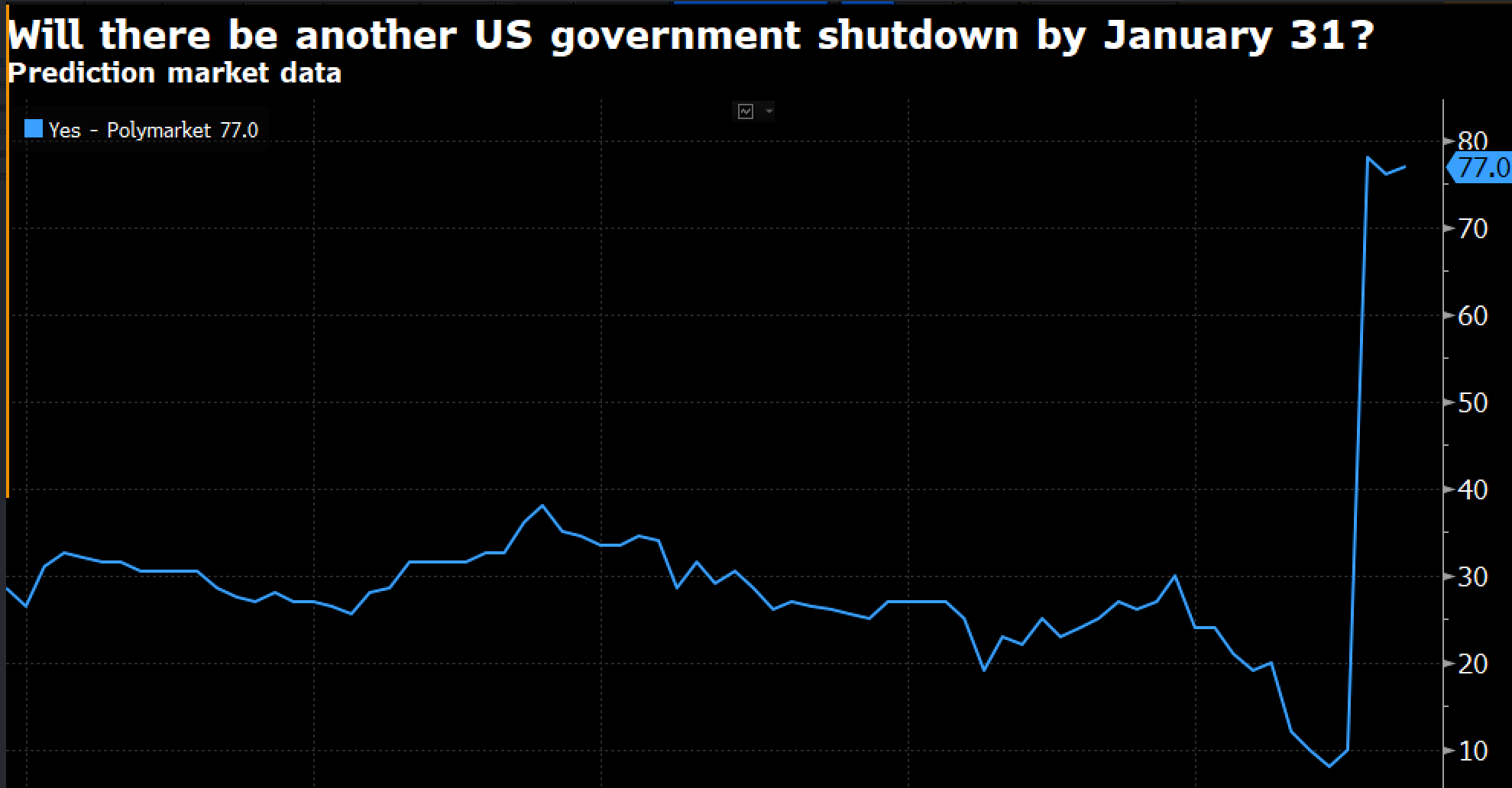

In the past week, the U.S. federal government has once again slid toward the brink of a "shutdown." According to data from the blockchain prediction market Polymarket, traders have assessed the probability of the government entering a shutdown before January 31 has surged from less than 10% in mid-January to over 80%.

As the deadline enters a 72-hour countdown, the intense standoff between the two parties on Capitol Hill not only threatens to halt government services but also has a ripple effect on the economy, people's livelihoods, and other critical legislative agendas.

1. Risk Surge: Dual Alarms from Market Probabilities and Political Statements

The risk of a shutdown has sharply increased, resulting from the mutual reinforcement of market expectations and the hardline positions of key political figures.

● Prediction Market "Sounds the Alarm": As a barometer reflecting collective expectations, the trading volume of related contracts on Polymarket has exceeded $5 million, with the displayed probability of a shutdown experiencing a vertical surge after January 24, briefly reaching a high of 85%. This intuitively reflects the market's deep concern over the dysfunction of Washington's political machinery.

● Core Political Figures Stand Firm: The direct trigger for the risk reassessment is the clear statement from Senate Majority Leader and Democrat Chuck Schumer. He recently declared that Senate Democrats would not provide the votes needed to advance a funding bill that includes Department of Homeland Security (DHS) funding. Schumer linked this decision to a recent shooting incident involving federal law enforcement in Minnesota, calling it "shocking" and criticizing the related funding bill as "completely inadequate to curb the abuses of the Immigration and Customs Enforcement (ICE)."

● White House Stance Adds Uncertainty: Meanwhile, President Trump did not attempt to ease tensions in a public interview, instead stating, "We are likely to find ourselves in another government shutdown caused by the Democrats." This public confrontation between key figures in the executive and legislative branches significantly undermines expectations for a last-minute compromise.

2. Historical Echoes: The Shadow of a Record 43-Day Shutdown Lingers

The current standoff is not an isolated incident but a continuation of a previous, more severe political crisis. Just months ago, from October to November 2025, the U.S. experienced the longest government shutdown in history, lasting 43 days.

● Solution to the Last Crisis: That crisis ultimately ended with the passage of a "continuing resolution" that provided funding for government departments until January 31, 2026. Now, this "deadline" is approaching again, while a new long-term funding bill remains unresolved due to bipartisan disagreements.

● Lingering Negotiation Framework and Unresolved Contradictions: Although the last resolution temporarily restored government operations, it postponed addressing several core policy disputes (such as subsidies for the Affordable Care Act and border security funding). Today, these structural contradictions remain unchanged, and have even intensified due to new political events (such as the Minnesota incident), leading to the expiration of temporary agreements based on old dates, while new agreements fail to materialize.

3. Core Controversy: Policy "Poison Pills" and Procedural Dilemmas

On the surface, it is a funding issue, but in essence, it is a fundamental contest between the two parties over key domestic policies. Both sides have attached their core demands as additional conditions to the funding bill, turning the budget proposal into a "hostage" in the policy game.

● Core Demands of the Democrats:

● Healthcare Subsidies: Insist on extending and expanding enhanced subsidies for the Affordable Care Act (i.e., "Obamacare"), viewing it as crucial for ensuring healthcare coverage for tens of millions of low- and middle-income individuals.

● Social Program Funding: Seek to restore or increase spending on social programs such as public healthcare, public broadcasting, and housing assistance.

● Core Demands of the Republicans:

● Border Security and Immigration Enforcement: Demand a significant increase in funding for border security and immigration deportation, while limiting funds for asylum applicants. The DHS funding that Schumer explicitly opposes is at the heart of this controversy.

● Control of Fiscal Spending: Oppose bundling expanded social welfare spending with temporary funding, advocating for strict control over budget size.

● Senate's "60-Vote" Procedural Threshold: Even if a party's bill can pass the House with a partisan majority, it faces significant procedural hurdles in the Senate. The vast majority of bills require 60 votes to end debate and proceed to a vote, meaning the Republicans controlling the Senate must seek support from at least some Democrats. In the current highly polarized atmosphere, bipartisan cooperation is exceptionally challenging.

4. Potential Impacts: From Public Services to Macroeconomics

If the government shuts down after midnight on January 31, the impacts will quickly spread.

● Federal Employees and Public Services: Approximately 800,000 non-essential federal employees are expected to be forced into unpaid leave. National parks, the Smithsonian museums, and other services may close or be reduced; processing services for passports, visas, green cards, etc., will face severe delays; new applications at the Social Security Administration and drug approvals at the Food and Drug Administration will come to a standstill.

● Economy and Markets:

● Direct Economic Losses: Analysts estimate that each week of government shutdown could reduce GDP growth by 0.1 to 0.2 percentage points. The U.S. Travel Association has estimated that a week of shutdown could lead to a $1 billion loss in the travel industry.

● Market Confidence Undermined: A government shutdown is seen as a sign of political dysfunction, which will exacerbate market concerns about the stability of U.S. policies and could trigger volatility in financial markets. The release of key economic data may also be delayed, affecting investor decisions.

● Other Legislative Processes Stalled: A government shutdown will shift congressional attention and lead to many staff members taking leave, severely slowing down other legislative work. For example, the much-anticipated cryptocurrency regulatory legislation, the CLARITY Act, has already been delayed due to last year's shutdown, and if another shutdown occurs, its legislative prospects will become even more bleak.

5. Final Showdown: Three Possible Outcomes

In the remaining days, the situation could develop in several directions:

Extreme Compromise, Short-Term Extension: The most likely scenario is that the two parties reach a very short-term temporary funding bill (e.g., for a few weeks) at the last moment, pushing the deadline back again to allow more time for negotiations. This essentially postpones the crisis once more.

Partial Shutdown: Congress may pass funding for departments with fewer disputes while allowing departments with significant disagreements (such as the Department of Homeland Security) to shut down. However, this is complex both technically and politically.

Full Shutdown: If no compromise can be reached, the government will formally partially shut down starting February 1, until one side makes a substantial concession.

The risk of a U.S. government shutdown has surged to 80% within 72 hours, resulting from political polarization, procedural gridlock, and the resonance of specific social events.

It is not only a political drama in Washington but also a stress test concerning livelihood security, economic confidence, and government governance capabilities. Regardless of the final outcome, this annual budget game profoundly reveals a fact: under the U.S. political system, providing operational funding for the government is becoming increasingly difficult to achieve smoothly.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance Benefits Group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。