The epic surge and avalanche-like drop in the silver market have awakened global investors who were intoxicated by asset frenzy, like a clap of thunder. The two seemingly independent markets of precious metals and digital currencies are being driven by the same macro undercurrent, heading towards a historic crossroads.

On Monday, the spot price of silver surged by 14% during trading, reaching $117 per ounce, marking the largest intraday increase since the global financial crisis, but quickly fell back. Gold prices continued to rise, approaching the key psychological level of $5000 per ounce.

On the other hand, Bitcoin is consolidating around $90,000. The cryptocurrency world is brewing a "super narrative" that could break the traditional four-year cycle.

1. Silver's Epic Roller Coaster

The precious metals market at the beginning of 2026 opened with a dramatic volatility that is worthy of being recorded in history. Silver prices experienced a thrilling "inverted V" reversal on Monday.

● The spot silver price suddenly surged during trading, with intraday gains peaking at 14%, reaching a high of $117 per ounce. This not only marks the largest intraday increase since the 2008 global financial crisis but also pushes silver prices to a historic high.

● The market frenzy could not be sustained. After reaching a peak, silver prices faced significant selling pressure, falling sharply from the high, and by the end of the U.S. trading session, it erased all intraday gains and turned negative, ultimately closing with a slight increase of 0.4%.

This extreme movement was described by analysts at Heraeus Precious Metals as "the most extreme since the Hunt brothers attempted to corner the market in 1980."

● The day's violent fluctuations were not an isolated event. Since the beginning of 2024, silver prices have cumulatively risen by over 200%. In the photovoltaic manufacturing industry, the cost of silver paste has surged from 3.4% to 19.3% of the total cost of components, replacing silicon materials as the largest cost item.

2. Core Driving Forces: Silver's Surge Under Fourfold Logical Resonance

The current surge in silver prices is the result of a rare resonance of four major logics: supply-demand imbalance, macro finance, geopolitical hedging, and trading aspects.

● From a fundamental perspective, the structural explosion of industrial demand and rigid supply constraints form the most solid foundation. The photovoltaic industry is the absolute mainstay of silver demand, accounting for over 34% of industrial silver use. With the acceleration of global energy transition, the global installed capacity of photovoltaics is expected to reach 520-600 GW by 2026, driving a surge in silver usage.

● The AI and new energy revolution has created new demand growth points. The power demand of AI servers is expected to grow by 31% over the next decade, and these data centers are five times more likely to choose solar power than nuclear energy. Each smart electric vehicle uses 2.3 times more silver than traditional fuel vehicles.

● The supply side faces structural issues. About 75% of the world's silver is produced as a byproduct of mining basic metals like copper, lead, and zinc, lacking the flexibility for independent production increases. Bringing newly discovered silver mines into production requires a 10 to 15-year cycle. This has directly led to a fifth consecutive year of supply shortages in the global silver market, with a gap of 63.4 million ounces expected in 2025. LME deliverable inventories are only enough for 1.2 months of global consumption.

● On the macro level, there is a strong expectation of 3-4 rate cuts by the Federal Reserve in 2026, a weakening dollar index, and declining real interest rates, which reduce the holding cost of non-yielding silver and enhance its attractiveness.

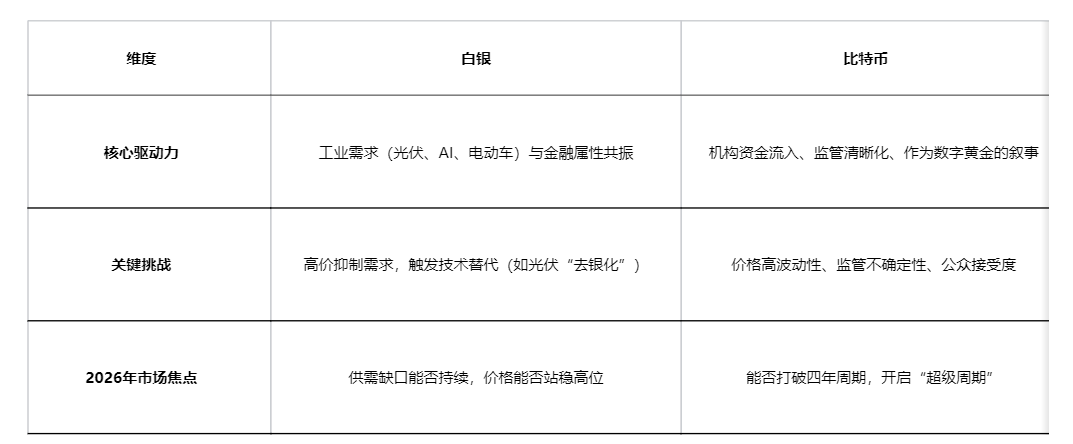

3. Silver and Bitcoin: The Dual Narrative of Safe-Haven Assets

During the same period of silver's volatility, the Bitcoin market presented a different scene. Bitcoin prices are consolidating around $90,000, with the market gearing up for a possible "super cycle." Despite their apparent differences, both share a similar macro narrative foundation—distrust in the traditional fiat currency system and the need to hedge against inflation.

● The advantage of silver lies in its dual attributes: it is both a historically established safe-haven precious metal and an indispensable industrial metal in modern green technology and the AI revolution.

● The advantage of Bitcoin is its digital scarcity and increasing institutional acceptance. UTXO management and Bitwise Asset Management predict that by the end of 2026, over $400 billion of institutional capital will flow into Bitcoin.

● The passage of the U.S. Cryptocurrency Act in 2026 provides a clear regulatory framework for digital assets, particularly the GENIUS Act, which establishes a systematic regulatory framework for stablecoins.

The investment logic of the two is diverging. Silver is shifting from being a purely financial asset to being priced based on commodity attributes, deeply tied to the progress of global manufacturing and energy transition. Bitcoin, on the other hand, is accelerating its financialization and institutionalization, transitioning from a high-risk speculative asset to a potential allocation option for corporate balance sheets and sovereign funds.

4. Market Differentiation: Structural Risks and Potential Turning Points

Behind the fervent market sentiment, structural risks and potential turning points are accumulating, with silver and Bitcoin facing their own distinct challenges.

● For silver, the biggest risk comes from its own high price. The photovoltaic industry has begun to accelerate a "de-silverization" technological revolution, seeking alternatives like copper and other cheaper materials.

● Currently, "copper replacing silver" has formed three clear industrialization paths:

○ Copper paste wrapped in silver that can be quickly applied in the short term.

○ Electroplated copper technology aimed at high-end markets but requiring high equipment investment.

○ And the still-in-development ideal solution of pure copper paste.

● Regulatory risks are also not to be overlooked. If regulatory agencies implement cooling measures, such as exchanges adjusting trading limits, it could quickly suppress short-term speculative enthusiasm.

● The Bitcoin market faces a different risk structure. The marginal changes in macro liquidity are the primary focus. Although the interest rate hike cycle has ended, Federal Reserve policy may still fluctuate with economic data. The details of regulatory enforcement and coordination within the crypto market will directly impact the pace and manner of trillion-dollar institutional capital entering the market.

5. Market Outlook: New Equilibrium and Investor Strategies

Standing at the crossroads at the beginning of 2026, while the future paths of the silver and Bitcoin markets may intersect, they will ultimately unfold according to their own internal logic.

● The prospects for Bitcoin are also deeply tied to institutional behavior. Bitwise Asset Management predicts that by the end of 2026, institutions may have accumulated over 4.2 million Bitcoins.

● As multiple U.S. states and even other countries may officially incorporate Bitcoin into their strategic reserves, Bitcoin's status as a "global non-sovereign reserve asset" will be further solidified.

● The infrastructure of the crypto market will also undergo a qualitative change, with annual settlement volumes of stablecoins expected to surpass Visa, becoming the largest 7×24-hour clearing network in the world.

The dramatic drop in silver after reaching $117 occurred against the backdrop of LME deliverable inventories being only enough for 1.2 months of global consumption. Meanwhile, on-chain data for Bitcoin indicates that over 30% of on-chain interactions may soon be autonomously completed by AI agents, which will use stablecoins for high-frequency machine-to-machine micropayments.

As silver trembles due to extreme scarcity in the real economy, Bitcoin is gaining momentum due to institutional acceptance in the digital world, marking the quiet beginning of a value storage revolution that transcends physical and virtual boundaries.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。