Written by: DaiDai, Maicong MSX

Edited by: Frank, Maicong MSX

The Q4 financial report reveals that the new leader is dismantling the previous "technological utopia" through "layoffs" and "asset sales," betting on the 18A process to carve out a path for survival.

For Intel, 2025 is a year of life and death.

Compared to Nvidia, which is dancing at the center of the AI stage, Intel (INTC.M) resembles a foot lingering at the ICU door. With the departure of "technology evangelist" Pat Gelsinger at the end of last year, the new leader Lip-Bu Tan has officially taken over this aging machine burdened with challenges.

The latest Q4 financial report has once again brought a familiar question to the surface: has this century-old chip giant reached its end?

If we only look at the stock price performance after the earnings announcement, the answer may be disappointing. However, if we extend the timeline, what Intel is experiencing may not be a fleeting moment of glory, but rather a critical moment of pulling the oxygen tube from the ICU and attempting to breathe on its own.

Objectively speaking, this Q4 financial report is not only the first complete answer sheet after Lip-Bu Tan took office but also a comprehensive reckoning of the legacy from the Kissinger era.

Intel's stock price changes in 2025, source: CNBC / Intel Newsroom

1. Leadership Change: From Kissinger's "Technological Utopia" to Lip-Bu Tan's "Capital Battlefield"

"Survival is the first need of civilization." Before understanding this financial report, one must first recognize the narrative shift that Intel is undergoing.

At the beginning of Pat Gelsinger's return to Intel, he painted an almost idealistic blueprint, aiming to regain process leadership through an aggressive plan of "5 process nodes in 5 years" and rebuild domestic semiconductor manufacturing capabilities in the U.S. The underlying logic was simple—if technology leads, capital will eventually follow.

Thus, large-scale factory construction unfolded globally: in Ohio, USA, and in Germany and Poland, capital expenditures rapidly expanded.

But reality quickly countered; the AI wave swept in, and the true star on stage was Nvidia (NVDA.M). In the data center sector, Intel's CPUs were no longer the main characters, even being mocked as "accessories" to GPUs. Meanwhile, massive capital expenditures consumed cash flow, stock prices continued to decline, and Intel gradually fell into a dilemma of "technologically correct but financially bleeding."

Therefore, it can be said that Kissinger's departure marked the end of Intel's era of "pursuing technological hegemony at any cost," while Lip-Bu Tan's arrival represents a completely different survival logic—having been the CEO of Cadence and a venture capital mogul, he is well-versed in the ways of venture capital, particularly skilled in "balance sheet magic." Thus, his post-assumption logic is brutally clear: "stop the bleeding, then go all-in on the core":

- Surgical layoffs: A global reduction of 15%, cutting down on the bloated middle layer;

- Strategic contraction: Halting expensive overseas factories in Germany and Poland to recoup funds;

- Strategic focus: All resources directed solely to two targets—Arizona Fab 52 and the 18A process;

Intel's stock price trend from Q4 2025 to Q1 2026 (source: Yahoo Finance / TradingView)

This is a typical "stop the bleeding—contract—protect the core" strategy. For Lip-Bu Tan, surviving is more important than telling stories.

2. Analyzing the Financial Report: How Much Substance is Behind This "Surprise"?

Returning to the data itself, Intel's Q4 financial report is not without merit.

On the surface, profits did exceed market expectations, with EPS returning to positive territory. The profit of $0.15, although accompanied by the cost of layoffs, did pull the profit statement back from the brink, proving that large-scale cost-cutting and efficiency improvements have begun to repair the profit statement, allowing Intel to at least temporarily escape the "continuous bleeding" danger zone.

AI-assisted generated table

However, digging deeper reveals that problems still exist.

First, revenue is still declining year-on-year. In the context of the 2025 AI boom boosting the semiconductor industry, AMD and Nvidia's data center businesses are experiencing rapid growth, while Intel's overall revenue continues to shrink. This means that the profit improvement this time is more about "savings" rather than "earned growth."

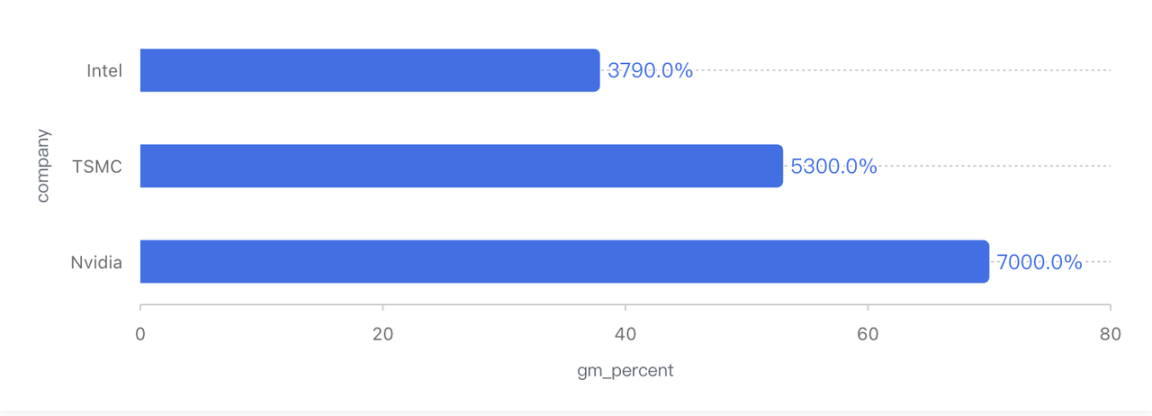

Second, while the gross margin has rebounded to about 38%, this level remains extremely low in Intel's history. A decade ago, the company's gross margin consistently hovered around 60%, and even in recent years, it has mostly been around 50%. In contrast, TSMC (TSM.M) maintains a gross margin exceeding 50%, while Nvidia's is over 70%.

Comparison of gross margins among semiconductor giants (data based on Q4 2025 Non-GAAP standards)

Ultimately, the main reason for this gross margin improvement is not a return of product pricing power, but rather the dilution of fixed depreciation costs due to increased capacity utilization. Particularly in the server CPU market, Intel still needs to compete directly with AMD through pricing strategies, and pricing power has not truly returned to its hands.

In other words, this is a financial report of "successful bleeding control but not yet recovered," akin to "overperforming" after the passing of a significantly lowered passing line, which essentially does not change the fact of being unqualified.

However, it is worth mentioning that the market's biggest concern was Intel's cash flow issues, and from this perspective, the situation has indeed improved: as of Q4, Intel held approximately $37.4 billion in cash and short-term investments; it repaid some debts during the quarter; and its annual operating cash flow was about $9.7 billion.

At the same time, the company secured valuable time by selling part of its Mobileye stake, bringing in external capital for Altera, and receiving subsidies from the U.S. CHIPS Act. Additionally, Nvidia's $5 billion strategic investment in Intel has released an important signal on the capital front.

Overall, Intel's cash flow crisis has been temporarily alleviated, at least allowing it to survive the most cash-intensive phase before the mass production of the 18A process.

But it is important to be cautious that this is not "financial safety," but rather "time bought for survival."

3. 18A and Panther Lake: The Last Chance for a Comeback?

From a business structure perspective, Intel's current state is highly differentiated.

The client PC business remains the company's cash cow, with the PC industry's inventory cycle basically cleared, and OEM manufacturers beginning to replenish stocks, providing Intel with a relatively stable cash source. However, constrained by product structure and foundry costs, this segment is unlikely to significantly expand profit margins in the short term.

After consecutive declines, the data center and AI businesses saw about a 9% year-on-year growth in Q4, primarily driven by the resurgence of the Xeon 6 platform's competitiveness and cloud vendors replenishing CPU resources after investing in GPUs. However, in terms of long-term trends, Intel's market share in the data center has significantly declined from its peak in 2021, and the current situation is more about "stopping the decline" rather than a true reversal.

The real pressure source remains the Foundry business, which suffered losses of tens of billions of dollars in a single quarter, primarily due to high depreciation costs of advanced process equipment, the ramp-up costs of the 18A process, and the revenue from external customers not yet being realized.

It can be said that before the 18A process reaches mass production, Foundry resembles a continuously bleeding wound. However, optimistically speaking, if the financial report represents the past, then the 18A process will undoubtedly determine the future, and it is crucial for the strategic position of the U.S. semiconductor industry.

To put it bluntly, the 18A is not just a process node; it is Intel's only ticket back to the throne.

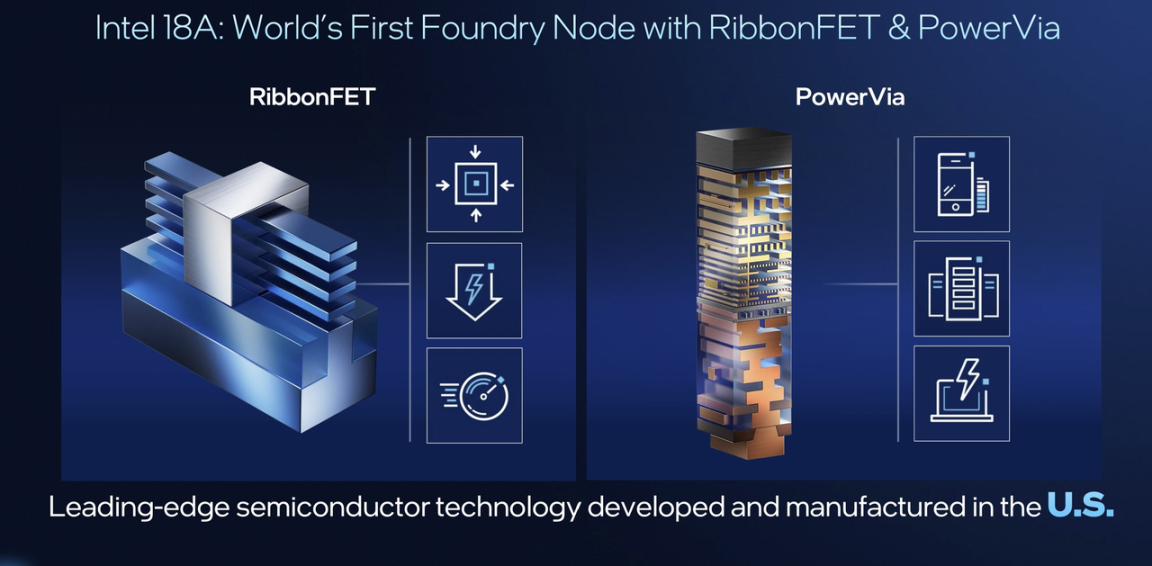

From a technological perspective, the 18A is not a castle in the air. Its use of the RibbonFET (GAA) architecture allows Intel to catch up with the industry's mainstream in transistor structure; the PowerVia back power supply technology provides it with a temporary leading advantage in energy efficiency and wiring density. More importantly, the 18A will be applied on a large scale for the first time in the consumer-grade Panther Lake platform.

Official data shows significant improvements in performance, gaming performance, and battery life, especially in battery life metrics, indicating that x86 laptops are for the first time approaching or even challenging the Apple Silicon camp in terms of user experience.

At the same time, Microsoft (MSFT.M) and Amazon (AMZN.M) have become anchor customers for the 18A, and Nvidia's strategic investment is seen by the market as a "geopolitical insurance endorsement" of Intel's manufacturing capabilities. Additionally, it is reported that the yield rate of the 18A is improving at a rate of 7% per month and has entered a predictable trajectory.

In contrast, TSMC is expected to apply similar technology to its A16 process by the end of 2026, which means that in 2026, Intel's 18A will be globally leading in power supply technology, making it highly attractive to energy-sensitive customers (such as Apple, Qualcomm, and AI inference chip manufacturers).

Overview of Panther Lake chip architecture and 18A (source: Intel Tech Tour)

CEO Lip-Bu Tan also stated during the conference call: "The losses in Foundry peaked in 2024 and will begin to narrow in 2025." If this goal is achieved, as losses narrow, Intel's overall profits are expected to experience explosive growth.

These may not signify victory, but at least indicate that Intel has not been completely abandoned.

4. Q1 Guidance Shocks the Market? Understanding the Game Beyond the Fundamentals

On the surface, Intel's significant drop after the earnings report is almost a "textbook" market reaction.

The main reason is essentially the extremely conservative Q1 2026 guidance, with revenue projections falling below consensus expectations, and Non-GAAP EPS even being pushed down to zero. For short-term investors, this equates to a stark signal—"don't expect profit improvement next quarter." In a market accustomed to the "AI high-growth narrative," such guidance naturally triggers sell-offs.

However, if this is only understood as a deterioration in fundamentals, one might miss a more important layer of meaning. A more reasonable explanation is that this is a typical "Kitchen Sink" strategy from the new CEO: new CEOs often engage in a "Kitchen Sink" approach, thoroughly releasing bad news, lowering expectations, and setting the stage for future surprises.

AI-assisted generated table

From this perspective, the Q1 guidance appears more like a strategic conservatism rather than a signal of operational loss of control. What is truly noteworthy is a geopolitical undercurrent that is gradually emerging beneath the surface of the financial report.

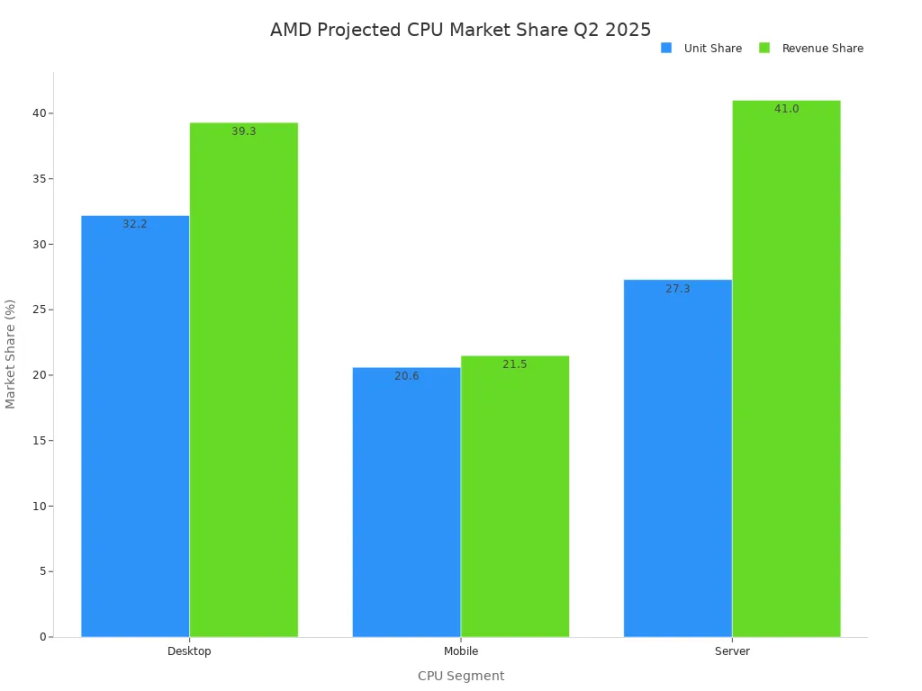

From an industry perspective, the competitive environment Intel faces at this moment is almost hellishly difficult:

- AMD (AMD.M): The Zen 6 architecture is imminent, and it still enjoys priority access to TSMC's most advanced processes, with a stable product rhythm and clear roadmap;

- NVIDIA: Blackwell remains in high demand, continuously siphoning off global data center capital expenditures;

- ARM / Qualcomm: The PC sector continues to encroach on x86 territory, with Apple's M series and Qualcomm's X Elite always hanging like a sword over Intel's head;

In such a landscape, it is nearly impossible for Intel to defeat all competitors through "commercial competition" in the short term, which determines a reality: Intel's valuation logic is quietly shifting from performance-driven to "system value."

AMD vs Intel CPU market share forecast (Q2 2025)

And this is key to understanding Nvidia's $5 billion investment.

On the surface, Nvidia's $5 billion investment in Intel seems almost counterintuitive. After all, one is the absolute king of global AI chips, while the other is still bleeding in its foundry business. However, if we step back from the financial report and shift our perspective to supply chain security, this transaction appears exceptionally reasonable:

Investing in Intel and supporting its Foundry business, especially in advanced packaging and domestic U.S. capacity, is essentially purchasing a long-term "geopolitical insurance" for itself. This is not about immediately shifting orders away from TSMC, but rather preparing an alternative system that can be activated in advance.

This is precisely the scenario the White House is most pleased to see—two American semiconductor giants forming a certain degree of "symbiotic structure," reducing the entire industry's dependence on overseas single points of failure.

This also means that even in the most intense commercial competition, Intel is still viewed as an indispensable infrastructure node.

In Conclusion

Overall, this financial report is neither a signal of a comprehensive recovery nor a final judgment.

What Intel has truly accomplished is to stop telling grand narratives of technological utopia and instead return to a more realistic and brutal path: compressing scale, preserving cash, and betting on a single core variable.

The 18A and Panther Lake represent Intel's "qualifying rounds"—if it wins, there remains a possibility for repricing; if it loses, this century-old giant will be completely marginalized to the role of an industry supporting character.

Ultimately, Intel is no longer the "prodigal son of the landlord's family" that can squander capital at will, but rather a heavy asset enterprise standing at the ICU door, needing to be frugal.

Whether it can truly emerge from the hospital, the answer lies not in this financial report, but in the execution over the next 12 to 18 months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。