As new whales holding over 100,000 bitcoins quietly enter the market, a large number of retail investors are panic-selling their holdings, resulting in a brutal turnover in the market as funds flow. Bitcoin whales are accumulating digital gold at an unprecedented rate. Data shows that wallets holding at least 1,000 BTC have recently increased their holdings by over 100,000 bitcoins.

The holdings of new whales have also surpassed 100,000 bitcoins, valued at approximately $12 billion. Meanwhile, the number of daily transfers exceeding one million dollars has risen to a two-month high.

The feasting of whales stands in dramatic contrast to the panic selling of ordinary investors. This market is witnessing a silent transfer of wealth.

1. Market Drivers: From Narrative Fantasies to Capital Flows

The shift in the macro environment has provided strong support for Bitcoin. The U.S. Treasury yield curve has escaped the inverted state that lasted for several years, and changes in the economic landscape have prompted a repricing of risk assets. This macro change coincides perfectly with an internal turning point in the crypto market.

● What is truly noteworthy is the fundamental shift in market drivers. The rise of Bitcoin in 2025 was primarily driven by narratives such as the "halving story" and "ETF launch expectations," while the rise in 2026 is based on tangible capital flows.

● The Federal Reserve's monetary policy has quietly shifted. After nearly three years of quantitative tightening, the Fed's balance sheet has shrunk from $9 trillion to $6.6 trillion, withdrawing $2.4 trillion in liquidity. Now, this trend has reversed.

● According to the latest data, the Fed's balance sheet increased by approximately $59.4 billion in one week. While this is not the same as the quantitative easing of 2020, the re-injection of liquidity provides foundational support for risk assets, including Bitcoin.

● Market mechanisms are also self-repairing. After the sell-off at the end of 2025, the excessive leverage in the Bitcoin derivatives market has been significantly cleared. Open interest in futures has dropped from a peak of $98 billion in October 2025 to $58 billion, and financing rates have returned to normal levels.

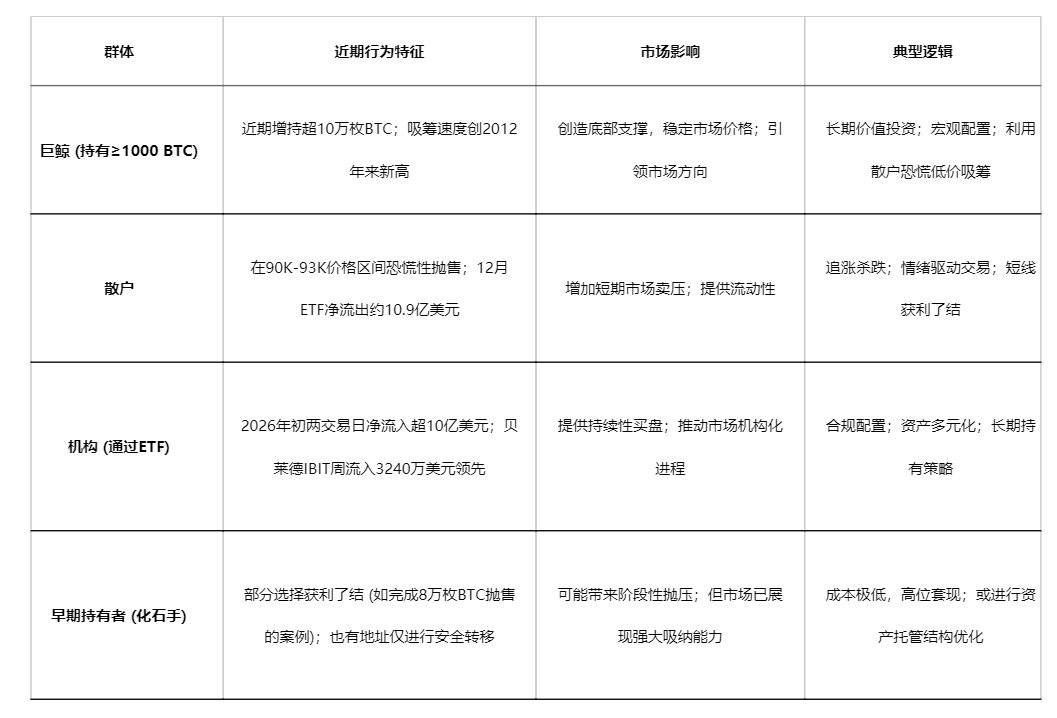

2. Behavioral Divergence: Whale Greed vs. Retail Fear

The behavioral differences among market participants have never been so pronounced. On-chain data reveals a divided market landscape: as whales accelerate their accumulation, retail investors choose to exit.

● The "whale" group holding 10 to 10,000 bitcoins has cumulatively increased their holdings by over 56,000 bitcoins since December 17, 2025. Notably, the accumulation speed of these large holders has reached the highest level since 2012.

● In a short period, whales holding 100 to 1,000 BTC bought approximately $23.5 billion worth of Bitcoin. This behavior contrasts sharply with that of retail investors, who often exhibit a tendency to "take profits" when prices rise.

This divergence is evident not only in holding behavior but also in trading expectations. Options data from the Deribit platform shows a surge in demand for $100,000 call options expiring in January, while the premiums for put options are declining. This reflects a positive outlook from professional investors regarding Bitcoin's future.

3. Institutional Entry: ETF Channels and the Wave of Compliance

The launch of Bitcoin spot ETFs has fundamentally changed the game for institutional participation in the crypto market. These financial products have paved a compliance highway for traditional capital to enter the crypto world.

● Data shows that on the first trading day of 2026, Bitcoin ETFs saw a net inflow of $471 million, the highest single-day inflow since November 2025. Behind this figure is the continued buying by asset management giants like BlackRock.

● BlackRock's IBIT topped the list with a weekly inflow of $32.4 million, while Fidelity's FBTC also continues to attract funds, becoming the second-largest source of growth among Bitcoin ETF products.

● Contrary to traditional perceptions, ETFs experienced a sell-off at the end of 2025, but this trend was quickly reversed at the beginning of 2026. In the week ending January 2, 2026, the net inflow for spot Bitcoin ETFs reached $45.877 million, successfully reversing the previous week's net outflow of $78.2 million.

● Even traditional financial institutions are adjusting their strategies. Bank of America’s wealth management platform, including Merrill Lynch and Bank of America Private Bank, has begun allowing investment advisors to recommend cryptocurrency exchange-traded products.

These institutions believe that for clients who can withstand price volatility, allocating 1% to 4% of their funds to cryptocurrencies is reasonable.

4. On-Chain Truth: The Wealth Code Behind the Data

Whale activity is not a new topic, but the characteristics of the current stage are worth in-depth analysis. Data shows that the top 100 addresses hold over 40% of the cryptocurrency market value, and this high concentration makes whale behavior a core indicator of market sentiment.

● Whale accumulation data can sometimes be misunderstood. The research director at CryptoQuant pointed out that some recent "whale accumulation" data may be misled by internal wallet consolidation activities at exchanges.

● When filtering out exchange factors, the true whale addresses holding 100 to 1,000 BTC have actually slightly reduced their holdings. The real buying pressure comes more from the small, dispersed addresses of new whales and institutional subscriptions to ETFs.

● Another key phenomenon is "generational turnover." Traditional whales who entered the market at a very low cost may choose to take profits at high prices, while the new generation of whales picks up the slack at these price levels. Tether's behavior provides a typical case. This stablecoin issuer has been purchasing Bitcoin with 15% of its net profits every quarter since May 2023, continuously for ten quarters without interruption.

This disciplined investment strategy has allowed it to achieve an average cost price of approximately $51,117, with unrealized gains exceeding $3.5 billion at current prices.

5. Future Outlook: Slow Bull Pattern and Potential Risks

In the current market environment, several analysts hold an optimistic view of Bitcoin's future. An analyst using a pseudonym even predicts that Bitcoin could reach $250,000 in 2026. This optimistic expectation is based on historical patterns, as a similar phase of positive accumulation in 2012 preceded a price increase of about 100 times. More analysts set $150,000 as a relatively common mid-term target.

● As the market evolves, the Bitcoin market in 2026 may exhibit different characteristics than before. Based on the current capital-driven logic, the market may bid farewell to the extreme volatility of 2025 and enter a "slow bull" pattern.

● This shift is closely related to changes in the structure of market participants. The increase in institutional investors typically reduces market volatility, as they tend to adopt long-term holding strategies rather than short-term speculation.

● Potential risks still exist. The Fed's current balance sheet expansion policy is a "technical buy to replenish reserves," which is limited in scale and duration compared to full quantitative easing.

If the market overinterprets this signal, it may create unrealistic expectations. Some "whale accumulation" data may have statistical biases, requiring more refined on-chain analysis to discern.

Tether's Bitcoin wallet address increased its holdings by 8,888 BTC again on New Year's Eve 2025, and the company's cryptocurrency reserves have quietly surpassed the $10 billion mark.

When the world's largest stablecoin issuer is regularly converting profits into Bitcoin, the attitude of institutions towards Bitcoin has fundamentally changed. As new whales continue to take over the chips of early holders, the structure of Bitcoin holders is becoming more decentralized and healthier.

Transaction records on blockchain explorers show that even "fossil-level" Bitcoin addresses that have been dormant for over 14 years are starting to show activity. However, analysts point out that these transfers are more about optimizing asset custody structures rather than a precursor to large-scale sell-offs.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。