Global stock markets fell sharply in early trading, with Bitcoin dropping over 3% in 24 hours, while gold surged past the $5000 mark—markets are violently swaying in a storm of "triple black swan" events intertwined with geopolitical tensions, currency interventions, and tariff threats.

As of the morning of January 26, U.S. stock futures, cryptocurrencies, and the dollar index rarely fell in sync, while safe-haven assets like gold and silver soared to unprecedented highs.

The S&P 500 futures fell by 0.9%, and the Nasdaq 100 futures dropped by 1.3%. Bitcoin briefly fell over 3%, and Ethereum plummeted over 5%.

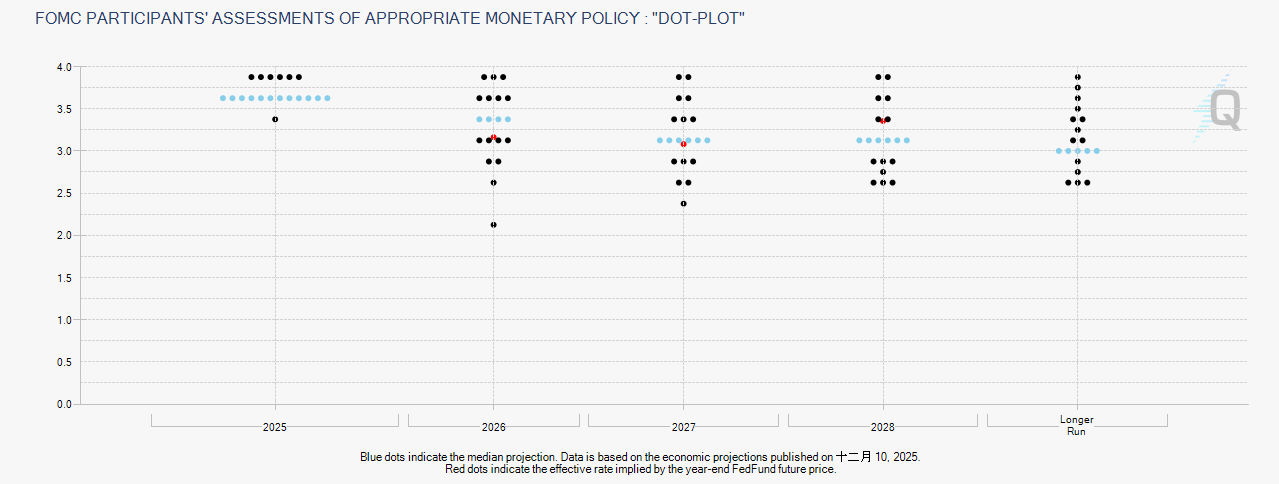

The market expects the Federal Reserve to keep interest rates unchanged, but clues about the future path of rate cuts and rumors of personnel changes at the Fed will make this meeting the next "guiding stick" for market sentiment.

1. Macroeconomic Storm

The market turmoil this morning is not coincidental. Analysts generally believe it is primarily triggered by three major variables, forming a temporary "black swan" storm.

● First is the sharp deterioration in U.S.-Canada relations. Trump threatened on social media that if Canada reaches an agreement with "certain countries," he would impose a 100% tariff on Canadian goods entering the U.S. This statement has sparked profound concerns in the market about renewed tensions in global trade. Canadian Prime Minister Carney's response video, emphasizing "we will buy Canadian products," further highlights the strained relations between the two countries.

● Second is the rare intervention signals in the foreign exchange market. The New York Federal Reserve, representing the U.S. Treasury, inquired with several banks about the cost of converting yen to dollars. This action was interpreted by the market as a preliminary signal that the U.S. may be preparing to intervene in the currency market to support the yen and suppress the dollar. This led to a significant rise in the yen, causing the dollar index to fall below the 97 mark.

● Third is the renewed escalation of the situation in the Middle East. According to media reports, the U.S. Navy's USS Abraham Lincoln carrier strike group has arrived in the Middle East. The rise in geopolitical risks is one of the core drivers pushing the prices of traditional safe-haven assets like gold and silver to soar.

2. Market Reaction

Under these three pressures, various assets have exhibited divergent and dramatic trends.

● Safe-haven assets soar: Spot gold prices have historically broken through the $5000/ounce mark, while spot silver has also surpassed $106/ounce for the first time, with an intraday increase of nearly 3%. U.S. natural gas futures prices surged by 16% due to winter storm impacts.

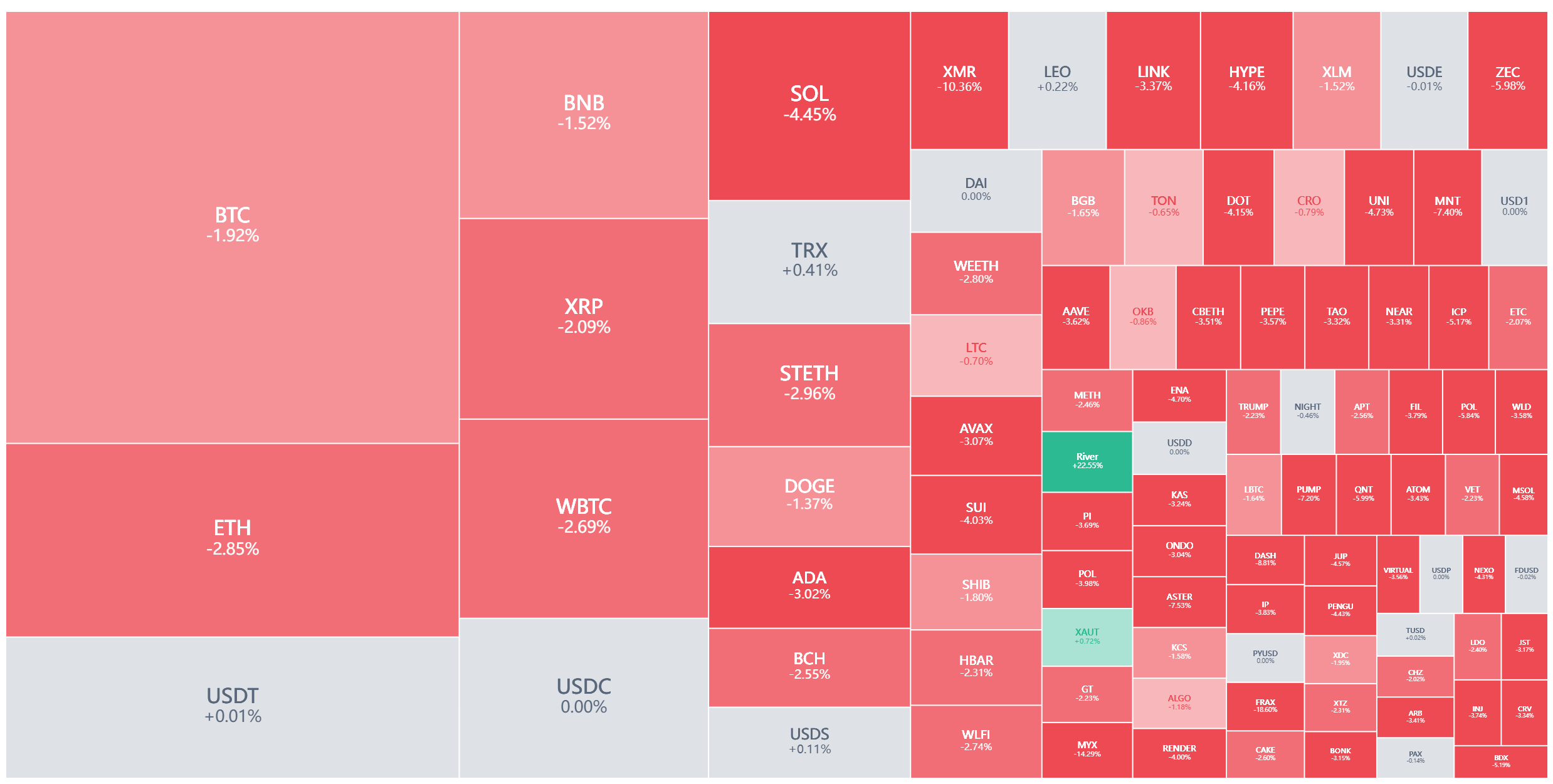

● Risk assets under pressure: In contrast to the frenzy in safe-haven assets, global stock markets and the cryptocurrency market have suffered heavy losses. The Nikkei 225 index opened down 1.51%, and the decline later expanded to nearly 2%. The cryptocurrency market plummeted across the board, with Bitcoin's 24-hour drop exceeding 3% and Ethereum falling over 5%.

● Bond and currency markets in flux: The yield on U.S. 10-year Treasury bonds has risen. The dollar-yen exchange rate fell by 0.89%, reported at 154.32. These fluctuations collectively reflect the tightening of market liquidity patterns and a sharp shift in investor sentiment.

3. The Federal Reserve's Crossroads

Despite being shrouded in geopolitical storms, the market's long-term focus has already turned to the upcoming Federal Reserve meeting.

● The market generally expects the Federal Reserve to maintain the federal funds rate target range at 3.50%-3.75% unchanged. According to the FedWatch tool from the Chicago Mercantile Exchange, the probability of keeping rates unchanged is as high as 95%.

However, maintaining rates is almost a given; the real suspense lies in the future policy path. Recent signals released internally by the Federal Reserve lean towards a "hawkish pause."

● Several Fed presidents, including those from Chicago, Kansas City, and San Francisco, have spoken out, indicating a willingness to pause rate cuts at this meeting. Their consensus is that the current labor market has stabilized, while inflationary pressures persist, and monetary policy is in a "favorable position" to wait for more data.

● The focus of the meeting will center on the "dot plot" for future rate predictions, changes in the wording of the policy statement, and comments from Fed Chair Powell at the press conference. Fidelity International's analysis points out that future market interest rate trends will increasingly be determined by speculation surrounding the new Fed chair nominee nominated by President Trump.

4. The Independent Battlefield of Cryptocurrencies

As the macro market faces turmoil, the cryptocurrency market is also undergoing a profound internal adjustment. Data shows that during the week from January 19 to 23, over 80 of the top 100 cryptocurrencies by market capitalization experienced declines, with the total market cap shrinking by nearly 7%, falling back to $3.02 trillion.

● Retail investors are exiting. Data analysis indicates that a large number of small traders are selling off cryptocurrencies in favor of traditional assets like gold and silver, which are hitting new highs. This large-scale "retail surrender" behavior often appears near market bottom areas in past market cycles.

● Institutional interest is also waning. The Ethereum ETF recorded the largest single-day outflow of funds since last September on January 21. This indicates that not only retail investors but institutional investors are also synchronously engaging in risk aversion, validating the prevailing bearish sentiment in the current market.

● Divergence signals are emerging in the market. Despite the overall market weakness, some tokens in the gaming and NFT sectors have risen against the trend.

For example, The Sandbox ($SAND) has risen about 50% year-to-date, significantly outperforming Bitcoin over the past week. This abnormal rise in specific sectors during a bear market is sometimes considered a characteristic of the later stages of market cycles.

● Meanwhile, a noteworthy reverse signal has appeared in Solana. As Bitcoin and Ethereum are surrounded by various negative news, Solana's social discussion volume has dropped to a one-year low, with almost no one paying attention. Historically, such extreme "silence" often indicates that selling pressure has exhausted, potentially serving as a leading indicator of market sentiment hitting bottom.

5. Traditional Finance's Crypto Ambitions

● Despite the short-term market slump, the infrastructure construction and strategic position of cryptocurrencies in the traditional financial world are quietly rising. At the recently concluded 2026 World Economic Forum in Davos, tokenization became a core topic.

○ Traditional financial giants are embracing this trend with unprecedented enthusiasm. Larry Fink, CEO of the world's largest asset management company BlackRock, reiterated that "the future of assets lies in tokenization." He urged for a rapid migration of financial instruments to a single blockchain to reduce intermediaries and corruption in areas like money market funds, stocks, and real estate.

● Stablecoins are positioned as the future financial infrastructure. Executives from Circle and Ripple described stablecoins as the financial infrastructure for cross-border payments, believing they can significantly enhance efficiency. Ripple CEO Brad Garlinghouse even predicted that stablecoins, as the flagship application case of tokenization, would reach new highs in 2026.

● More notably, cryptocurrencies are entering the national strategic vision. Wall Street star fund manager "Cathie Wood" predicts that the Trump administration may start purchasing Bitcoin as a national strategic reserve before the midterm elections in 2026 to maintain political momentum and garner support from cryptocurrency voters.

● Domestically in the U.S., a Kansas senator has proposed a bill aimed at establishing a strategic Bitcoin reserve. Meanwhile, the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission will hold a joint event next week to discuss how to fulfill President Trump's promise to "make America the cryptocurrency capital."

These trends clearly indicate that regardless of market price fluctuations, the integration of cryptocurrencies with mainstream financial and political systems is accelerating, and their long-term narrative has shifted from merely speculative assets to multiple roles as payment infrastructure, value storage tools, and even national strategic assets.

6. Outlook for Next Week and Key Events

Next week, the market will strive to digest the geopolitical shocks and refocus on economic data and central bank policies. The Federal Reserve meeting is undoubtedly the top priority.

Here are the key events to watch for in the coming week:

Monday, the U.S. will release November durable goods orders data, an important indicator for observing the health of manufacturing and business investment.

Tuesday, the January Conference Board Consumer Confidence Index will provide insights into consumer outlook and spending willingness.

Wednesday, market focus will completely shift to the Federal Reserve. At 3 AM Beijing time, the Fed will announce its interest rate decision; at 3:30 AM, Powell will hold a press conference. The market will carefully analyze every wording change in the policy statement.

Thursday, the U.S. will release initial jobless claims for the week ending January 24, a high-frequency indicator for assessing labor market health; also released will be the U.S. trade balance for November.

Friday, the U.S. will announce the December PPI year-on-year, an important indicator for measuring inflationary pressures at the production level and a leading indicator for CPI.

Saturday, the 2028 FOMC voting member and St. Louis Fed President will speak on the U.S. economy and monetary policy, providing the market with more insights into the Fed's internal policy thinking.

In addition to the U.S., several central banks around the world will also announce interest rate decisions, including the Bank of Canada, the Riksbank, the Central Bank of Brazil, and the South African Reserve Bank. Their decisions will collectively outline a new framework for global monetary policy.

The market will attempt to find answers to several key questions from these events: How long will the Fed's "pause" last? Will geopolitical risks dissipate or continue to escalate? Has the weak cryptocurrency market provided a value opportunity for astute investors?

For investors, in such a highly uncertain environment, it may be wise to follow the advice of the data analysis team Santiment: patience in waiting, ignoring daily noise, and making judgments based on on-chain data and fundamental signals will be a more prudent choice.

In the eye of the storm, maintaining a calm mind is more important than any quick reaction.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。