Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.1 trillion, with BTC accounting for 59.2%, or $1.83 trillion. The market capitalization of stablecoins is $30.81 billion, which has decreased by 0.75% in the last 7 days, with USDT making up 60.57%.

Among the top 200 projects on CoinMarketCap, most have declined while a few have risen, including: BTC down 6.87% over 7 days, ETH down 11.6% over 7 days, SOL down 11.2% over 7 days, AXS up 122.1% over 7 days, and ZRO up 34.8% over 7 days.

This week, there was a net outflow of $1.32 billion from the U.S. Bitcoin spot ETF; a net outflow of $600 million from the U.S. Ethereum spot ETF.

Market Forecast (January 26 - February 1) :

The current RSI index is 44.24 (neutral range), and the fear and greed index is 25 (re-entering the fear range), while the altcoin season index is 39 (neutral, higher than last week).

BTC core range: $88,000-92,000, with a short-term overall tendency towards high-level fluctuations.

ETH core range: $2,900-3,300, waiting for directional choice.

SOL core range: $124-137, with mixed technical signals, waiting for new catalysts. The "Alpenglow" network upgrade expected in Q1 2026 for Solana may become an important catalyst affecting its price.

The cryptocurrency market is currently highly volatile, and short-term trends are very sensitive to news. Special attention should be paid to Trump's foreign tariff policies and the Federal Reserve's monetary policy signals, as this information will affect the risk appetite of the entire cryptocurrency market.

Understanding Now

Review of Major Events of the Week

On January 19, the cryptocurrency market experienced a "flash crash" on Monday morning, with Bitcoin dropping as much as 3.79% in nearly an hour, falling from around $95,500 to $91,900, and currently recovering to around $92,800;

On January 18, Sonic announced that "as planned, through fully permissionless smart contracts, 16,027,929.41 S tokens were successfully burned, which were allocated for unclaimed first-quarter airdrops;

On January 18, according to Defillama data, Meteora's revenue in the past 24 hours reached $1.33 million, surpassing Pump.fun which had $1.16 million in the past 24 hours, only behind Tether ($16.45 million) and Circle ($6.6 million);

On January 19, Paradex's official status page updated to show that its blockchain status was restored at 20:13;

On January 20, Japan's 40-year government bond yield rose by 5.5 basis points to 4%, marking the highest level since its issuance in 2007, and the first time in over 30 years that a government bond yield in the country reached this level. This marks the first time since December 1995 (when the 20-year yield hit 4%) that Japanese government bond yields have crossed the 4% threshold;

On January 21, according to Bitget market data, spot gold surged 10% over 20 days, breaking through $4,800/ounce for the first time, with an increase of over $480 this year;

On January 21, cryptocurrency wallet Rainbow announced that it would conduct an RNBW token airdrop snapshot at 16:20 EST on January 26, with the official airdrop taking place on February 5;

On January 22, Trump stated that he would not impose tariffs on Greenland, causing a brief rebound in cryptocurrency prices;

On January 22, North Korean hackers resurfaced, attacking over 3,100 IP addresses using fake job interviews;

On January 23, according to the Financial Times, Musk's rocket manufacturer SpaceX is seeking Wall Street investment banks for a "super" IPO, which is expected to become one of the largest IPOs in history;

On January 22, cryptocurrency custody service provider BitGo (BTGO.US) officially listed on the New York Stock Exchange, marking the first crypto IPO of the year.

Macroeconomics

On January 22, the number of initial jobless claims in the U.S. for the week ending January 17 was 200,000, expected to be 210,000, with the previous value revised from 198,000 to 199,000;

On January 23 at 23:00, the U.S. released the January University of Michigan Consumer Sentiment Index at 56.4, forecasted at 54, previous value 54;

On January 23, according to CME's "FedWatch" data, the probability of the Federal Reserve cutting rates by 25 basis points in January is 5.7%, while the probability of maintaining the current rate is 94.3%.

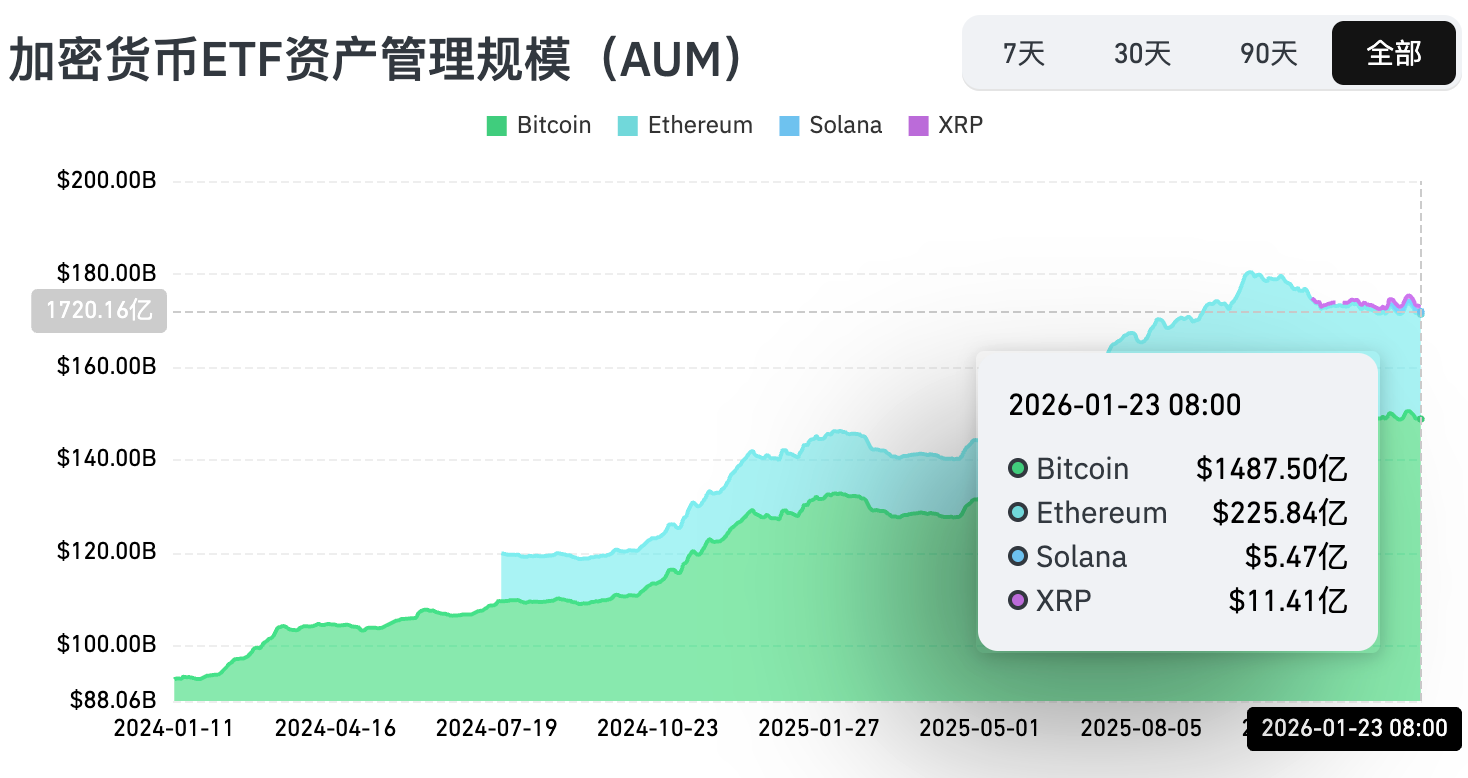

ETF

According to statistics, from January 19 to January 24, there was a net outflow of $1.32 billion from the U.S. Bitcoin spot ETF; as of January 24, GBTC (Grayscale) had a total outflow of $25.539 billion, currently holding $14.414 billion, while IBIT (BlackRock) currently holds $69.721 billion. The total market capitalization of the U.S. Bitcoin spot ETF is $120.315 billion.

The U.S. Ethereum spot ETF had a net outflow of $600 million.

Envisioning the Future

Industry Conferences

Consensus Hong Kong 2026 will be held from February 11 to 12 in Hong Kong, China;

ETHDenver 2026 will be held from February 17 to 21 in Denver, USA;

EthCC 9 will be held from March 30 to April 2, 2026, in Cannes, France. The Ethereum Community Conference (EthCC) is one of the largest and longest-running annual Ethereum events in Europe, focusing on technology and community development.

Project Progress

Defiance will close its Ethereum ETF listed on Nasdaq: Defiance Leveraged Long and Yield Ethereum ETF (ETHI) on January 26;

The first unlock application deadline for the Base network Perp DEX protocol RollX is January 26. The total amount of genesis airdrop tokens is 180 million, with eligible addresses including Trade & LP point holders and contributors participating in activities from Binance Wallet, Bitlayer, Galxe, etc.;

The airdrop application window for Aster's Phase 4 will open on January 28, 2026;

The TON ecosystem project Catizen game Pixel Ninja will go offline on January 29, 2026;

The cross-chain aggregation DeFi platform Infinex TGE is scheduled for January 30, with a public sale involving 868 participants, raising 7.214 million USDC, allocating about $5 million in funds (5% of INX supply), and refunding about $2.21 million;

Coinbase is suspending services in Argentina. Starting January 31, 2026, Coinbase will no longer support buying and selling USDC using the Argentine peso, but deposit and withdrawal functions will not be affected;

The metaverse Avatar platform Ready Player Me has been acquired by Netflix and will cease operations on January 31, 2026, with all team members being integrated into Netflix.

Important Events

The South Korean FIU will restrict unreported overseas cryptocurrency exchanges and wallets from being listed on Google Play starting January 28. Reporting requirements include having an anti-money laundering (AML) system and certification from the Korea Internet & Security Agency (KISA) for information security management systems (ISMS). If applications do not comply with the policy, they will be blocked in South Korea starting January 28, preventing new users from installing them, and existing users may face usability issues due to the inability to update;

On January 28 at 22:45, Canada will announce its central bank interest rate decision as of January 28;

On January 29 at 03:00, the U.S. will announce the Federal Reserve interest rate decision (upper limit) as of January 28;

On January 29 at 21:30, the U.S. will announce the number of initial jobless claims for the week ending January 24 (in ten thousand).

Token Unlocking

Jupiter (JUP) will unlock 53.45 million tokens on January 28, valued at approximately $10.53 million, accounting for 1.7% of the circulating supply;

TreeHouse (TREE) will unlock 85.85 million tokens on January 29, valued at approximately $8.5 million, accounting for 39.41% of the circulating supply;

Zora (ZORA) will unlock 168 million tokens on January 30, valued at approximately $5.23 million, accounting for 4% of the circulating supply;

Kamino (KMNO) will unlock 228 million tokens on January 30, valued at approximately $11.22 million, accounting for 3.68% of the circulating supply;

Optimism (OP) will unlock 31.34 million tokens on January 31, valued at approximately $9.88 million, accounting for 1.62% of the circulating supply;

Sui (SUI) will unlock 43.52 million tokens on February 1, valued at approximately $65.29 million, accounting for 1.15% of the circulating supply;

EigenCloud (EIGEN) will unlock 36.82 million tokens on February 1, valued at approximately $12.53 million, accounting for 8.88% of the circulating supply.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. We analyze market trends through our "Weekly Insights" and "In-Depth Research Reports"; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening) to identify potential assets and reduce trial-and-error costs. Each week, our researchers will also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize value opportunities in Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investing carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。