The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and reject any market smoke screens!

The emergence of several heavyweight news items yesterday, although expected, still caught me a bit off guard; this has led me to redefine the gold market. From a long-term perspective, gold is likely to be in a growth state over the next five years and will maintain a trend of continuous new highs. To elaborate, this news comes from within the country and can be said to have intensified geopolitical turmoil. Perhaps within five years, there will be an expected event. Only such an outcome can explain everything happening at this stage, especially the long-term behavior of regularly purchasing gold domestically, selling U.S. Treasury bonds, and even reducing foreign exchange reserves. The series of clues that have emerged will drive up the price of gold. Coupled with the current changes in the global landscape, future conflicts will only become more severe. If you are considering long-term investments, it is advisable to hold certain domestic assets; within five years, there will definitely be gains, especially in the one to two years following success, where at least a doubling is expected. Pay attention to semiconductors.

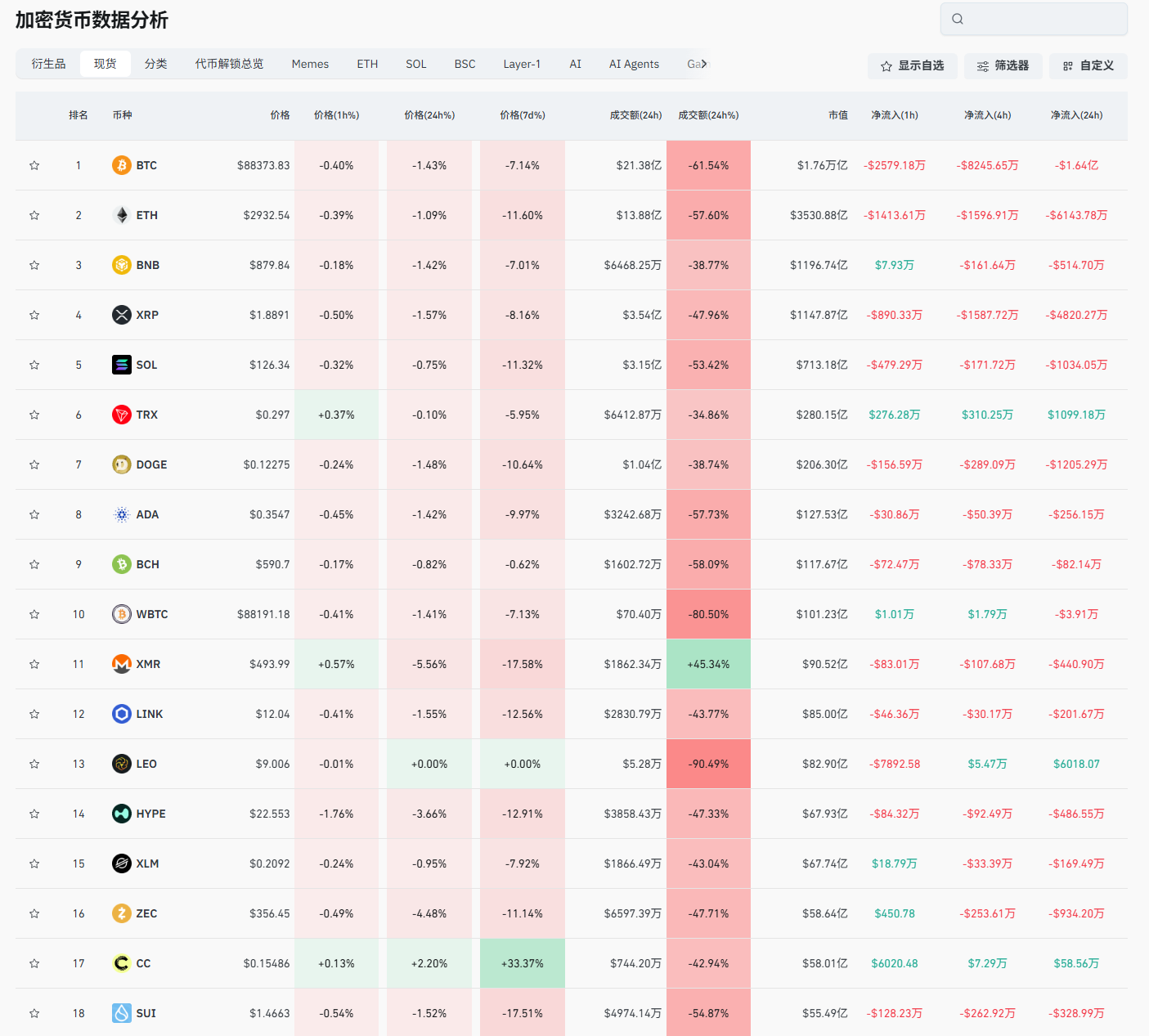

I can't elaborate too much, so returning to our own market, I checked the dynamics of SOL; one of the most striking data points is that the staking ratio has reached over 70%, once again setting a historical high. You might think this is good news because such staking at least represents the involvement of major funds. However, in my view, it is unlikely that SOL will reach a historically high level again in the short term, as this staking is mostly for about a year. For a bull market to grow, the next round of bull market giants must hold a massive amount of chips. It is clear that even if someone wants to push up the price at this stage, they do not have the chips to enter the market. This distribution pattern is not the structure for starting a bull market, but this action can provide SOL with the ability to build a bottom. In the short term, it can be said that the upper limit will not be too high, while the lower limit has support, at least not creating a historical new low. From a long-term perspective, the current giants in the SOL market are definitely optimistic; otherwise, they wouldn't be staking.

Looking back at Bitcoin, the entire downward trend of Bitcoin is also the most obvious trend in the cryptocurrency circle; however, the reasons for Bitcoin's decline from its high are somewhat forced. Since Trump took office, up to the establishment of the high point, and even during that time, there have not been significant negative news for Bitcoin. The high point seems to have been fixed at 126,000. In the past two days, there has been enough explanation about Bitcoin's trend, but every day we can still see news about Bitcoin expanding its trading attributes. Regardless of the regulatory strategies from various countries, the clues presented to everyone are all inflows, but the actual data is the opposite, which even I find somewhat contrary to financial common sense. Perhaps this is also the charm of the cryptocurrency circle; the expansion of the market actually gives a downward feedback to the cryptocurrency market. This cannot be established by any financial logic. I attribute it to the awakening of ancient wallets, leading to the decline in prices. The turnover of giants, although valid, results in a downward trend, which cannot be denied.

Why do I mention these two cryptocurrencies? Because both of these cryptocurrencies have similarities, whether it is BTC or our main investment SOL; the bearish friends and my discussion are simply that there are too many retail investors, and the chips needed for the big players to push the price are too heavy. I cannot dispel your concerns; what you all mention are realistic results. In terms of market capitalization, Bitcoin's market cap currently reaches 1.77 trillion, while SOL's market cap reaches $71.568 billion. Many friends feel that a doubling is needed, which requires the same amount of capital; this is also a misconception. Doubling Bitcoin's market cap from 1.77 trillion to 3.54 trillion would complete a wave of doubling. You don't need me to calculate this; just think about how much Bitcoin was when the market cap was 3 trillion? It basically maintained around 126,000. Therefore, reaching 3.54 trillion, Bitcoin can only touch around 135,000. Doesn't that seem a bit absurd? To drive a market's doubling growth, a certain timing is required.

The emergence of this timing is mainly to avoid retail investors exiting the market, meaning that the buying volume must at least be greater than the selling volume by a factor of one. This is the role of news; when extremely positive news appears, it is enough to indicate that there will be no selling pressure, so the big players can easily push the price up. Perhaps only 100 billion is needed to double Bitcoin. Similarly, as long as you start selling, when the volume is large enough, the power of retail investors is extremely important; the profits of the big players mainly come from retail investors. This is also the most important point I mentioned: the sell-off by ancient giants will indeed make the current giants hesitate; even BlackRock does not have unlimited bullets. Therefore, at this stage, it has led to major figures in the market running around, telling everyone to hold and buy Bitcoin, which will definitely reach 200,000. When everyone truly chooses to buy, the initiative will return to the hands of the giants, and whether to crash or push up will be decided by them.

As I mentioned earlier, the cryptocurrency circle needs stories to emerge. Trump's so-called creation of a cryptocurrency capital, allowing cryptocurrencies to have more trading scenarios, is gradually being realized; however, the current dilemma faced by the cryptocurrency circle, which causes hesitation among the giants, is whether Trump can fulfill this slogan. The current conclusion is that no one is following, so the price does not rise, which instead leads to a layer of base color in the cryptocurrency circle, which is trapped by regulation. Whether it is taxation or personal KYC certification, these did not exist before compliance. At that time, the cryptocurrency circle could barely be considered decentralized, but the current Bitcoin has become a hybrid, leading those who truly have demand to start considering whether there are other avenues. In my view, the application of cryptocurrencies is gradually phasing out retail investors; perhaps this is the goal pursued by the Americans. Especially in this context, the phenomenon of centralization is obvious, which will further exacerbate turmoil.

In summary, finance is almost always linked to certain sensitive matters, and centralization is a blow to finance. You can refer to the Roosevelt era, including the current dissolution of the Japanese House of Representatives, and the current high centralization of Trump's Senate, House of Representatives, and military. The consequences of this are military actions in Venezuela, and the current slogans also include Greenland. What will Japan's centralization bring? Confrontation with the entire Asia? In this state, it will only push up the price of gold and the assets of the victorious side. What about the impact on ordinary assets? You can look at employment rates and inflation data. Of course, I am not specifically pointing to anything; in this environment, what does the cryptocurrency circle bring? These giants will definitely prefer certain more stable and higher-return markets. From the giants' perspective, stable returns far outweigh higher returns, and gold is the only choice. Therefore, the growth of the cryptocurrency circle is very special; although increased confrontation will expand payment scenarios, you can refer to Russia and Ukraine, where the external transactions of these two countries have utilized Bitcoin. But in the short term, it will cause giants to flee; the premise for the cryptocurrency circle to grow is the return of giants. And now we are waiting for Trump's slogan to be implemented and to see if Musk's capabilities can succeed. Confrontation is only temporary; ultimately, the application of the cryptocurrency circle will be greater. At this stage, everyone must hold on, although this is a very difficult thing for many people. My conclusion at this stage is to buy spot and short contracts; if you don't understand, just ask!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, resulting in frequent entrapment.

This material is for learning reference only and does not constitute trading advice. Trade at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。