Introduction: The Importance of Macroeconomic Factors in the Cryptocurrency Market

The current volatility in the cryptocurrency market can no longer be solely explained by "narrative hype" or "on-chain innovation." Cryptographic assets are increasingly resembling "macro-sensitive risk assets," being repeatedly tugged by interest rates, inflation, dollar liquidity, regulatory frameworks, geopolitical factors, and institutional capital inflows and outflows. You will see the same on-chain data interpreted as "capital inflow" when expectations of interest rate cuts rise, and as "risk contraction" when tariff threats and geopolitical frictions escalate; similarly, ETF capital inflows can be seen as long-term increments when regulatory channels are smooth, but may also become short-term exits during periods of heightened policy uncertainty. Macroeconomic variables are no longer background noise but the core engine determining market trends, depth of pullbacks, and structural patterns.

This article will analyze the mechanisms and pathways through which macroeconomic factors affect the cryptocurrency market, outline the main macro variables that may influence the cryptocurrency market in 2026, and forecast the potential evolution of these variables and their impact on cryptocurrency trends, aiming to provide ordinary investors with a clearer framework: in the noisy macro environment of 2026, how to identify where trends come from, why volatility occurs, why capital leans towards certainty assets, and which variables, once they turn, require immediate adjustments in positions and risk exposure.

I. Historical Review of the Impact of Macroeconomic Variables on the Cryptocurrency Market

In the early days of the cryptocurrency market, the impact of macroeconomic factors was not obvious, as crypto assets were more driven by their own supply and demand and technological advancements. However, as market capitalization expanded and institutional participation increased, crypto assets were gradually viewed as a high-risk investment, with their price fluctuations increasingly linked to the macro environment. Below are the typical pathways through which major macro variables influence the cryptocurrency market:

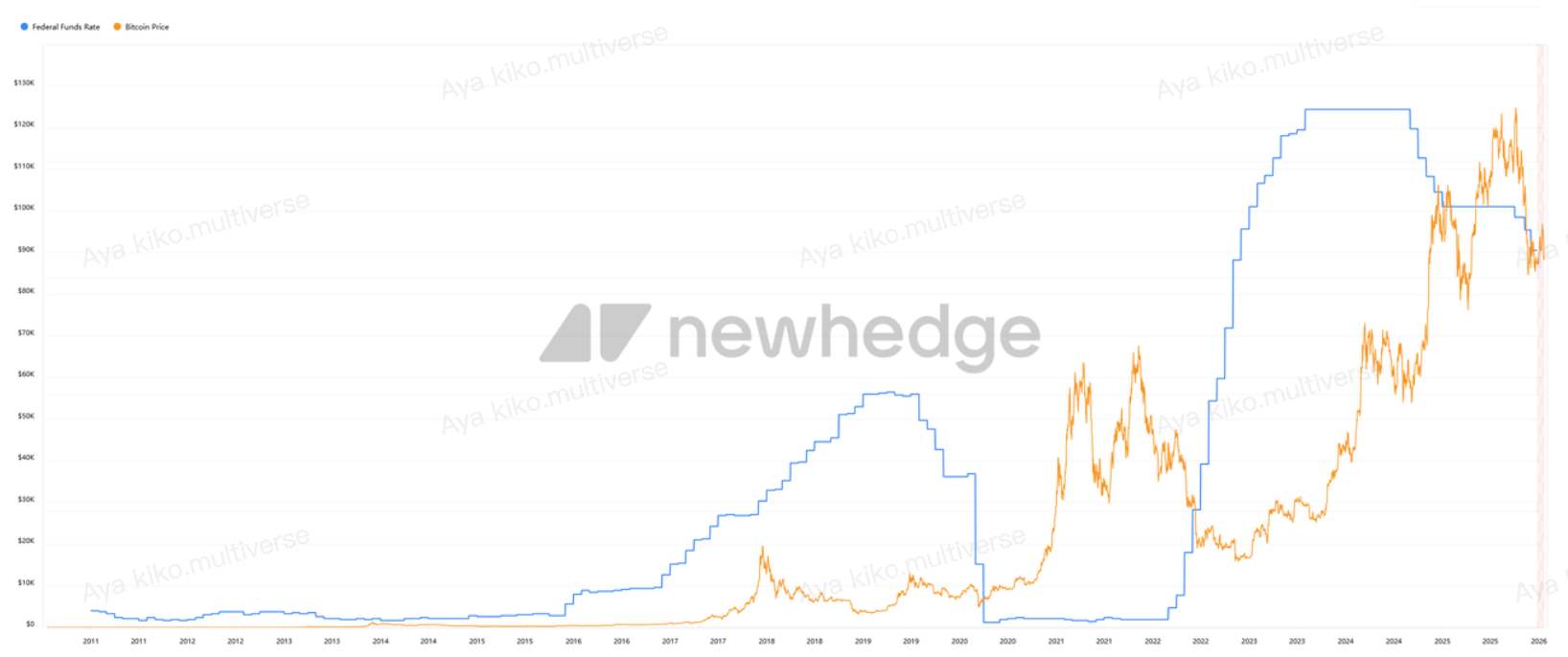

Interest Rates and Liquidity: Interest rates determine the tightness of the monetary environment, which in turn affects global liquidity and risk appetite. When interest rates decline or liquidity expands, investors are more willing to allocate to high-risk assets, with capital potentially shifting from low-yield bonds to stocks and cryptocurrencies. Conversely, in a high-interest-rate environment, the rise in risk-free interest rates diminishes the incentive for investors to allocate to crypto assets. The ultra-low interest rate environment from 2020 to 2021 fueled a surge in risk assets; however, the rapid interest rate hikes to over 5% starting in 2022 sharply tightened liquidity, putting pressure on the cryptocurrency market. In the second half of 2024, the Federal Reserve is expected to begin a rate-cutting cycle, with rates projected to drop to the 3.5-3.75% range by the end of 2025, and the market anticipates further gradual declines to around 3.25% in 2026. Interest rates and liquidity can be considered one of the most significant macro factors affecting the cryptocurrency market in recent years.

Source: https://newhedge.io/bitcoin/bitcoin-vs-federal-funds-rate

Inflation and Economic Growth: The level of inflation affects monetary policy orientation and directly relates to the purchasing power of fiat currencies and investor psychological expectations. In a high-inflation environment, central banks often tighten policies, which suppressed the cryptocurrency market in 2022. However, inflation itself also led some investors to view Bitcoin as "digital gold" to hedge against inflation risks, although this safe-haven attribute did not manifest immediately during the high inflation period of 2021-2022, overshadowed instead by the negative effects of tightening policies. On the other hand, economic growth or recession indirectly influences crypto investment by affecting corporate and household wealth and market risk appetite. The sluggishness of the cryptocurrency market between 2022 and 2023 stemmed partly from policy tightening amid high inflation, and partly from a slowdown in global economic growth and rising recession expectations, which weakened speculative willingness. Overall, inflation and economic cycles have a medium-term impact on cryptocurrency trends by shaping the policy environment and risk sentiment, often intertwining with interest rate policies.

Regulatory Policies and Legal Environment: Regulatory variables significantly impact the cryptocurrency market by altering the behavioral norms of market participants, channels for capital inflow and outflow, and expectations of legality. Favorable regulations, such as clarifying legal status and approving new investment channels, often enhance investor confidence and attract incremental capital; conversely, harsh regulatory crackdowns, such as banning trading or prosecuting industry leaders, can trigger market sell-offs and risk-averse sentiment. From 2021 to 2023, enforcement actions taken by U.S. regulators against certain crypto projects and delays in ETF approvals also put pressure on market sentiment. However, the gradual advancement of regulatory frameworks in various countries between 2024 and 2025 brought some positive news to the market: for example, the MiCA regulation in Europe will implement unified regulatory standards starting in 2025, and the U.S. will pass the stablecoin bill (GENIUS Act) in 2025, providing a standardized approval pathway for exchange-traded products (ETPs). These measures enhance compliance and transparency, viewed by the market as long-term positives. The impact of regulatory factors is reflected in short-term policy news shocks, while in the long term, they profoundly shape industry structure and capital distribution, serving as another decisive variable aside from monetary policy.

Institutional Capital Flows and Market Structure: With the opening of compliant investment channels such as ETFs and the participation of publicly traded companies and institutional investors, the capital structure and pricing mechanism of the cryptocurrency market are changing. Institutional capital is typically large in scale and prefers mainstream assets, and its inflows and outflows amplify market trends. For instance, after the launch of the first U.S. spot Bitcoin ETFs in 2024-2025, there was a massive influx of capital. Statistics show that in 2025 alone, Bitcoin ETFs and plans from publicly traded companies like MicroStrategy contributed nearly $44 billion in net buying demand. Institutional participation also brings changes to market structure, such as Bitcoin's dominance in the total cryptocurrency market capitalization rising to over 60% in 2025, significantly higher than previous cycle peaks, indicating that capital is increasingly concentrated in leading assets like Bitcoin.

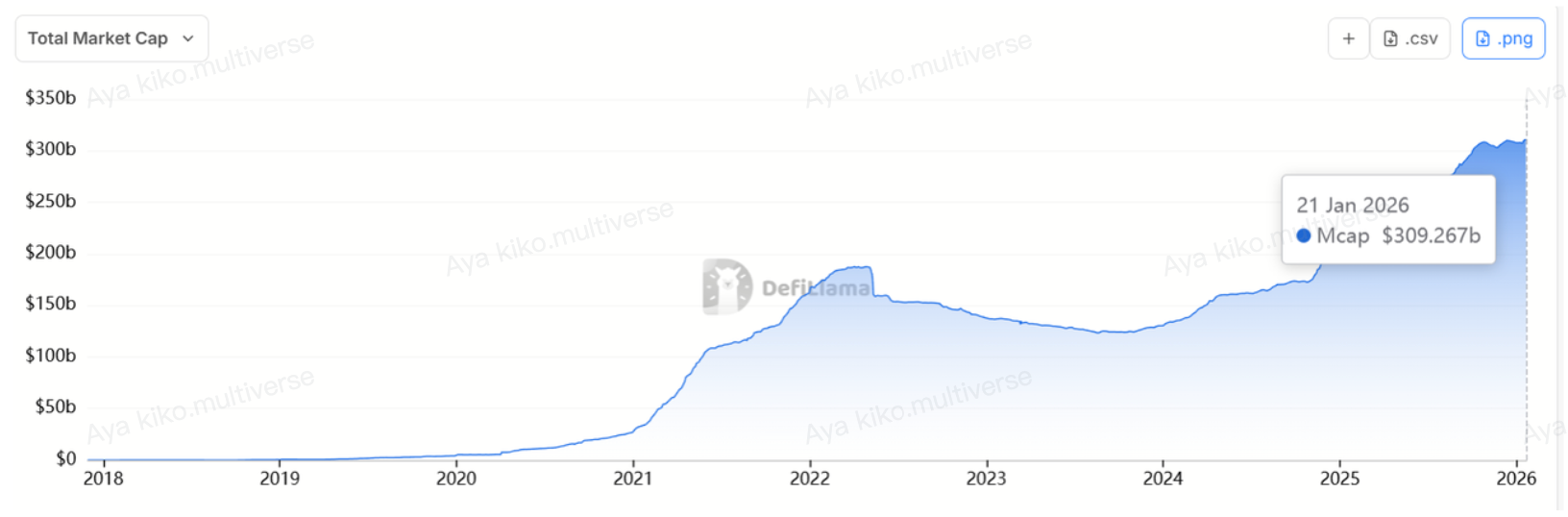

Stablecoins and Capital Flow: As a key infrastructure in the cryptocurrency market, the issuance and circulation scale of stablecoins directly reflect the "reservoir" status of funds in the market and are also influenced by the macro environment. In a bull market, capital inflows drive the rapid rise in stablecoin market capitalization, while in a bear market, demand for stablecoins declines, and their scale contracts. Changes in stablecoin supply often lead or synchronize with the dynamics of capital entering and exiting the market. For example, during the bull market of 2020-2021, the supply of stablecoins like USDT and USDC surged from less than $30 billion to over $150 billion by the end of 2021; while in the 2022 bear market, the total market capitalization slightly retreated, stabilizing around $130 billion in early 2023. As we enter a new round of market activity in 2024-2025, the stablecoin market is expanding again, with the total global stablecoin market capitalization surpassing $300 billion, a growth of about 75% compared to a year ago.

Source: https://defillama.com/stablecoins

II. Analysis of the Impact Strength of Macroeconomic Variables on the Cryptocurrency Market

Variable One: Global Interest Rates, Inflation, and Liquidity Outlook

Monetary Policy Direction – Impact Strength: ★★★★★

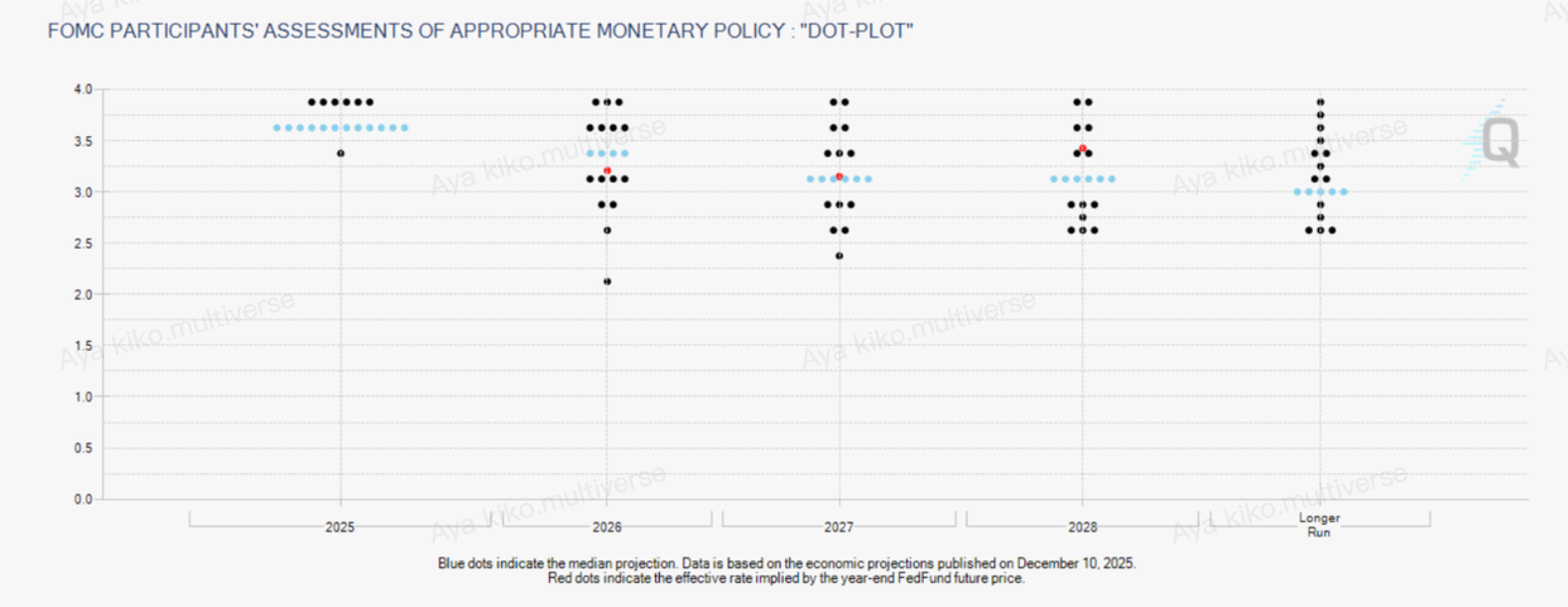

As we enter 2026, the global monetary policy environment is at a critical turning point. The Federal Reserve experienced a shift from tightening to easing between 2024 and 2025: after consecutive interest rate hikes pushed the federal funds rate peak to 5.25%, it began to gradually cut rates at the end of 2024. By 2025, the Federal Reserve had cut rates three times, bringing the rate down to the 3.5%-3.75% range, the lowest level in three years. In 2026, the Federal Reserve is expected to continue a slight easing but at a restrained pace: the Fed's dot plot indicates that the federal funds rate will drop to about 3.25% by the end of the year. Notably, Chairman Powell's term will end in May 2026, which may introduce some policy uncertainty with potential changes in the Fed's leadership. Overall, barring any significant inflation surprises, the monetary environment in the U.S. in 2026 will be much friendlier compared to the past two years. Although there are no signs of a return to quantitative easing (QE), at least liquidity will no longer continue to tighten, which is beneficial for the performance of risk asset prices.

Regarding other major central banks, the European Central Bank and the Bank of England are also gradually ending interest rate hikes in 2024-2025, and are likely to enter a wait-and-see or rate-cutting cycle in 2026, although the extent may lag behind the Federal Reserve. The Bank of Japan is an exception, having maintained zero or even negative rates for a long time; it has raised rates somewhat in 2025 but remains low, and may maintain a relatively independent pace in 2026. Overall, global interest rates are entering a downward channel in 2026, particularly as the decline in rates in dominant markets like the U.S. will release more liquidity and lower the opportunity cost of risk assets. However, persistently high inflation remains a potential threat: if inflation's stickiness declines less than expected, central banks will be constrained by price pressures and unable to significantly ease.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Inflation and Economic Outlook – Impact Strength: ★★★★☆

The mainstream expectation for 2026 is that inflation rates in major economies will further return to target levels or even slightly below. For instance, the Federal Reserve's latest forecast indicates that the U.S. PCE inflation will drop to around 2.4% in 2026, close to the long-term target of 2%. A cooling inflation environment allows central banks to halt interest rate hikes, which is a significant positive for risk assets, including the cryptocurrency market. If inflation remains moderate or slightly below expectations in 2026, it may provide central banks with the space for unexpected rate cuts or liquidity support, further boosting market valuations. For example, when inflation data was slightly better than expected at the end of 2025, both Bitcoin and U.S. stocks rose simultaneously.

In terms of economic growth, global growth is expected to be moderate in 2026. The IMF predicts that major developed economies will grow around 2% in 2025-2026, with the U.S. possibly slightly leading Europe. A low-growth but non-recessionary environment typically supports moderate policies and stable market confidence. JP Morgan's 2026 outlook also assumes that major economies will grow steadily or slightly above potential levels. However, if a significant financial risk event unexpectedly occurs in 2026, it may initially impact risk assets, including cryptocurrencies. Historically, in recessionary environments, central banks tend to adopt more aggressive easing policies, which may subsequently give rise to a new bull market.

Risks that need to be continuously monitored include: energy prices or geopolitical conflicts causing inflation to fluctuate; changes in major central bank leadership or poor policy communication leading to market volatility, etc. If these risks can be avoided, a loose monetary environment will become an important support force for the cryptocurrency market in 2026.

Variable Two: Trends in Regulatory Policies and Changes in Market Structure

Regulatory and Legal Environment – Impact Strength: ★★★★☆

2025 is referred to as the "Year of Cryptocurrency Regulation," as major jurisdictions have introduced or implemented key regulations, accelerating the cryptocurrency industry’s transition from a gray area to compliance. In 2026, regulatory policy developments will remain one of the focal variables for the cryptocurrency market. Overall, global regulation is moving towards clarification and standardization, which will improve long-term market expectations. However, during the short-term transition period, differences in pace across regions may also trigger capital flows and fluctuations in market sentiment.

In the United States: The first federal stablecoin law, the GENIUS Act, was passed in July 2025. According to the bill, regulatory agencies are required to issue specific implementation rules by July 2026. If the rules are well-crafted, they will greatly enhance the transparency and banking participation of stablecoins, further expanding the supply of stablecoins and the capacity of the cryptocurrency market, potentially leading to a more decentralized market structure. Currently, the market share of USDT has dropped from 86% in 2020 to about 58% in 2025, while USDC has risen to 25%, and new stablecoins like USD1 and PYUSD have also rapidly emerged. In addition to stablecoin legislation, the U.S. Congress also advanced discussions on the "Digital Asset Market Structure Clarity Act" (CLARITY Act) in 2025, attempting to delineate the boundaries between security tokens and commodity tokens. The focus in 2026 will be whether such legislation can be enacted. Although there is still political uncertainty regarding the passage of the CLARITY Act, the market is highly attentive to it, and if passed, it is expected to trigger a new round of price increases.

On the regulatory front, the U.S. Securities and Exchange Commission (SEC) completed a significant shift in 2025. The new chair initiated the "Project Crypto" plan, which aims to comprehensively reform cryptocurrency securities rules. In September 2025, the SEC approved general listing standards for spot commodity ETFs, significantly lowering the legal barriers for issuing cryptocurrency ETFs. In 2026, more types of cryptocurrency ETF/ETP products are expected to emerge (e.g., diversified cryptocurrency basket ETFs, ETH spot ETFs), enriching investment tools for investors and marking the inclusion of crypto assets into mainstream portfolios. It is important to note that the SEC and CFTC's stance on DeFi and altcoins remains unclear. If regulatory constraints are imposed on certain tokens or decentralized protocols in 2026, it may impact the prices of related assets. However, until the CLARITY Act is resolved, such enforcement measures are expected to remain cautious.

Other Regions: The European Union fully implemented the Markets in Crypto-Assets Regulation (MiCA) in 2025, and the EU's regulatory environment is expected to remain stable and continue progressing towards compliance in 2026. In addition to MiCA, the EU also passed amendments to anti-money laundering regulations in 2025, requiring crypto transactions to comply with the "Travel Rule," which helps improve the transparency of crypto transactions and combat illegal fund flows, but also puts pressure on non-compliant platforms. Major Asian economies have also strengthened their cryptocurrency regulatory frameworks in 2025. Japan has improved exchange and custody regulations; South Korea is advancing legislation for the "Digital Asset Basic Law" to comprehensively regulate cryptocurrencies; Hong Kong issued more exchange licenses and introduced stablecoin regulatory regulations in 2025; Singapore enacted a cryptocurrency licensing system under the Financial Services and Markets Act in 2025, which will enter a regular regulatory phase in 2026. Additionally, emerging markets in the Middle East and Latin America have also formulated crypto-friendly policies or attracted crypto businesses (e.g., UAE, El Salvador) in 2025. In 2026, these regions may continue to benefit from the outflow of crypto capital.

In summary, regulatory variables are expected to have a more positive impact on the cryptocurrency market in 2026: clear rules will remove obstacles to industry development, while the direction of policies still requires close monitoring, as any regulatory changes in any region could quickly reflect in prices through the globalized market.

Variable Three: Institutional Investment and Market Structure Evolution

Institutional Capital and Investment Tools – Impact Strength: ★★★★☆

2026 may witness a significant increase in the "institutionalization" of cryptocurrency assets. First, with the launch of U.S. spot Bitcoin ETFs and Ethereum futures/spot ETFs, traditional financial institutions are increasingly incorporating cryptocurrency assets into their asset allocations with unprecedented vigor. Products like ETFs lower the barriers to investing in cryptocurrencies, allowing conservative institutions such as insurance companies, pension funds, and university endowments to begin exploring Bitcoin through ETFs and small-scale exploratory allocations. Statistics show that Bitcoin ETFs listed in the U.S. in 2025 brought approximately $30 billion in incremental demand for Bitcoin. This figure is expected to continue rising in 2026, with asset categories expanding from BTC and ETH to cryptocurrency combination ETFs, DeFi ETFs, and more. A large influx of funds from the securities market through ETFs will provide lasting buying support for Bitcoin and mainstream coins. On a deeper level, ETFs change the capital structure, dispersing market holdings among numerous institutional portfolios and reducing systemic risk.

Secondly, the trend of publicly traded companies holding cryptocurrencies and reporting them in financial statements is on the rise. As of January 21, 2026, MicroStrategy has accumulated 709,715 Bitcoins, accounting for 3.38% of the total Bitcoin supply. An increasing number of companies incorporating cryptocurrency assets into their balance sheets enhances market recognition. Emerging "Digital Asset Treasury" (DAT) companies have also gone public, injecting significant buying demand into the market in 2024-2025, and are expected to continue expanding in 2026. However, it is also important to note that when prices are high, these holding companies may consider taking profits or reducing their positions, which could create marginal selling pressure. Overall, the increase in institutional holdings strengthens Bitcoin's store of value attribute and market stability, but it also creates a certain degree of cyclicality—institutions may buy low and sell high, which could mitigate extreme volatility.

Market structure changes: Another impact of institutional participation is the alteration of market structure and volatility patterns. In 2025, Bitcoin's dominance rose to over 60% with relatively low volatility. This is partly attributed to institutions' preference for blue-chip assets, leading to more capital being concentrated in BTC, ETH, and other top market cap coins, rather than flowing into speculative altcoins. At the same time, the development of the derivatives market and the use of options hedging strategies have also suppressed some short-term volatility. In 2026, Bitcoin's institutional holding ratio is expected to further increase, while Ethereum is likely to continue steady growth. For small and mid-cap tokens, 2026 may be a tale of two extremes. On one hand, macroeconomic recovery is favorable for overall market cap expansion, with Bitcoin leading a "altcoin season." On the other hand, regulatory clarity is a double-edged sword for altcoins; the altcoin sector may not experience the comprehensive frenzy seen in 2017 or 2021, but rather a split: high-quality projects at the forefront will benefit from industry growth, while lower-tier and high-risk tokens will remain sluggish.

In summary, driven by institutionalization, the cryptocurrency market in 2026 is likely to be dominated by institutions and compliant capital, with blue-chip coins and quality projects occupying core positions, while speculative bubbles are relatively contained.

Variable Four: Geopolitics and Global Capital Flows

Geopolitical Events and Macro Risks – Impact Strength: ★★★☆☆

In addition to economic and regulatory factors, geopolitical situations and significant macro risk events can also indirectly impact the cryptocurrency market by influencing investor risk appetite and capital flows. In 2026, the following aspects should be closely monitored:

International Tensions and Conflicts: Geopolitical uncertainties (such as geopolitical conflicts and trade frictions) often trigger a rise in short-term risk aversion in global markets, leading capital to flow into traditional safe-haven assets like the dollar and gold, while high-risk assets like stocks and cryptocurrencies come under pressure. However, severe long-term geopolitical risks (such as economic sanctions or currency devaluation in certain countries) can sometimes spur localized demand for cryptocurrencies, as people seek channels for asset transfer and inflation hedging. For example, after the Russia-Ukraine conflict, the Russian ruble plummeted, leading to a surge in local Bitcoin trading volume. Potential risks in the international situation in 2026 include: escalating tensions in Eastern Europe and the Middle East, renewed geopolitical conflicts involving the U.S. in Venezuela and Greenland, sanctions and capital controls resulting from great power rivalries, and uncertainties surrounding the U.S. midterm elections. All of these could lead to a rise in global risk aversion, negatively impacting the cryptocurrency market in the short term. However, in the long run, the "neutral" and "borderless" attributes of crypto assets may allow them to serve as a liquidity outlet during global financial fragmentation, which is where their value in hedging traditional systemic risks lies.

Exchange Rates and Dollar Trends: The strength of the U.S. dollar index (DXY) often shows an inverse relationship with the cryptocurrency market. When the dollar appreciates significantly, capital flows out of emerging markets, and global liquidity tightens, which is unfavorable for non-dollar assets like cryptocurrencies; conversely, when the dollar weakens, crypto assets become relatively more attractive. If the Federal Reserve cuts interest rates in 2026 while Europe lags behind, the dollar may weaken moderately, reducing exchange rate concerns for non-U.S. investors and enhancing the motivation to allocate to cryptocurrencies. If a country experiences a currency crisis in 2026, the inflow and outflow of regional capital in the cryptocurrency market may undergo structural changes: citizens or businesses in high-inflation countries may increase their cryptocurrency holdings to preserve wealth, and the cryptocurrency market may gain new incremental users and funds from these regions.

Global Capital Controls and Tax Policies: India previously imposed high taxes and strict regulations on cryptocurrency trading, leading to a decline in trading volume; if India relaxes its policies in 2026, it could unleash significant potential demand. Conversely, if certain crypto-friendly regions tighten their policies due to changes, corresponding markets may shrink. From another perspective, countries are increasingly tightening regulations on cross-border capital flows (such as anti-money laundering and anti-tax evasion), and cryptocurrencies may be used for legitimate compliant cross-border transfers, such as international remittances using stablecoins, but they may also be abused by criminals. In 2025, many countries strengthened their anti-money laundering enforcement for cryptocurrencies, and such enforcement is expected to become more routine in 2026. In the short term, this will affect the demand for certain anonymous coins or privacy-related tokens.

Overall, the impact of geopolitical and macro risk events is often sudden and short-term, making precise predictions difficult. However, investors should have risk control plans, such as moderately allocating to gold and Bitcoin as a hedge.

### Outlook for the Cryptocurrency Market in 2026 Under Multiple Macroeconomic Variables

Based on the analysis of macro variables above, we can make projections about the potential trends in the cryptocurrency market in 2026. Of course, the future is full of uncertainties, and the following scenarios aim to provide a framework for thinking, with investors adjusting their expectations based on real-time data.

Baseline Scenario (Stable and Loose Macroeconomic Environment): Global economic growth is moderate, major central banks like the U.S. slightly cut interest rates and maintain rates around 3%, with inflation remaining close to target levels. On the regulatory front, there are no major negative shocks, and existing regulations are gradually implemented with good market adaptation. In this scenario, the cryptocurrency market is expected to continue the upward trend from 2025 and enter a mature growth phase. Bitcoin may further reach new highs based on the 2025 peak, driven by ongoing ETF capital inflows and the gradually visible effects of supply reduction, with an annual cumulative increase that may narrow compared to 2025 but still be considerable. Ethereum is expected to benefit from technological upgrades and increased institutional allocations, potentially outperforming Bitcoin in certain months while generally maintaining a certain level of follow-through. Among mainstream altcoins, projects with clear application value and good compliance prospects will be sought after, while purely speculative altcoins may see relatively short-lived and limited gains even in a rising market atmosphere. The scale of stablecoins is expected to further rise and surpass the $400 billion mark. Overall, investor sentiment is optimistic but more rational, with market volatility at a moderate level, and extreme euphoria or panic is less likely to occur.

Optimistic Scenario (Macroeconomic Surprises and Technological Breakthroughs): Overlaying several favorable factors on the baseline: rapid decline in inflation or even signs of slight deflation, prompting major central banks to restart quantitative easing (QE) in the second half of 2026; the U.S. Congress smoothly passing the CLARITY Act and other cryptocurrency legislation, with the SEC and CFTC coordinating regulation to eliminate regulatory gray areas; tech giants launching significant applications that bring blockchain technology to hundreds of millions of new users, or pension funds in countries like the U.S. and Europe beginning to allocate investments in Bitcoin, etc. These additional positives will trigger "FOMO" sentiment, pushing the market into an accelerated upward phase. In this optimistic scenario, Bitcoin prices may experience a parabolic rise similar to that of 2017 or 2021. Leading coins like Ethereum will also soar in tandem, potentially leading to a short-term surge in altcoins, with total market capitalization in this scenario possibly surpassing multiples of the previous cycle, truly entering the realm of global financial asset classes. However, it is important to be cautious, as such overheating states are often difficult to sustain, and once the macro or policy environment shifts, it may trigger a sharp correction.

Pessimistic Scenario (Macroeconomic Shocks and Risk Events): If the following combination occurs: rising inflation in the U.S. hinders the interest rate cut process, a systemic crisis emerges in international financial markets, U.S. cryptocurrency legislation stagnates or even regresses, escalation of the Venezuela situation and the disruption of sanctions chains affecting energy and inflation expectations, the U.S. forcibly acquiring Greenland and threatening European tariffs, and the uncertainty of U.S. midterm elections in 2026 affecting policy expectations. In this pessimistic macro scenario, the cryptocurrency market is bound to suffer severe blows. Liquidity tightening and risk aversion may lead to a significant correction in Bitcoin prices, with institutional capital potentially withdrawing from crypto ETFs and other positions due to losses in other assets or a sudden drop in risk appetite, resulting in net capital outflows. At the same time, if some large industry institutions face risks, it will exacerbate panic sentiment. In a pessimistic scenario, altcoins will be the hardest hit, with Ethereum and others also declining alongside the market. For long-term investors, the pessimistic scenario provides an opportunity to accumulate quality assets at lower prices; for short-term traders, it is essential to be prepared for stop-loss exits.

The most likely trend may fall between the baseline and optimistic scenarios, leaning towards the positive. Current signs indicate that the macro environment is gradually improving, the regulatory framework is being put in place, and endogenous innovation within the industry is gaining momentum. Bitcoin has not experienced the extreme euphoric bubbles seen in past cycles after reaching new highs in 2025, which actually leaves room for further upward movement in 2026. Market sentiment has matured and become more rational after the trials of 2022-2023. As long as there are no significant negative "black swan" events, the overall trend of the cryptocurrency market in 2026 looks bullish, but the pace of volatility will be more moderate than before. Perhaps the yearly trend will be "oscillating upward": the first quarter may experience consolidation due to macro uncertainties or profit-taking, while the second and third quarters may rise under falling interest rates and the realization of regulatory benefits, and if there are new technological catalysts in the fourth quarter, another surge may occur. From a longer-term perspective, 2026 may lay the foundation for the next cryptocurrency cycle; regardless of price fluctuations, the underlying foundation of the industry is more solid than ever: the number of global users continues to grow, mainstream institutional recognition is increasing, legal status is clarified, and technology is continuously evolving. These fundamental factors will support cryptocurrency assets moving towards a broader stage.

Conclusion

The cryptocurrency market in 2026 stands at a new starting point. The changing tides of the macro economy and policy waves will continue to shape the fate of this emerging market to a large extent. From interest rate trends to regulatory frameworks, from institutional capital to geopolitical factors, various macro variables intertwine, making the cryptocurrency market no longer isolated from the global financial system but rather integrated and resonating with it. On one hand, this means that the investment logic of crypto assets is becoming richer, requiring investors to possess a macro perspective and cross-market thinking; on the other hand, it signifies that cryptocurrency is gradually maturing, with its rise and fall no longer just a celebration for speculators but closely related to the pulse of the global economy and institutional changes.

For ordinary investors, 2026 will be a year full of opportunities and challenges. We must recognize the historical opportunities that a warming monetary environment and clearer regulations may bring, while also remembering that the market is unpredictable and risk events may still arise unexpectedly. Being prudent yet forward-looking, rational yet passionate, is essential to grasp the threads of cryptocurrency investment in this complex and ever-changing macro landscape. Looking ahead, the cryptocurrency market will continue to evolve; regardless of bull or bear trends, its inherent innovative vitality and pursuit of open finance will not cease. Let us wait and see what exciting chapters the cryptocurrency world will write in 2026, driven by macro waves.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Every week, our researchers also engage with you face-to-face through live broadcasts, interpreting hot topics and predicting trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment itself carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。