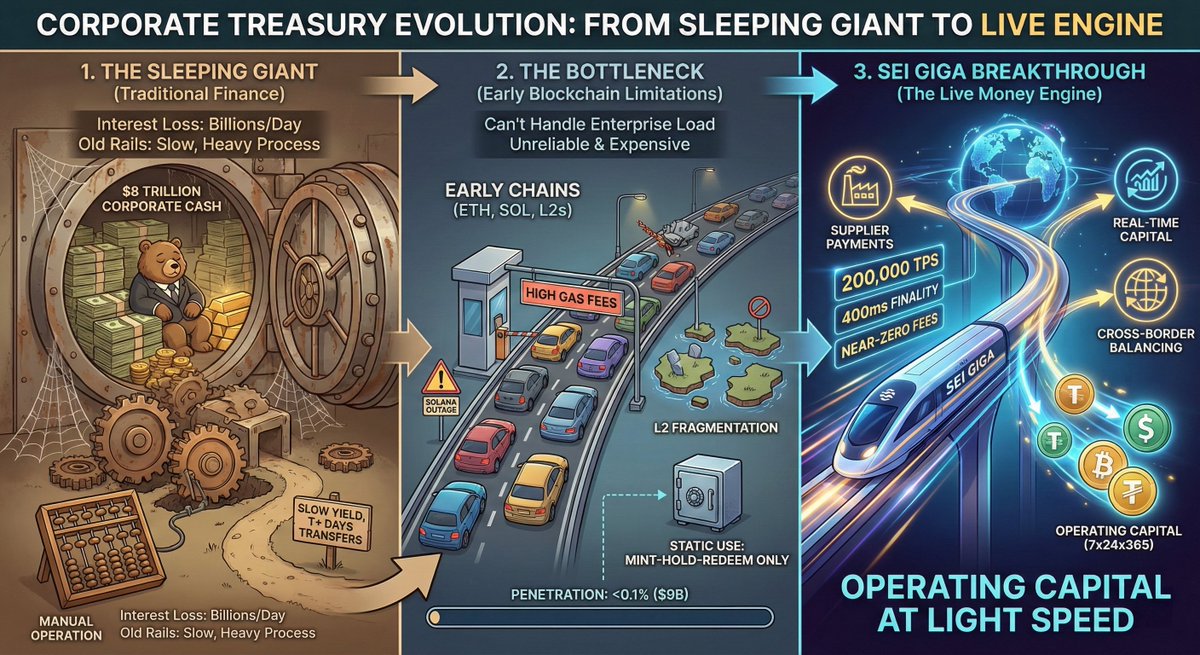

Recently, I came across a set of data 📊 that surprised me. Currently, global companies hold $8 trillion in cash, but it is mostly "asleep."

Just imagine, giants like Apple, Microsoft, and Tesla have hundreds of billions of dollars lying in their accounts, and the daily interest loss could be in the millions. In the traditional banking system, they put their money into short-term government bonds and money market funds, earning meager returns, but the operations are slow, the processes are cumbersome, and cross-timezone transfers can take several days. Not to mention high-frequency actions like cross-border payments, internal fund allocation, and temporary collateral, which rely entirely on manual processes and outdated systems, making efficiency as low as using a computer for stock trading.

In the RWA scenario, government bonds can be tokenized, moving these "safe assets" onto the blockchain, transforming them into programmable, divisible, and 24/7 tradable digital assets. We can buy today and use them as payment tools tomorrow, without intermediaries, directly transferring tokenized government bonds, with the recipient receiving them instantly, and they can continue to earn interest.

This is equivalent to transforming the previous "piggy bank" function into a "living money engine." However, it is worth noting that since the experience of tokenized government bonds is so good, why is the entire market only at $9 billion now, with a penetration rate of less than 0.1%?

The core pain point lies in the fact that previous public chains simply cannot withstand enterprise-level usage.

Imagine a multinational company might have thousands of fund transfers daily: paying salaries, settling invoices, adjusting positions, posting collateral… Each transaction needs to be fast, stable, and cheap. But Ethereum? Confirmation times are slow. Other L2s? They are severely fragmented, have poor interoperability, and lack complete compliance interfaces.

Enterprises are not retail investors; they cannot tolerate "possible failures" or "uncontrollable costs." Therefore, in the past few years, tokenized government bonds could only be used in static scenarios like "Mint-Hold-Redeem," akin to locking gold bars in a safe—secure, but not liquid.

At this point, the emergence of #Sei Giga is like installing a magnetic levitation track on a highway. It fully meets enterprise-level technical standards:

- 200,000 TPS (transactions per second)

- Final confirmation within 400 milliseconds

- Costs approaching zero, especially in high-frequency scenarios

→ A company can initiate 100,000 cross-border payments simultaneously, with the system not lagging, crashing, or being expensive.

→ The financial system can rebalance global accounts in real-time, as naturally as breathing.

→ Tokenized government bonds are no longer just "held assets," but true working capital.

Moreover, this time #Sei is not just making empty promises. The Kingdom of Bhutan has joined as a validating node, which is not an ordinary endorsement; it is a trust vote at the level of national credit. For conservative treasury departments, this is a hundred times more powerful than "VC investment" or "KOL endorsements."

I personally believe that this enterprise-level narrative can reach a trillion-dollar scale. The logic is simple: as long as global companies convert 1% of their idle cash ($80 billion) into tokenized government bonds, the market will multiply by nine. And if in the next five years, with clearer regulations and mature infrastructure, this ratio rises to 5%, 10%… a trillion-dollar scale is not a dream. More importantly, once enterprises start using tokenized government bonds for daily operations, a flywheel effect will form: more usage → stronger liquidity → lower friction → more companies joining. Banks, custodians, and auditing firms will also be compelled to integrate, ultimately becoming the "new operating system" for global treasury management, which is something to look forward to. 🧐

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。