Original link: 《Big Ideas 2026》

Original translation by: CryptoLeo(@LeoAndCrypto)

Recently, Cathie Wood's Ark Invest released the annual report "Big Ideas 2026." This report focuses on AI, robotics, blockchain, energy storage, and multi-omics (a research method and strategy in biology), which ARK refers to as five major technology platforms. These five platforms will be interdependent and catalyze each other, promoting the accelerated integration of technologies to create new platform functionalities. It states that the world is entering an unprecedented technology investment cycle, where innovations in each technology platform will have far-reaching macroeconomic impacts, and each platform will provide structural momentum for global growth.

The report also briefly mentions quantum computing, such as the long-standing concern about quantum computing breaking Bitcoin. ARK states that the performance improvements in quantum computing have been relatively gradual, despite significant investments in its research and development. Google has only doubled the number of quantum bits over more than four years. Even if its performance and cost improve significantly, reaching the speed of Moore's Law, quantum computing will not be usable for encryption and decryption until the 2040s.

Odaily has compiled the cryptocurrency-related content from "Big Ideas 2026," Enjoy~

1. Blockchain and Bitcoin

Once blockchain achieves widespread adoption, all funds and contracts will migrate on-chain, where these blockchains can verify digital scarcity and proof of ownership. The financial ecosystem is likely to be reconfigured to accommodate the rise of cryptocurrencies (including connections between traditional finance and stablecoins) and smart contracts. These technologies should enhance transparency, reduce the impact of capital and regulatory controls, and lower the costs of contract execution.

As more assets become currency-like, and businesses and consumers adapt to new financial infrastructures, digital wallets will become increasingly necessary. These wallets may evolve into AI-driven purchasing agents, potentially developing into distribution platforms for digital services.

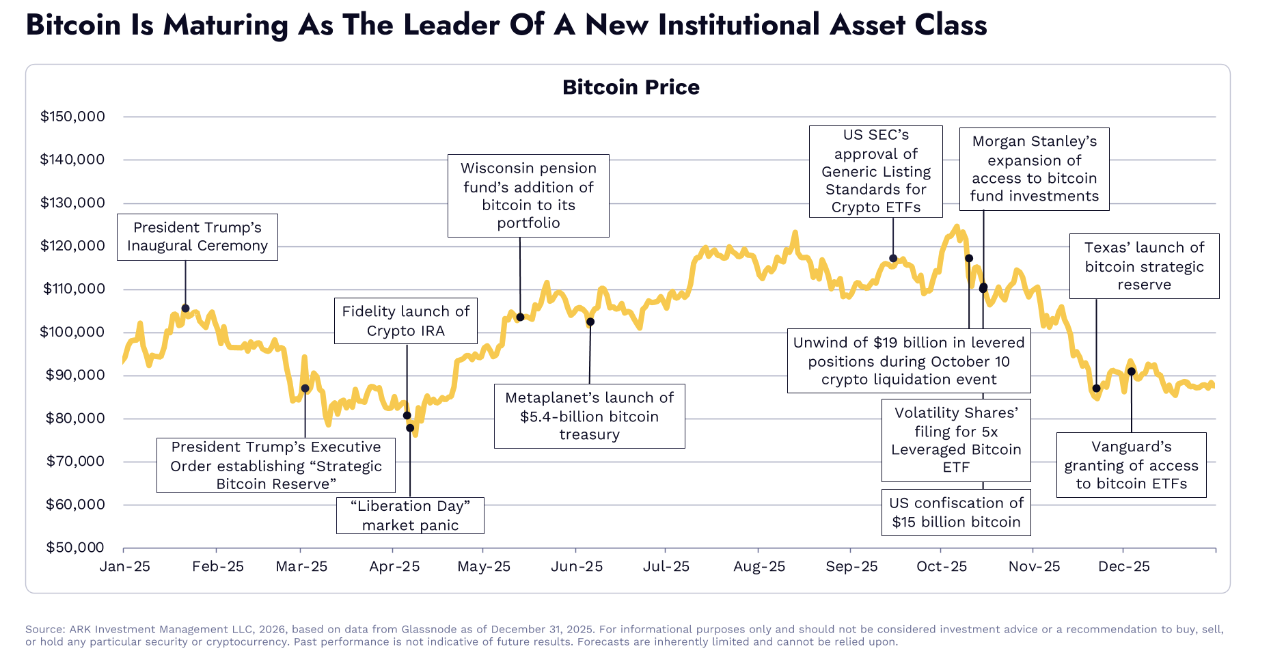

The above image shows the price trend of Bitcoin throughout 2025 alongside key events related to Bitcoin. From Trump's inauguration speech at the beginning of 2025 to Bitcoin's strategic reserves, and by the end of the year, Vanguard's engagement with Bitcoin ETFs.

Bitcoin is maturing as an emerging asset class, with U.S. Bitcoin ETFs and publicly traded companies holding 12% of the total Bitcoin supply. In 2025, the balance of Bitcoin ETFs grew by 19.7%, from approximately 1.12 million to about 1.29 million, while the Bitcoin held by publicly traded companies increased by 73%, from about 598,000 to approximately 1.09 million. The circulation ratio of Bitcoin held by Bitcoin ETFs and publicly traded companies increased from 8.7% to 12%.

The risk-adjusted annual return of Bitcoin (i.e., the Sharpe ratio) has exceeded the average of the cryptocurrency market over time. For most of 2025, Bitcoin's risk-adjusted returns surpassed those of most other large-cap cryptocurrencies. Since the recent cycle low (November 2022), early 2024, and early 2025, its average annual Sharpe ratio has also been higher than that of ETH, SOL, and the average of the other nine tokens in the top 10 by CoinDesk market cap.

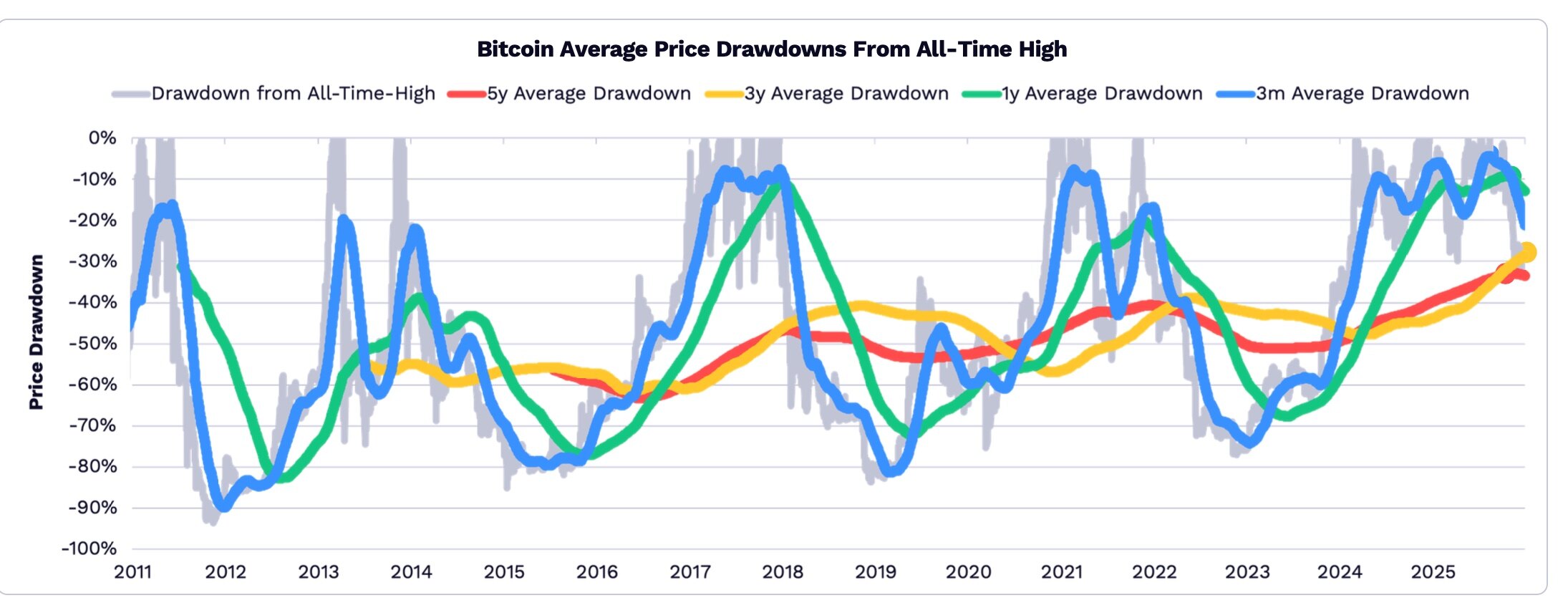

In 2025, the decline in Bitcoin's price relative to its historical peak narrowed, and as Bitcoin's role as a safe-haven asset increased, its volatility decreased. Over the spans of 5 years, 3 years, 1 year, and 3 months, Bitcoin's drawdown in 2025 was not significant compared to historical drawdowns.

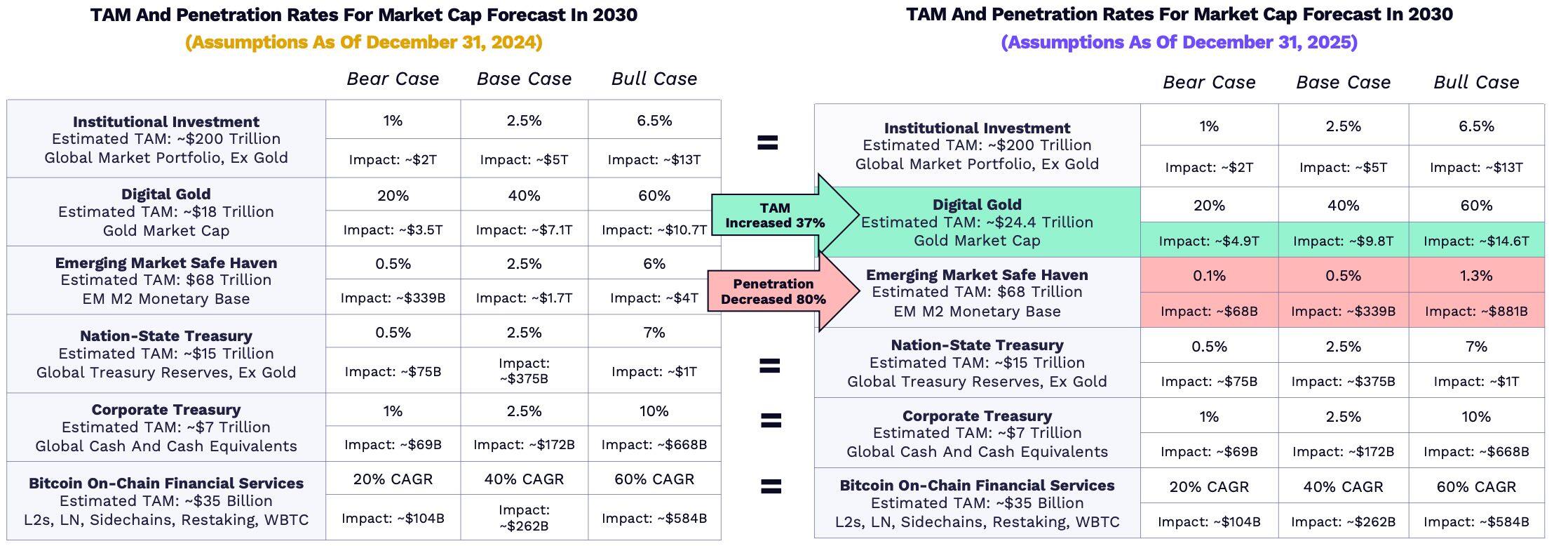

With gold prices steadily rising and the adoption of stablecoins accelerating, ARK's valuation model for Bitcoin in 2030 saw two changes: the total TAM of digital gold, which increased by 64.5% in 2025, leading to a 37% growth in its potential market size; and due to the rapid adoption of stablecoins in developing countries, the penetration rate of Bitcoin as a safe haven in emerging markets decreased by 80%.

Reference reading: 《Ark Invest releases Bitcoin valuation model: BTC starting at $500,000 in 2030》

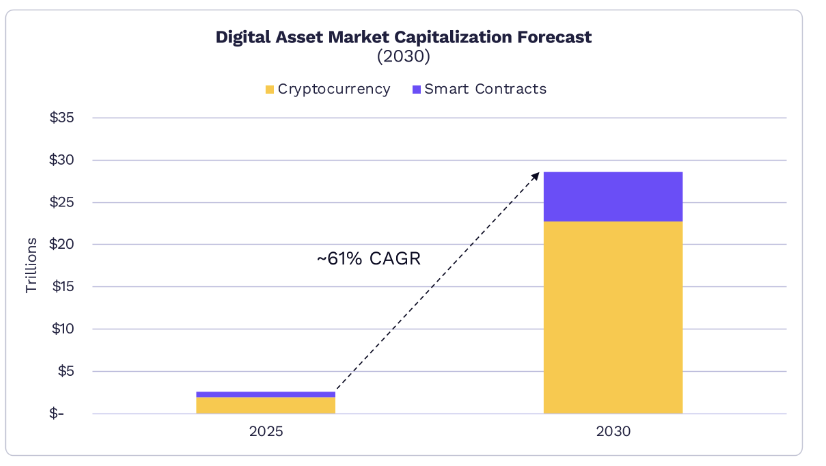

By 2030, the market value of digital assets could reach $28 trillion, with the smart contract and pure digital currency market potentially growing to $28 trillion at an annual growth rate of about 61% by 2030. ARK believes Bitcoin could capture 70% of this market, with the remainder dominated by ETH and Solana.

Data shows that Ethereum remains the preferred blockchain for on-chain players, with assets on Ethereum now exceeding $400 billion. Among the eight major blockchains, seven have stablecoins and the top 50 tokens accounting for about 90% of market value. Outside of Solana, the market share of meme coins is about 3% or lower. On Solana, the market share of meme coins is about 21%.

According to ARK's predictions, Bitcoin is likely to dominate the cryptocurrency market cap, growing at an approximate compound annual growth rate (CAGR) of 63% over the next five years, increasing from nearly $2 trillion to $16 trillion by 2030.

By 2030, the market capitalization of smart contracts could grow at an annual rate of 54%, reaching about $6 trillion, generating approximately $192 billion in annual revenue at an average fee rate of 0.75%.

Two to three L1 smart contract platforms should capture the majority of the market share, with their market value derived from monetary premiums (value storage and reserve asset characteristics) exceeding discounted cash flows.

2. Tokenized Assets

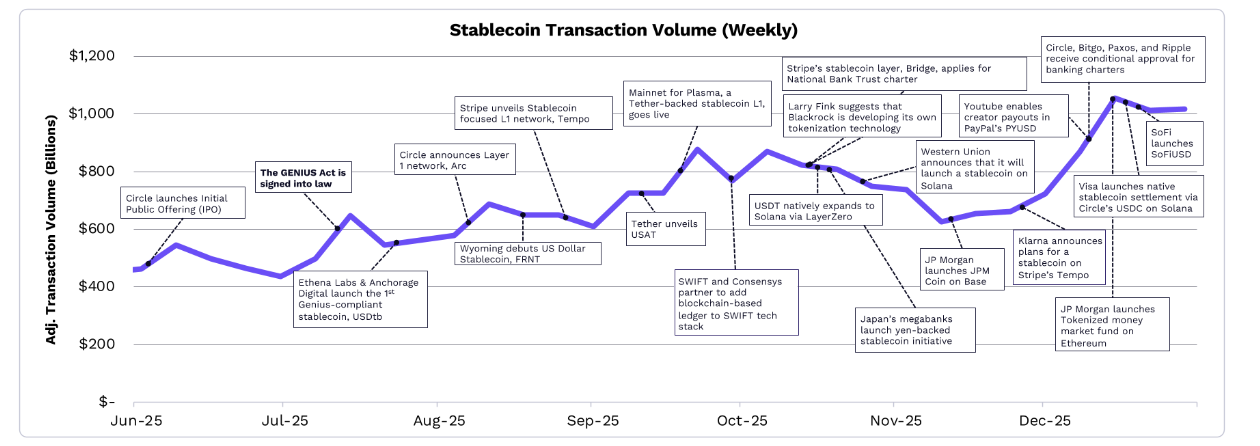

Thanks to the GENIUS Act, financial institutions are reassessing their stablecoin and tokenization strategies. With the clarification of regulations related to the GENIUS Act, stablecoin activity surged to historic highs. Many companies and institutions are launching their own stablecoins, and BlackRock has disclosed plans for an internal tokenization platform. Major enterprises and fintech companies like Tether, Circle, and Stripe are also launching or supporting Layer 1 blockchains optimized for stablecoins.

In December 2025, stablecoin transaction volume reached $3.5 trillion, far exceeding most traditional payment systems:

In December 2025, the 30-day moving average of adjusted stablecoin transaction volume was $3.5 trillion, 2.3 times that of Visa, PayPal, and total remittances.

Circle's stablecoin USDC dominated the adjusted transaction volume, accounting for about 60%, followed by Tether's USDT at about 35%.

In 2025, the supply of stablecoins grew by about 50%, from $210 billion to $307 billion, with USDT and USDC accounting for 61% and 25%, respectively.

Sky Protocol is a stablecoin issuer with a market value exceeding $10 billion by the end of 2025. Notably, PayPal's PYUSD saw its market value grow more than sixfold, reaching $3.4 billion.

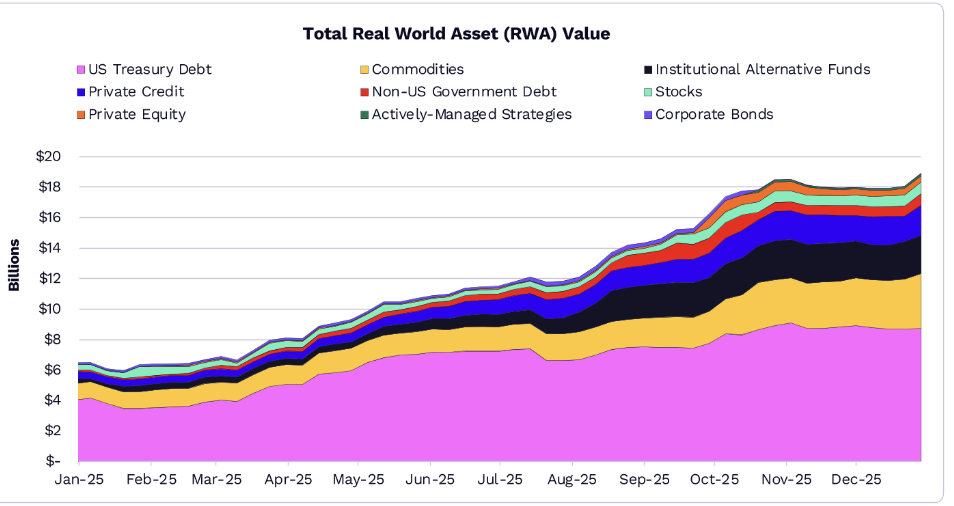

Led by U.S. Treasury bonds and commodities, the market size of tokenized assets doubled in 2025, reaching $19 billion.

In 2025, the market value of tokenized real-world assets (RWA) grew by 208%, reaching $18.9 billion.

BlackRock's $1.7 billion BUIDL money market fund is one of the largest products, accounting for 20% of the $9 billion in U.S. Treasury bonds;

Tether (XAUT) and Paxos (PAXG) led the tokenized commodities, increasing to $1.8 billion and $1.6 billion, respectively, together accounting for 83%;

The amount of tokenized public stocks approached $750 million;

RWA could become one of the fastest-growing categories, although decentralized assets occupy a large portion of global value, off-chain assets still represent the largest growth opportunity for on-chain adoption.

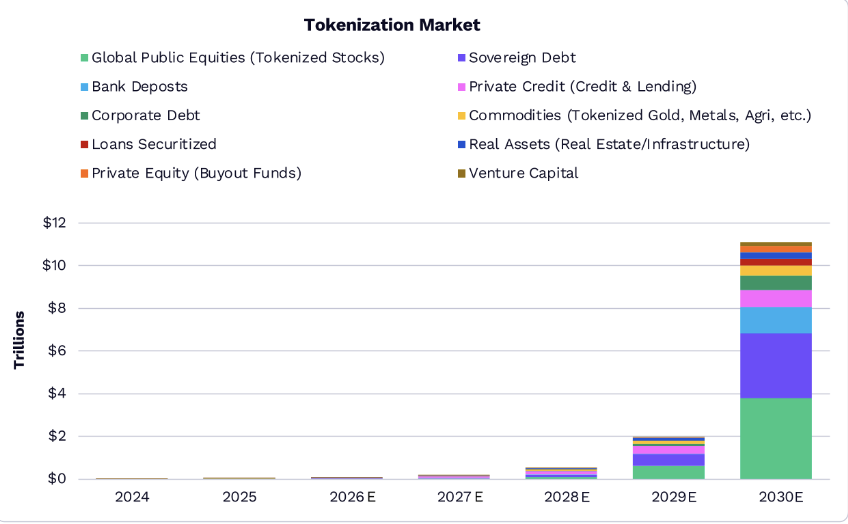

By 2030, the global market size of tokenized assets could exceed $11 trillion.

By 2030, tokenized assets could grow from $19 billion to $11 trillion, accounting for approximately 1.38% of global financial assets.

Although sovereign debt is currently the primary area for tokenization, bank deposits and global public equities are likely to present a larger share on-chain over the next five years. With regulatory clarity and the development of institutional-grade infrastructure, tokenization is likely to see widespread adoption.

Traditional companies are expanding their on-chain presence by launching their own infrastructures. For example, Circle (Arc), Coinbase (Base, cbBTC), Kraken (Ink), OKX (X Layer), Robinhood (Robinhood Chain), and Stripe (Tempo) are all launching L1/L2 networks named after their respective brands to support their own products, such as Bitcoin-collateralized loans, tokenized stocks and ETFs, and stablecoin-based payment channels.

3. DeFi Applications

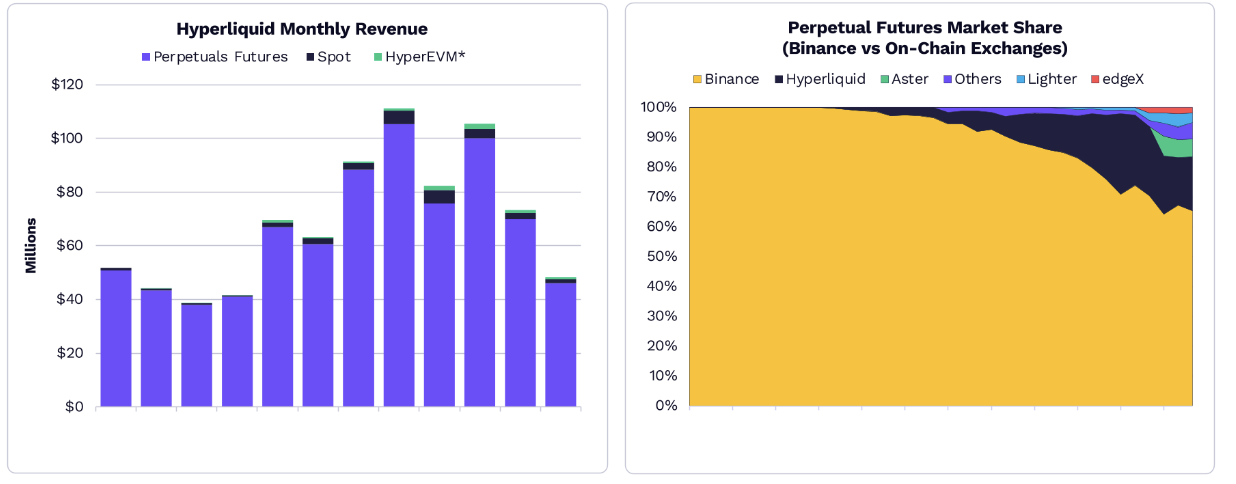

The value acquisition of digital assets has shifted from networks to applications, with networks becoming public utilities rather than economic layers, pushing user economies and profits toward the application layer. Led by Hyperliquid, Pump.fun, and Pancakeswap, the total revenue from DeFi applications reached a historic high of approximately $3.8 billion in 2025.

In 2025, one-fifth of application revenue was generated in January, marking the highest single-month revenue ever recorded. Today, there are 70 applications and protocols with monthly recurring revenue (MRR) exceeding $1 million.

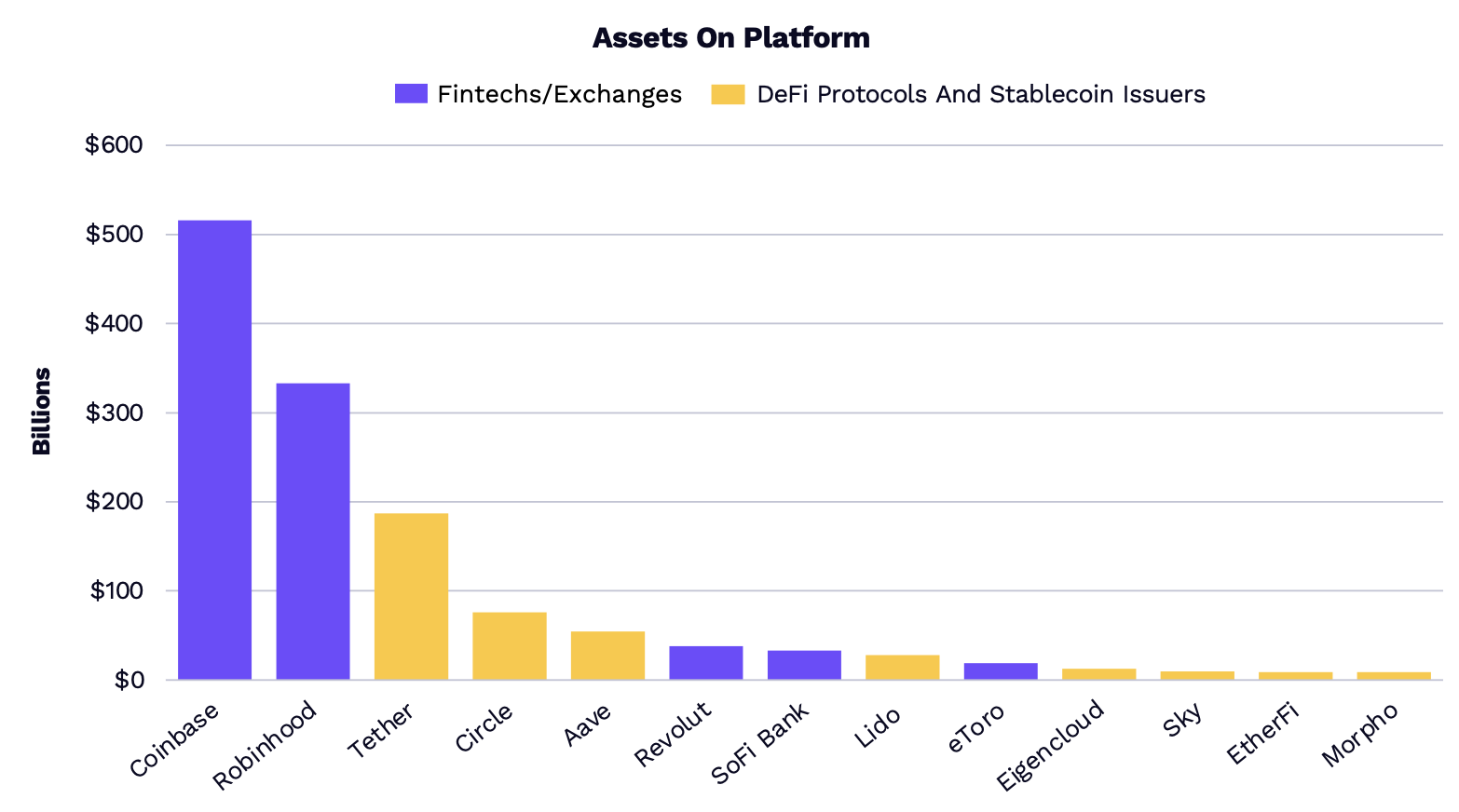

The asset scale of DeFi and stablecoin issuers is catching up with many fintech companies. The asset disparity between traditional fintech platforms and native cryptocurrency platforms is narrowing, indicating a gradual convergence between traditional infrastructure and on-chain infrastructure. DeFi protocols like liquid staking or lending platforms are attracting institutional capital and rapidly scaling.

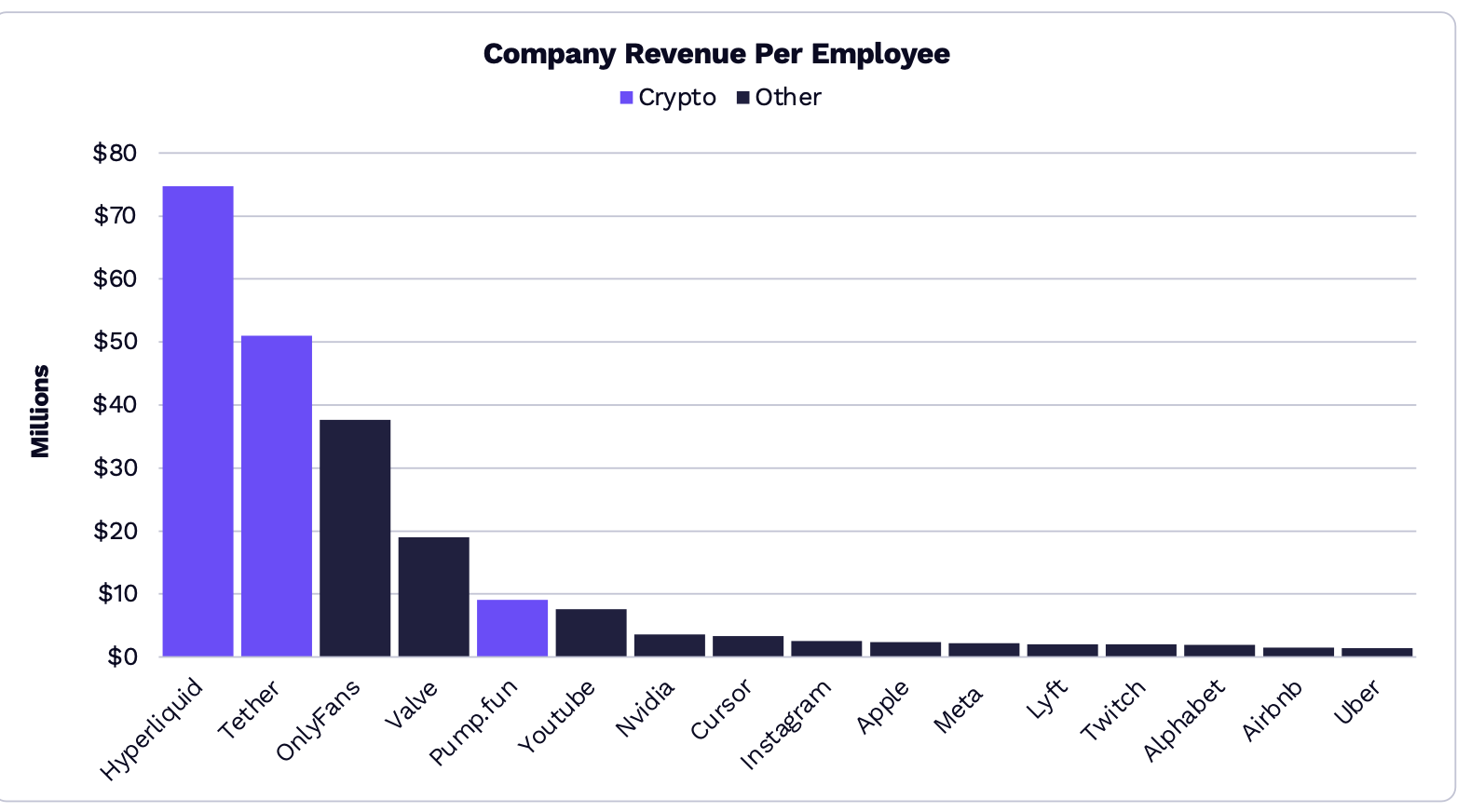

Among the top 50 DeFi platforms, each platform has a total value locked (TVL) exceeding $1 billion, while each of the top 12 platforms has a TVL exceeding $5 billion. The companies with the highest global revenue efficiency include Hyperliquid, Tether, and Pump.fun.

In 2025, Hyperliquid generated over $800 million in annual revenue with fewer than 15 employees. Perpetual contracts, stablecoins, and meme coins, as on-chain verticals, have a clear product-market fit, capable of attracting users and capital on a large scale.

On-chain businesses and protocols are redefining productivity, with a small number of employees driving world-class revenue and profitability.

In the perpetual contract market, DeFi derivatives led by Hyperliquid are capturing market share from Binance.

Layer 1 is evolving from a revenue-generating network to a monetary asset. Applying a 50x high-growth revenue multiple to its network revenue indicates that over 90% of Ethereum's market value is attributed to its role as a monetary asset.

Solana generated $1.4 billion in revenue, indicating that 90% of its valuation depends on its network utility.

Only a few crypto assets can retain monetary properties as a liquid store of value.

Additionally, the ARK report also mentioned artificial intelligence. Since the ChatGPT boom, the growth rate of data center systems has increased from 5% per year to 29%. As AI foundational models become a new layer of internet architecture, consumer interactions with applications are gradually decreasing, shifting more towards interactions through AI Agents. This structural shift is intensifying the digital experience for consumers. The speed at which consumers adopt AI far exceeds the speed at which they initially embraced the internet. By 2030, AI Agents are expected to facilitate over $8 trillion in online consumption. The share of AI Agents in digital transactions is expected to continuously increase—from 2% of online spending in 2025 to about 25% by 2030.

By 2030, AI Agents are expected to generate approximately $900 billion in business and advertising revenue. As AI agents drive the transformation of the digital economy, consumer income mediated by AI is projected to grow at an annual rate of about 105% over the next five years, increasing from approximately $20 billion now to about $900 billion by 2030. Lead generation and advertising will drive most of the growth, far exceeding the contribution from consumer subscription revenue.

Currently, the infrastructure in the crypto industry that is closest to AI Agent consumption is the x402 protocol, which also promotes the development of crypto + AI.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。