The world is bustling, all for profit; the world is in turmoil, all for profit! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to cryptocurrency enthusiasts. I welcome all friends in the crypto community to follow and like, and I reject any market smoke screens!

As mentioned earlier by Lao Cui regarding the gold market, many crypto enthusiasts have come to ask Lao Cui to predict the price of gold. This has also raised a derivative question: if gold falls, will the crypto market rise? In a sense, a surge in gold prices does indeed relate to capital absorption in the crypto market, as it will draw a significant amount of funds away from the crypto space. You can take a look at Tether, a stablecoin collateral company, which has accumulated over a hundred tons of gold in just a few years. This indirectly suggests that the crypto market has actually boosted the gold market. Many friends are confused, wasn't it said that Bitcoin is digital gold? Why is gold surging while Bitcoin is not rising? Here, Lao Cui reminds everyone that the concept of digital gold was proposed between 15-20 years ago, and there is no substantial evidence linking Bitcoin to gold. The only evidence is the aforementioned stablecoin companies' purchases; these two are not in a symbiotic relationship.

Let's tackle the first question. Lao Cui will break down the high price of gold; Goldman Sachs has recently raised its forecast for Bitcoin's price this year from 4800 to over 5000. Almost all investment banks are continuously raising their psychological expectations in line with market fluctuations. To predict the price of gold, we must clarify who is buying it. The top buyer is definitely us, purchasing tens to hundreds of tons to transport back to the country. Next are the major central banks in Europe, but Lao Cui is not quite clear on the specific amounts. However, everyone needs to understand the timeline of these purchases; our large-scale buying started in 2016. When mentioning 2016, many friends are aware of what happened; many believe that the US-China confrontation began with the Huawei incident, but that is not the case. Obama had already formulated targeted strategies during his presidency, which were completely disrupted by Trump.

Perhaps it was due to his lack of experience as a first-time president that we became aware of the confrontation issue too early. Since then, we have been continuously increasing our gold purchases, peaking during the mask period and the Russia-Ukraine conflict. The US's reckless monetary easing, combined with the freezing of Russian assets, has awakened Europe to the realization that the dollar is just a piece of paper. During this period, Lao Cui elaborated on the value of the dollar, and you can search online for it. At that time, Lao Cui's advice was relatively conservative, only stating that the depreciation of the dollar was highly probable. Why did I say this? This was also concluded in last year's article, which stated that the value of currency lies in what it can buy, not in itself. For us, the dollar cannot buy the desired technology, cannot buy chips, and certainly cannot buy advanced weapons. In a situation where all essential needs cannot be met, using dollars for anything would be like scraping blood.

This logic applies to Europe as well. With the accumulation of tariffs and the escalation of the trade war, the dollar will only lose more of its value. This panic is not caused by retail investors but by the inherent instability of the US, leading more countries to lose confidence, resulting in a frenzy of gold purchases. Therefore, this round of gold price increases cannot simply be defined as purely financial attributes; the implications are vast, and there are many reasons that cannot be discussed. For high price predictions, as long as central banks are buying aggressively, it at least supports the notion that gold cannot decline. During the growth phase, do not expect a downward trend to occur. Regarding this growth high, even if it hits international prices above 6K, Lao Cui believes it is a normal phase. From Lao Cui's perspective, the current trend resembles a challenge from a new order to the old order. Many friends are clamoring for a fourth industrial revolution, which may indeed already be underway.

For this price, it is not a predictive price; this is completely illogical speculation. Lao Cui currently does not possess the ability to predict such a large scale, and with limited understanding, can only provide suggestions based on known conditions through purchasing. What Lao Cui sees is a frenzy of buying, which may also just be a way to back the CNY, making domestic capital more competitive internationally. This may also be a part of the proposed internationalization theory. Not to elaborate on the domestic situation, you can look at Japan's strategy. According to the latest news, Japan has maintained its interest rates while raising inflation and growth expectations. What does this mean? Everyone should understand that Japan's current inflation is above 2%, with prices nearing 4%, and they are still raising inflation expectations, indicating that the data for Japanese bonds and stocks is at a point of no return, becoming a choice between life and death.

This means that global strategies are surprisingly consistent; the depreciation of fiat currency goes unnoticed. The current economy is such that whoever loosens will have their market completely consumed. Therefore, the depreciation of fiat currency will certainly promote the growth of gold, especially under the recent adjustments, where gold has become a type of asset that can be used for loans in any country, its status is rapidly increasing. In this economic situation, if you were a giant, how would you choose? Would you buy Bitcoin or gold? The answer is obvious; the gold purchased this month has a 20% chance of growth next month, which is hard to achieve in the crypto market, especially since gold is so stable. This is not a choice between the crypto market and the gold market; rather, the gold market creates a siphoning effect on all financial markets. As long as the gold market maintains this growth, other markets will find it difficult to break through. At the same time, you need to be clear about one point: a certain sage once said, "We must oppose everything the enemy supports and support everything the enemy opposes." We are not supporters of the crypto market, which is also a form of competition.

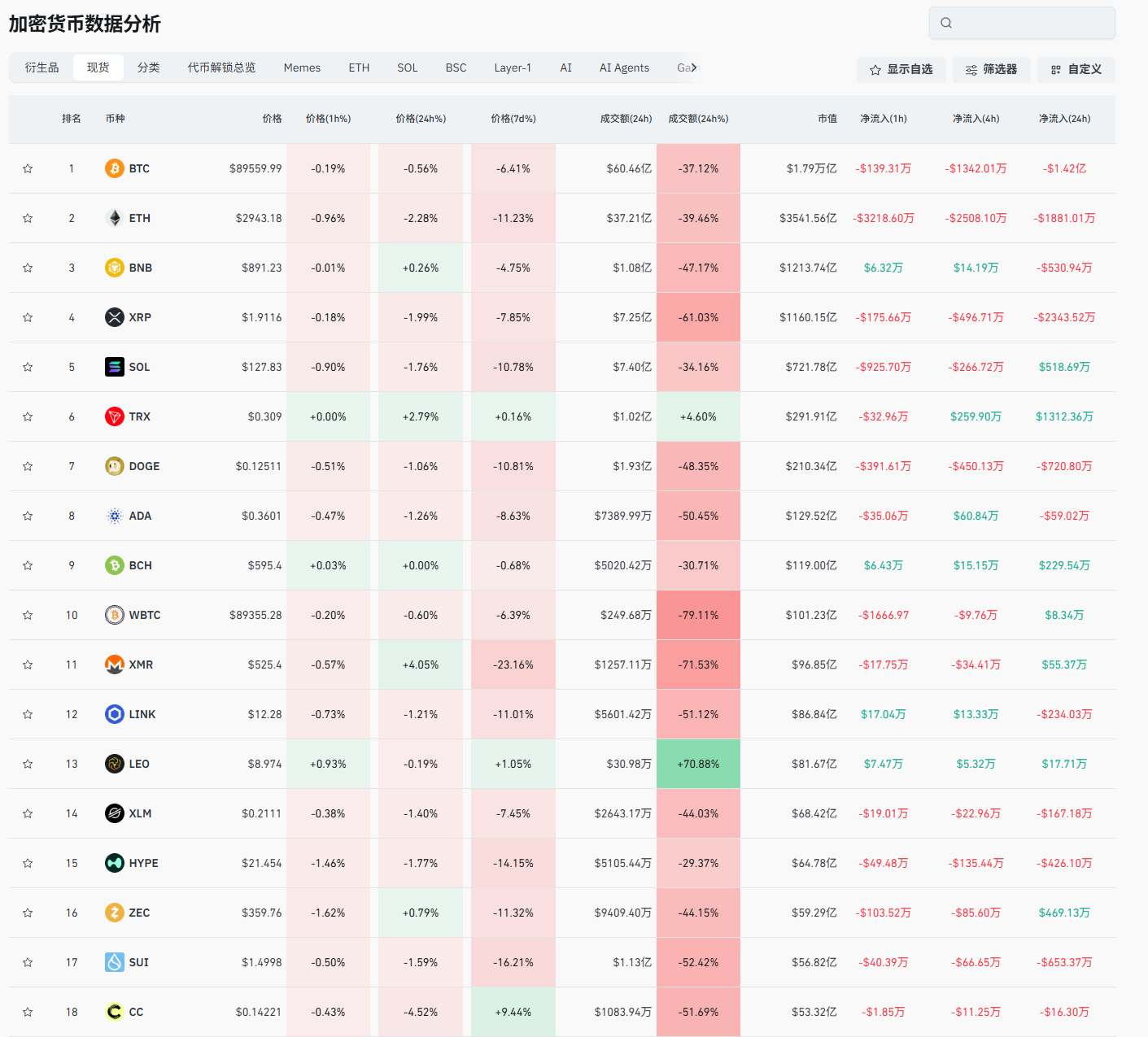

Lao Cui summarizes: Overall, when gold surges, the crypto market may fall; when gold falls, the crypto market may not necessarily rise, as there are many other valuable financial markets. The premise for breaking this situation is that gold cannot surge; it must maintain a slight increase or slight decrease for other markets to have opportunities. Under the premise of gold surging, no market can compare; there is no need to discuss the value of US stocks. The growth of US stocks is linked to technology, and do not be misled by certain things domestically; many people lack self-awareness. Just to mention one thing, the American insurance company Lemonade has officially announced that it will charge half the insurance premium for vehicles using Tesla's FSD technology. The superiority of this technology is already evident. It is precisely because of this technological support that US stocks have grown. You can compare the growth of the top ten technology companies; this is not something other markets can compare to. You must think independently and discern right from wrong! If you are in the crypto market, the short-term downward pressure still exists, whether macro or short-term. Bitcoin's breakthrough must wait for information in February, and there may even be another round of decline, which is the official announcement of the US not lowering interest rates. In the short term, bears still dominate! Those small coins will only fall harder!

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one territory, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。