# I. Market Overview This Week

This week, the cryptocurrency market is generally in a state of fluctuating adjustment, with short-term trends dominated by risk-averse sentiment. Major cryptocurrencies are under pressure, with Bitcoin's price oscillating down from the $92,000 range to around $90,000, and Ethereum following suit. The total market capitalization has shrunk by over $100 billion, and the Fear and Greed Index has dropped from the neutral zone back to the fear range of 32-34, indicating a significant cooling of market sentiment. The uncertainty of macro trade tariffs, the light trading atmosphere during the holiday, combined with the continuous net outflow of ETF funds, have collectively suppressed market performance. The AI and RWA sectors are leading the market decline, with only a few new coins and meme coins rising against the trend, and localized speculative opportunities concentrated in the new listing activities of exchanges.

The core driving clues exhibit characteristics of multidimensional games. From a medium to long-term positive perspective, the integration of institutions and traditional finance continues to deepen. The U.S. plans to incorporate over 200,000 confiscated Bitcoins into its strategic reserves and has paused liquidation, with frequent actions from the government and enterprises regarding Bitcoin reserves. Wall Street giants are accelerating their layout in the tokenization track, with Galaxy planning to launch a crypto-configured hedge fund, and Grayscale applying to convert the Near trust into an ETF, further broadening the compliant pathways for crypto assets. Exchange dynamics are significantly differentiated, with Binance Alpha intensively launching new coin airdrops to attract speculative funds, although some tokens have seen significant initial corrections; OKX has delisted low liquidity coins, highlighting the increasingly strict liquidity management in the industry. The regulatory side is sending out diverse signals, with Hong Kong clearly stating that it will issue stablecoin licenses this year and suggesting a faster approval process for RWA products; U.S. crypto legislation is entering a window period, but there are disputes over the terms, and regulatory efforts vary from country to country, bringing uncertainty to the market. Meanwhile, risks such as hacker attacks and project migration disputes are frequently occurring, causing disturbances to market confidence in the short term.

# II. Core Market Trends and Fund Dynamics

This week, the cryptocurrency market presents a contradictory pattern of "sudden emotional decline and oversold rebound coexisting," with intense long-short battles leaning towards caution. The short-term volatility has intensified, contrasting sharply with the emerging medium-term layout opportunities. Market sentiment has experienced a cliff-like drop, with the crypto Fear and Greed Index plummeting from last week's 54 to 34, directly falling from the previously neutral and slightly optimistic range into the fear range. This change aligns closely with the pullback of major cryptocurrencies, the contraction of market liquidity, and the rise of macro uncertainties. The current market is in a short-term panic phase, although there is potential for medium-term layout, the short term still requires waiting for clear signals of volatility convergence and fund inflow.

In terms of market capitalization, the total cryptocurrency market cap has rebounded to $3.04 trillion, with a slight increase of 2.05% in 24 hours, showing signs of an oversold rebound. This is a mild recovery after last week's market cap fell below $3.1 trillion, reflecting that technical buying has begun to enter after panic selling, but the current market cap has not yet stabilized at the previous $3.2 trillion level, and the effectiveness of the rebound remains in doubt. Future attention should focus on whether trading volume can continue to expand to confirm the stability of the rebound trend.

Core cryptocurrencies have slightly rebounded after being under pressure, with clear differentiation in long-short logic. Bitcoin is currently priced at $90,137.06, up 1.21% in 24 hours, but has accumulated a 7-day decline of 6.48%, with a market cap of $1.78 trillion and a slight increase in market share to 59.06%; its short-term indicators show overbought conditions, indicating a pullback pressure, while medium to long-term indicators are oversold, forming a potential rebound basis. However, the price is under mid-term pressure, with significant upward resistance. In the short term, it is advisable to wait and avoid chasing highs, while in the medium to long term, it is necessary to wait for a stabilization signal at the support level below. Ethereum is performing slightly weaker, currently priced at $3,029.98, with a 24-hour increase of 2.07% and a 7-day cumulative decline of 8.81%, with a market cap of $360.30 billion and a slight decrease in market share to 11.96%; although there is rebound momentum in the short term, it is accompanied by overbought risks, and medium to long-term indicators are weak and under downward pressure. In the short term, it is advisable to reduce positions at highs, while in the medium to long term, it is necessary to wait for the price to fall back to the support level before making layout decisions. Both require simultaneous tracking of trading volume and market sentiment compatibility.

The pressure on the funding side continues to be prominent, with BTC and ETH spot ETFs continuing to experience net outflows, further suppressing market rebound momentum. Bitcoin ETF saw a net outflow of $64.4 million on the day, with a cumulative net outflow of $248 million last week; Ethereum ETF had a net outflow of $36.7 million on the day, with a cumulative net outflow of $130 million last week. The continuous outflow of funds reflects a strong short-term risk-averse sentiment among institutions and a strong willingness to take profits. Future market sentiment and price recovery still need to wait for clear signals of ETF fund inflow.

The derivatives market shows differentiated characteristics, highlighting the cautious layout logic of funds. The scale of open interest in near-term futures reached $3.67 billion, a slight increase of 1.17%, reflecting that short-term speculation and hedging demand are still present, with some funds inclined to layout for wave trading; the scale of perpetual contracts decreased by 2.64% to $65.63 billion, reflecting traders' active deleveraging and avoidance of market volatility risks, aligning with the overall cautious sentiment in the current market. Overall, the market's leverage structure is becoming conservative, with long-short battles remaining restrained. Short-term volatility may be influenced by leveraged fund adjustments, requiring further confirmation of trend direction in conjunction with changes in trading volume.

# III. Selected Trading Strategy Rankings

## 1. High Yield Strategy Selection

Core Highlights:

Extremely high yield elasticity: The yield rate and AI predictions exceed 640%, with outstanding aggressiveness, suitable for the high volatility characteristics of small coins.

Significant profit-loss ratio advantage: A profit-loss ratio of 3.34 can cover a low win rate of 36.36%, allowing single profits to effectively hedge losses, providing ample margin for error.

Reasonable risk-reward ratio: A Sharpe ratio of 1.48 (>1) can still provide attractive unit risk returns under high volatility.

Applicable Scenarios:

Suitable for investors with extremely high risk tolerance, focusing on short-term speculation in small coins, compatible with the pulse market of high-heat small coins like FLOKI (e.g., concept speculation, fund rotation phases), requiring a fast-paced trading rhythm, not suitable for conservative or long-term allocated funds.

## 2. High-Frequency Trading Strategy Selection

Core Highlights:

Extremely high adaptability for high-frequency: Hourly operation rhythm, with a Sharpe ratio of 17.29, providing highly attractive unit risk returns, perfectly aligning with the core logic of high-frequency trading "controlling risk, accumulating small profits."

Excellent risk control: Maximum drawdown of only 5.06%, with very low volatility, capable of stably supporting high-frequency short-term operations, avoiding significant drawdowns affecting compound interest accumulation.

Stable return expectations: AI predicts an annualized return rate exceeding 50%, combined with the high-frequency model of "accumulating small victories into great victories," showing significant long-term compound interest effects.

Applicable Scenarios:

Suitable for investors with moderately high risk tolerance, pursuing stable compound interest in high-frequency trading, specifically designed for high liquidity mainstream trading pairs like SOL-USDT, adaptable to fluctuating or mild trend markets, can serve as a high-frequency bottoming strategy, also suitable for funds preferring low volatility and continuous returns, not applicable for small coins or extreme one-sided markets.

## 3. High Stability Strategy Selection

Core Highlights:

Outstanding stability: Maximum drawdown of only 5.06%, performing steadily among high-volatility assets like BTC, aligning with the "relatively stable" positioning.

Excellent risk-reward ratio: A Sharpe ratio of 2.14 (far greater than 1), providing highly attractive returns corresponding to unit risk, with good long-term compound interest effects.

Profit-loss ratio supports margin for error: A profit-loss ratio of 1.83 can cover a win rate of 39.02%, allowing single profits to effectively hedge losses, enhancing the strategy's ability to withstand volatility.

Ample yield elasticity: Actual yield rate exceeding 100%, achieving high returns within a stable framework, balancing safety and aggressiveness.

Applicable Scenarios:

Suitable for investors with moderate risk tolerance, pursuing "steady progress," specifically designed for mainstream high liquidity coins like BTC, adaptable to fluctuating upward or mild trend markets, can serve as a core strategy for medium to long-term allocation, also suitable for traders preferring low drawdowns and slow accumulation rhythms in wave trading, not applicable for extreme one-sided markets or small coin speculation.

Download TradingBase.AI to follow quality strategies with one click:

https://app.tradingbase.ai/downLoad

# IV. Top 24h Cryptocurrency Price Changes

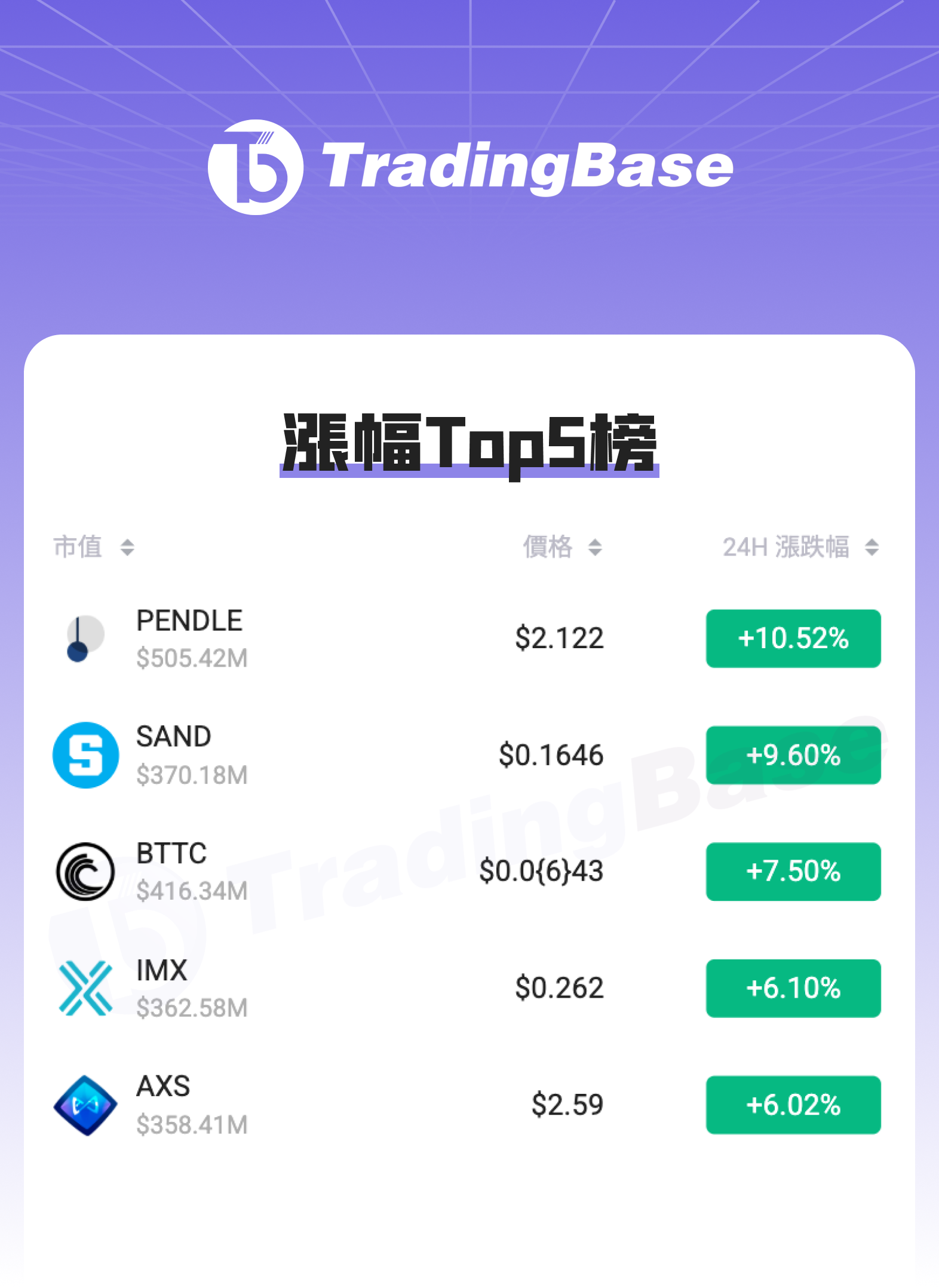

Top 5 Gainers:

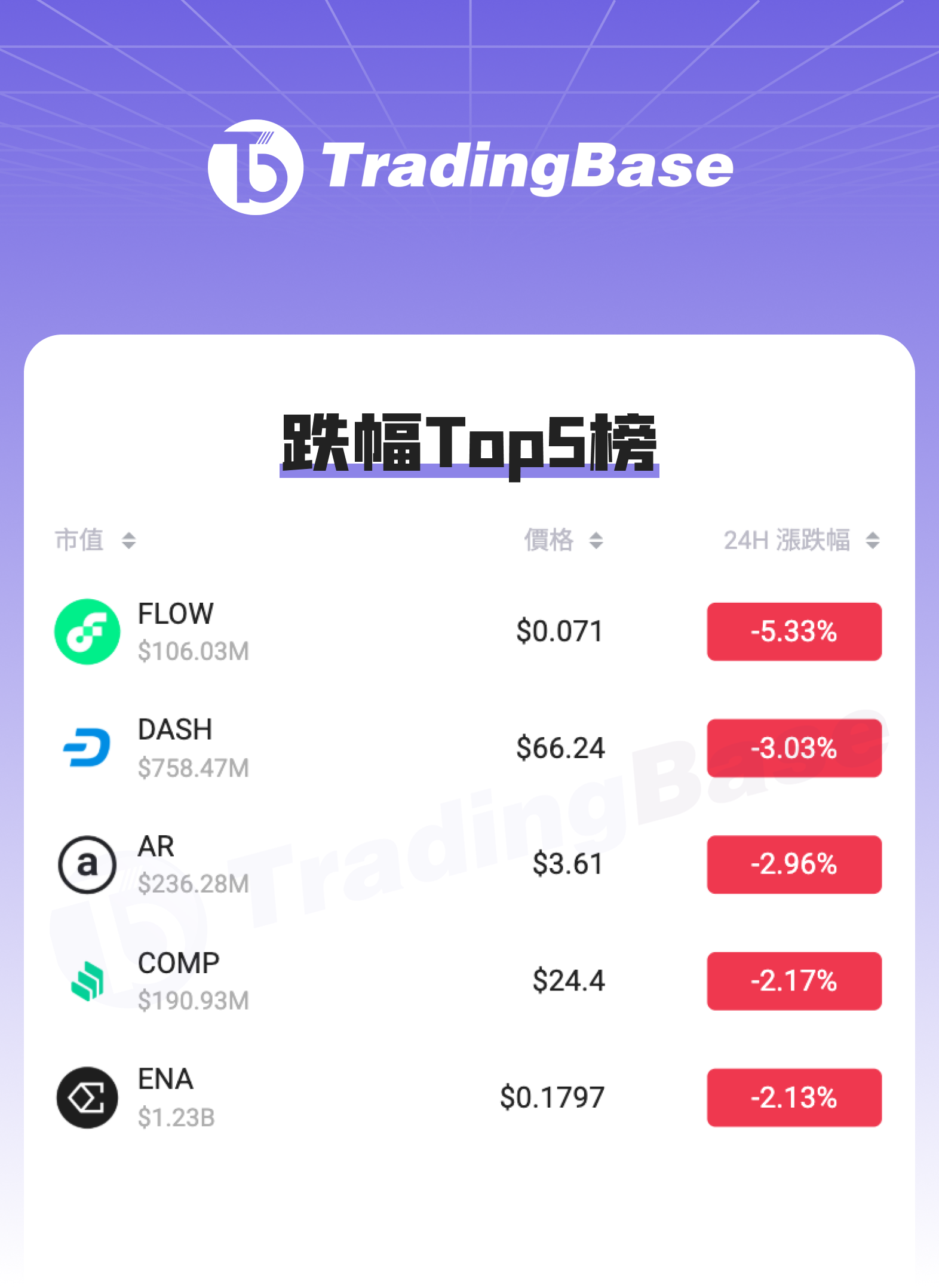

Top 5 Losers:

# V. Conclusion

This week, the market is navigating through the game between short-term emotional suppression and the accumulation of medium to long-term positives, with major cryptocurrencies under pressure but institutional layout actions not decreasing. In the short term, it is crucial to focus on the defense of Bitcoin's key support levels and the direction of macro trade policies, while in the medium to long term, it is necessary to track institutional fund inflows, the implementation of regulatory frameworks, and the progress of the tokenization track. We welcome you to continue following this column for the latest market interpretations and strategy analyses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。