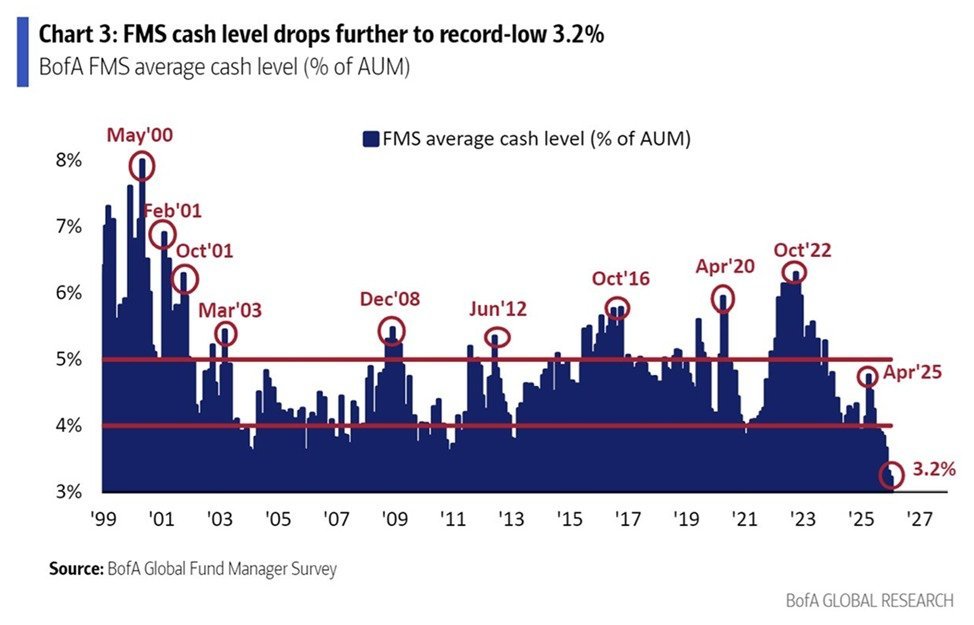

A month ago, the cash allocation of global fund managers was already at a historic low of 3.3%. Now, more than a month later, the cash allocation of global fund managers has set a new historic low at 3.2%.

This indicates that the cash reserves of global fund managers are extremely low. The lower the cash ratio, the fuller the institutional positions, the higher the risk appetite, and the more the market pricing relies on the continuation of favorable conditions. Once the wind direction changes, low cash will become a support force because everyone is already on board, and a slight drop will prompt some to buy back.

However, once the wind direction changes, low cash can instantly become a weakness, as there is no cash buffer, and assets must be sold to obtain cash. Redemptions, stop-losses, and risk budget contractions can trigger a chain reaction.

Of course, this is not an immediate signal of a market peak. Last December was already a historic low, and a month later, the U.S. stock market reached a new high. However, corresponding to the new high is the fact that the bullets fund managers can fire are running low. Continuing to break upward relies not on institutions increasing their positions, but on new external funds or leveraging to push risks higher.

If uncontrollable negative situations arise, the impact could be even greater, as the market has little cash left to absorb the selling. In simpler terms, the upcoming market will increasingly resemble a game of risk premium, where positive news needs incremental support to drive prices, while negative news may be amplified due to crowding.

The best scenario currently is for the market to experience FOMO (Fear of Missing Out) sentiment, increasing retail purchasing power, allowing fund managers to sell some to retail investors, and then fund managers continue to accumulate cash, re-entering when there is a clear positive signal. This way, prices may continue to advance.

The worst scenario would be a repeat of the situation in April, where fund managers liquidate a large amount of assets to hoard cash, waiting for better opportunities to re-enter.

@bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。