Bitcoin is stalling while gold grinds higher.

The reason could be in Japanese bonds.

Normally rising yields pressure gold by increasing the opportunity cost of holding a non yielding asset.

When gold and yields move together, the market is pricing policy stress and balance sheet fragility instead of growth.

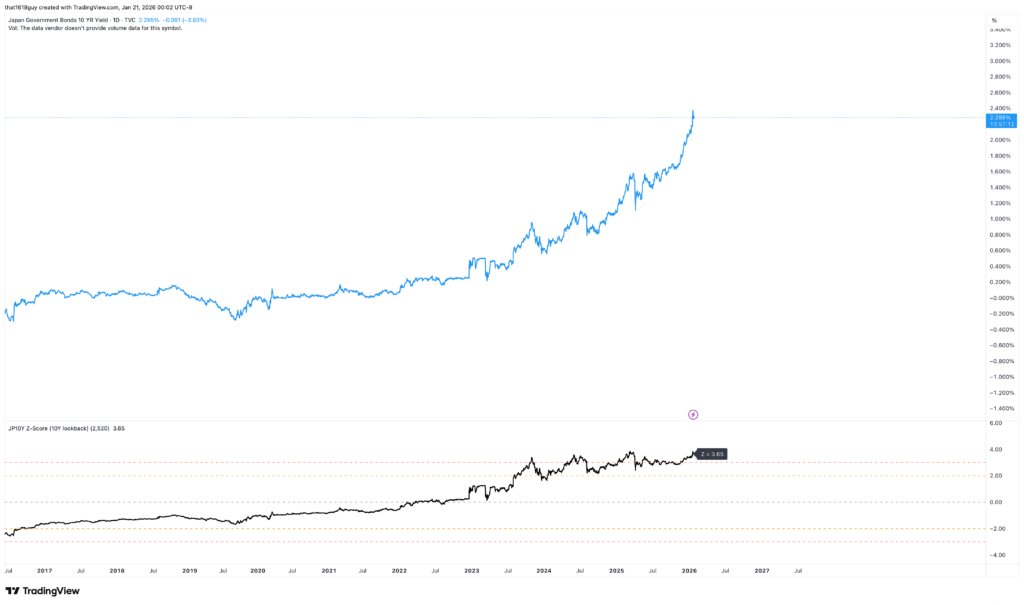

Japan's 10Y bonds are sitting at +3.65 standard deviations above its long run mean.

Japanese banks are structurally long duration and deeply exposed to Japanese government bonds as both assets and collateral.

While Gold is absorbing this stress. BTC has remained inversely correlated with JP10Y, and over longer horizons has consistently struggled as Japanese yields rise.

If the BOJ steps in to stabilize the JGB market, the stress premium in gold could ease and BTC gets room to recover.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。