Original author: Eric, Foresight News

Recently, Solana made a joke about Starknet, mocking an L2 with only 8 daily active users and 10 transactions per day, yet having a FDV of $15 billion.

In hindsight, this salt-in-the-wound joke was meant to attract attention, leading to the announcement that the Starknet token STRK would be launched on Solana via NEAR Intents. However, Solana's criticism is not unfounded; the numerous L2s that have sprung up in the past two years are indeed facing a traffic crisis.

The most compelling recent example is the Zero Network, an L2 network incubated by Web3 wallet company Zerion, which was reported to have stopped block production for over three weeks as of January 8, yet seemingly without any impact. The official response was even more subtle, as Zero Network ceased block production on December 19, 2025, but the official announcement to address the issue was only made on December 23, with the last original content posted on Zero Network's official Twitter being in May of the same year.

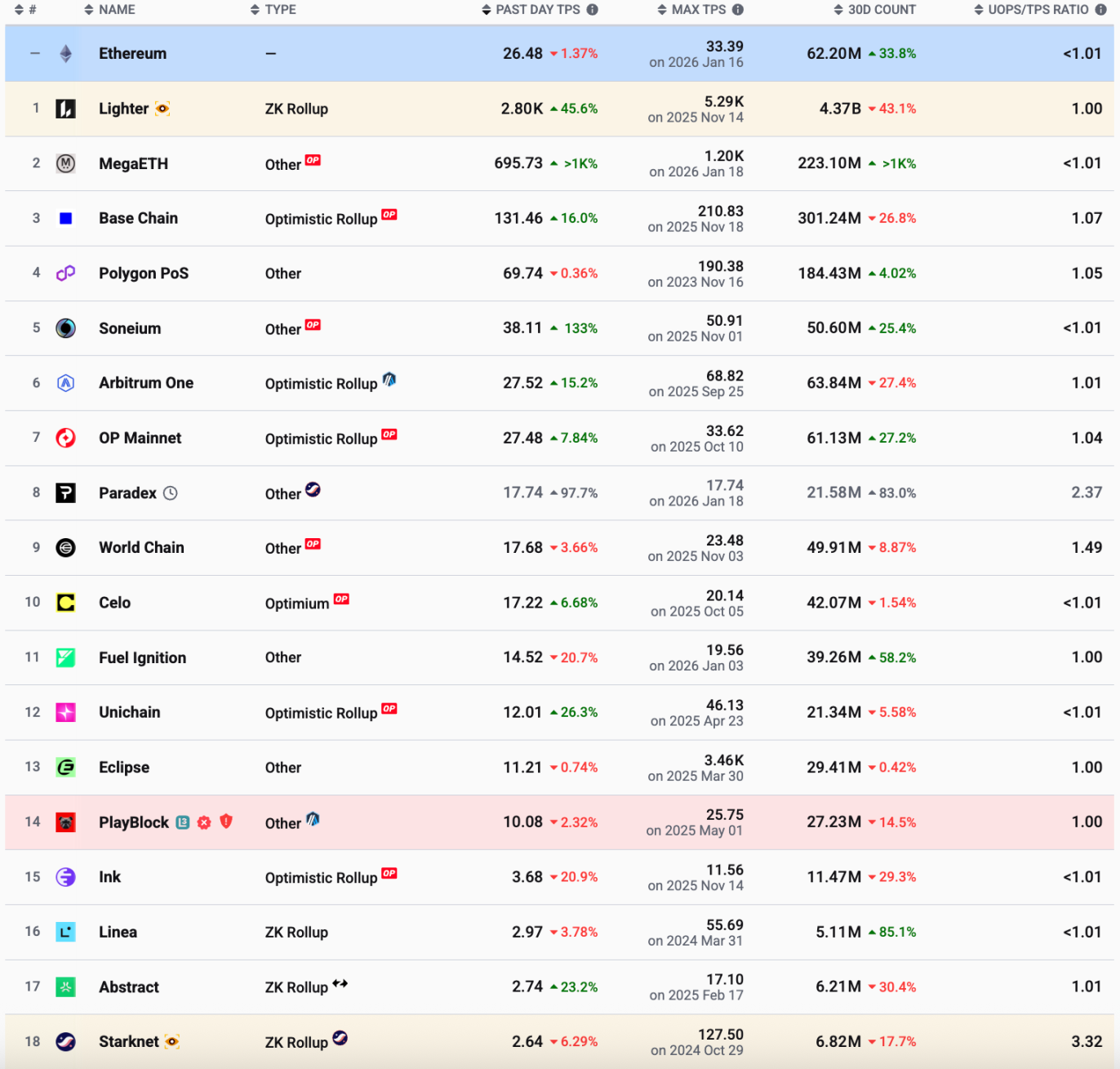

Despite this, the claim of only 8 users executing 10 transactions in a day is an exaggeration. According to data from L2BEAT, Starknet's TPS yesterday was 2.64, meaning there were over 200,000 transactions on the network in a day. However, this number is still absurdly low; even the Ethereum mainnet's daily transaction volume is 10 times that of Starknet.

Data shows that among general L2s, apart from Base and Polygon, even Arbitrum and OP Mainnet's TPS have not significantly exceeded that of Ethereum. Linea and Starknet's TPS is below 3, and the parts not captured in the screenshot include Scroll with a TPS slightly over 1, as well as ZKsync, Blast, and others with less than 1.

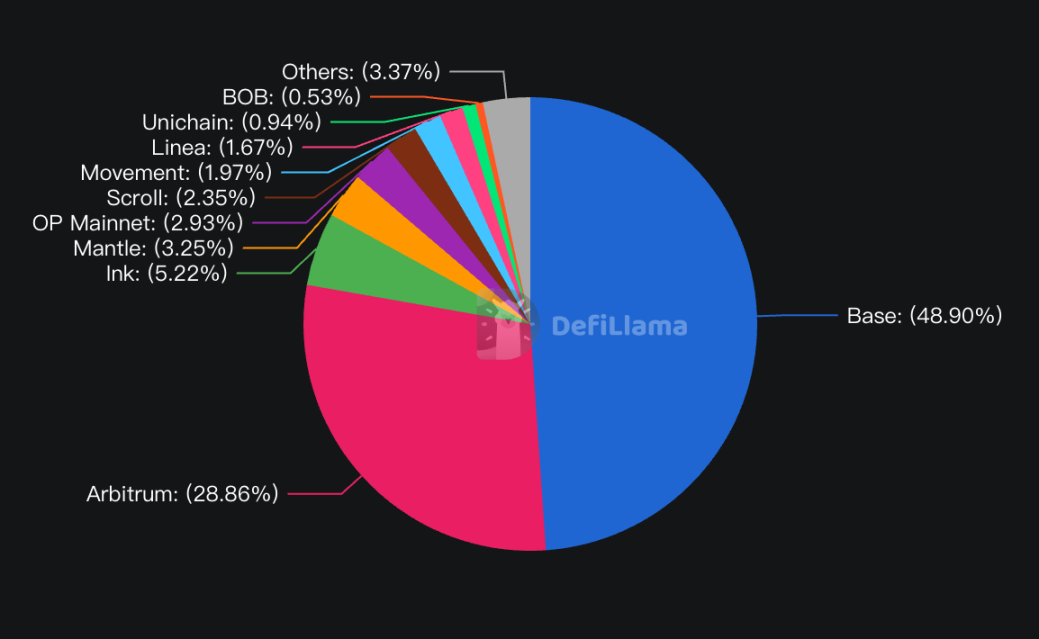

From the TVL data compiled by DefiLlama, Base and Arbitrum together account for nearly 80% of all L2 TVL, while the remaining L2s not classified as Others have a combined valuation during their private fundraising phase that conservatively approaches $10 billion, yet their combined TVL is less than $2 billion.

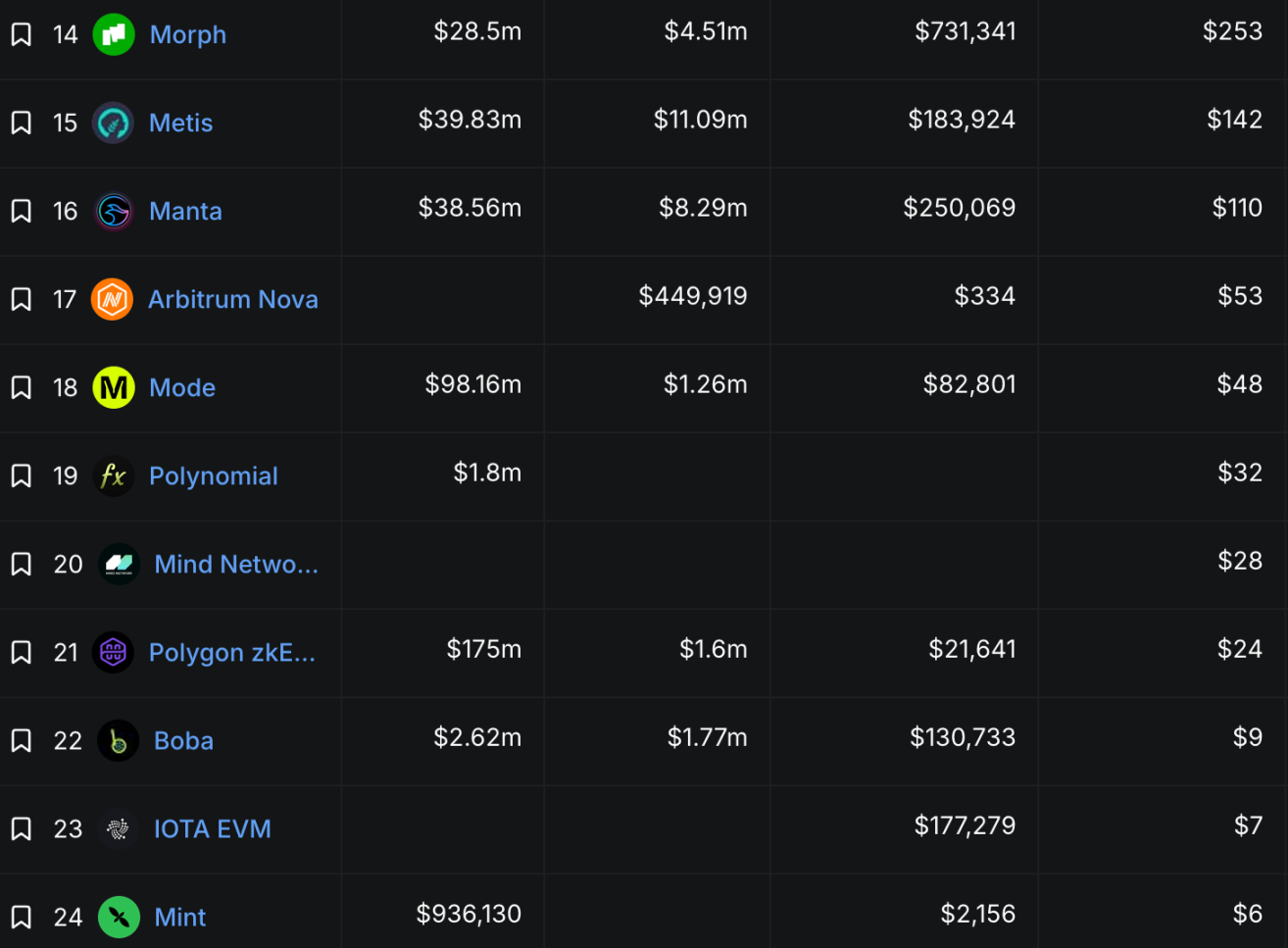

In terms of protocol revenue, only the top 7 protocols have generated over $1,000 in revenue in the past 24 hours, while protocols earning three-digit or even two-digit revenues in a day may not even match the interest some large holders receive from their assets parked in exchanges.

These data points vividly illustrate the current predicament of L2s: in a context where application narratives are lacking, expecting a killer application that operates willingly on general L2s without being an application chain has become a luxury. In addressing the challenge of finding an application scenario that can provide stable transaction data, L2s have found a common answer: cryptocurrency cards.

Pavel Paramonov, founder of the cryptocurrency research organization Hazeflow, has criticized that cryptocurrency cards are essentially not "cryptocurrency payments" but still fiat payments, failing to truly promote cryptocurrency. However, he also mentioned that many projects or public chains launching crypto cards do so out of necessity, aiming only to keep users within the ecosystem.

Currently, many cryptocurrency cards launched by exchanges are "custodial" cards, where users' assets are held in exchange or institutional custodial accounts, and settlements are conducted by the exchange, off-ramp companies, and card issuers during consumption. The settlement chains for such cards are typically Tron or Solana, or even the slightly more expensive Ethereum; on one hand, the stablecoin asset supply on these chains is sufficiently large, and on the other hand, some cards reduce costs through batch settlements rather than per-transaction settlements. For institutions, liquidity and stability may be more important than the low costs of L2s.

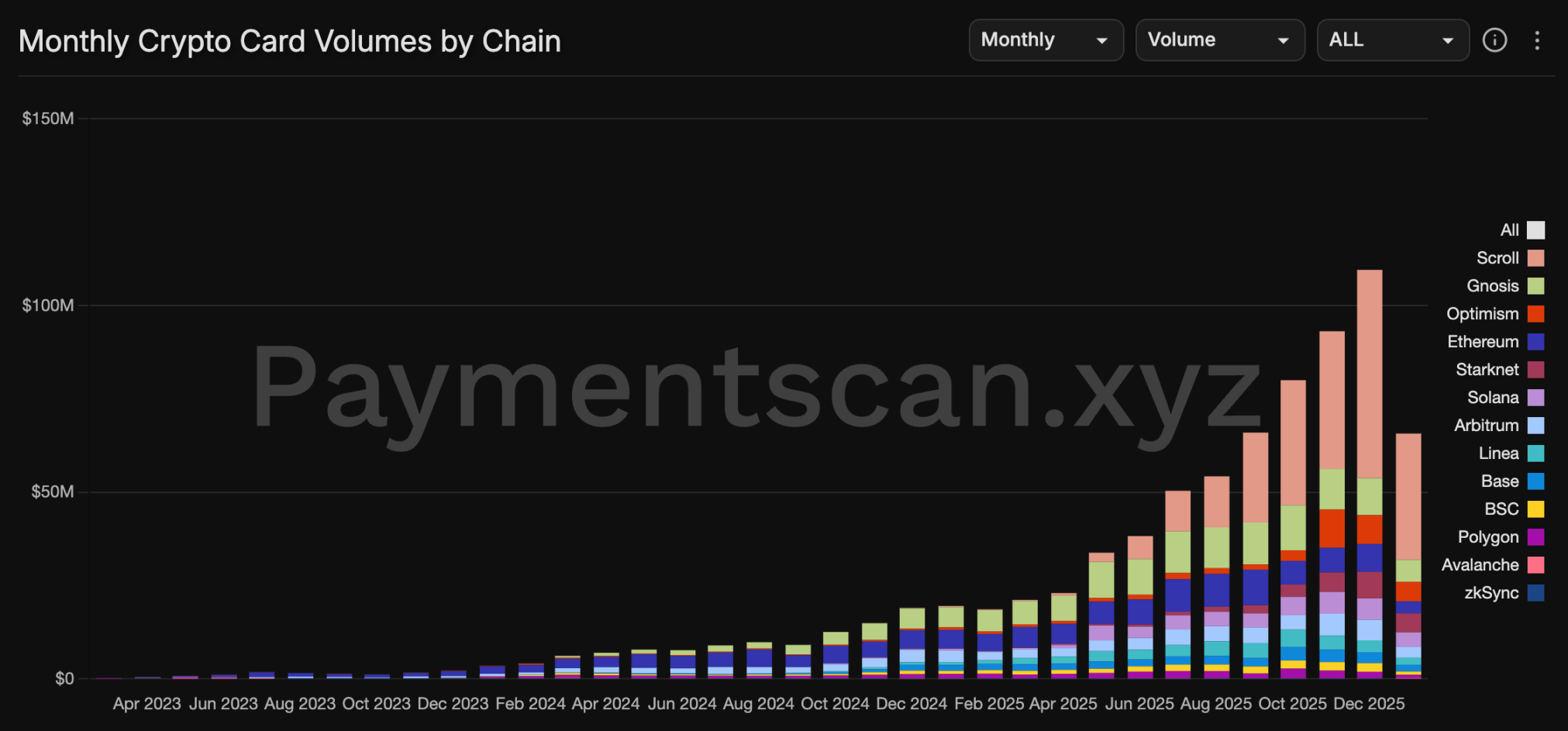

The cryptocurrency cards that L2s are interested in are various forms of "non-custodial cards," where assets are held in the user's own wallet before using such cards for payment, with each payment settled individually, effectively increasing on-chain activity. Typical examples include Scroll (Etherfi card settlement chain), Gnosis, and Linea (MetaMask card settlement chain).

In September 2024, Etherfi announced that its payment card would use Scroll as the settlement layer, allowing Scroll to help Etherfi achieve "gasless transactions" and provide higher cashback through SCR token subsidies. In addition to the traditional direct consumption of assets on Scroll, Etherfi cards also have a special mechanism: users can use interest-bearing assets on Scroll as collateral to borrow fiat for payments, with supported assets including eETH, weETH, wETH, eBTC, etc.

Gnosis, a sidechain that has long lacked presence, has successfully made a comeback with its Gnosis Pay card, primarily operating in Europe. Users can connect non-custodial wallets like MetaMask and Gnosis Safe in the Gnosis Pay App, and during consumption, Gnosis Pay converts the supported assets in the user's wallet (some euro, pound, and dollar stablecoins) into the euro stablecoin EURe issued by Monerium, which is then converted 1:1 into euros for payment.

The cryptocurrency card issued by MetaMask uses Linea, a L2 under ConsenSys, as its main settlement network, and also supports Solana and Base. Before consumption, users need to deposit supported payment assets (various dollar or euro stablecoins) into their MetaMask wallet, and during payment, the user's assets are transferred to the off-ramp service provider, converted into fiat, and then paid to the merchant.

Due to the per-transaction settlement nature of non-custodial cards, each user consumption corresponds to an activation contract to verify the remaining asset quantity and the on-chain asset transfer. This way, L2s can rely on payments, a highly frequent and sustainable scenario, to ensure a certain level of on-chain activity. According to Paymentscan data, Scroll has captured a considerable market share in card payments through its collaboration with Etherfi and SCR subsidies. However, this data may not be entirely accurate, as many cards may not have conducted on-chain transfers during payments but settled internally within institutions. Nevertheless, it is an undeniable fact that L2s have found practical application scenarios through payments.

Not only are emerging L2s anxious, but Polygon, which cannot be strictly classified as an L2, has also shifted its strategic focus to payments recently. By the end of 2025, the non-dollar stablecoin transfer volume on Polygon exceeded $11.1 billion, with the new stablecoin XSGD reaching a trading volume of $2.24 billion and the Australian dollar stablecoin AUDF reaching $2.46 billion. Additionally, Polygon has become one of the main chains used for stablecoin payments by Stripe; its announcement on January 13 to acquire cryptocurrency payment infrastructure Coinme and blockchain development platform Sequence for $250 million further emphasizes its "all-in on payments" strategy.

After experiencing a barrage of various concepts, L2s have come to terms with reality. While still hoping for novel applications, the urgent task is to survive by leveraging their low-cost and high-efficiency characteristics through payments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。