Article editing time: January 22, 2026, 18:00. All opinions do not constitute any investment advice! For learning and communication purposes only.

Self-discipline hides infinite possibilities in life, and its depth also measures the height of life. Every step of deep cultivation has its own echo; the more disciplined one is, the farther they go. I am Fuzhu, deeply engaged in analyzing mainstream cryptocurrency trends, breaking down market logic with professional accumulation, and providing pragmatic trading ideas.

Market Overview

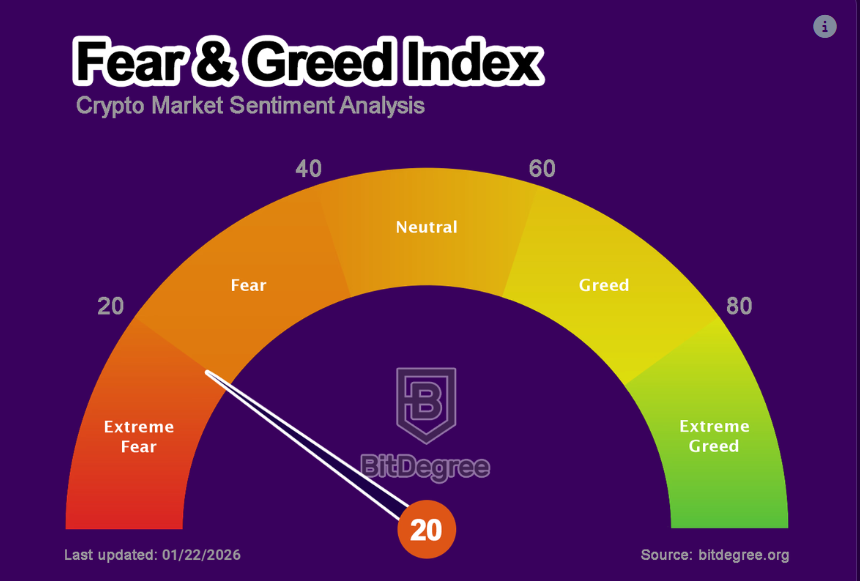

Last night, the crypto market was thrown into chaos by the "tariff aftershocks"! It was as thrilling as riding a roller coaster. The total global crypto market cap shrank to about $3.12 trillion, with a 24-hour decline of 0.5%-1% and trading volume around $70-150 billion. Bitcoin fluctuated back and forth in the $87,000-$90,000 range, Ethereum fell below the $3,000 mark, and Altcoins like Solana (SOL) also suffered, plunging 2%-5%. The Fear and Greed Index rushed towards the "fear abyss" at 20, with investors selling off as if avoiding a "nuclear bomb"! But don’t panic; this wave of "risk aversion" might just be a perfect "golden pit" for whales to accumulate.

Fundamentals

The fundamentals of BTC are strong, benefiting from a rebound in institutional demand and an increase in small wallet purchases after leveraged liquidation, leading to a rise in supply from long-term holders. ETF inflows hit a record high, and futures trading volume surged, reinforcing the narrative of "digital gold" as a safe haven. Institutional bigwigs are hoarding like hungry wolves! Last week, net inflows into digital asset investment products reached a record $2.17 billion. Although there was a $160 million outflow from ETFs recently, overall institutional inflows have exceeded $87 billion, indicating that "smart money" may be accumulating chips during the downturn.

Policy Aspects

Today, Trump canceled tariffs on the EU, allowing global risk assets to breathe a sigh of relief, but the "Greenland aftershocks" still linger! The original 10% tariff threat caused hundreds of billions in market value to evaporate, but after the cancellation, BTC rebounded. Regulatory bills have been postponed: the much-anticipated U.S. "Cryptocurrency Market Structure Bill" has been delayed for at least a few weeks until late February or March. This has dampened the optimistic expectations that arose from "regulatory clarity." Additionally, the withdrawal of support from key players like Coinbase has increased the uncertainty surrounding the bill's passage.

Trump's remarks caused turbulence: Former President Trump's inconsistent statements regarding Greenland tariffs directly led to significant fluctuations in Bitcoin between $87,300 and $90,500. This once again proves that during uncertain times, cryptocurrencies are highly correlated with macro news.

Technical Analysis

BTC is currently consolidating around $90,000. Last night, it created a significant golden pit, touching a low near $87,200. After such a volatile market, it also needs time to digest, and today it has mostly moved sideways. Technically, if it cannot return above $91,000-$92,000, weakness may continue. Key support is around $85,000. ETH is currently consolidating at the $3,000 mark, with a slightly stronger rebound than BTC. In the short term, watch for support at $2,900; if it effectively breaks down, it could drop to $2,700-$2,600.

The strategies provided yesterday offered multiple entry opportunities, with BTC yielding nearly 3,000 points in profit and ETH providing a profit of 100 points.

Today, we plan to set up short positions in the $90,000-$91,000 range, targeting $89,000-$87,000. Consider going long near $85,000. For Ethereum: set up short positions in the $3,000-$3,100 range, targeting $2,900-$2,800, and consider entering long positions at $2,800. (Remember to control contract positions within 10% and set stop-losses.)

Disclaimer: The above content is personal opinion, and the strategies are for reference only, not as investment basis. Any risks taken are at your own discretion.

Friendly Reminder: The above content is created by the public account: Fuzhu Zhiyuan. The advertisements at the end of the article and in the comments section are unrelated to the author. Please discern carefully. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。