1. From Greenland to Global Markets: The Trump-style TACO Deal Replayed

Unlike previous tariff games centered around trade deficits, industrial subsidies, or exchange rate disputes, the "pricing core" of the current US-EU friction lies not in economic accounts but in sovereignty and geopolitical control: tariffs are merely a means, while territory and strategic depth are the goals. The immediate trigger for the event was the joint military exercises held by Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland on Greenland. The Trump administration defined this as a challenge to US Arctic strategic interests and quickly weaponized, politicized, and sovereignized tariffs—using the binary threat of "either sell the island or pay taxes" to tie trade measures to territorial claims, presenting a clear and tough timeline: starting February 1, a 10% punitive tariff would be imposed on the aforementioned European countries, potentially rising to 25% by June 1, with the only exemption being an agreement on the US purchasing or long-term control of Greenland. The European response further reinforced this uncertainty. Denmark reiterated that Greenland's sovereignty is non-negotiable, and the EU quickly initiated emergency consultations and prepared reciprocal countermeasures. Crucially, the EU has a countermeasure list totaling up to €93 billion—this is not a temporary emotional reaction but a institutionalized "anti-coercion toolbox." Thus, the market is faced not with a single point of friction but with a potentially rapidly escalating transatlantic confrontation framework: both sides are "playing cards," but the stakes are not short-term trade interests but alliance order, resource control, and strategic presence.

However, Trump soon stated on Wednesday that he had reached a cooperation framework with NATO regarding Greenland and retracted the tariff threats against the eight European countries. At the same time, in his keynote speech at the World Economic Forum in Davos, Trump called for "immediate negotiations" regarding the acquisition of Danish territory Greenland, stating that only the US could ensure its security. Yet he also hinted that he would not use force to control the island. This replayed the classic Trump-style TACO deal, leading to a broad rebound in US stocks and a slight rebound in the crypto market, though it did not fully recover previous losses.

However, what truly amplified market volatility was not Trump's imposition of a 10% or 25% tariff on multiple European countries, nor the repeated threats of tariffs followed by compromises, but the institutional uncertainty it represented: the trigger conditions for conflict are clear (tariff timeline), yet the endpoint of the conflict is unclear (sovereignty issues have no "reasonable price"); execution actions may be swift (executive orders can be implemented), but negotiation cycles may be long (alliance coordination and domestic politics require time); at the same time, there exists a repetitive rhythm of "extreme pressure—partial compromise—further pressure," necessitating a higher risk premium in asset pricing. For the global market, such events will first raise volatility through expectation channels: companies and investors will first reduce risk exposure, increase cash and safe-haven asset allocations, and then observe whether policies are truly implemented; once the conflict continues, supply chain costs and inflation expectations will further transmit to interest rates and liquidity, ultimately spreading pressure to all "risk-sensitive" areas such as stocks, credit, foreign exchange, and crypto assets. In other words, this is not a traditional trade friction but a geopolitical sovereignty conflict leveraged by tariffs, and its greatest harm to the market lies in upgrading negotiable economic issues to difficult-to-compromise political issues—when uncertainty becomes the main variable, price volatility will shift from "emotional disturbance" to "structural premium," which is the pricing backdrop that global assets currently face.

2. The Starting Point of Interest Rate Shock: The Synchronous Rise of US and Japanese Bond Yields

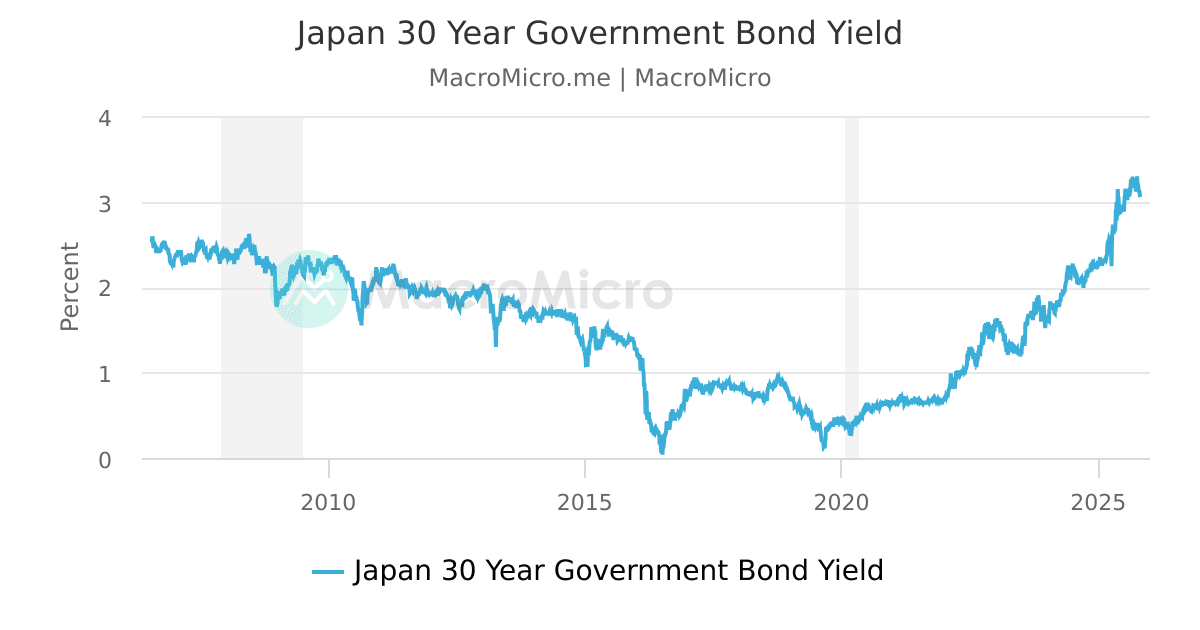

As geopolitical risks are rapidly repriced, the global bond market has provided the most direct and "systemic signal" response. In mid-January, the yield on Japan's 30-year government bonds surged more than 30 basis points in a single day, reaching a high of 3.91%, a 27-year record; almost simultaneously, the yield on US 10-year government bonds climbed to 4.27%, hitting a four-month high. For the global market, this "synchronous rise in US and Japanese long-term rates" is not a short-term emotional fluctuation but a structural shock capable of changing the basis of asset pricing, with impacts far exceeding the bond market itself. It is essential to clarify that Japan has long played a role in the global financial system that is not merely that of an ordinary sovereign bond issuer but as an anchor point for global low-cost liquidity. Over the past two decades, Japan has exported a massive amount of low-cost yen funds to the world through sustained ultra-loose monetary policy, becoming the foundational source for global carry trades and cross-border capital allocation. Whether in emerging market assets, US and European credit products, or high-risk stocks and crypto assets, there is more or less an embedded implicit financing structure of "borrowing yen to invest in high-yield assets." Therefore, when Japanese long-term bond yields rise sharply in a short time, the implication is not simply that "Japanese bonds are more attractive," but a deeper signal: the most stable and cheapest source of funds in the global financial system is becoming unstable.

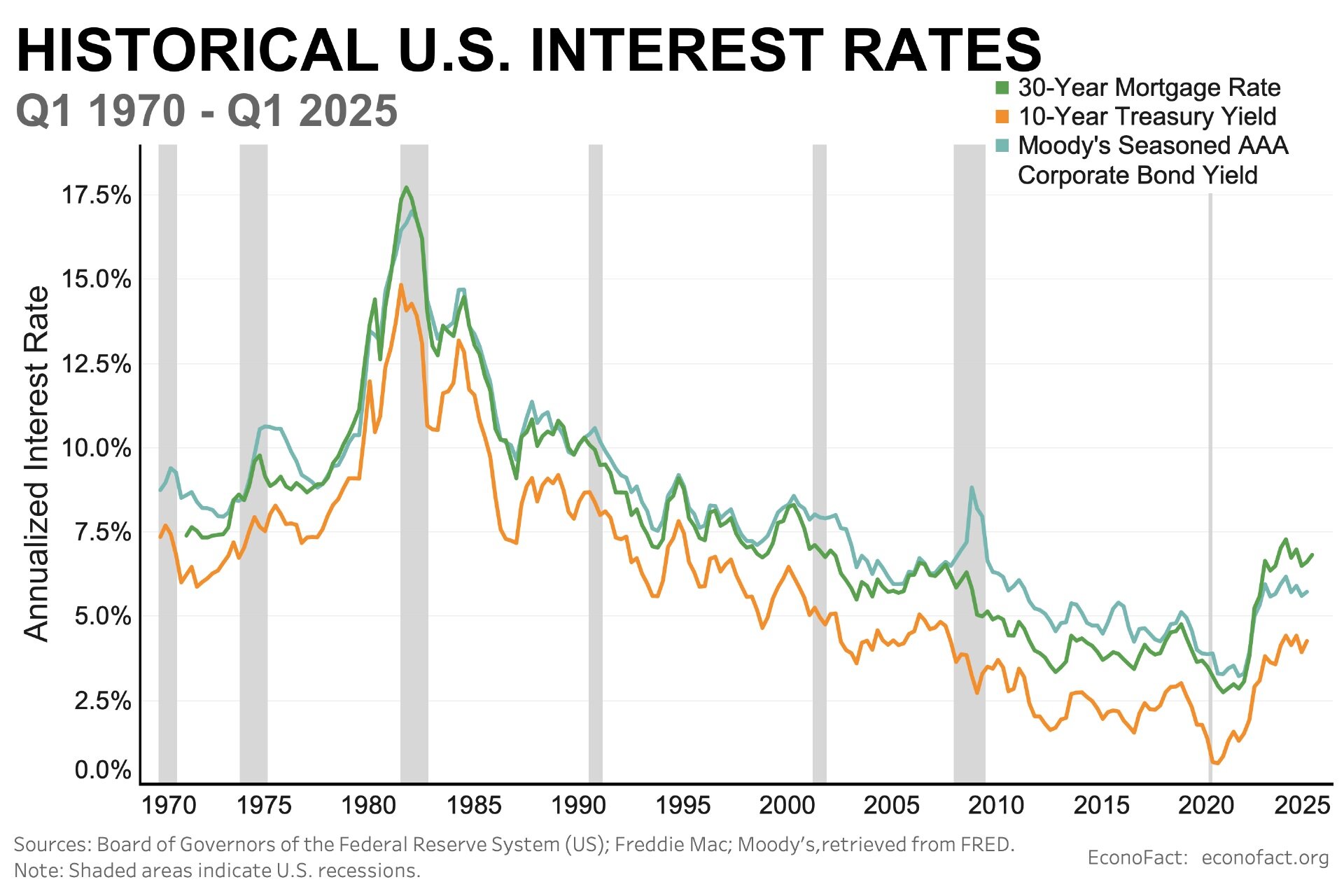

Once Japan no longer stably exports low-cost funds, the risk-return ratio of global carry trades will rapidly deteriorate. High-leverage positions established with yen financing will face dual pressures of rising financing costs and amplified exchange rate risks. This pressure often does not immediately manifest as asset collapses but first prompts institutional investors to actively reduce leverage and cut exposure to high-volatility assets. It is at this stage that global risk assets exhibit a characteristic of "indiscriminate pressure"—not due to fundamental deterioration but rather a systemic rebalancing triggered by changes in funding sources. Secondly, the US-EU tariff conflict at this time further raised expectations for imported inflation, making the rise in interest rates appear "reasonable." Unlike previous trade frictions centered around consumer goods or low-end manufacturing, this round of potential tariffs affects high-end manufacturing, precision instruments, medical equipment, and automotive supply chains—areas with extremely high added value and significant difficulty in substitution. The US has a structural dependence on European countries in these areas, and tariff costs will almost inevitably be transmitted through the supply chain to end prices. In terms of market expectations, this means that the interest rate pricing logic previously based on "falling inflation central" is beginning to be re-evaluated. Even if tariffs have not yet fully materialized in the short term, the "potential and difficult-to-reverse" inflation risks themselves are sufficient to elevate the risk premium on long-term interest rates.

Furthermore, the US's own fiscal and debt issues provide a structural backdrop for the rise in long-term US bond yields. In recent years, the US fiscal deficit and national debt have continued to expand, and concerns about the long-term sustainability of debt have not truly dissipated. If the tariff conflict escalates further, it could not only raise inflation expectations but also accompany more fiscal subsidies, industrial support, and security spending, thereby increasing the fiscal burden. In this environment, long-term US bonds find themselves in a typical "tug-of-war": on one hand, geopolitical uncertainty and market risk aversion drive funds into the bond market; on the other hand, inflation and debt concerns demand higher term premiums to compensate for risk. The result is a simultaneous rise in yield levels and volatility, making the risk-free rate itself "no longer risk-free." The final outcome of these three forces is a systemic upward shift in the global risk-free interest rate central and a passive tightening of financial conditions. For risk assets, this change is highly penetrating: rising discount rates will directly compress valuation space, increasing financing costs will suppress new leverage, and liquidity uncertainty will amplify market sensitivity to tail risks.

The crypto market is under pressure in this macro backdrop. It is important to emphasize that Bitcoin and other mainstream crypto assets are not being "singled out," but rather are taking on the role of high-volatility, high-liquidity risk assets during the process of rising interest rates and tightening liquidity. When institutional investors face margin pressures or risk exposure constraints in traditional markets, the first assets to be reduced are often not those with poor liquidity, high adjustment costs, or complex regulatory structures, but rather those that are highly volatile, easily liquidated, and most "friendly" for portfolio adjustments. Crypto assets precisely possess these characteristics. Additionally, the upward shift in the risk-free interest rate central is also changing the relative attractiveness of crypto assets. In a low-interest, wide liquidity environment, the "opportunity cost" of assets like Bitcoin is low, and investors are more willing to pay a premium for their potential growth; however, when US and Japanese long-term rates rise synchronously, safe assets themselves begin to offer more attractive nominal returns, making the allocation logic for crypto assets inevitably need to be reassessed. This reassessment does not imply a long-term bearish outlook but rather suggests that in the short term, prices need to adjust to realign with the new interest rate environment. Therefore, from a macro perspective, the synchronous rise in US and Japanese bond yields is not a "bearish story" for the crypto market but rather the starting point of a clear transmission chain: rising interest rates → tightening liquidity → declining risk appetite → pressure on high-volatility assets. In this chain, the correction in the crypto market more reflects the result of changes in global financial conditions rather than a deterioration in its own fundamentals. This also determines that as long as the trends in interest rates and liquidity do not fundamentally reverse, the crypto market will remain in a state of high sensitivity to macro signals in the short term, and the real directional choice will still need to wait for the marginal changes of this round of interest rate shock.

3. The Real State of the Crypto Market: Not a Collapse, But Temporarily Under Pressure

The rise in interest rates itself does not directly "hit" the crypto market, but it forms a clear and verifiable transmission chain through changes in liquidity and risk appetite: tariff threats raise inflation expectations, inflation expectations push up long-term interest rates, rising interest rates increase credit and financing costs, financial conditions tighten as a result, ultimately forcing funds to systematically reduce risk exposure. In this process, price volatility is not the starting point but the result; the real driving force is the change in funding sources and funding constraints. Among these, the offshore dollar market plays a crucial yet often underestimated role. With the US-EU tariff conflict overlaying geopolitical uncertainty, the risk premium for global trade financing and cross-border settlements has risen, and the cost of obtaining offshore dollars has begun to increase. This change may not necessarily be reflected in explicit policy rates but is more reflected in interbank lending, cross-currency basis, and financing availability. For institutional investors, this means stricter margin requirements, more conservative risk exposure management, and a decreased tolerance for high-volatility assets. When traditional markets experience volatility and correlations rise, institutions often do not prioritize selling assets with poor liquidity, high exit costs, or complex regulatory structures, but rather choose to reduce positions in those highly volatile, easily liquidated, and most "friendly" for portfolio adjustments. In the current structure, crypto assets precisely possess these two characteristics, thus taking on the primary "regulating valve" role in macro shocks.

In this context, Bitcoin has failed to demonstrate the safe-haven properties similar to gold during this shock. This phenomenon is not unusual; rather, it is a natural result of the evolution of its asset attributes. Unlike its early narrative as "digital gold," Bitcoin at this stage is more akin to a macro risk asset that is highly dependent on US dollar liquidity. It cannot operate independently of the US dollar credit system, and its price is highly sensitive to changes in global liquidity, interest rates, and risk appetite. When offshore dollars tighten, long-term rates rise, and institutions need to quickly replenish margins or reduce portfolio volatility, Bitcoin naturally becomes the asset that is prioritized for reduction. In stark contrast, gold and silver have continued to strengthen during this shock, driven not by short-term return expectations but by central bank demand, physical attributes, and the "de-sovereignization" characteristics that bring a risk premium. In an environment where geopolitical games escalate and sovereign risks are repriced, such "stateless" assets are more likely to attract funding. It is important to emphasize that this is not a "failure" of Bitcoin, but rather a recalibration of the market's perception of its role. Bitcoin is not a safe haven in a crisis but an amplifier in the liquidity cycle; its advantage lies not in hedging extreme risks but in being highly sensitive to the recovery of risk appetite during liquidity expansion phases. Understanding this helps avoid unrealistic expectations of it during macro shocks.

From a structural perspective, although there has been a noticeable price correction, the current crypto market has not replayed the systemic risks of 2022. There has been no credit crisis involving major exchanges or stablecoins, nor have we observed continuous liquidation cascades or on-chain liquidity freezes. The behavior of long-term holders remains relatively orderly, with their distribution of chips reflecting rational profit-taking rather than forced selling. Bitcoin did trigger some liquidations after breaking key price levels, but the overall scale and chain effects are significantly lower than in the previous bear market, resembling more of a position rebalancing under macro shocks rather than a collapse of the market's structural integrity. In other words, this is a phase of pressure dominated by exogenous shocks, not a collapse triggered by imbalances within the crypto system.

4. Conclusion

The market volatility triggered by the escalation of US-EU trade frictions and the synchronous rise in US and Japanese bond yields is essentially not a "single-point risk event" for any particular asset or market, but a systemic repricing process surrounding global liquidity, interest rate central, and risk appetite. In this process, the decline in the crypto market does not stem from a deterioration of its own fundamentals, nor from failures at the institutional or credit level, but is a natural result of its role in the current financial system—as a high liquidity, high elasticity risk asset that is prioritized for pressure during phases of tightening liquidity and rising interest rates. From a longer time perspective, this round of adjustment does not negate the structural re-evaluation process that the crypto market is experiencing in 2026. On the contrary, it clearly reveals an ongoing change: crypto assets are gradually shedding the early stage of "narrative-driven, emotion-based pricing" and entering a more mature, institutionalized pricing framework. In this framework, prices are no longer primarily driven by stories, slogans, or single events, but begin to internalize as a function of changes in macro liquidity, interest rate structures, and risk appetite. For investors, the real challenge lies not in judging short-term fluctuations but in the ability to timely update analytical frameworks and understand and adapt to this long-term trend of transitioning from a "narrative market" to a "macro market."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。