Written by: Bitrace

The year 2025 is a crucial year for the cryptocurrency industry, marked by a coexistence of regulatory transformation and structural progress.

The Trump administration is fulfilling its political commitments through a series of pro-crypto policies (such as the "Strengthening American Leadership in Digital Financial Technology" executive order signed in January 2025, the establishment of a strategic Bitcoin reserve in March, the signing of the GENIUS Act stablecoin bill in July, and the ongoing CLARITY Act market structure bill), providing a clearer regulatory path for the crypto industry and promoting the U.S. to become the global "crypto capital."

At the same time, the Hong Kong government is actively advancing a regulatory framework for virtual assets, officially implementing the "Stablecoin Ordinance" in August 2025, which requires stablecoin issuers to obtain licenses and strengthens the regulation of VASP platforms, further consolidating its position as an Asian Web3 hub.

These global policies are stimulating the accelerated adoption of cryptocurrencies by individual investors, institutional investors, and sovereign nations, pushing Bitcoin to a peak of $126,000, with the total market capitalization of the entire industry maintaining a high level of approximately $3 trillion, marking the transformation of crypto assets from the margins to mainstream finance.

However, alongside the booming industry and mature infrastructure, cryptocurrencies have also become favored by criminals due to their high liquidity, rapid transfer, and relative anonymity, as decentralized exchanges (DEXs), cross-chain bridges, DeFi protocols, and various cryptocurrency tools are widely used.

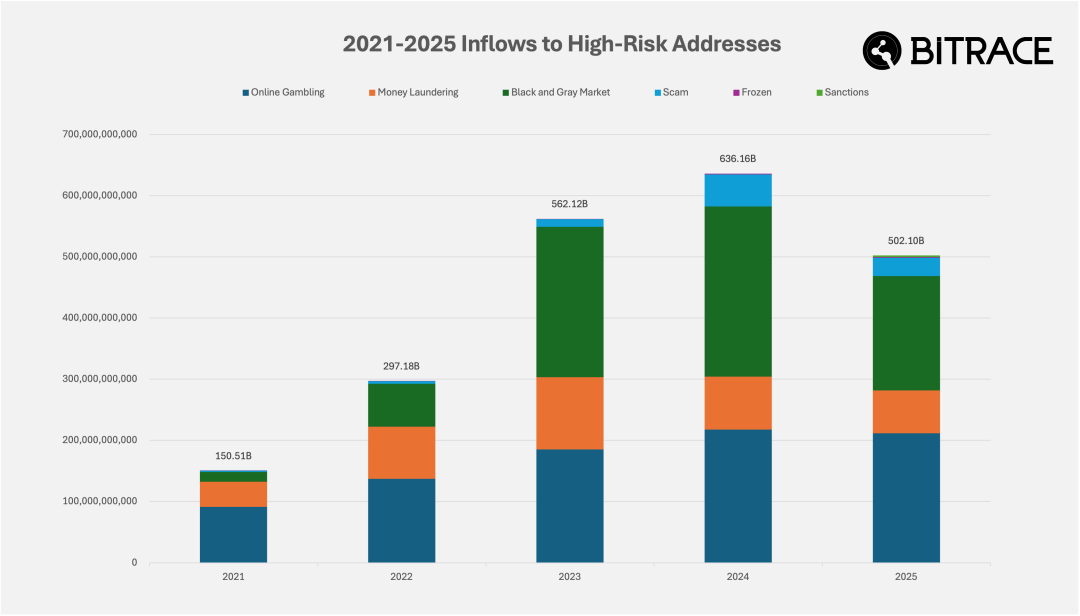

With the widespread application of crypto assets and on-chain protocols, the risk of their misuse in certain illegal and high-risk activities is gradually becoming apparent. The relevant infrastructure primarily undertakes functions such as value transfer, fund mixing, and illegal asset storage in scenarios like online gambling, money laundering, black and gray market transactions, fraud, and evasion of sanctions, a trend that is under continuous scrutiny by regulatory agencies. According to Bitrace's monitoring and statistics, the illegal funds received by blockchain addresses marked as high risk across the network reached $50.21 billion in 2025.

This report aims to remind the industry that while embracing innovation, it must strengthen compliance and risk prevention by disclosing the trends and scale of cryptocurrency crime in 2025.

Trends

Southeast Asian Organized Crime Networks Suffer Major Setbacks

In 2025, major countries around the world launched a series of crackdowns on the fraud industry in Southeast Asia, marking a new phase of international cooperation. Despite the large scale of fraud parks, with annual revenues reaching hundreds of billions of dollars, and the rapid relocation of criminal groups, significant progress has been made through joint law enforcement, sanctions, and repatriation actions by multiple countries.

This joint effort has been reflected on the blockchain. The U.S. and U.K. jointly sanctioned Cambodia's Prince Group, seizing or freezing billions of dollars in crypto assets, which directly led to one of the local organized crime networks, Huione Group, being forced to temporarily halt operations of Huionepay; the illegal cross-border human trafficking business, as part of the infrastructure for the telecom fraud industry, was also targeted, with channels of a series of human trafficking transaction guarantee platforms led by Linghang Guarantee being shut down, and funds flowing out of business addresses being controlled by mainstream trading platforms; some fraud parks were also shut down under pressure from neighboring countries, with many fraud practitioners being repatriated.

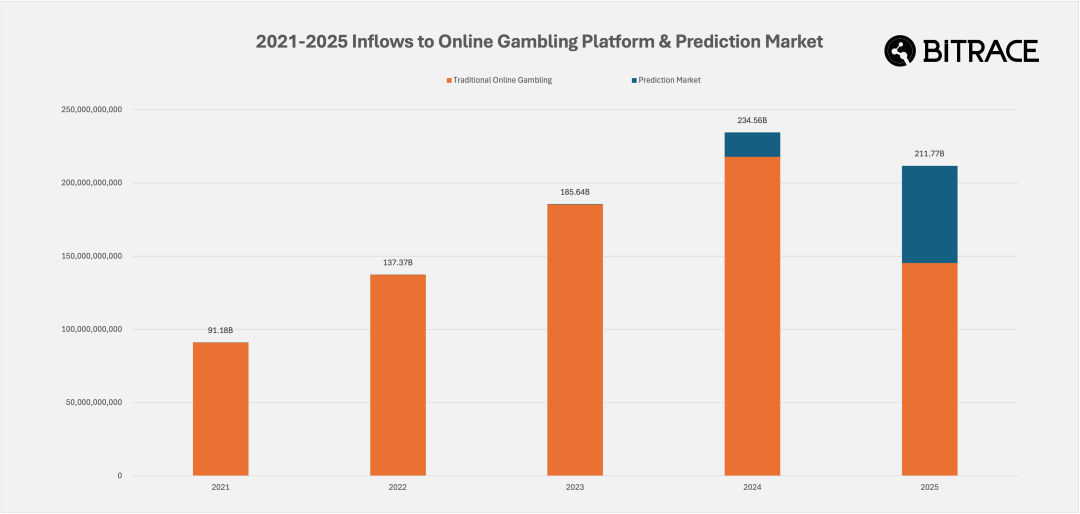

Online Gambling Users Begin Shifting to Prediction Markets

Online gambling is one of the earliest illegal industries to adopt cryptocurrencies for business activities. Traditional online gambling platforms provide chip redemption services based on cryptocurrencies through self-built settlement systems or by integrating third-party payment tools, successfully circumventing some countries' or regions' crackdowns on fiat currency settlement systems for gamblers and casinos. As a result, the scale of cryptocurrency transactions related to online gambling has continued to increase over the past few years.

However, with the rise of the phenomenal prediction platform Polymarket in 2024, and the emergence of various competing products in 2025, there has been strong pressure on the market share of traditional online gambling platforms, leading to a trend of reduced inflow of crypto funds into the latter, as gamblers begin to turn to new prediction markets.

Tether's Law Enforcement Collaboration Activities Become More Active

As the issuer of the most widely used stablecoin, Tether (USDT), Tether has been continuously blacklisting cryptocurrency addresses that receive criminal funds over the past few years, collaborating with law enforcement agencies in major countries or regions.

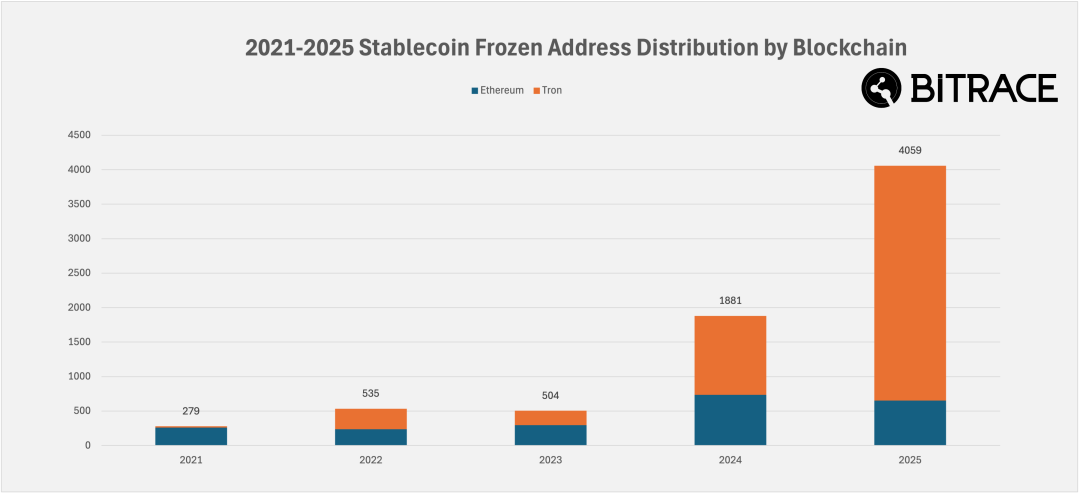

In last year's crime report, Bitrace disclosed that Tether significantly increased its law enforcement collaboration activities in 2024, freezing a number of blockchain addresses far exceeding previous years. In 2025, this initiative became even more proactive, with the number of frozen addresses exceeding double that of 2024, highlighting the company's emphasis on compliance.

Cryptocurrency Sanctions Amid Geopolitical Conflicts

In 2025, the conflict between Israel and Palestine entered its third year, during which Israel continued to crack down on cryptocurrency channels suspected of funding Hamas, Hezbollah, and Iranian-related entities.

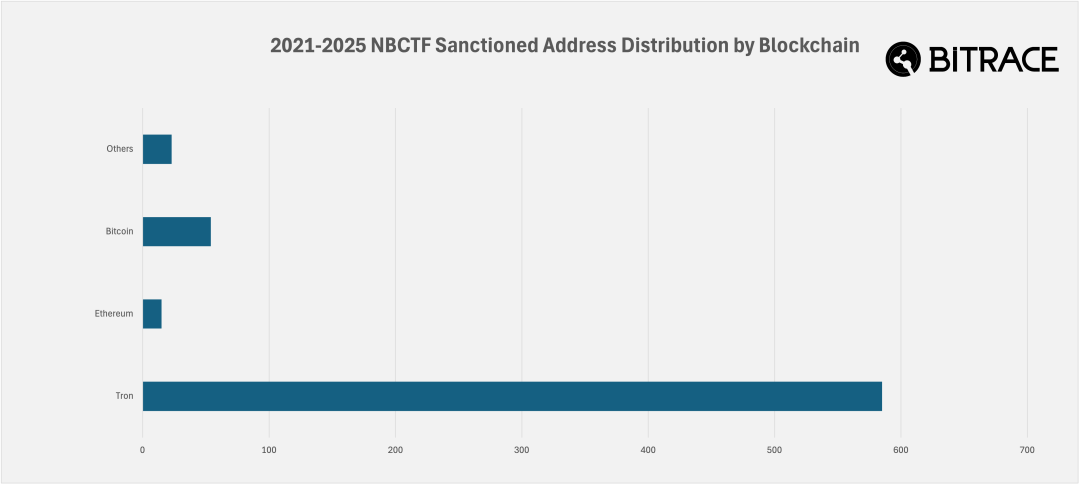

According to Bitrace's monitoring, the Israeli National Bureau for Counter Terror Financing (NBCTF) sanctioned at least 446 blockchain addresses or exchange accounts in 2025, primarily involving USDT and Bitcoin, far exceeding other countries.

Online Gambling

By establishing their own cryptocurrency settlement channels or integrating third-party cryptocurrency payment tools, online gambling platforms have achieved a business address structure similar to centralized cryptocurrency exchanges, where gamblers do not directly purchase and cash out chips through fiat currency but instead use cryptocurrencies (especially stablecoins) for transfers, achieving a high degree of anonymity.

Over the past few years, this system has been operating stably mainly on the Tron and Ethereum networks. Although lower than previous years, the amount received by high-risk online gambling addresses in 2025 still reached $145.3 billion, down from $217.8 billion in 2024.

Additionally, the emerging prediction platform market has seen significant growth, with known business address funds transferred or bet in that year reaching as high as $66.4 billion, far exceeding the previous year's $16.7 billion.

Clearly, prediction markets are rapidly capturing market share from traditional online gambling platforms.

Statistics on the activities of prediction platforms in 2025 show that besides Polymarket continuing to grow steadily, the newly launched Opinion in the fourth quarter and the established compliant platform Kalshi are also rapidly expanding and have surpassed Polymarket.

Statistics on the outflow of funds from traditional online gambling platform addresses show that in 2025, at least $1.7 billion of USDT or USDC directly flowed into exchange user addresses, with 82.40% entering the three trading platforms Binance, OKX, and Bybit.

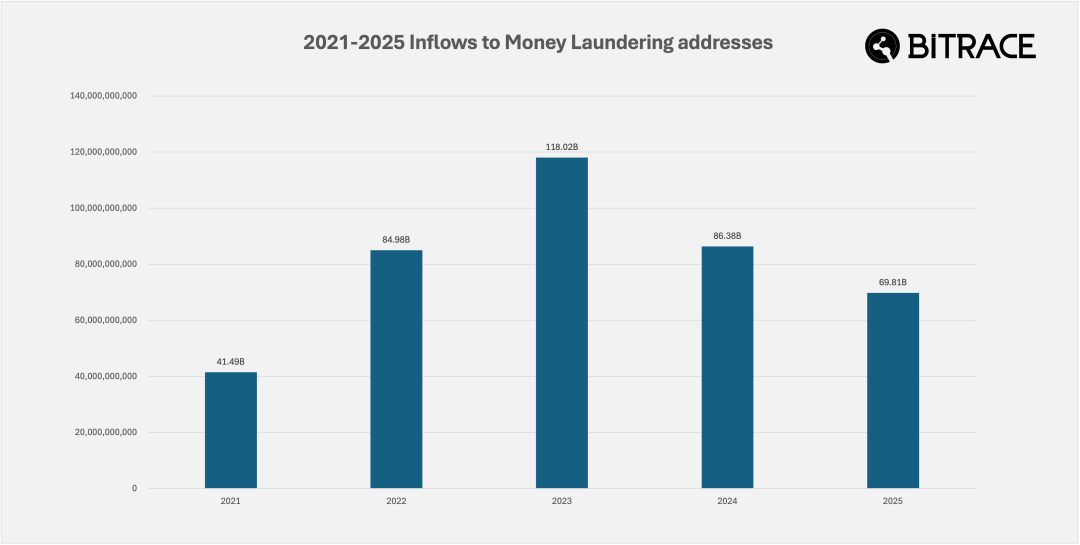

Money Laundering

Money laundering remains a major area of illegal use of cryptocurrencies, primarily concentrated in the Tron and Ethereum networks, achieved through the receipt and payment of USDT.

In 2025, high-risk money laundering addresses received a total of $69.8 billion, with USDT-related money laundering activities on the Ethereum and Tron networks amounting to $5.7 billion and $60.2 billion, respectively.

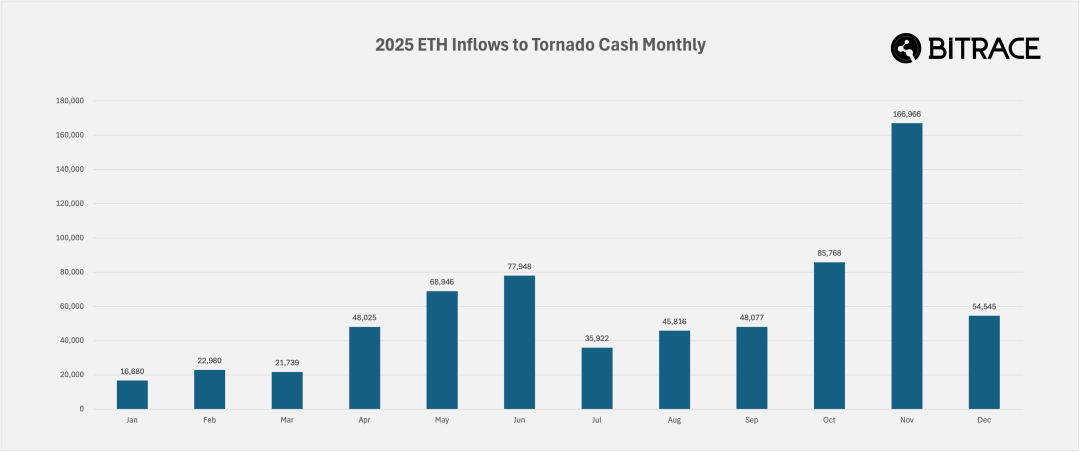

In addition to traditional money laundering channels, the business scale of privacy transfers and mixing protocols has also been included in this statistic.

Railgun has been widely adopted by crypto practitioners this year, with revenues from DAI, USDT, USDC, and ETH tokens valued in USD exceeding $1.4 billion, primarily supported by ETH token transaction volumes.

The well-known mixing protocol TornadoCash, after being sanctioned by OFAC, continues to operate, with a total income of over 690,000 ETH tokens in 2025, equivalent to $2.5 billion.

Black and Gray Market Transactions

The illegal adoption of cryptocurrencies by organized crime networks in East Asia and Southeast Asia constitutes the largest illegal cryptocurrency trading market globally. These funds are used for business activities by transaction guarantee platforms, illegal cross-border human traffickers, telecom fraud parks, online or physical casinos, and other entities.

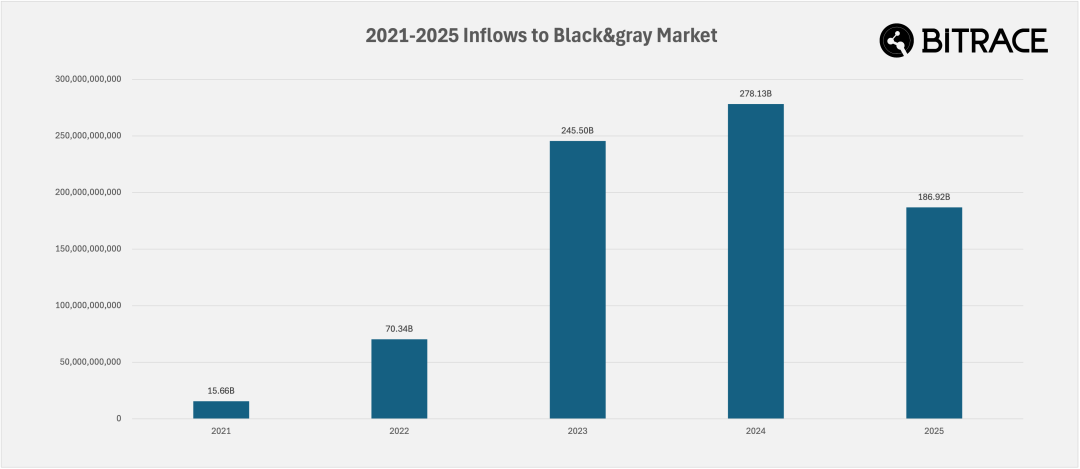

These stablecoin adoption activities almost entirely occur on the Tron network, with addresses marked as high-risk for black and gray market transactions receiving a total of $186.9 billion in 2025, of which $186.7 billion is on the Tron network.

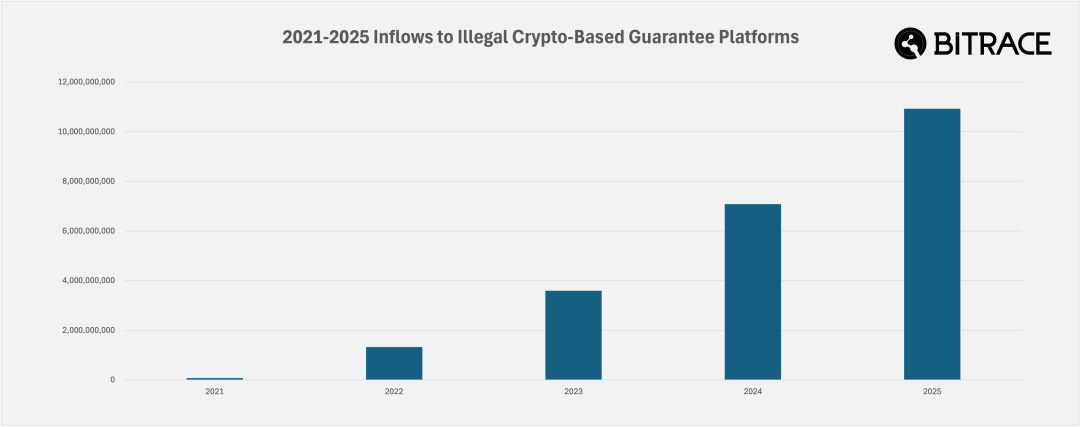

Although the overall scale of the black and gray market has decreased compared to the previous year, illegal transaction guarantee platforms based on cryptocurrencies continue to grow despite strong crackdowns from law enforcement agencies in various countries. According to Bitrace's statistics, in 2025, the deposit addresses of various illegal transaction guarantee platforms received a total of $10.9 billion USDT.

Due to different platforms' guarantee rules, this figure does not fully reflect the actual scale of illegal transaction business, as actual transactions occur in the business addresses of guarantee merchants, and the scale should far exceed the deposits.

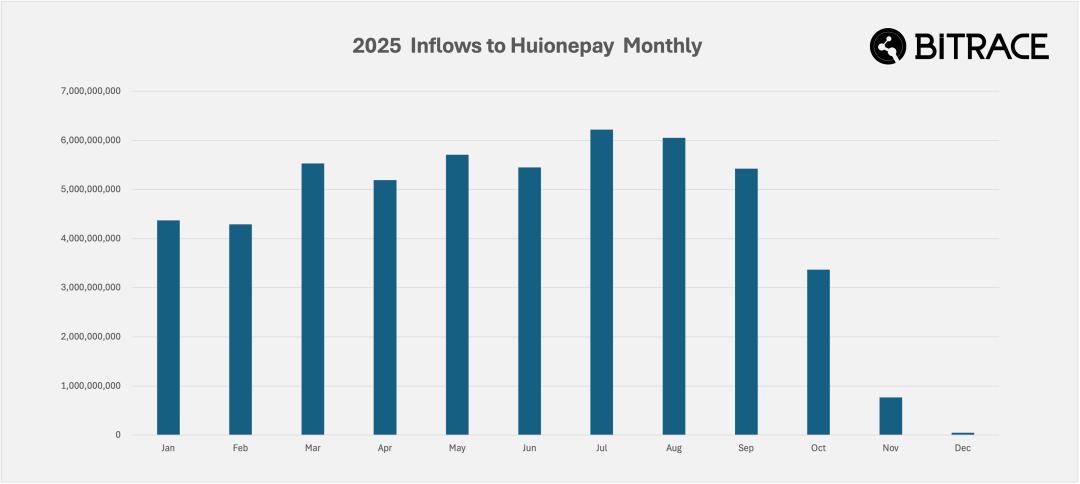

Due to the joint sanctions by the U.S. and U.K. against Cambodia's Prince Group and Huione Group, Huione Group was forced to temporarily halt operations of its main industry, Huionepay. According to Bitrace's statistics, Huionepay received a total of $52.4 billion USDT that year, but by December, it had almost ceased on-chain activities.

This incident has caused chaos in the local black and gray market trading, with some practitioners unable to withdraw funds from Huionepay, leading to a loss of stable and secure payment tools in the industry. Combined with ongoing law enforcement activities from various countries and the crackdown on Telegram, organized crime networks in East Asia and Southeast Asia are currently in a state of chaos and disorder.

Fraud

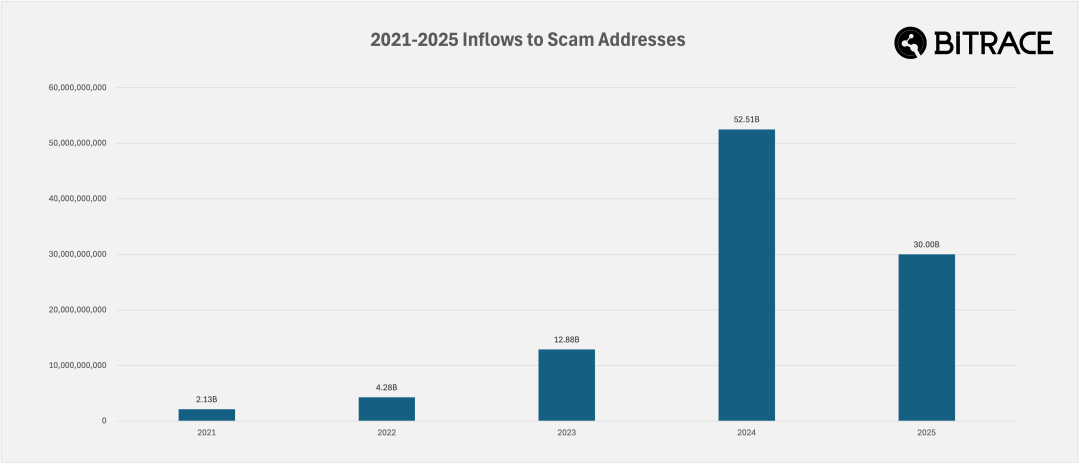

Cryptocurrency fraud includes both direct financial deception targeting native crypto users and investment scams aimed at non-crypto investors. Both types of illegal fraudulent activities are key focus areas for law enforcement agencies in various countries.

In 2025, the funds associated with addresses involved in real fraud cases, stablecoin freezes, and address poisoning tracked by Bitrace reached $30 billion, a significant decrease compared to 2024.

With the increase in law enforcement collaboration activities by Tether and Circle, the scale of stablecoin activities related to frozen addresses also reached an all-time high, with these addresses receiving a total of $18.3 billion in stablecoins in 2025.

Sanctions

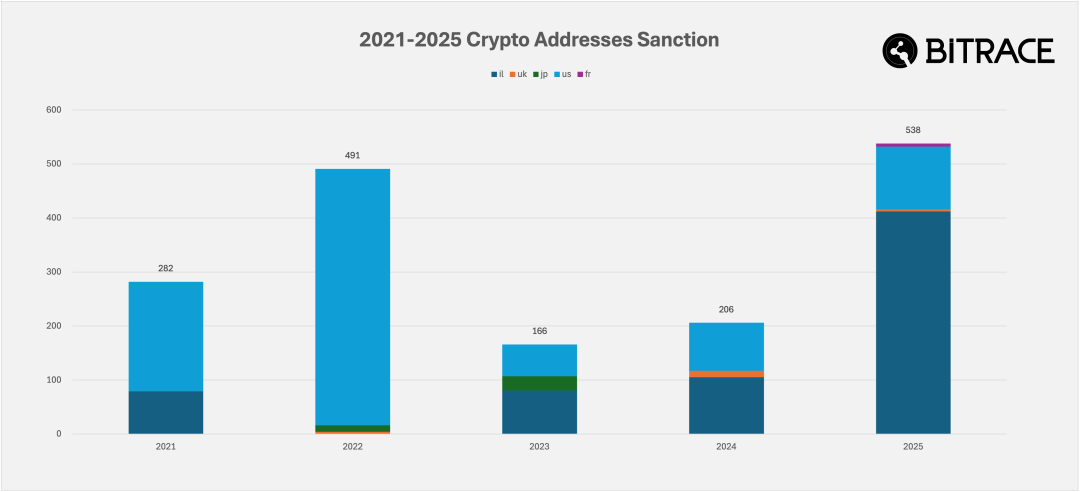

Bitrace primarily tracks national-level sanction activities from the United States, Japan, the United Kingdom, Israel, and France.

From 2021 to 2025, these five countries (excluding centralized cryptocurrency exchange accounts) imposed sanctions on at least 1,683 blockchain addresses, with the U.S. OFAC having the highest number, followed by Israel's NBCTF. Most of Israel's sanctions occurred during the conflict, primarily targeting cryptocurrency addresses suspected of providing funding to Hamas, Hezbollah, and Iranian-related entities.

Further analysis of the sanctions activities by Israel's NBCTF from 2021 to 2025 shows that there were a total of 585 addresses on the Tron network, far exceeding other networks, indicating that terrorist financing is currently heavily utilizing assets on the Tron network.

Freezing

Restricting specific blockchain addresses from operating USDT or USDC is the primary law enforcement collaboration method used by the two major stablecoin issuers, Tether and Circle.

After excluding certain contract addresses and abnormal addresses, the number of frozen addresses in 2025 still reached a record 4,059, surpassing the total of 3,199 from the past four years. Among these, 653 Ethereum addresses were frozen, and 3,406 Tron addresses were frozen, with the latter almost entirely executed by Tether.

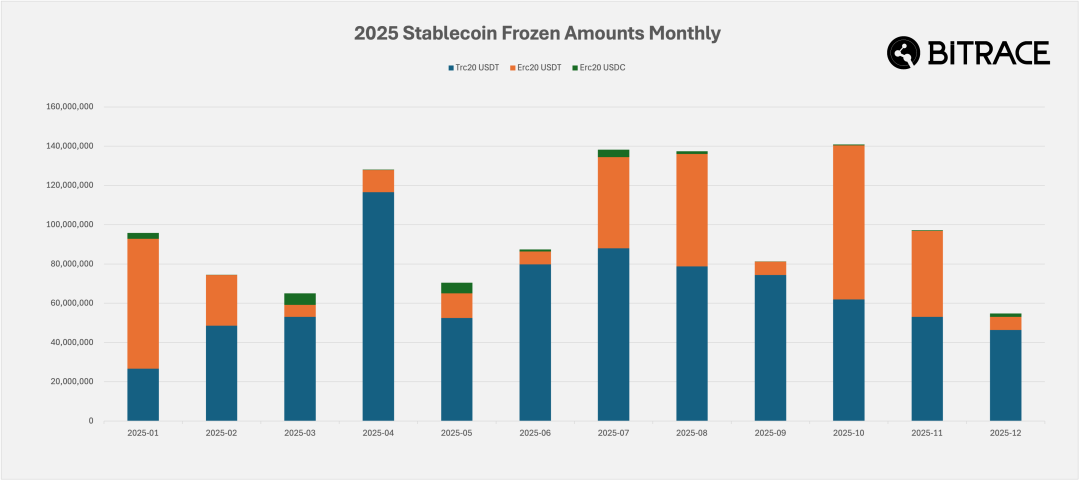

Further statistics on the amounts frozen show that in 2025, Tether successfully froze over $1.1 billion USDT, while Circle successfully froze over $23 million USDC, with Circle's law enforcement collaboration activities significantly lower than Tether's.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。