Original Title: Wall Street Pulls Back From Bitcoin's Money-Spinning Basis Trade

Original Author: Sidhartha Shukla, Bloomberg

Translator: Peggy, BlockBeats

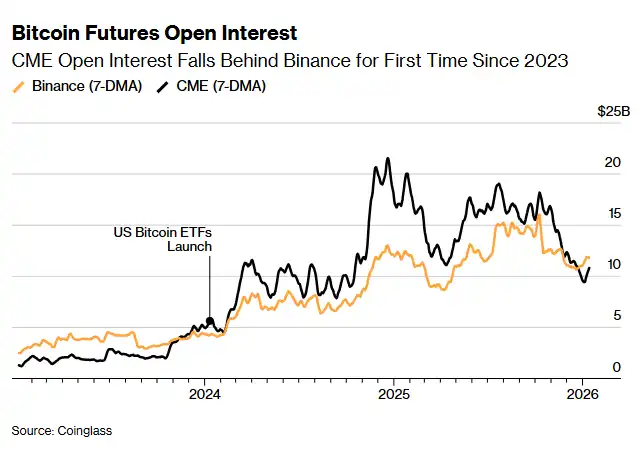

Editor’s Note: Once regarded as a "sure-win" Bitcoin basis arbitrage, it is quietly losing its appeal: the open interest between CME and Binance is fluctuating, and the price difference has narrowed to a point where it barely covers funding and execution costs.

On the surface, this indicates that the arbitrage space is being squeezed; more deeply, the crypto derivatives market is maturing. Institutions no longer need to rely on "arbitrage" for profits, and traders are shifting from leverage to options and hedging. The era of high returns from simple strategies is coming to an end, and new competition will arise from more complex and refined strategies.

The following is the original text:

A quiet yet significant change is occurring in the crypto derivatives market: one of the most stable and profitable trading strategies is showing signs of failure.

The "cash-and-carry" trade commonly used by institutions, which involves buying Bitcoin spot while simultaneously selling futures to profit from the price difference, is heading towards collapse. This not only indicates a rapid compression of arbitrage space but also signals a deeper change in the structure of the crypto market. The open interest in Bitcoin futures at the Chicago Mercantile Exchange (CME) has fallen below that of Binance for the first time since 2023, further illustrating that as the price difference narrows and market access becomes more efficient, the once lucrative arbitrage opportunities are being quickly eroded.

After the launch of the spot Bitcoin ETF in early 2024, CME briefly became the preferred venue for Wall Street trading desks executing such strategies. This operational logic is highly similar to the traditional market's "basis trade": buying Bitcoin spot through the ETF while selling futures contracts to profit from the price difference between the two.

In the months following the ETF approval, this so-called "Delta neutral strategy" often achieved annualized returns in double digits, attracting billions of dollars in inflows—these funds were indifferent to the direction of Bitcoin price fluctuations, only concerned with obtaining returns. However, it was precisely the ETF that drove the rapid expansion of this trade that also sowed the seeds for its demise: as more trading desks rushed in, the arbitrage price difference was quickly erased. Now, the returns from this trade can barely cover the cost of capital.

According to data compiled by Amberdata, the annualized return for a one-month term is hovering around 5%, a low point in recent years. Greg Magadini, head of derivatives at Amberdata, noted that just a year ago, the basis was close to 17%, but it has now dropped to about 4.7%, barely enough to cover the threshold for capital and execution costs. Meanwhile, the one-year U.S. Treasury yield is around 3.5%, rapidly diminishing the attractiveness of this trade.

In the context of a continuously narrowing basis, data compiled by Coinglass shows that the open interest in CME Bitcoin futures has fallen from a peak of over $21 billion to below $10 billion; while Binance's open interest has remained relatively stable, around $11 billion. James Harris, CEO of digital asset management firm Tesseract, stated that this change reflects more of a retreat by hedge funds and large U.S. accounts, rather than a comprehensive withdrawal from the crypto market following Bitcoin's peak in October.

Exchanges like Binance are the main trading venues for perpetual contracts. The settlement, pricing, and margin calculations for these contracts are ongoing and often updated multiple times a day. Perpetual contracts, commonly referred to as "perps," account for the largest share of trading volume in the crypto market. Last year, CME also launched smaller denomination, longer-term futures contracts covering crypto assets and stock indices, providing futures positions that closely align with the spot market, allowing investors to hold contracts for up to five years without frequent rollovers.

Harris from Tesseract stated that historically, CME has always been the preferred venue for institutional funds and cash-and-carry trades. He added that the fact that CME's open interest has been surpassed by Binance is "an important signal indicating that the structure of market participation is shifting." He described the current situation as a "tactical reset," driven by declining yields and thinning liquidity, rather than a loss of market confidence.

According to a statement from CME Group, 2025 is a key turning point for the market: as the regulatory framework becomes clearer and investor expectations improve, institutional funds are beginning to expand from solely betting on Bitcoin to include tokens like Ethereum, Ripple's XRP, and Solana.

CME Group stated: "In 2024, the average nominal open interest for Ethereum futures is about $1 billion, and by 2025, this figure is expected to grow to nearly $5 billion."

Although the Federal Reserve's interest rate cuts have lowered funding costs, this has not led to a sustained rebound in the crypto market since the collective price drop of various tokens on October 10. Current lending demand is weakening, decentralized finance (DeFi) yields are low, and traders are more inclined to use options and hedging tools rather than directly leveraging directional bets.

Le Shi, Managing Director of Auros in Hong Kong, stated that as the market matures, traditional participants now have more channels to express directional views, from ETFs to direct access to exchanges. This increase in options has narrowed the price differences between different trading venues, naturally compressing the arbitrage space that once boosted CME's open interest.

Le said: "There is a self-balancing effect here." He believes that as market participants continue to gather at the lowest-cost trading venues, the basis will narrow, and the motivation to engage in cash-and-carry trades will diminish.

On Wednesday, Bitcoin briefly fell 2.4% to $87,188, before narrowing its losses. This drop wiped out all gains since the beginning of the year.

Bohumil Vosalik, Chief Investment Officer of 319 Capital, stated that the era of nearly risk-free high returns may be over, forcing traders to turn to more complex strategies in decentralized markets. For high-frequency and arbitrage-focused institutions, this means they need to look elsewhere for opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。